Gustavo Caballero/Getty Images Entertainment

- Build-A-Bear Workshop (NYSE:BBW) is an iconic children’s brand that has strong unit economics and a number of growth avenues including a strong ecommerce business (‘ecom’), plenty of room for growth in third party wholesale (~50%+ contribution margin), pet toy entrance this fall (1,600 PetSmart locations plus ecom), new store growth, and further penetration into a larger demographic of teens/tweens/adults as well as a burgeoning gifting business.

- At 1.3x YE 2022 EV/EBITDA BBW is priced as a dying business instead of the growing high quality toy company that it is.

- By YE 2022 or 1Q2023 BBW should have $100M+ in net cash, management is taking steps to return large amounts of capital to shareholders via share repurchases – which will create significant value for shareholders.

- BBW will likely generate $75M in EBITDA in 2022, displaying strong earnings power even in a weak economy.

- Despite operational success at BBW, the stock is down over the last 7 years, but over the last 5 years is up ~75%. BBW likely realizes now is the time to pursue share repurchases which is the missing piece to bring BBW closer to its fair value, and we argue fair value is multiples of the current share price.

BBW has ~80% brand awareness and is an iconic children’s brand. This brand has been created over several decades and out of hundreds of millions of positive children’s experiences. BBW has 12M+ loyalty club members, 10B media impressions per year, and ~4.2M web visits per month.

BBW has 30% contribution margins at both its US stores and ecommerce business. BBW also has a burgeoning third -party wholesale business which currently has 65 locations, this generates high margin asset light recurring revenue. We believe this business could double over three years from $18M in high contribution revenue to $35-40M, and this would add another $10M in high quality EBITDA without capital needs. This could come from partnerships with Chuck-e-Cheese, theme parks, and a host of other family fun venues in our opinion.

BBW is introducing its pet toy products into 1,600 PetSmart locations and online this fall. The initial rollout will be a license model, thereby generating high margin royalty income. This rapid speed to market and path to meaningful scale can likely be further augmented over time as it proves successful, and ultimately evolve into wholesale/manufacturer EBITDA margins of 25%. Over the next several years, we think BBW has potential to reach $100M in pet toy retail revenue when considering the bricks and mortar plus online potential (PetSmart, Petco, Pet Supplies Plus, Chewy.com (CHWY), Target (TGT), Walmart (WMT), etc). The global market for pet toys in 2021 was an estimated $2.5B. Plush toys alone is estimated to reach $1B by 2027 with a 5.5% CAGR. (source)

BBW plans to increase its North American store count by mid-single digits in years to come, with this alone contributing mid-single digit EBITDA growth.

BBW sees continued momentum in its initiative to capture sales in a larger demographic that includes teens/tweens/adults. BBW has been successful with collectables and its gifting segment. We believe these initiatives are in the early to middle innings.

We also think BBW ecom has room to double over the next 5 years, from ~$65-70M revenue today, as BBW effectively monetizes its strong brand. This would add $20-25M in incremental EBITDA over 5 years, BBW has an extremely low return rate which is a reason for its 30% contribution margins in ecom.

Balance Sheet and Valuation

BBW ended January with $33M in net cash. CFO Voin Todorovic said on the May earnings call that he expected FCF for this year to be greater than net income. Let’s assume FCF is equal to net income. This would equate to BBW having >$80M in net cash at year end (before repurchases). BBW also owns its Ohio distribution center which is worth at least $30M and we believe BBW could pursue a sale-lease back to unlock cash and monetize an asset at a high valuation. This would add another $30M in net cash to BBW, resulting in $110M in net cash by YE (before repurchases).

Looking at management’s track record, they typically set guidance for where they beat on the high end. The high end of BBW’s guidance is $75M in EBITDA. With a $212M market cap today, and $115M in YE net cash, BBW trades at 1.3x EV/EBITDA.

While the above demonstrates to us that BBW is extremely mispriced, we think BBW is even cheaper than it appears.

If management and the board adeptly allocate capital, here is what we think could happen at BBW

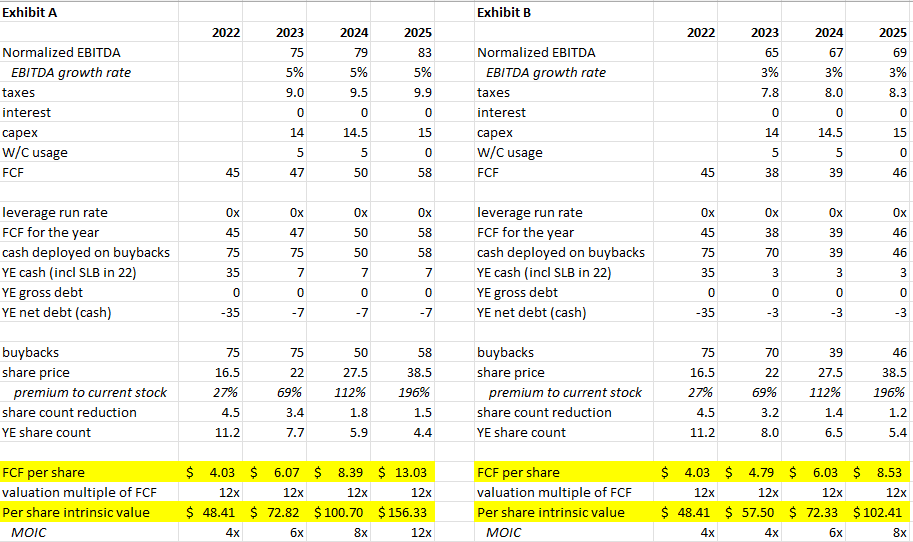

BBW, with its $110M in net cash at year end, could repurchase $75M in shares in CY 2022, in CY 2023 it would have room to repurchase $70M+ and still not have any leverage. Note, the below also includes conservative EBITDA figures and growth rates, it also assumes BBW repurchases shares at much higher levels than the stock currently trades for. As shown below, this capital allocation plan could result in BBW stock price being 8x-12x higher by 2025. If we use a 12x multiple of 2025 FCF per share, BBW would be worth between $102-$156 per share. Mattel (MAT) trades at a 15x P/E.

BBW model (author’s estimates)

Because management and the board have yet to deliver meaningful returns to shareholders over the past decade, and activist investors have taken notice, we think there is a high likelihood they will continue to execute upon the plan laid out above. Furthermore, CEO Sharon John is highly aligned with approximately 500k shares and will benefit to a large proportion along with other members of the executive team.

Risks – management and the board don’t execute on the plan to create shareholder value.

Be the first to comment