Joe Raedle/Getty Images News

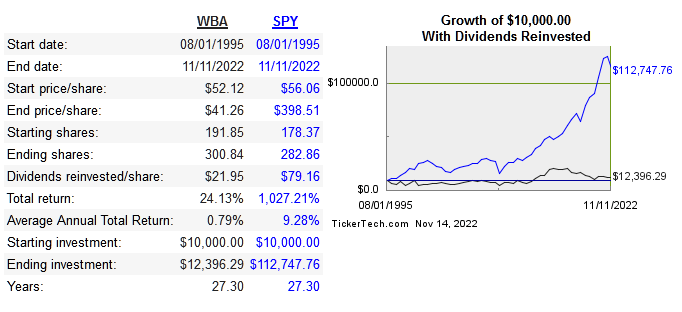

Walgreens Boots Alliance (NASDAQ:WBA) is a legacy business known for its chain of retail pharmacies. They currently operate 8,886 stores in all 50 states. WBA is no longer just a retail pharmacy chain though, they along with CVS have become more integrated by adding healthcare services to the business. Below is the longer term share price performance:

dividend channel

Below are the return on capital metrics between competitors:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

6.4% |

13.7% |

8.8% |

7.5% |

-2.7 |

|

|

10.6% |

11.5% |

8.2% |

8.8% |

18.3% |

|

|

-0.6% |

-12.5 |

1.3 |

n/a |

n/a |

Capital Allocation

The table below shows free cash flow and how it is spent.

|

Year |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

FCF(bil) |

3.08 |

2.78 |

4.41 |

6.52 |

5.9 |

6.89 |

3.89 |

4.11 |

4.17 |

2.16 |

|

Dividends(bil) |

1.04 |

1.19 |

1.38 |

1.56 |

1.72 |

1.73 |

1.64 |

1.74 |

1.61 |

1.65 |

|

Repurchases(mil) |

615 |

705 |

1,226 |

1,152 |

5,220 |

5,228 |

4,160 |

1,589 |

110 |

|

|

Acquisitions(mil) |

834 |

744 |

4,018 |

2,412 |

88 |

4,793 |

741 |

718 |

2,189 |

Many people identify WBA as a dividend stock and for good reason. It has consecutively raised its dividend for 47 years in a row. Share buybacks have trailed off lately, and this is the biggest issue I see in regards to capital allocation. This stock never trades at extremely high multiples, so I do believe that EPS would have been boosted by emphasizing reducing share count over the long term.

Risk

The biggest fundamental risk in the long run comes from the company poorly allocating capital. This includes the possibility that adding health services to the business model just doesn’t work out as expected. Cost cutting measures were introduced in 2015, but this has yet to pan out as margins at all levels are higher now. The current operating margin of 1% obviously needs to expand in order for EPS to grow.

Long term debt plus lease obligations are around $32 billion. I’m not concerned with this level of debt due to the fact that WBA has been aggressively paying down debt recently. Over $60 billion of debt has been paid down in the past five years.

Valuation

The multiples comp is below:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

WBA |

0.3 |

8.8 |

1.15 |

1.1 |

4.6% |

|

CVS |

0.5 |

8.1 |

8.2 |

1.8 |

2.2% |

|

RAD |

0.1 |

12.6 |

-15.1 |

-1 |

n/a |

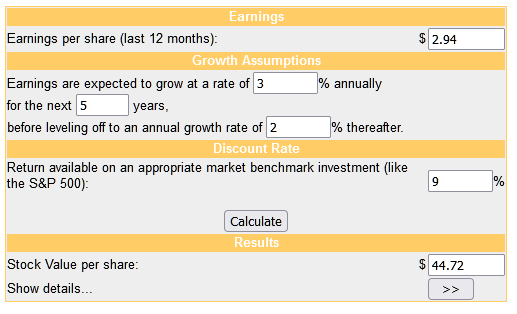

Next is the dcf model using 2021 EPS:

money chimp

The time to buy would have been early last month, when shares dropped to $30.52 and the dividend yield was at 6.2%. This would have been a very good yield to lock in for a blue chip stock, but my concerns about future growth still remain.

An investor needs to be honest about what they can possibly receive from WBA. Like many blue chips, the law of large numbers has slowed revenue growth. The limit has already been hit as far as acquiring any direct competitors. This is why so much emphasis has been put on health services lately.

The dividend yield might seem good in the context of being higher than the S&P average, but the one-year US bond rate is currently at 4.6%, exactly the same as WBA’s current dividend yield. The fundamental growth of the businesses is so slow that it has almost become like a trust. I consider WBA to be a good quality business, but at this price it is a hold. The better opportunity, last month’s decline, has already passed.

Conclusion

WBA deserves credit for trying to expand their business model into health services, but even if it works it will take time. I’m not very bullish on fundamental growth, and would prefer to see a heavy emphasis on share count reduction over dividends. WBA has a reputation for being a dividend-centric stock, and for income seekers it has done its job by raising the dividend 47 years in a row.

The best opportunities to buy the stock revolve around the dividend yield, and the best recent opportunity has passed. There is virtually no way to beat the market with this stock, its best use is in collecting dividends. The stock deserves a low multiple.

Be the first to comment