Alistair Berg/DigitalVision via Getty Images

Looking through the iREIT Ratings tool, I noticed something rather extraordinarily this week…

The 3 highest rated stocks on the tracker are all currently in “Buy” territory.

When I say highest rated, I’m talking about the iREIT IQ quality rating system.

This is a 100-point rating scale which is based off of a wide variety of operational, fundamental, and balance sheet related metrics.

Right now there are only 3 REITs within the iREIT rating universe that have a perfect 100/100 iREIT IQ quality scores.

One would imagine that during a volatile time like this in the markets we’d witness a flight to quality as investors flock towards safe and reliable income (and fundamental growth prospects). However, after the sell-off that we’ve seen in recent weeks, that doesn’t appear to be the case.

Yet, these blue chips with perfect quality ratings are the perfect types of stocks to own during uncertain times. This is why I’m writing about Realty Income (O), Prologis (PLD), and Alexandria Real Estate (ARE) again.

Truth be told, I’ve covered each of these companies fairly recently.

Both Prologis and Alexandria made my list of “Top 10 REITs A 70-Year-Old Should Hold Forever.”

I admit, when I started writing this piece, I wondered if I was beating a dead horse here. But, I wanted to take the time here to double down on that bullish thesis, highlighting just how attractive today’s valuations are for these picks.

At the end of the day, if I’m going to sound repetitive, I want to do it singing the praises of best-in-breed stocks.

When I see real estate investment trusts (“REITs”) like these trading with historically cheap valuations and historically high dividend yields…well, needless to say, I get excited.

That’s especially the case when I believe that low-risk blue chips have the potential to provide double-digit total returns.

Buying blue chips into weakness is the best way that I know of to get rich in the markets (regardless of how old you are).

As you’ll see in a moment, these picks aren’t just about safe yields, but also, strong total returns.

The fact is, get-rich-quick schemes don’t work. We all know that. What I’m interested in is getting rich in a steady, reliable, and low-risk manner. And, that’s exactly what the opportunities presented by these 3 stocks can do for patient and disciplined investors over the long-term.

Realty Income Corporation

Realty Income is a triple net lease REIT with a $41.9 billion market cap, an A- rated balance sheet, and a 4.48% dividend yield.

O’s triple net lease business model has allowed the company to produce positive bottom-line growth during 25 out of the last 26 years. In short, it doesn’t get more reliable than “The Monthly Dividend Company.”

Realty Income’s average annual adjusted-funds-from-operations growth since 1996 is 5.1%. And, this reliable fundamental growth has translated directly into a reliably increasing dividend.

Realty Income has declared 625 monthly dividends and the company has increased its dividend for 99 consecutive quarters. Since 1994, Realty Income’s compound annual dividend growth rate is 4.4%.

At the end of its most recent quarter, Realty Income owned 11,427 commercial real estate properties. For decades, Realty Income has been known for owning top notch real estate in the U.S., and in recent years the company has taken advantage of this expertise, combined with low rates across the Atlantic, to build out a European portfolio as well.

At the end of the second quarter, Realty Income owned more than $5 billion worth of European real estate investments, increasing its overall diversification.

Overall, 43% of Realty Income’s tenants carry investment grade credit ratings, providing peace of mind during markets like this when more and more investors are talking about an impending recession.

Since 1994, Realty Income has generated a total return CAGR of 15.1% alongside a 0.5% beta, meaning that shares are in the 93rd percentile of S&P 500 companies in terms of total return per unit of market risk.

During the 28-year period since Realty Income’s IPO, the company has posted the 6th lowest beta in the S&P 500, which is why I consider this a perfect “SWAN” (Sleep Well At Night) stock.

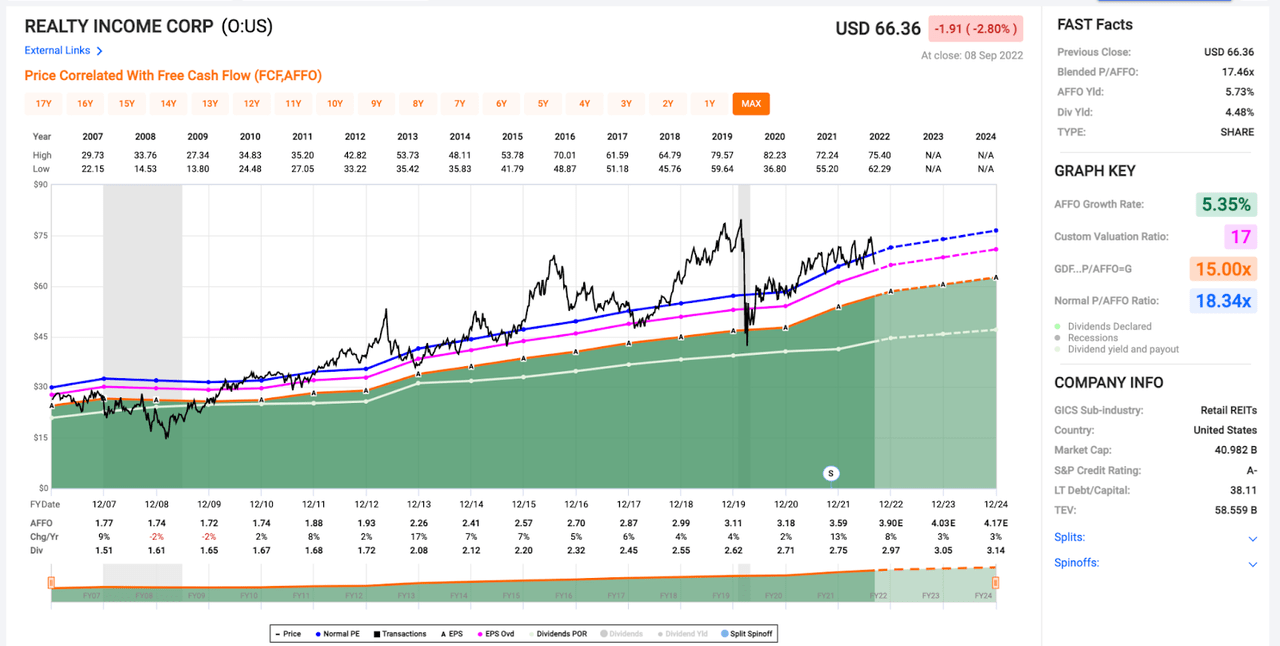

With all of that in mind, you’d think that the market would be willing to pay a premium for O shares; but, as you can see below, Realty Income is currently trading at a discount to its long-term average P/AFFO multiple.

Realty Income shares are down by 9.41% during the last month and this sell-off has pushed the blended P/AFFO ratio attached to shares down to 17.5x.

On a forward basis, Realty Income is trading for 17.0x 2022 full-year expectations and just 16.5x 2023 full-year estimates.

FAST Graphs

On the chart above I’ve highlighted that 17.0x multiple in pink.

As you can see, it has served as very strong support for Realty Income since 2011 and therefore, I find today’s valuation very attractive from a risk/reward perspective.

O’s 5-year, 10-year, and 15-year average P/AFFO multiples are 19.86x, 19.74x, and 18.48x, respectively.

What’s more interesting here is that O’s AFFO growth in recent years (13% in 2021 and 8% estimated for 2022) is above historical averages in the mid-single digits. Therefore, fundamentally speaking, the stock deserves a premium today, not a discount.

O’s recent sell-off has pushed its dividend yield from the sub-4% level back up to the 4.5% mark.

Due to its immense quality and ongoing growth prospects, we believe that O deserves an AFFO multiple in the 19-20x area.

But, to generate double digit total returns moving forward, O doesn’t even need to trade up into that range.

If Realty Income manages to hit earning growth estimates over the next 16 months or so and shares receive a bullish bid that pushes its P/AFFO multiple up from the 17.5x mark to the 18.0x mark, investors buying shares here today in the $66.00 area would be looking at an annualized rate of return in the 11.50% area by the end of 2023.

If O were to trade towards the midpoint of our fair value range (~19.5x), investors buying today would be looking at an annualized rate of return of approximately 18.1% (a share price of ~$78.50 + approximately $4.00 in dividends).

Finally, looking at the long-term chart above, you’ll see that O shares have traded in the 22-24x range several times during the last decade. If O were to trade back up into the 23x range by the end of 2023 (the midpoint here), investors buying today would be looking at an annualized rate of return north of 33%.

At that point in time, we’d believe that shares are overvalued; however, we also don’t think that sort of premium is outside of the realm of possibility, showing the strong upside potential that O shares offer investors today on the dip.

O is currently rated a “Buy” within the iREIT universe with a fair value estimate of $70.30/share.

Prologis, Inc.

Since I already highlighted PLD’s operations in yesterday’s article, I’ll hop right into the stock’s wide margin of safety and my forward-looking total return expectations (here’s a link to that piece if you’re looking for a high-level overview of the company).

PLD is down by more than 21% on a year-to-date basis and in recent weeks, the stock has fallen from the $138.50 range to its current level in the mid-$120’s.

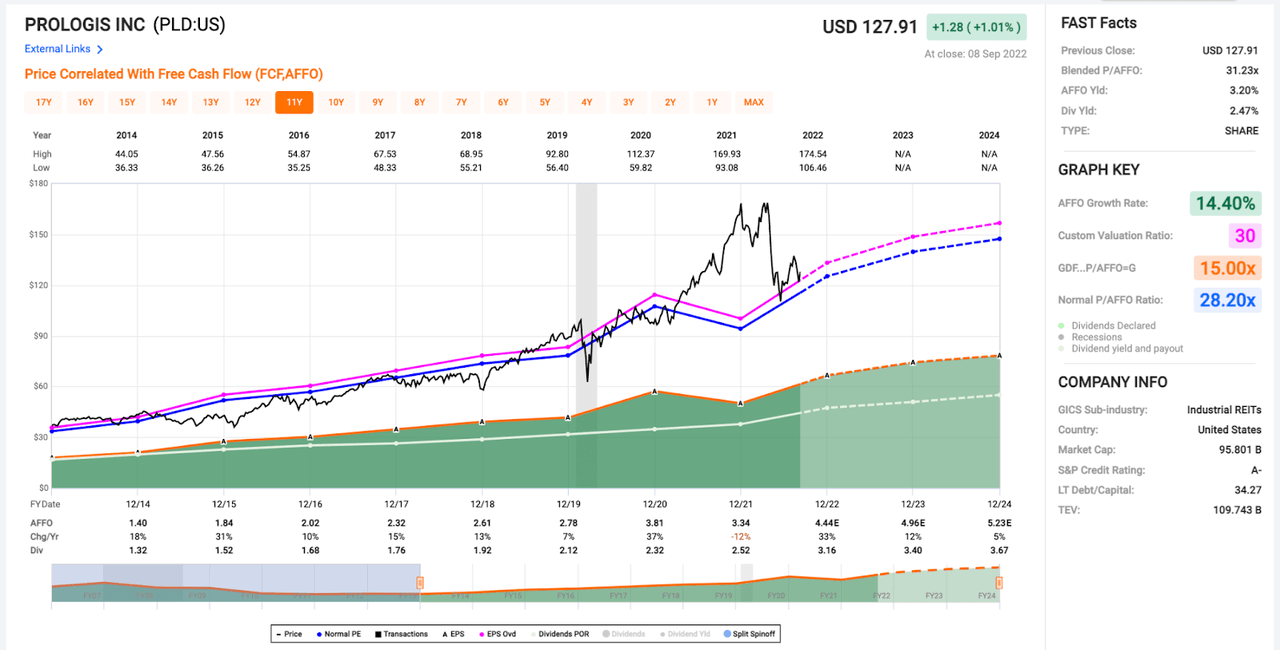

Today, PLD shares trade with a blended P/AFFO multiple of 31.2x attached to them. However, it’s important to note that PLD is expected to post 33% AFFO growth in 2022 and, therefore, when looking at PLD’s forward P/AFFO multiple (based upon current consensus 2022 AFFO estimates), the stock is trading for less than 29x.

PLD’s strong growth is expected to continue into 2023 as well. Right now, we believe that this company will generate 12-15% AFFO growth next year, and with that in mind, PLD’s forward multiple (when based on 2023 expectations) is even cheaper.

PLD is currently trading for just 25.8x next year’s AFFO estimates and that sub-26x level is well below the stock’s 5 and 10-year average P/AFFO multiples of 28.0x and 28.4x, respectively.

When analyzing PLD, we like to look at the stock’s relative valuation through a lens that encompasses the 2013+ period because that’s when PLD’s strong double-digit growth really took off (due to the strong rise in eCommerce operations across the global retail space). During this period of time, PLD’s average P/AFFO multiple is 28.2x.

FAST Graphs

Therefore, with our strong forward looking growth estimates in mind, we believe that shares are cheap today.

iREIT’s fair value estimate for PLD is $150.00/share, which equates to a ~30x forward multiple (which is marked on the chart above with the pink line).

As you can see, the stock recently bounced off of that level, and we certainly wouldn’t be surprised to see that threshold serve as support for shares in the near-term (once again, resulting in an attractive risk/reward proposition at current levels).

Looking ahead, if PLD produces 12% AFFO growth in 2023 (the low-end of our growth estimates), continues to grow its dividend as expected, and trades in that 30x area (remember, this is a slight discount to the stock’s present blended valuation, to this thesis includes some downward pressure on the stock’s valuation), then investors buying shares today in the $128 area are setting themselves up to generate an annualized rate of return in the 14.6% area.

We expect to see PLD’s growth slow into 2024 (largely, due to extremely rough same-store NOI comps that shares will be up against in the coming years); yet, even with that in mind, if PLD trades for 30x our 2024 estimates, investors buying shares today are still looking at an ~11.5% total return CAGR.

PLD posted 25%+ dividend growth in 2022 and looking ahead, we expect to see double digit dividend growth during 2023 as well.

So, not only does this stock offer a relatively safe, fast-growing 2.5% dividend yield…but also very strong total return potential as well.

Alexandria Real Estate Equities, Inc.

Once again, I broke down ARE’s operations in yesterday’s article, so in this piece, I’ll skip right to the valuation thesis.

ARE shares are down nearly 28% on a year-to-date basis.

They’re down roughly 2.25% during the last month (this includes a nearly 5% rally during the last week when I was originally planning out this article series).

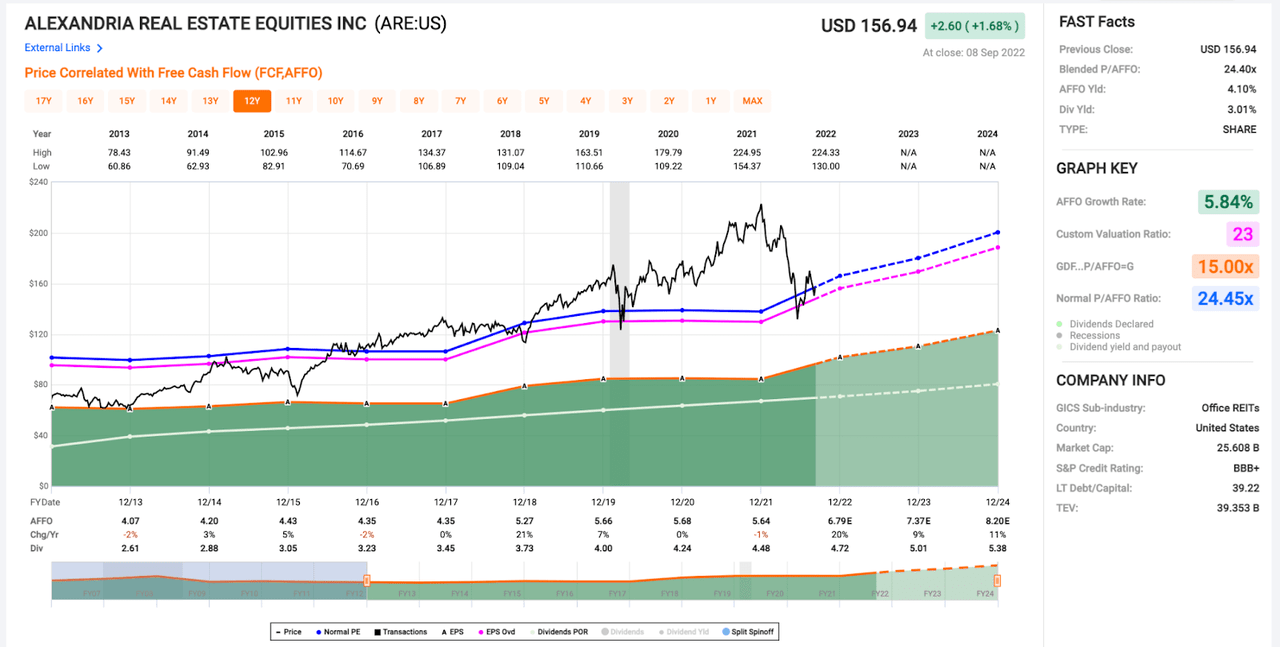

Today, ARE trades with a 24.4x blended P/AFFO multiple.

FAST Graphs

Again, this may seem pricey to some; however, this valuation level represents a discount to ARE’s 5 and 10-year average multiples of 30.0x and 24.5, respectively.

And, like both O and PLD, Alexandria’s growth in recent years (as well as the stock’s future expectations) has been well above historical averages and, therefore, we believe that ARE shares deserve a premium in today’s market environment.

ARE is expected to post 20% AFFO growth in 2022. And, in 2023 and 2024, we’re expecting to see ARE compound its bottom-line at a double-digit clip.

In short, it’s rational to pay up for this double-digit compounding potential.

iREIT’s fair value estimate for ARE is $170.00. That equates to a ~23x forward multiple, which is a discount that we feel comfortable with.

This 23x threshold is marked on the chart above with a pink line and once again, you’ll see that during recent sell-offs, it has served as fairly strong support for shares.

At this 23x forward level, assuming that ARE hits consensus AFFO and dividend growth estimates looking out to 2023 and 2024, investors buying shares today are looking at 11%+ annualized total return prospects over the next 2+ years.

If ARE continues to trade in the 24.5x range where the stock sits today, fundamental growth over the next 16 months or so would result in an annualized rate of return of nearly 14% between now and the end of 2023.

Lastly, in a more bullish scenario where ARE shares saw their multiple revert back up to the 30x 5-year average, investors buying here at $157/share would be looking at annualized RoRs of 32.7% and 23.9% by the ends of 2023 and 2024, respectively.

Those are amazing return potentials from a high quality, defensive blue chip like ARE.

Our “Buy” rating on the stock isn’t based on that sort of bullish mean reversion occurring, but we don’t think it’s outside of the realm of possibility.

Few REITs, regardless of property sector, are posting same-store NOI that can match ARE’s right now.

While the office sector is out of favor due to work-from-home trends, ARE is uniquely positioned to maintain strong occupancy ratios; therefore, we think that this stock’s recent sell-off has been irrational (a baby being thrown out with the bathwater situation), and, therefore, we continue to believe investors buying into this 2022 dip are likely to be handsomely rewarded.

Be the first to comment