Colin Temple/iStock Editorial via Getty Images

Introduction

It’s been more than nine months since I last discussed Dollarama (OTCPK:DLMAF), and as the company is getting ready to publish its full-year financial results (the financial year ends in January, so the communication on the full-year results will only happen in a few months), this is a good moment to catch up on the story. Dollarama benefited from COVID-related tailwinds but it looks like inflation may become an issue in the near future as labor expenses and transportation expenses will likely go up.

Dollarama’s most liquid listing is in Toronto where it’s trading with DOL as its ticker symbol. The average daily volume in Toronto is approximately half a million shares. The current market capitalization, based on the 298M shares outstanding is approximately C$18B.

The margins are expanding, and that’s positive for the free cash flow

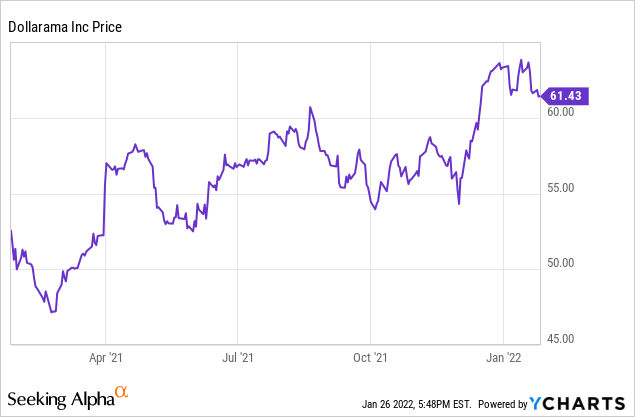

Dollarama’s share price is trading approximately 10% higher compared to April last year and that’s perhaps a little bit surprising as the company has posted good results in the past few quarters.

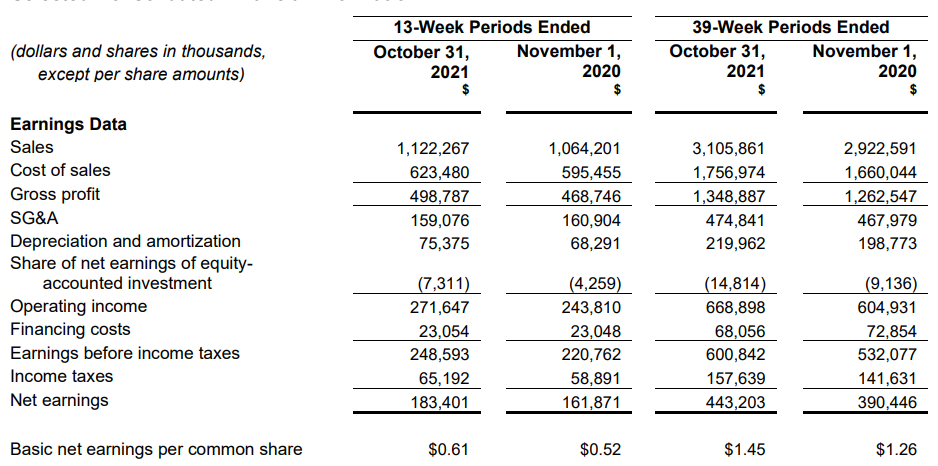

In the third quarter of FY 2022 for instance (the financial year ends on Jan. 31), Dollarama reported a 5.5% revenue increase which included a 0.8% same store sales increase. That was a positive surprise as this actually builds on the momentum the dollar store generated in the previous financial year wherein its same store revenue increased by a high single digit percentage.

Not only is the revenue increasing, Dollarama is also becoming more efficient as its gross margin increased to 44.4% (up from 44%) while the EBITDA margin increased to 30.9% of the revenue compared to just 29.3% of the revenue. Looking at the performance in the first nine months of the year, the EBITDA margin was approximately 28.6% compared to 27.5% in the first nine months of FY 2021 (those nine months ended on Nov. 1, 2020, so they included the full impact of the accelerating pandemic in that year).

Dollarama Investor Relations

Looking at the 9M 2022 results, the total revenue was just over C$3.1B, resulting in a gross profit of C$1.35B. That’s a very nice increase compared to the C$1.26B in 9M FY2021. Meanwhile, I was a little bit surprised to see the SG&A expenses are up by just 1.5%. I would have thought wage increases would have resulted in a more serious uptick of the total SG&A expenses but Dollarama may also have had to dial back some of its COVID measures. Despite opening additional stores, we see the SG&A expenses actually decreased in the third quarter. Just by 1% to C$159M but that is a very interesting evolution.

The reported net income of C$183.4M and C$443.2M represented an EPS of C$0.61 and C$1.45 per share respectively but readers are cautioned the EPS is based on the average share count of 301M shares and 305M shares, respectively. As Dollarama aggressively buys back shares (see further down), the share count as of Oct. 31 was just around 298M shares which means that if we would apply the reported net income on the existing share count rather than the average share count, we would see an EPS of C$1.49 in the first nine months of the year.

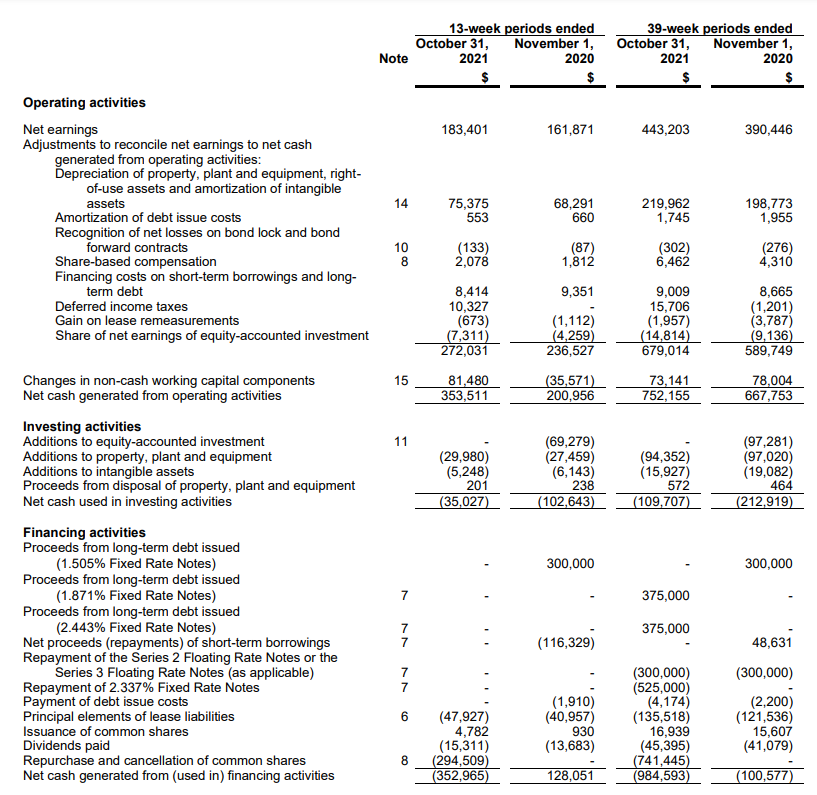

The robust results of Dollarama also indicate the company offers strong cash flows. In the first nine months of the financial year, Dollarama reported an operating cash flow of C$679M before changes in the working capital position, but this includes about C$16M in deferred income taxes and excludes the C$136M in lease payments. On an adjusted basis, the operating cash flow was approximately C$527M (compared to C$470M in 9M FY 2021, which once again emphasizes how strong the year-to-date results actually are).

Dollarama Investor Relations

The total capex was approximately C$110M resulting in a reported free cash flow result of C$417M. It’s important to note the capital expenditures include all growth expenses. Dollarama plans to open 60 to 70 new stores in the current financial year and we should expect a substantial portion of the capex to be related to these growth plans. Keep in mind the depreciation expenses excluding the lease portion is just C$85M and Dollarama has spent almost C$110M on tangible and intangible capex. I’d like to argue a substantial portion of the C$110M in capex is actually related to growth and the underlying sustaining free cash flow is likely closer to, or exceeds C$450M.

Dollarama continues to buy back stock

That’s a lot of free cash flow and Dollarama spends it entirely (and then some) on buying back its own shares. The dollar store does pay a dividend but as the quarterly dividend is just C$0.0503/share for a dividend yield of just under 0.35%, it’s clear dividends aren’t very high on the priority list.

Dollarama prefers to buy back its own shares as this will create longer-term value. In the third quarter, about C$295M was spent on buying back stock, bringing the 9M FY2022 total on C$741M. During the Q3 and 9M period, Dollarama repurchased 5.27M and 13.1M shares, respectively, reducing the share count by approximately 4%. While I’m usually in favor of share buybacks, I’m not entirely sure buying back stock at a current free cash flow yield of around 3.5% is the best way to do this. I understand Dollarama wants to buy back as many shares as possible but perhaps the company should also consider completing a Dutch Auction Tender where it could offer an above-market buyback to shareholders which are then invited to tender their shares. While this wouldn’t allow Dollarama to purchase as many shares as it’s able to buy on the open market, it would be an option for a certain group of shareholders to just tender their shares and take their capital gains.

Investment thesis

Dollarama isn’t trading at spectacularly cheap levels, but with a total net debt of just around 1.7 times the EBITDA (adjusted for lease depreciation) and a growing revenue both on a comparable basis as well as including the expansion plans, Dollarama remains a very interesting idea to keep an eye on. The growth rate is very intriguing, and although it appears it’s buying back stock at a rather expensive level, it’s better to do so now than after seeing your EBITDA increase an additional 20% in the next 2-3 years.

From an investment perspective, I’m keeping an eye on the company’s options. A P54 for June can be written for an option premium of C$1.10 which would result in an effective purchase price of C$52.9 and this would bring the free cash flow yield closer to 4% while Dollarama likely continues to buy back stock which further increases the per-share results.

Dollarama isn’t a “must buy now” stock but the company’s level of execution has been excellent in the past few years.

Be the first to comment