Chatchy4406/iStock via Getty Images

LGIH is resilient despite a cooler market

LGI Homes (NASDAQ:LGIH) is a 100% speculative homebuilder that is 10th largest nationwide with above industry average margins and history of growth. Texas is their home and key market with almost 40% of sales and more net income despite growing geographical expansion into most regional markets.

Our last report called LGI Homes a hold at around $112 on August 13 because we felt that there would be better buying prices as rates rose. It didn’t take long. Our suggested buy price of $93 a share arrived a few weeks later in early September and traded well below that in the high $70’s in October.

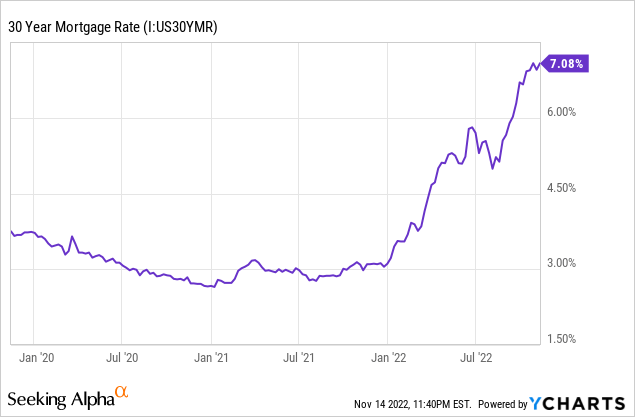

Since then, mortgage rates continued to rise past 7% and housing has correspondingly cooled. But now with rumors of inflation’s demise, where does LGIH, inflation and the property sector stand today? Is LGI Homes now a buy or has the housing market’s decline changed the picture.

Today’s Agenda

- LGIH Recent Performance

- Inflation and Rate Outlook

- Growth and Earnings Outlook

Homebuilders remain highly exposed to changes in mortgage rates, which themselves are dependent on interest rates. Thus it makes sense to have a view on the short term battle between rates and inflation.

LGIH Recent Performance

The spike in mortgage rates has continued over recent months to 7.08%. That’s a huge jump from just 3% in January. This has cooled the property market noticeably.

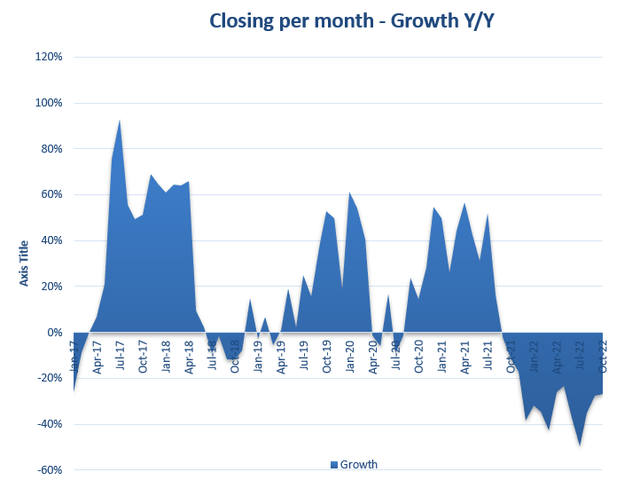

The best way to see the impact is that the growth in monthly closings has gone into reverse. Each month LGIH is seeing 20-40% year-on-year decline although this has moderated to about 22-25% recently.

LGIH Closings Growth Y on Y (Caterer Goodman)

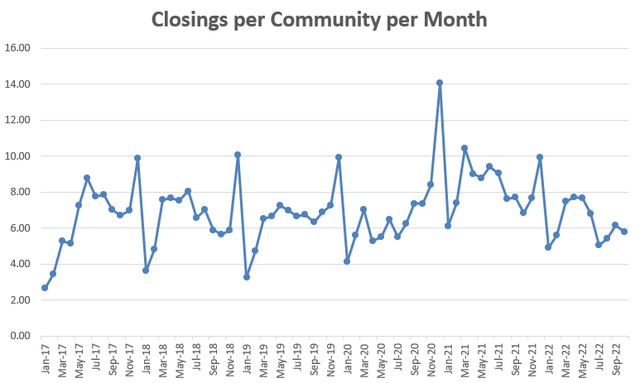

In better news, closings per community per month although also moderated, haven’t collapsed. About 5-6 closings per month is still a solid result given mortgage rates at 7%.

LGIH Closings per Community Per Month (Caterer Goodman)

LGI Homes is 100% speculative home builder. Speculative in the sense that they build the house first, then sell it. Most builders first take the order (for a majority of sales) and then build to the client’s specification.

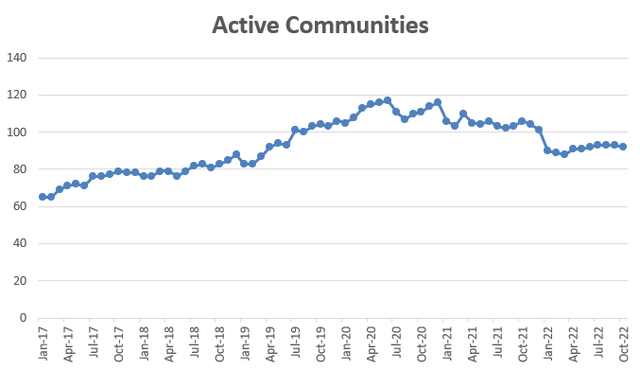

The risk of LGIH’s “spec” model is un-sold houses when the market cools. Therefore you need careful management of your inventory pipeline. It appears LGIH is doing this. It has declined to increase active community numbers in 2022 despite increasing investment in landholdings in 2020 and 2021. Active communities are currently below their long term trendline.

LGIH Active Communities (Caterer Goodman )

LGI Homes seems to have increased its conservatism with both land and property releases. During the Q3 2022 earnings call CEO Eric Lipar outlined this moderation of pipeline by saying:

So that total amount of inventory that we have is just not necessary. I mean we got as high as 4,800 houses total under construction. We got that number down to 4,100. And at the pace we’re running right now, probably 3,500 is where we need to be.

Despite the current cooling the company seems prepared to grow strongly in 2023 and 2024 should conditions improve. New community releases have slowed, but Eric Lipar mentioned that this could speed up.

We’re actively investing in development to grow our community count 20% to 30% in 2023 and another 20% to 30% in 2024. (then later) most of the development costs incurred to bring on next year’s communities have already been spent. So that is on balance sheet already. So as we move and open into those communities, we’ll start generating cash flow.

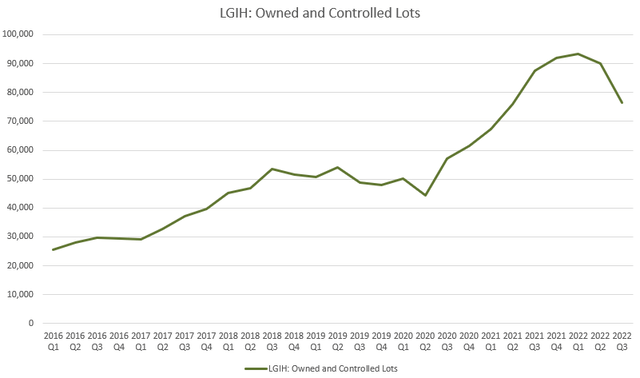

You can see this preparation in the big lump of owned and controlled lots that will facilitate this active community increase.

LGIH Owned and Controlled Lots (Caterer Goodman)

LGIH also seems intent on gently running down this inventory of lots given the current economic uncertainty and elevated rates.

This would have the impact of producing cash and reducing debt levels. Currently debt-to-capitalization is 42.3%. That’s not excessive, but not as low as some conservatively run larger competitors like D.R. Horton (DHI). For example, LGIH has paused share buybacks in Q3 2022 to manage the balance sheet more cautiously.

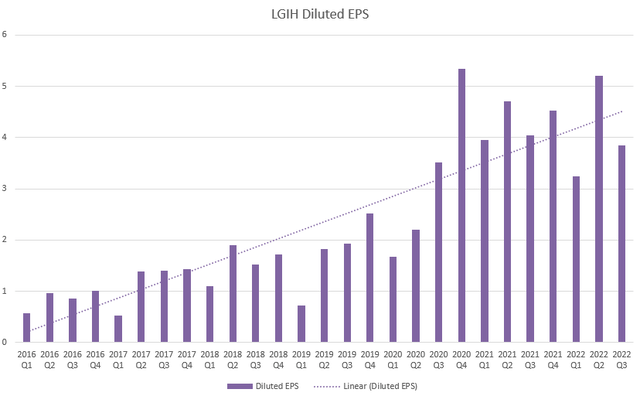

Despite all this conservativism, EPS remains well above 2019 levels and similar to 2020 when the housing market started to move.

LGIH Diluted EPS (Caterer Goodman)

Given the current environment, this shows admirable resiliency.

A little nugget mentioned in the earnings call, is the wholesale market had reached 20% of total closings from a previously reported negligible level. That provides some stability to sales and earnings. Although executive comments do point to skinnier margins without being specific.

Inflation and Rate Outlook

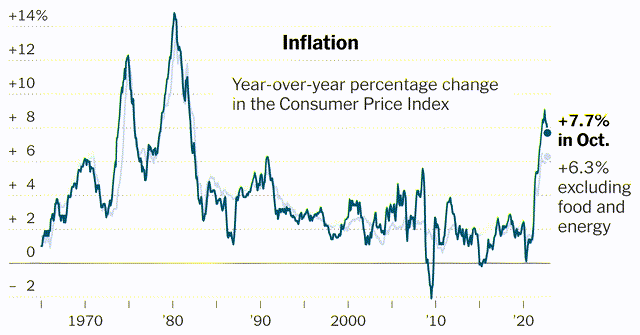

Moving to the macro outlook, the broader market as well as LGIH have bounced up strongly since inflation numbers that seemed to show easing with an annualized 7.7% in October.

Inflation (The New York Times)

The burst of buying that resulted, is probably already overdone. Federal Reserve comments also reinforce that. Comments from Federal Reserve Governor Christopher Waller on November 14 were an example:

“These rates are going to stay — keep going up — and they’re going to stay high for a while until we see this inflation get down closer to our target. We’ve still got a ways to go. This isn’t ending in the next meeting or two.”

Stock markets do indeed look forward, but right now you get the feeling they are looking forward to lower rates in 2024 with unreasonable confidence. They seem to be forgetting that a recession in 2023 is likely, and what unexpected collateral damage occurs over the next 14 months is far from clear.

Household Formation Stalls – Rents Soften

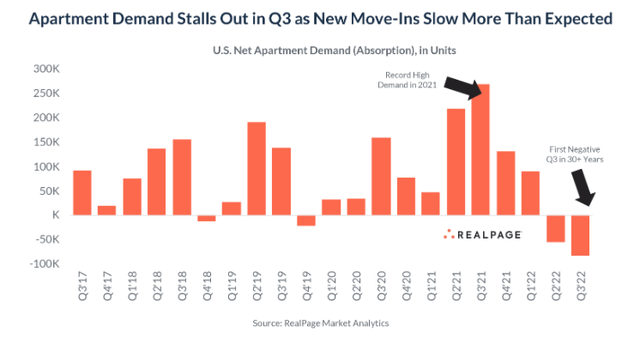

Still, there is good inflation news from rents and housing. Rents, which had been super hot, have noticeably eased in just a couple of months.

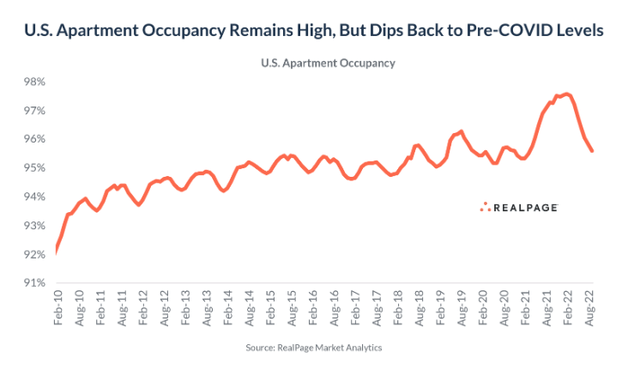

Apartment Demand Stalls (RealPage Market Analytics)

That’s a remarkable cooling from record highs just a year ago. This cooling is also reflected in apartment occupancy which is back to far more normal levels after a big surge during the COVID surge.

Apartment Occupancy (Somwehre)

As several analysts have explained, the explanation can only be household formation stalling. People are moving back home, sharing houses or apartments again or renting out their garage.

The implication for homebuilders like LGIH are more mixed. The good news is that although rent inflation metrics for the CPI are high, they should, with a lag, start to lower inflation in Q2 and Q3 next year.

Lower rents however make the leap to buying a house less attractive. LGIH in particular focuses on converting renters to home buyers. High rents and low vacancies can make the jump a no-brainer.

Moderate Wage Growth

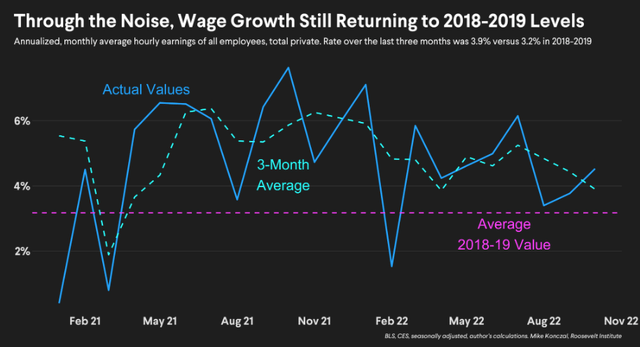

The second inflationary factor that worried us a few months ago was a wage growth-inflation spiral.

Those fears also seem to be easing as pointed out by economist Paul Krugman with smoothed wage growth much the same as the pre-COVID period.

Smoothed Wage Growth (Mike Konczal)

With rents easing and vacancies rising on top of gas prices that eased significantly, there is hope that inflation should continue its decline. Unemployment remains close to record lows for the moment, despite the high profile technology redundancies of recent weeks

The question is whether inflation will cool enough before a recession. We still doubt that. Growth is weak given low unemployment. But at least there is hope on the horizon that it will only take a short recession to kill inflation.

Growth and Earnings Outlook

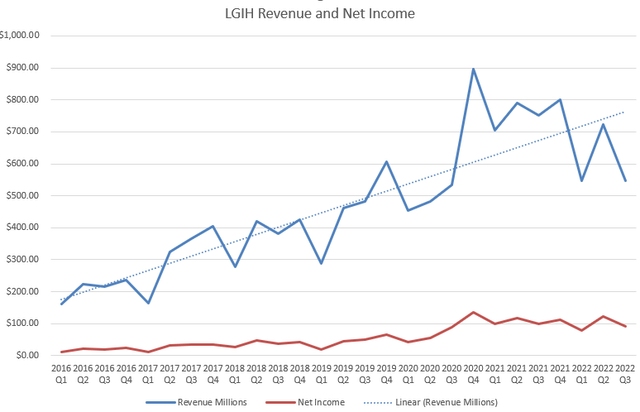

LGI Homes’ earnings has held up in Q3 so far despite 7% mortgage rates.

LGIH Revenue and Net Income (Caterer Goodman)

Now, there is a good chance that Q1 and Q2 will lag further as the economy slows and confidence ebbs. However, further out the picture for LGIH and it’s potential profitability brightens further out if we assume that mortgage rates can moderate to a more normal 4-5% range from the current 7%.

Thus, if we look further out to 2024 and conservatively assume earnings similar to the last four quarters, then we have EPS of $16.83 against at market price of $96 per share at the time of writing, giving an earnings multiple 5.7.

The implicit assumptions here are that there are no buybacks and LGIH doesn’t accelerate active community releases. So there may be upside from there yet.

On the flipside, recession economies can often shake skeleton’s unexpectedly out of closets and sentiment could yet turn nastier. Therefore we maintain our buy price of $93 per share from last report.

Conclusion

LGIH remains a well run company with good margins, conservative management, and a bulging land bank of land ready to go. Thus it has an excellent outlook once mortgage rates moderate to 4-5% at some point in 2024.

For patient investors we restate our buy call at $93 a share.

Despite the mortgage rate spike to 7% sales, closing and margins have been impressively firm. LGIH stock price has shown considerable volatility and correlation with expectations on interest rates.

Another big buying opportunity is quite possible in coming months.

Should something surprise the market from an inflation/rate perspective, investors are quite likely to get a big buying opportunity. The dip to $76 on October 21 demonstrates that.

Another possibility is that as the economy hits recession over the coming quarters and this affects sales and earnings in early 2023 a ‘strong buy’ opportunity will present itself to buy LGIH in the $70-80.

Be prepared to act if/when the market provides an opportunity for a great entry point for a quality stock worthy of a medium term hold.

Be the first to comment