vm

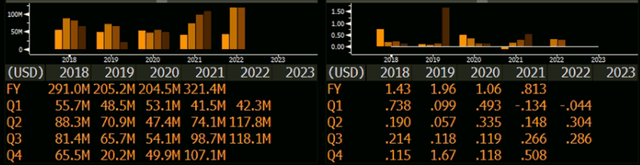

FutureFuel (NYSE: FF) reported extremely strong results for Q3 ended September, which were much ahead of our expectations. Revenues surged +20%, while EPS was up +71%. After a poor Q2, it is encouraging to see a solid rebound in Q3. All segments of the business had solid performance. Biodiesel, in particular, operated at full capacity and experienced a sharp increase in margins. This is despite extreme volatility in energy markets and pricing.

Within the chemical segment, momentum is strong, with revenues and operating income increasing both YoY as well as sequentially. Both product mix and higher sales volume contributed to the strong showing. The heating oil business experienced some minor losses, and FF has amended its derivatives strategy to help reduce these losses and volatility in results going forward.

As can be seen from the following chart, Q3 was the highest revenue quarter for FF in the past 5 years. We don’t yet have FCF numbers for Q3, but those too should be among the most robust results during the past few years.

The stock price has soared +22% within a couple days of the results announcement, and now the stock is up +5% YTD, but well off of its prior highs of $10.45 achieved earlier this year in May.

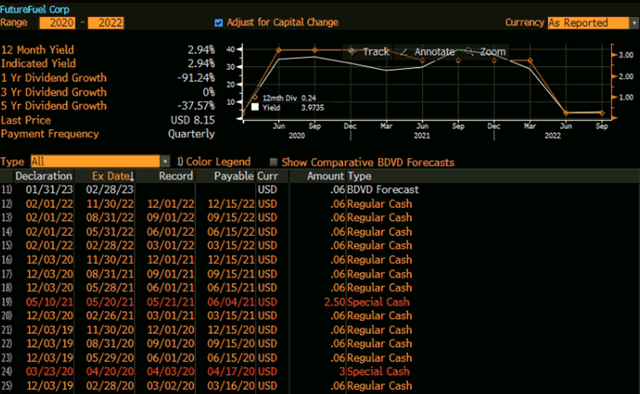

Net cash totaled $210 million as of September-end, up significantly from $185 million at 2021 year-end. Net cash is now $4.80 per share, or fully 59% of the current stock price. This will likely enable special dividends going forward.

The company also announced its regular dividend of $0.06 per share. We remain quite confident of another special dividend announcement shortly, most likely at the start of calendar 2023.

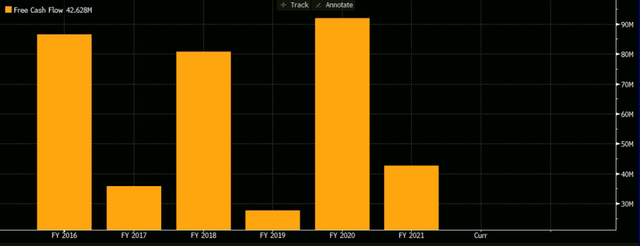

Strong Free Cash Flow

FutureFuel’s stock is down 13% [including dividends] since we initiated coverage on it in May 2020, due to issues with the Texas winter storm last year, prior weak chemical segment performance and higher commodity prices now. Also, the lack of a special dividend earlier this year during a bear market sent the stock downwards – as we have already discussed in previously.

As we have noted in our earlier updates on the company – “FutureFuel’s profitability numbers can show large variations because of mark-to-market changes on financial instruments. Our earnings model forecasts a steady state business for the company and our estimates don’t factor in the impact of such mark-to-market changes.”

On our current pro-forma estimates the stock is currently trading at inexpensive valuations of 6.8x our 2023 estimate of $1.20. On an ex-cash basis this looks even cheaper as ex-cash P/E is 3.6 on 2023. The company has demonstrated good ability to generate free cash flow, and our $1.40 FCF per share estimate for 2023 results in a FCF yield of 17%. In 2021, the dividend yield touched a whopping 34% [including the special dividend] based and on today’s stock price. The company also has a net cash to market cap of 59% which gives us comfort on the balance sheet and the company’s ability to pay dividends. This indicates that the downside from here is limited, in our opinion.

For a current market cap of $356 million [cash-adjusted Enterprise Value of only $146 million], FutureFuel generates a tremendous amount of FCF. The company generates high levels of cash flow from operations [CFO], with minimal CAPX – one could call it an FCF machine! In strong years, the FCF [CFO – CAPX] is over $80 million, while in soft years, the FCF is still around $30 million, as seen in the following chart:

Valuations and target price

We value FutureFuel using an ex-cash 13.0x P/E on our 2023 ex-cash EPS estimate of $1.20 and add back the $4.80 per share of net cash. This gets us to a target price of $20.00. Our target price of $20.00 implies a 16.7x P/E on the 2023 EPS and an upward potential of 245% from the current stock price. Note the stock traded over $19 in 2019, and the high teens last year as well.

FutureFuel’s large $2.50 per share Special Dividend last year, and $3.00 per share in 2020, can been seen in the following chart:

Conclusion

FutureFuel generates tremendous amounts of FCF from its biofuel business and chemical businesses. There is year-to-year volatility in results, and some unpredictability for any given quarter, but even in tough years and during the pandemic, FF always generated significant FCF. With net cash to market cap of 59%, we believe the downside from here is limited, and another large special dividend is probably just a few months away. That will be a huge catalyst for the stock.

The stock is currently trading at inexpensive valuations of 6.8x our 2023 estimate of $1.20, and even cheaper on an ex-cash basis at 3.6x. We reiterate our unchanged $20 price target, and extremely positive risk-reward viewpoint.

Be the first to comment