ArtMassa/iStock via Getty Images

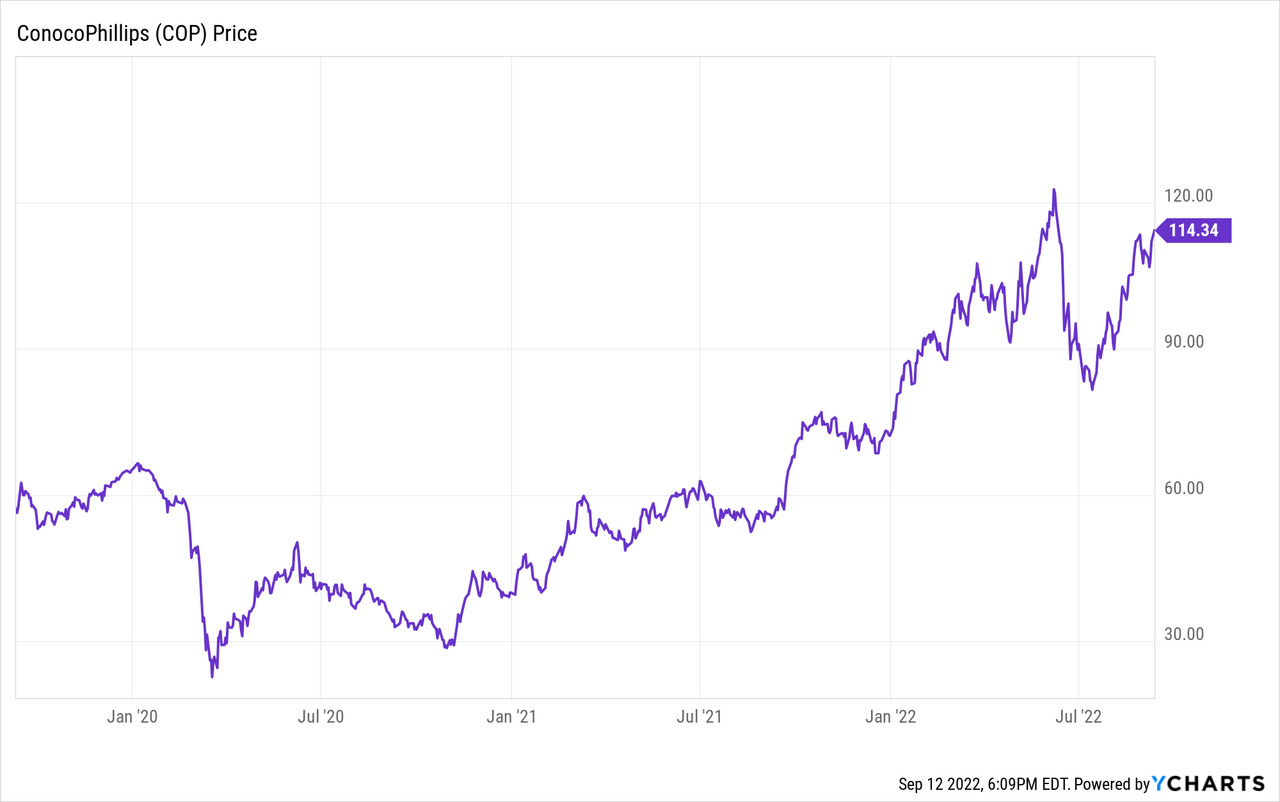

ConocoPhillips’ (NYSE:COP) stock price has quintupled since its lowest point in March 2020. While this is partially due to big oil and gas price increases, credit also goes to savvy managers who bought Permian reserves a) being sold for non-economic reasons (Shell Permian in 2021, to reduce its carbon footprint per European Union guidance) or b) whose value was not fully recognized (Concho, after its RSP Permian acquisition).

Moreover, the company’s international diversification in the North Sea (Norway) means it is already doing the offshore drilling the UK and some European countries now finally again support.

The company was chosen to participate in QatarEnergy’s North Field East LNG project. It has also entered into a non-binding Heads of Agreement with Sempra (SRE) to participate in large-scale US LNG export projects.

So, despite the 400% stock price increase from a March 2020 low of $22.67/share, due to the company’s growth prospects, regular dividend increases, special (variable) dividends, enhanced repurchase program since my last review, and general oil and gas sector price strength, I recommend ConocoPhillips as a “buy.”

Macro

As Russia stopped exporting oil, gas, distillate, and coal to Europe-and as Europe has sanctioned those purchases due to Russia’s invasion of Ukraine-the energy markets spiked, particularly natural gas in Europe. The UK and EU countries are pursuing financial subsidies and substitutes to meet their citizens’ energy needs. Indeed, a Wall Street Journal headline sums up one result: “Europe’s Industry Reels at Gas Shutoff.”

Very high European natural gas prices and lack of supply has incentivized liquefied natural gas trade into Europe. New LNG facilities are being built in the US, Qatar, and elsewhere, and Europe is building new regasification terminals and pipeline connections. However, since these are longer-term solutions that don’t address the issue now, EU countries are also lining up floating LNG vessels and seeking out natural gas substitutes (wood chips, oil, propane, diesel, coal, and-finally-nuclear).

On the oil side, with a fair amount of friction (evident in the discounting), Russia is now selling oil to China and India instead of Europe. Meanwhile, OPEC oil displaced from those markets is-musical chairs-going to Europe. Complicating supply factors include the US drawdown of strategic petroleum reserves and the potential for more Iranian oil. On the demand side, Chinese (and European) economies are lagging.

Investors should be aware that, although oil is helping fill the natural gas gap in Europe, fall and winter are off-seasons for gasoline demand, so oil prices tend to soften.

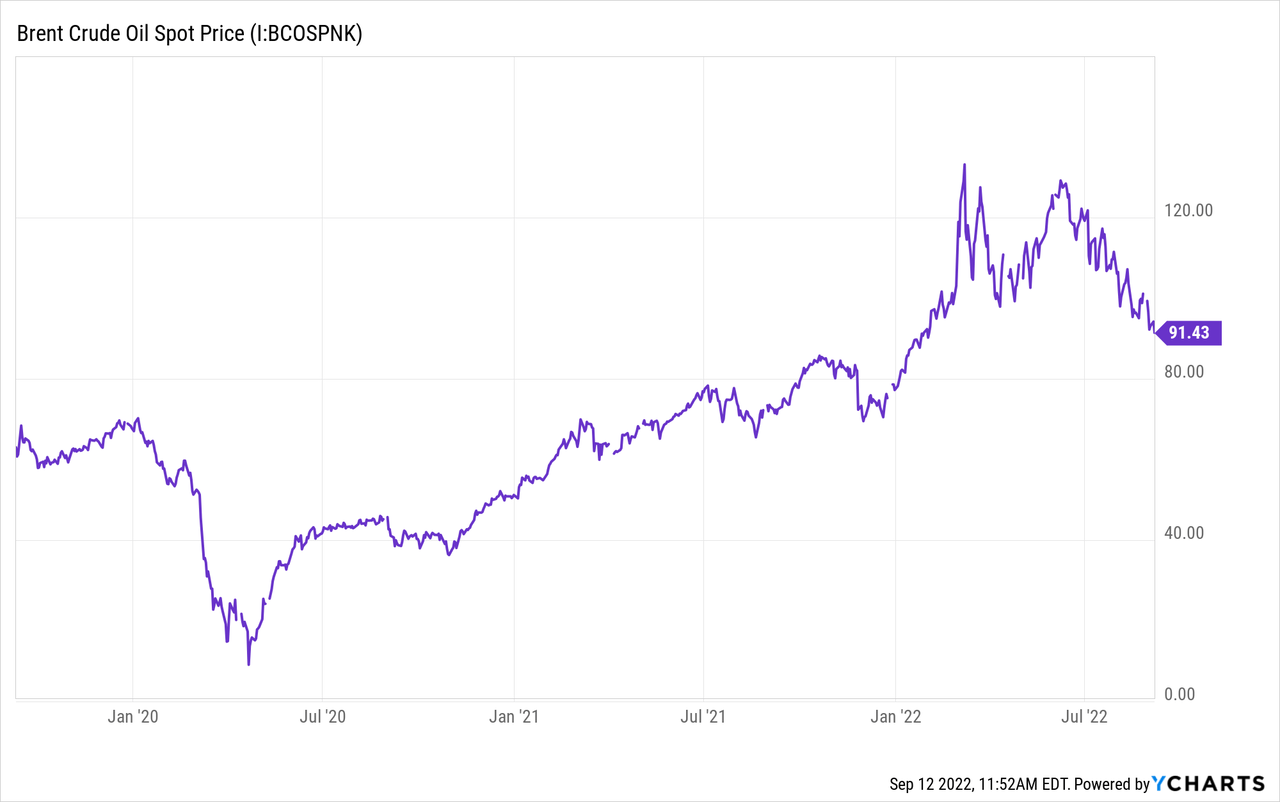

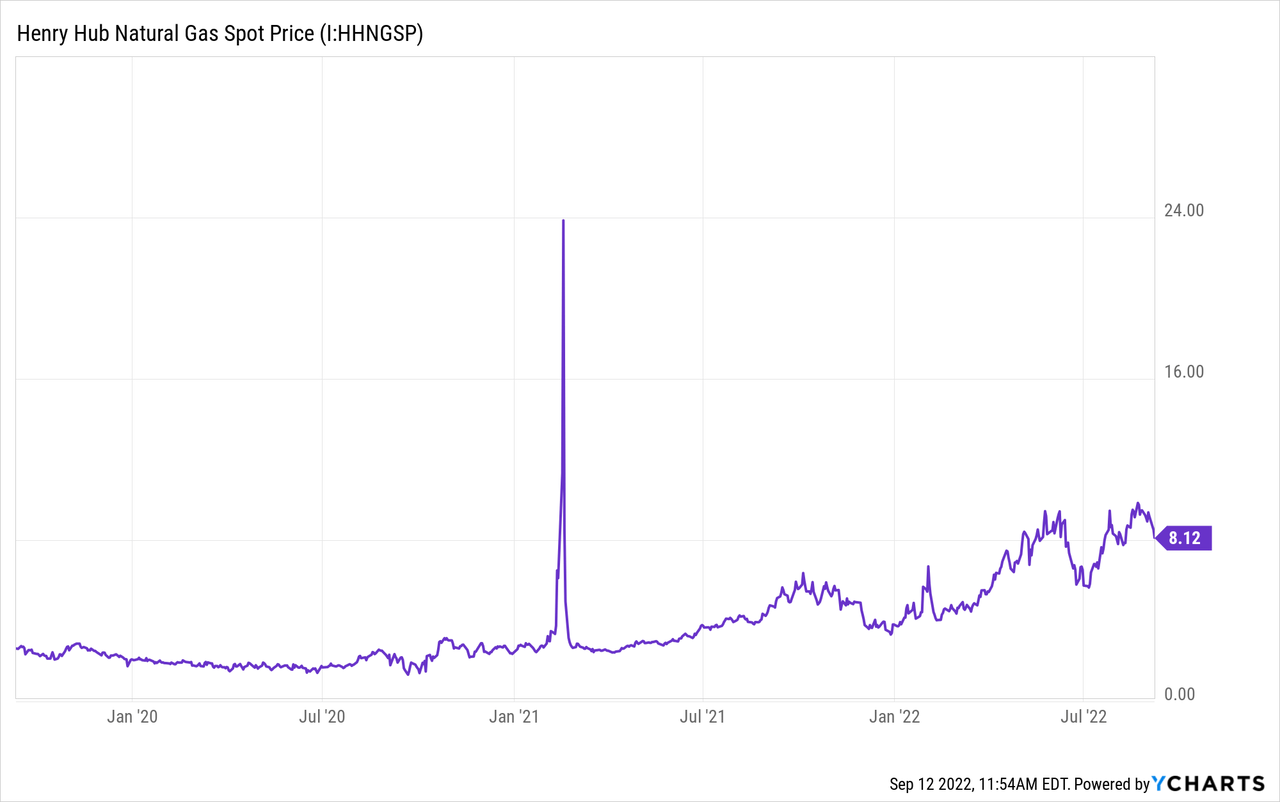

Oil and Gas Prices

The September 12, 2022, Brent oil price was $94.23/barrel for November 2022 delivery. The West Texas Intermediate (WTI) crude oil price was $88.00/barrel for October 2022 delivery. Henry Hub natural gas for October 2022 delivery was $8.37/MMBTU. Dutch Title Transfer Facility (TTF) LNG for October 2022 delivery was more than seven times higher at $61.12/MMBTU.

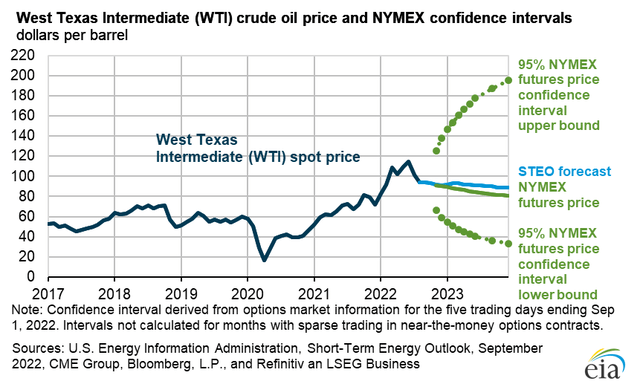

The US Energy Information Agency (EIA) shows a 5-95 confidence interval of about $35/barrel to $195/barrel for WTI prices at year-end 2024.

Energy Information Administration

ConocoPhillips Second-Quarter 2022 Results

In the second quarter of 2022, ConocoPhillips earned net income of $5.1 billion or $3.96/share. This compared to 2Q21 net income of $2.1 billion or $1.55/share.

The company’s average realized price in 2Q’22 was $88.57/BOE, versus $50.03/BOE for 2Q21.

In line with these excellent results, the company announced a $5 billion increase in planned 2022 return of capital to $15 billion. COP distributes capital via ordinary dividends, variable return of cash (VROC) payments, and share repurchases.

ConocoPhillips generated cash from operations of $7.9 billion, far ahead of $4.2 billion in 2Q21. From this, it made $2.0 billion in capital expenditures, paid $1.9 billion to reduce total debt, distributed ordinary dividends and VROC of $1.0 billion, and repurchased $2.3 billion of shares.

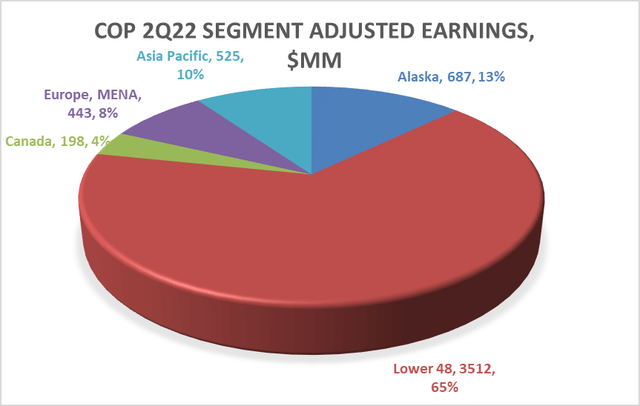

Starks Energy Economics, LLC & ConocoPhillips

The chart above shows the US (Lower 48 plus Alaska) accounted for 78% of ConocoPhillips’ segment earnings.

ConocoPhillips explores for and produces oil, natural gas, natural gas liquids, and bitumen in five geographic regions: Alaska, Lower 48, Canada, Europe and North Africa-Middle East, Asia-Pacific. The company’s largest Lower 48 production is from the Eagle Ford, Bakken, and the Midland and Delaware sub-basins of the Permian.

Internationally, COP’s Asia-Pacific region comprises China, Malaysia, and Australia. Its Europe-Africa-Middle East region comprises Norway, Qatar, and Libya.

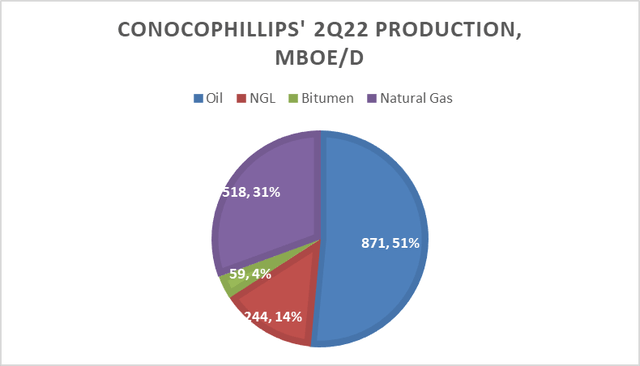

In 2Q’22 the company produced 1.692 million BOE/D:

- 51% or 871,000 BPD, was crude oil.

- 31% or 518,000 BOE/D was natural gas.

- 14% or 244,000 BPD was natural gas liquids.

- 4% or 59,000 BPD was bitumen.

Starks Energy Economics, LLC & ConocoPhillips

For 3Q22, the company expects to produce 1.70-1.76 million BOE/D and to average 1.74 million BOE/D for full-year 2022.

Operating cost guidance for 2022 is $7.5 billion. The company expects 2022 capital expenditures to total $7.8 billion.

Europe, Middle East, and North Africa

In 2021 the Europe/Middle East/North Africa region represented only 258,000 BOE/D of COP’s total production; however, it illustrates additions to the company’s North American operations:

- Libyan operations, uncertain at best, yielded an average of 40,000 BOE/D to COP, mostly oil.

- Qatari operations could grow with COP’s participation in QatarEnergy’s North Field East LNG project. In 2021, COP’s share of Qatari production was 83,000 BOE/D, mostly natural gas.

- Norwegian operations-a potential focus area with the cutoff of Russian oil and gas to Europe-in 2021 produced 135,000 BOE/D (COP’s share), 60% oil and 40% natural gas.

Reserves and PV-10 Value

As I predicted last year, higher prices and larger volumes combined to increase ConocoPhillips SEC PV-10 reserve value at year-end 2021 relative to year-end 2020. The increase was huge: an incredible 7.7x over year-end 2020 PV-10 reserve value: $57.7 billion for SEC PV-10 reserve value in 2021 compared to the year-earlier total of $7.5 billion.

This was partially a price effect: 2021 oil and gas prices were leagues ahead of 2020 prices.

But the 2021 reserve total also brought to light the hidden size of the Concho acquisition, particularly what Concho itself had earlier acquired with RSP Permian. The Concho and the Shell Permian reserve acquisitions factored into a 44% volumetric increase in COP reserves between 2020 and 2021. Put another way, ConocoPhillips’ reserves increased from 3.7 billion BOEs at year-end 2020 to 5.4 billion BOEs at year-end 2021. The increase due to purchases (acquisitions) was 1.17 billion BOEs, or about 32%.

Competitors

Headquartered in Houston, Texas, ConocoPhillips produces significant volumes of oil and gas from many major Lower 48 oil and gas basins as well as Alaska and offshore Gulf of Mexico. It thus competes with virtually every other public and private US producer.

Internationally, ConocoPhillips competes with North Sea and other international and national oil and gas companies.

Governance

At September 1, 2022, Institutional Shareholder Services ranked ConocoPhillips’ overall governance as a weak 9, with sub-scores of audit (3), board (8), shareholder rights (8), and compensation (10). In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk.

From Sustainalytics, Inc., in August 2022 ConocoPhillips’ total ESG risk score was 35, or “high,” in the 78th percentile. Its sub-scores are environmental risk (17.3), social risk (9.7), and governance risk (7.9).Controversy level is 2, or moderate.

Insiders own a negligible fraction, just 0.1%, of the stock. Effective August 15, 2022, stock shorted as a percent of float was 1.2%.

ConocoPhillips’ beta is 1.32. This is more volatile than the market for a large company but reflects the right-angle change in the energy sector due to Russia’s invasion of Ukraine, as well as the uncertain Chinese (and even more uncertain EU) economies.

On June 29, 2022, the five largest institutional stockholders, some of which represent index fund investments that match the overall market, were Vanguard (8.7%), Blackrock (7.9%), State Street (4.9%), JP Morgan (4.2%), and Capital International Investors (3.5%).

All five are signatories to the Glasgow Financial Alliance for Net Zero, a group that, as of May 31, 2022, manages $61.3 trillion in assets worldwide and which (despite high-cost energy due in part to hydrocarbon energy supply constraints) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

COP Financial and Stock Highlights

ConocoPhillips’ market capitalization is $145.6 billion at a September 12, 2022, stock closing price of $114.39/share, 92% of the 52-week high of $124.08/share. The current market capitalization is up 44% from $100.9 billion in October 2021.

The one-year target price is $121.09/share, putting the closing price at 94% of that level.

Trailing twelve-months’ EPS attributable to ConocoPhillips per share of common stock is $12.12 for a current price-earnings ratio of 9.4.

Twelve-month returns on assets and equity are both excellent at 16.1% and 33.7%, respectively.

ConocoPhillips’ dividend of $1.92/share represents a 1.7% annual yield at the closing price. This ordinary dividend does not include the company’s VROC payment, which was $1.40/share in 2Q’22.

The company also has a large share repurchase program underway.

On June 30, 2022, ConocoPhillips had $43.5 billion in liabilities, including $16.3 billion of long-term debt (and less than $700 million of short-term debt), and $93.7 billion in assets giving a liability-to-asset ratio of 46%.

The company’s ratio of debt to market capitalization is a small 12%.The debt-to-EBITDA ratio is very comfortable at 0.56.

The mean analyst rating is a 2.0, or “buy” from 21 analysts.

Notes on Valuation

ConocoPhillips’ market capitalization is $86,100/flowing BOE and $167,200/flowing barrel of oil. These are high relative to historical levels, but similar to those for Chevron (CVX) in my July 2022 Seeking Alpha analysis.

Book value per share of $39.44 is about a third of the market price, implying positive investor sentiment. The ratio of enterprise value to EBITDA is well into bargain range (less than 10) at 4.9.

Comparing overall totals: PV-10 reserve value is $57.7 billion, asset value is $93.7 billion (liabilities of $43.5 billion) and market capitalization is $145.6 billion.

Positive and Negative Risks

ConocoPhillips’ results are sensitive to global oil and natural gas prices. The biggest risks remain market dislocations resulting from the Russia-Ukraine war. On the supply side, OPEC could pump somewhat more oil, and more countries could, like China and India, simply buy Russian oil, despite the sanctions. Should the war end, it is conceivable that Russia could resume its old sales arrangements.

In the US inflationary pressure could cause drilling costs to continue to increase.

Political risk is quite pronounced in the US given the anti-hydrocarbon policies of the Biden administration and states like California. Internationally, in addition to the fallout from the Russian war on Ukraine and its effect on Europe, Libyan production has waxed and waned due to armed conflicts there.

However, the conflicts, particularly the need for North Sea supply and liquefied natural gas, have created demand openings for ConocoPhillips in its a) Norwegian operations, b) baseline US Permian operations, c) potential LNG agreement with Sempra, and d) an LNG project agreement with QatarEnergy.

Recommendations for ConocoPhillips

Despite its significant stock price increase, I recommend ConocoPhillips to both growth and dividend investors.

In addition to its small regular dividend, COP is making variable cash payouts and has repurchased shares, targeting a return of $15 billion to shareholders this year.

Yet the company sports an affordable price/earnings ratio, a bargain ratio of enterprise value to EBITDA (4.9), relatively little debt in its structure-and is paying down that debt-a good and perhaps even still undervalued Permian asset base, and very prospective international drilling and LNG projects.

conocophillips.com

Be the first to comment