Daria Nipot

Article Thesis

Major tech companies have not had a good time around their earnings releases this fall. The next one of these companies that experienced a harsh market reaction, following Alphabet (GOOG) (GOOGL) and Meta (META), is Amazon (NASDAQ:AMZN), which saw its shares drop by 19% following its earnings release. Not everything was bad in that report, but there were some noteworthy issues. On top of that, Amazon’s pretty high valuation remains a key headwind for its shares in a rising rates environment.

What Happened?

Amazon reported its third-quarter earnings results on Thursday afternoon. The headline numbers looked like this:

Seeking Alpha

A 15% revenue increase was marginally smaller than expected, but the $370 million miss is equal to just around 0.3% of AMZN’s overall revenue and thus not overly material. Earnings were higher than expected, but that doesn’t mean that they were strong. Instead, Amazon experienced considerable profitability headwinds in its core business, which is most likely the main reason for Amazon’s very weak after-hours price action – at the time of writing, shares are down 19% following an already sizeable 4% decline in the regular trading session. It should be noted that after-hours and pre-market price action is oftentimes highly volatile, thus this could easily change.

The Third Quarter: What’s Important

Starting at the top of the earnings report, with Amazon’s revenues, I believe that the 15% growth was far from bad, even though it missed estimates marginally. Amazon is a global company that has significant non-US exposure, thus a rising US Dollar was a headwind for its sales once denominated in USD. Still, the company managed to grow its revenue by almost 15%. On top of that, investors should also consider that 2020 and 2021 had major pandemic-caused tailwinds for the e-commerce industry, thus the comparables for Amazon were far from easy. Last but not least, high inflation in categories such as energy and food means that some consumers are scaling back their spending on discretionary consumer goods – the stuff that Amazon primarily sells. The fact that Amazon nevertheless managed to deliver 15% revenue growth in that environment, with currency rates, inflation, and tough comparables working against it, is far from a bad sign.

Revenue alone is not creating shareholder value, however, which gets us to the next point in the report. Unfortunately, Amazon was not able to translate its very solid or even attractive revenue growth into attractive earnings growth. Ideally, companies grow their profits more than their revenue, as operating leverage and improving scale allow for margin expansion. That was not at all the case here, as Amazon saw its profits drop significantly compared to the previous year’s period.

Seeking Alpha

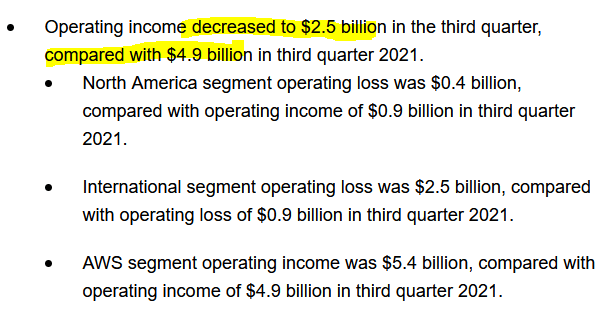

Operating income dropped by almost half year over year, hitting $2.5 billion during the period. That’s still $10 billion annualized, but for a company being valued at more than $1 trillion, that’s not an attractive earnings pace – especially once we consider the fact that taxes and interest expenses are yet to be subtracted from that number before we get to net profits.

Meta saw its operating profit drop by around half as well during the most recent quarter, but Meta is trading at a low-teens earnings multiple. Amazon is trading at well above 100x net profit based on these results, and yet it experienced a hefty drop in its profits.

Looking for the causes of this very weak bottom-line performance, there are several factors of note. First, high fuel expenses make its deliveries more costly, all else equal. With diesel supply issues in the US and with the ongoing energy shortage in Europe, it does not look like this headwind will cease in the very near term. Amazon also operates a labor-intensive business. With (skilled) labor shortages in many markets, including the US, expenses for its workforce continue to climb, as workers demand higher compensation in a high-inflation environment, and since AMZN has to make its offers more attractive in order to find the labor it needs. Amazon also is impacted by higher costs for white-collar employees, such as its engineers. There, a shortage is driving up employment costs as well, in a trend that has also impacted other tech companies including Alphabet, Meta, etc.

When we take a look at the individual sections that make up Amazon’s overall company-wide operating profit, there are some to-be-expected developments and a major negative surprise. Operating profit being down in the North American retail business and the International retail business is bad news, but it was expected, due to the aforementioned factors such as higher labor costs, higher fuel expenses, and so on. But the profit performance of AWS was much weaker than expected, which is a potential reason for concern. AWS revenue grew 27% year over year, or 28% in constant currencies. That’s less than the growth rate in the past, but that is to be expected – the law of large numbers dictates that growth rates have to decline eventually, as no company or business can grow at 40%, 50%, or more forever. But the operating profit that was generated at AWS grew by just 10% year over year, and thus way less than the unit’s revenue.

The advantage of tech/software businesses is that they scale very profitably, at least in theory – development costs are mostly fixed, and adding additional sales comes with low additional expenses, thereby creating significant profit growth as the business grows. When it comes to AWS, that does not seem to be the case – business growth was very healthy, at close to 30%, whereas profit growth was really underwhelming, as margins dropped from 30.4% to 26.3% in this unit over the last year. Higher energy expenses, e.g., for electricity, likely play an important role, while pricing pressure due to competition is another factor.

In recent quarters, Amazon has been able to subsidize the losses created in its retail business with the profits from AWS. But if the trend in Q3 does not reverse and AWS profits do not start to grow meaningfully again, then that won’t work forever. If AWS continues to grow its profits by a meager 10% per year, as was the case in Q3, then the ongoing loss increases in Amazon’s retail business will sooner or later make Amazon’s company-wide profits drop to zero. Shareholders should thus keep an eye on the AWS profit growth trend (and margins), and Amazon should work on turning its loss-generating retail business around.

Not surprisingly, the weak profit performance in both retail segments (US and International) and the underwhelming AWS profit growth have had a negative impact on cash generation. Over the last year, operating cash flow totaled $40 billion, which was down 30% year over year. Even worse, operating cash flows during Q3 totaled just $7.3 billion, or less than $30 billion annualized – not a lot of cash for a company being valued at more than $1 trillion. That does not yet account for Amazon’s spending on its huge distribution network. When we subtract capital expenditures of $15.7 billion for the quarter, we get to a free cash flow of -$8.4 billion – in other words, at the Q3 pace, Amazon is burning way above $30 billion per year. The company does not have an especially weak balance sheet, but it doesn’t have Apple (AAPL)-like cash reserves, either. Burning dozens of billions of cash per year won’t work for a very long time, thus the company is under some pressure to improve its cash burn rate. Lower capital spending is arguably the easiest way to achieve that goal, although that might hamper its growth to some degree. Speaking of growth, Amazon is forecasting revenue growth of just 5% for the fourth quarter – way less than the rate of inflation – and it forecasts that operating profits will roughly be cut in half, as operating profits are forecasted at ~$2 billion versus $3.5 billion a year ago. At least in the next couple of months, it thus does not look like the cash flow picture will improve materially.

Final Thoughts

Amazon is a company with a huge moat, being the clear e-commerce leader in many markets. But it is seemingly not able to monetize that moat successfully, as its retail business is generating widening losses. AWS had seen a bright start in the past, but even though AWS revenue growth remained very healthy in Q3, declining margins resulted in sub-par AWS profit growth. The resulting hit to cash flows means that Amazon is burning cash at a hefty pace, and looking towards the remainder of the year, that will most likely be the case. It’s far from guaranteed that things will improve next year, especially if the US is experiencing a recession, as many believe it will.

Amazon is, by far, not a bad company. But it’s a company with considerable issues. And yet, it trades at a pretty high valuation, being valued at ~40x Q3’s annualized operating cash flow, where we do not yet account for capital spending at all. Amazon’s buyback program that was announced in March is not doing anything for the stock, either, as shares are down considerably this year and since the share count is up year over year, despite buybacks. Due to profitability issues, slowing growth, questions around its cash burn rate, and a still-high valuation, I do not think Amazon is attractive right here.

Be the first to comment