sommart

Introduction

With worldwide inflation still high, investing capital to maintain purchasing power should be prioritized. That might not seem like the obvious thing to do given the lackluster performance of the stock market in recent months.

Despite the market’s performance, I still find it unattractive, however, there are certain individual stocks to consider. While I would not necessarily consider it a bargain, the dividend + future growth should outpace inflation in the long run.

British American Tobacco (NYSE:BTI) is a large British multinational company that sells cigarettes, tobacco and other nicotine products. The company is the second largest tobacco company in the world, and is the one with the largest international presence. The company expanded strongly in 2017 after it bought the remaining shares of the former American company, Reynolds American. The acquisition, which cost $49 billion, were financed by debt and share issuance.

Fundamentals

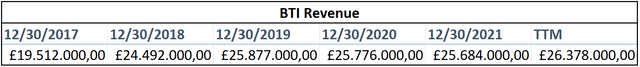

Considering the industry in which the company operates in, it comes as no surprise, that revenue growth is very low. This would typically be cause for concern, but far from a red flag in this case. As a result of the continuous decline in the number of people who smoke, it is very difficult for tobacco companies to increase the top line.

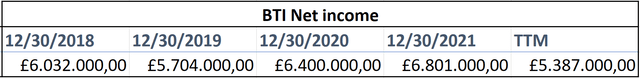

However, British American Tobacco along with other tobacco companies have such a moat, that they are able to continuously increase the margins. This is directly reflected in the amount of net income produced and the growth it has had.

Revenue of BTI (Yahoo finance)

The net income has primarily been used to finance the dividend payments, with the remainder being reinvested back into the business. Prior to the purchase of Reynold American, share buybacks were carried out continuously, but they were put on hold after the purchase, when the company chose to pay down debt instead. After reducing net debt by ~£4 billion, shares are finally being bought back again.

Annual net income of BTI (Yahoo finance)

Capital Allocation

Management has now started buying back shares, which is fantastic given the low earnings multiple at which the company is currently valued. The dividend yields 7% with the potential for share buybacks if fully utilized, being able to yield ~3.85%. That would result in annual capital gains of ~10.85%, assuming the assigned earnings multiple is unchanged.

British American Tobacco currently has an ongoing share buyback program in place, with the aim of buying back a total amount of £2bn worth of shares in 2022. I believe the use of cash makes sense, as return on equity has only averaged ~9%. Going forward, I expect that similar capital allocation will be made.

It is noteworthy to mention, that companies like tobacco companies do not necessarily need a large equity base to support earnings or even the growth of it. They are not, at their core, capital heavy businesses. They could, as seen with British American Tobacco prior to 2017, choose to fund extra share buybacks by reducing equity without hurting earnings.

Valuation

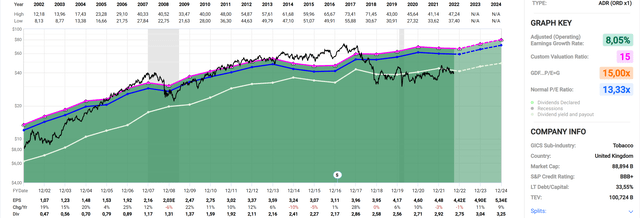

As with most consistently growing companies, a 15 multiple is often close to intrinsic value. This has been somewhat true with the company in the past, but it has had periods, where it either has been valued well below or above the multiple. The average multiple has been 13.33 with EPS growth averaging 8%.

Growth has in recent years slowed to low/mid-single digits, with multiples in the single digits as well. Part of the reason for the slowdown has been due to the increase in the dividend payout ratio, but also due to a lack of share buybacks in recent years.

After the acquisition of Reynold American, the company greatly increased their net debt. Having paid off some of that in recent years, it currently has ~£40.6 remaining. This is a significant amount that reduces the company’s value to equity investors. To prevent potentially paying too much, I will add the net debt to the market cap, giving us a business of ~£118 billion. The new business would now have a multiple of 13.5, which is still a low and attractive multiple. Especially when you consider, that part of the intrinsic growth and dividends are dependent on the given earnings multiple.

Stock Chart

Quick disclaimer: A technical analysis by itself is not a good enough reason to buy a stock, but combined with the fundamentals of the company, it can greatly narrow your price target range when buying.

The company first caught my interest when I saw that it was trading below its 200-month moving average. This has been areas of support in the past, and likely will be again. The moving average often proves to be a support area for consistently growing companies.

With fundamentals slowly improving, especially with share buybacks again happening, I don’t see the company staying at current valuations for long. However, I don’t mind the valuations, as the intrinsic growth + dividend directly benefits from it.

Final Thoughts

With average inflation in the US and most of Europe at ~8%, investors should potentially consider British American Tobacco to not only preserve but also increase their value of capital. The dividend of 7% is well covered by earnings, and is in no immediate danger of being reduced. On the contrary, it should continue to grow in the mid-single digits, which is what EPS will most likely average going forward.

Depending on the market valuation of the company, share buybacks should contribute mid-single digits to annual EPS growth. Whether the company can continue to improve the net profit margin remains to be seen, but it could potentially be a catalyst for growth beating expectations going forward.

The company appears attractively valued based on its stock chart performance, which is supported by historically low multiples even with net debt included. Growth may have been slow in recent years, but share buybacks should accelerate it in the coming years.

I see the stock as slightly undervalued with annual future capital growth prospects of at least ~10.85%.

I therefore give the company a “Buy” rating.

Be the first to comment