imaginima/iStock via Getty Images

Introduction

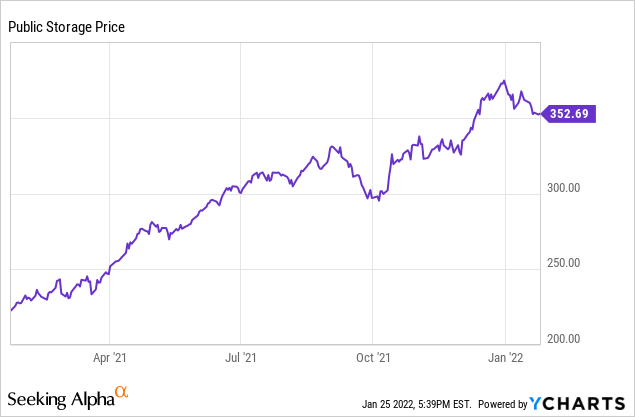

As part of my fixed income portfolio, I try to keep tabs on the new issues of preferred shares. I find those can be an interesting addition to such a portfolio and although preferred shares are obviously still equity and rank junior to owning bonds and notes, they do rank senior to the common shares. I most cases a decision to invest in preferred shares boils down to balancing the risk/reward. In the case of Public Storage (PSA) one needs to weight the benefits of the currently 4.13% yielding preferred share series R (PSA.PR) versus the 2.3% yielding common shares which also offer additional capital gains upside. On the other hand, the preferred shares offer more ‘certainty’ in the long run but that doesn’t mean it always is the best decision.

A look at Public Storage’s performance and balance sheet

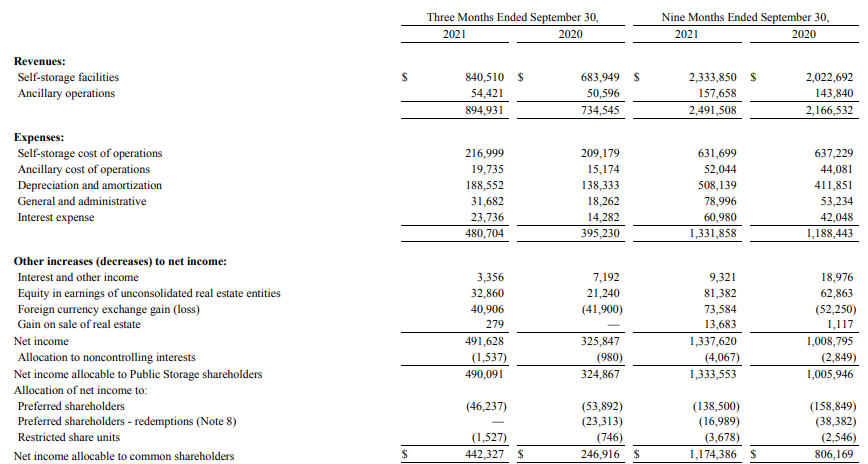

Public Storage continues to grow at a very fast pace as the REIT’s Q3 revenue came in at almost $900M, an increase from the $735M in Q3 2020 while the total revenue in the first nine months of 2021 was just under $2.5B, a double digit percentage increase compared to the $2.17B revenue in 9M 2020.

PSA SEC Filings

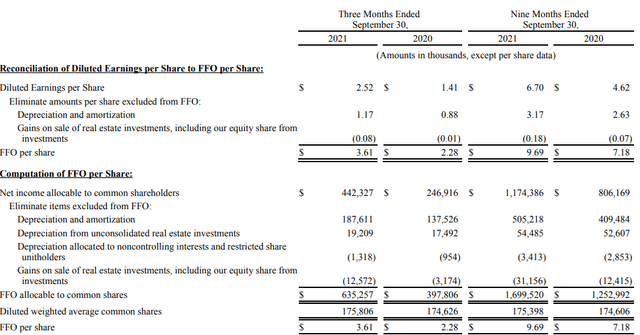

What really matters for a REIT isn’t the net income but the FFO per share as that’s a far better metric considering it excludes non-cash expenses like depreciation expenses. As these depreciation and amortization expenses are now trending at in excess of $800M per year (including the impact of a recent acquisition), it’s clear the reported net income is traditionally hit hard by these non-cash expenses.

Public Storage provides the calculation of the FFO in its financial statements, and as you can see below, the total FFO allocable to the common shares was just over $635M in the third quarter. This represents just over $3.60 per share.

It’s important to know the $635M already includes the impact of the preferred dividends, which have cost the REIT in excess of $46M during the quarter. This means the coverage ratio of the preferred dividends was almost 1,500% in the third quarter. That’s obviously excellent. Even if the pre-preferred dividend FFO would decrease by 80% (to be clear, this is just to paint an example, this is not a scenario I’m expecting at all), the preferred dividends would still be more than fully covered with a coverage ratio of just under 300%. So the preferred dividends appear to be very safe.

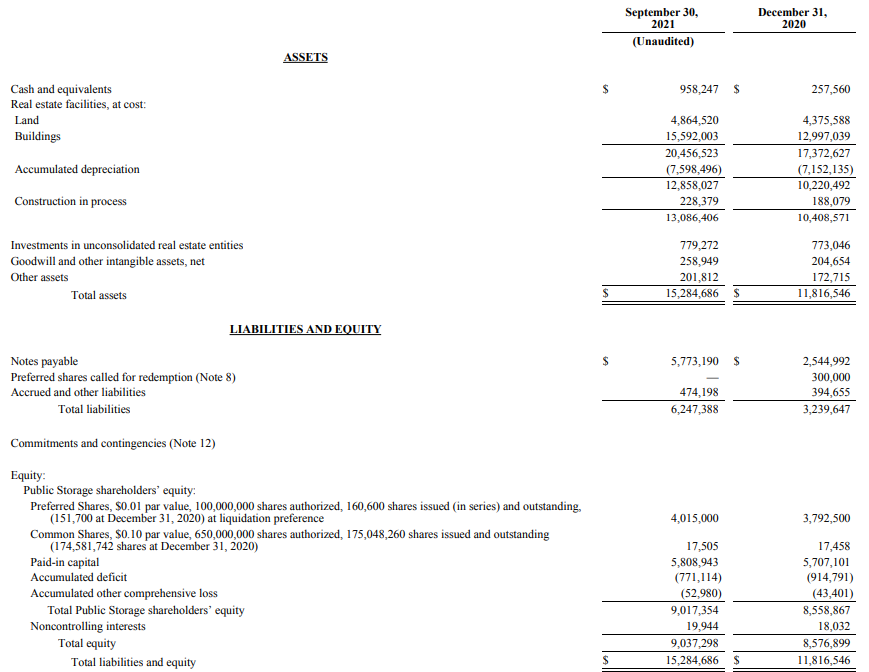

Now we have established the preferred dividends are safe, we also need to have a look at the balance sheet to check up on the asset coverage level.

PSA SEC Filings

We see the balance sheet total is approximately $15.3B of which just over $9B is equity.

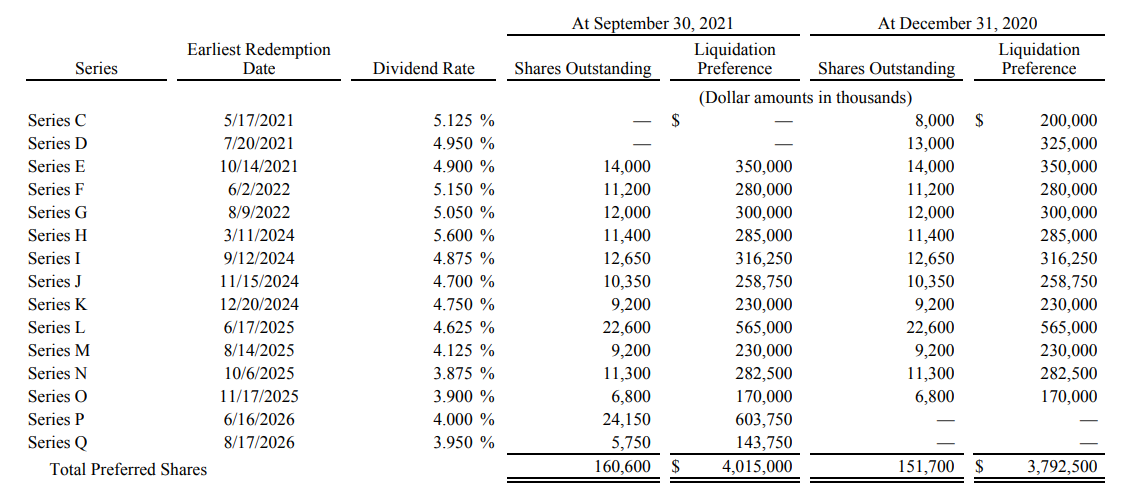

As of the end of September there were just over 160M preferred shares outstanding, for a combined equity value of just over $4B (note the Series R preferred shares and other preferred shares that were issued after September 30th are obviously not included in the table below.

PSA SEC Filings

While the $9B in equity is already more than sufficient to cover the $4B in outstanding preferred equity, keep in mind the $9.04B in total equity includes an accumulated depreciation of almost $7.6B on the assets. So if one would calculate the equity using the acquisition cost of the assets and deduct the $259M in goodwill, the tangible equity would be approximately $16.35B which means the asset coverage ratio of the preferred equity would be approximately 400%.

The recently issued preferred shares Series R

In this article I wanted to have a closer look at the preferred shares series R issued by Public Storage in November of last year. The company issued 17.4 million preferred shares at $25 for gross proceeds of $435M while the underwriters had an over-allotment option to place an additional 2.6 million shares for a maximum of 20 million preferred shares.

The preferred shares were issued with a 4% dividend yield, which means the $25 securities have an annual dividend of $1, divided in four quarterly payments of $0.25. At the current share price of $24.24, the yield is approximately 4.12%.

This wasn’t the only recent issue by Public Storage as the company issued another series of preferred equity in January, this time with a 4.10% preferred dividend. This series is currently trading at $24.89 for a very similar yield. These new preferred share issues will help to keep the balance sheet robust after announcing the plans to acquire All Storage, but it also is a good test to check up on the appetite of the market for these securities. In 2022, PSA will have the right to call $280M in preferred shares with a 5.15% preferred dividend and $300M in prefs with a 5.05% dividend. Should PSA be able to refinance these “expensive” prefs with newly issued preferred shares yielding 4.1-4.3%, the company could easily save a few million dollars per year in preferred dividends, which would benefit the common shareholders.

Investment thesis

I think the management of PSA is doing an absolutely excellent job in navigating the REIT toward a path of continuous growth without stretching itself too thin. I also believe issuing preferred equity at the current 4-4.2% rates will prove to be an excellent decision in the long run as this basically should be considered perpetual equity with cost of equity of just over 4%. The company has the right but never the obligation to buy these securities back so if we are heading toward a normalization of interest rates there’s absolutely no reason for PSA to buy back the preferred shares at par. Additionally, the preferred shares provide excellent torque to maximize the FFO for the common shareholders.

This brings me to the next point. Even if I’d exclude my desire to generate a capital gain – after all, I’m looking for a security for my income portfolio where the income and reliability of the income are much more important than potential capital gains. But that also means I should shy away from potential capital losses. In the scenario “the market” is requiring a 5% preferred yield from PSA (that could for instance happen when the interest rates move up), the Series R preferred share will drop to just $20 and it would take me over four years to recoup this drop in the form of preferred dividends.

PSA is an excellent example of a well-lead REIT but at this point I’m not overly excited to go long a 4.1% yielding preferred security. I will keep an eye on Public Storage’s preferred shares as higher market interest rates would result in value erosion on the preferred shares which could make them more appealing. A lot also depends on your personal tax situation. In my personal case, as a foreign investor, I would have to pay about 35-45% on the preferred dividends and that also plays an important role in not taking any position.

Be the first to comment