martin-dm

Article Thesis

ZIM Integrated Shipping (NYSE:ZIM) is a battleground stock that has seen its share price drop considerably in recent weeks. The macro environment for container liners is worsening, but at the same time, valuations across the industry are ultra-low and ZIM owns a hefty cash position. In this report, we’ll look at some of the risks and potential catalysts for ZIM Integrated Shipping going forward.

ZIM’s Shares Got Wrecked

ZIM Integrated Shipping has been a great investment for those that bought the company’s shares close to its IPO when ZIM traded at as low as $10. In an epic bull run for the company and many of its container liner peers, shares ran as high as $90 in early 2022, making for hefty returns for those that were in the stock early on.

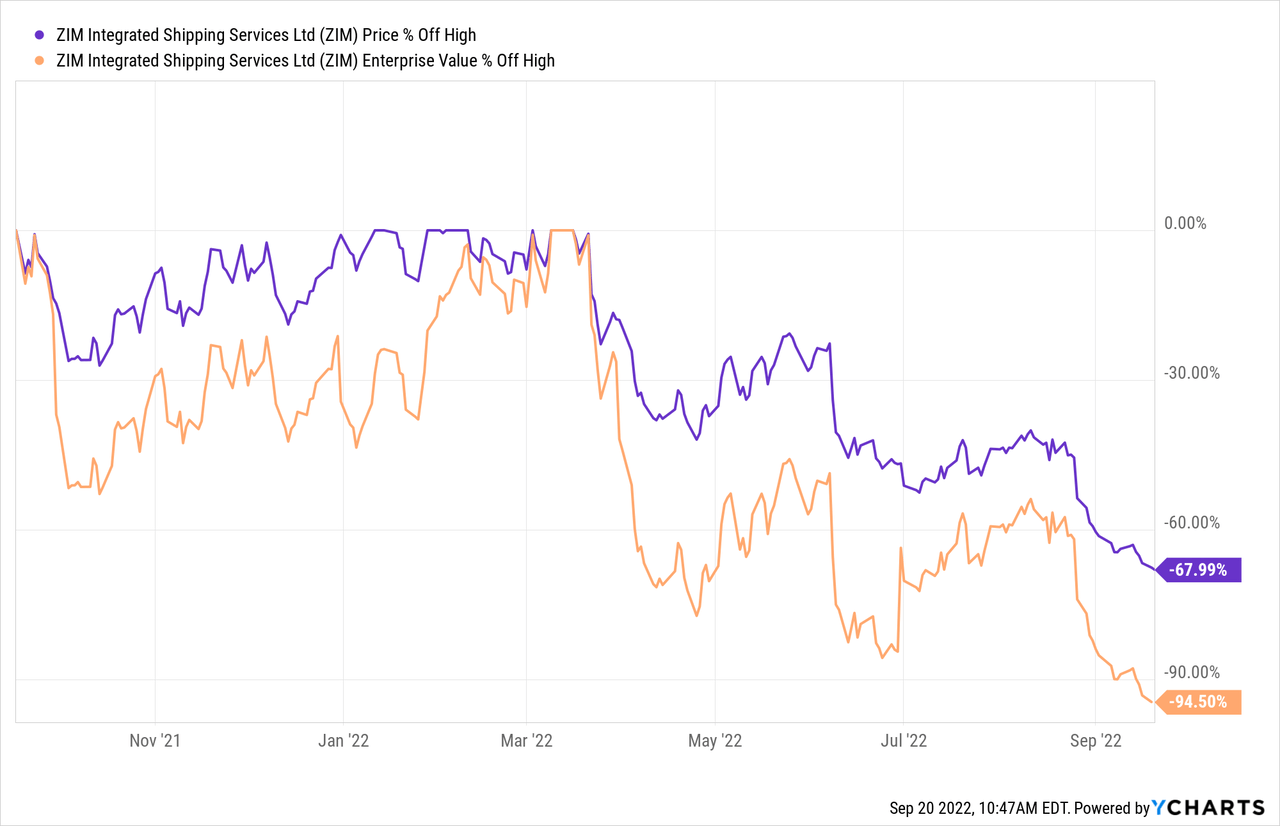

Since then, however, shares have crashed down, dropping to less than $30, which is around one-third of the price ZIM traded at half a year ago. Of course, that tells only one part of the story. On an enterprise value basis, with EV being calculated by adding a company’s market capitalization and its debt before subtracting the company’s cash position, the hit has been even larger:

ZIM’s enterprise value has dropped by an incredible 95% from this year’s highs. The difference between the large drop in ZIM’s share price and the even larger drop in its EV can be explained by the fact that ZIM’s cash position has improved relative to its debt load, which reduces a company’s enterprise value, all else equal.

At current prices and accounting for ZIM’s hefty cash position, the company is currently priced for an absolute disaster — the market-ascribed value of the entire company is just 1/20th of what it was a couple of months ago. In other words, the market is now pricing ZIM as if the future value of all its operations will be 95% lower compared to what the market assumed about ZIM’s value half a year ago.

There are a couple of reasons to believe that the macro outlook for the container liner industry has worsened in recent months. But does it make sense that ZIM’s cash-adjusted company value has dropped by 95%? I do not believe so.

Macro Headwinds And Opportunities

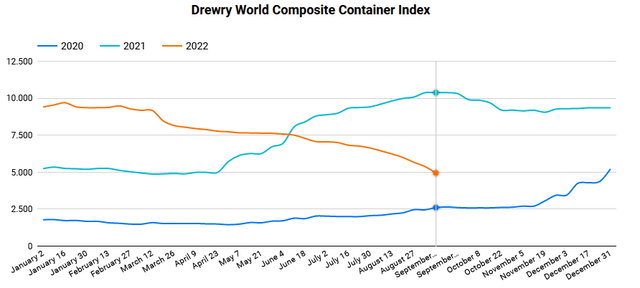

ZIM Integrated Shipping is a container liner primarily and is thus heavily dependent on the rates for moving containers from A to B. Unlike container ship leasing companies such as Danaos (DAC) or Global Ship Lease (GSL), ZIM has not locked in the majority of its future revenues and profits for the next couple of years. Instead, it operates with considerable spot exposure, although not all of its revenue depends on spot rates. ZIM has some minor exposure to non-container markets such as moving automobiles, and it has fixed contracts for some of its container ships. The fixed contracts that ZIM has in place right now are higher than the respective contracts from last year, which helps offset some of the declines in the spot market. Still, ZIM is feeling headwinds from lower spot container shipping rates, as those have dropped meaningfully over the last year:

Right now, the Drewry World Composite Container Index stands at $4,900, roughly half as high as the $10,400 reading from one year ago. That being said, last year’s $10,000+ level was an absolute outlier and not at all reflective of where the index stood in normal times. Record-high backlogs and logistics issues in ports in China, the US, etc. and high demand for goods due to stimulus payments made container shipping ultra-expensive last year. It was very clear that shipping rates would not remain at the levels seen in H2 2021 and early 2022, thus the pullback was to be expected.

In fact, current shipping rates are still well above what we have seen in 2020 when the index stood at $2,600, which is roughly half the current level. ZIM was quite profitable in the second half of 2020 already, despite the fact that container shipping rates were considerably lower back then, on average. During Q4 2020, ZIM earned $3.50 per share, for example, for a $14 annualized profit pace. Current rates are above the Q4 2020 average. On top of that, contract rates are higher, and ZIM has expanded its business since. Last but not least, ZIM has improved its balance sheet by paying down debt and increasing its cash position, thereby improving its interest expense/income line. We can thus say that it is very likely that ZIM would earn $15 plus per share per year if container shipping rates remained at the current level. For a stock that is trading for less than $30, that would be very attractive. The current share price thus prices in further steep declines in container shipping rates, as ZIM would be able to earn the full share price in less than two years if container shipping rates remained at current levels.

What could cause such a decline in shipping rates? There are four key factors. A significant amount of new container ships will hit the water in the coming years, thereby increasing transportation capacity. The world has also made some progress in clearing up transportation backlogs and jams. This was done by rerouting ships to more efficient ports, while strikes could be averted in important cases, such as the recent railroad strike. An ongoing economic slowdown has resulted in fewer goods being shipped over the oceans, as consumers are less eager to spend their money on goods. Last but not least, a shift in consumer spending from goods to services has further reduced shipping demand. As the pandemic is waning, some consumers are buying fewer goods, deciding to spend on travel and experiences instead — those don’t need to be shipped from China to the US, for example, reducing demand for container shipping services.

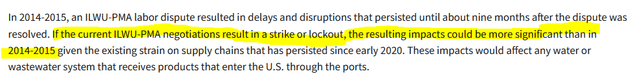

That being said, there are also some potential positive catalysts for ZIM going forward. First, the impact of the current economic slowdown is not yet known. Right now, the market seems to be in full-blown panic mode, looking at the recent price performance of many commodities and cyclically-sensitive stocks such as those of steel producers. But maybe the economic slowdown will be more benign than many think, in which case container shipping rates would likely drop less than what is expected today. Second, there are still several potential logistics issues that could disrupt global trade flow considerably. In that case, shipping rates would increase, as was the case last year. A recent railroad strike could be averted, but several other strikes could still occur over the coming quarters. This includes the ILWU union that represents US West Coast port workers. The union reports on its website:

If there is a strike, the impact could be huge. And since rates are currently above the long-term average still, we might see a big increase that would make ZIM ultra-profitable again. Other potential trade flow disruptions could come from potential conflict in Taiwan or the middle east (Suez Strait), or from renewed COVID-related lockdowns in China. It’s not guaranteed that any of these potential tailwinds (for ZIM) will occur, but it seems at least possible that transportation issues will persist.

Another factor to consider is the new IMO regulation framework that will start in 2023. The International Maritime Organization seeks to curb emissions next year, which will force some ships to move slower in order to reduce fuel consumption. This effect will be particularly pronounced for container ships that are generally moving faster than many other types of ships. When older container ships are forced to move slower, the global transportation network will become less efficient, potentially leading to more logistics issues and higher container shipping prices — which would be good for ZIM.

Priced For Disaster

There are thus several macro risks and macro opportunities. Right now, ZIM is priced as if it was guaranteed that all of the risks (e.g. a steep recession) will occur, while none of the opportunities (e.g. strikes) will occur. In other words, ZIM is priced for disaster. I do believe that this provides a buying opportunity, although it should be mentioned that ZIM is not a low-risk stock. In case container shipping rates come crashing down, the company might not be profitable next year. Bankruptcy is extremely unlikely thanks to a multi-billion dollar cash position and no debt, but in case profits vanish during a very harsh recession, the stock could have more downside potential.

At the same time, the company’s stock could be a compelling investment in case rates don’t drop too much. ZIM is forecasted to earn $17 during Q3 and Q4, and another $13 in 2023. At current rates, ZIM could thus earn back the entire share price over the next 15 months. And that does not yet account for potential upside catalysts such as strikes at major ports or lockdowns that disrupt port operations in China. Also, this does not give ZIM any credit for its cash position — which we estimate at around $41 right now.

ZIM will likely pay out a total of $12 to $20 for fiscal 2022, based on a 30%-50% payout ratio and estimated EPS of a little more than $40 this year. $5 to $12 could thus be paid out to investors over the next couple of months alone. If the company pays out $9 over the next two quarters, that’s around one-third of the current share price that will flow back to shareholders’ pockets in just half a year.

Takeaway

ZIM is a battleground stock, and it can’t be described as a low-risk pick due to its vulnerability in a harsh economic downturn. Container ship leasing companies such as Danaos offer lower volatility and more safety thanks to locked-in long-term contracts. But at current prices, ZIM is so cheap that not too many things would have to go right for the company to be a profitable investment. Shares are priced for disaster right now, but if container shipping rates do not slump too much going forward, shares would be very cheap. If a positive catalyst for container shipping rates emerges (e.g. port strikes), ZIM could run up considerably from the current levels. If management finds a way to employ the hefty cash hoard in an accretive way, that could happen, too. Last but not least, it is pretty clear that investors will get hefty dividend payments over the next six months, no matter what. All in all, one can call ZIM a higher-risk, high-reward pick. I hold a small position, but a bigger position in lower-risk container ship leasing companies Danaos and GSL.

Be the first to comment