NoDerog/iStock Unreleased via Getty Images

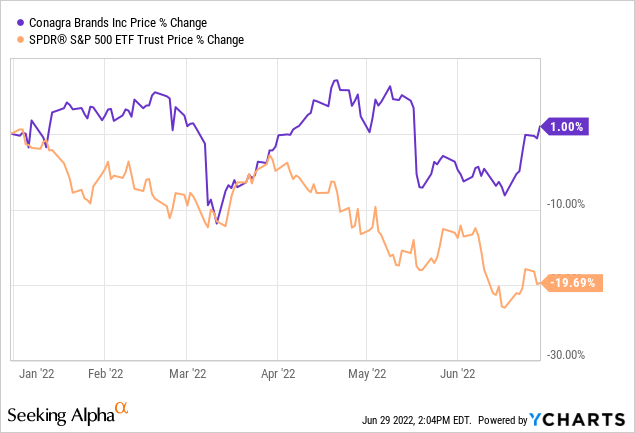

Conagra Brands’ (NYSE:CAG) stock price has increased by 1%, compared with the almost 20% decline of the broader market.

We expect this outperformance to continue in the near term, as CAG has a strong track record of outperforming the broader market in times of declining/ low consumer confidence.

In this article we will first take a look at, how the stock price has developed in times of low consumer confidence, and then we will highlight some details about the firm that we believe could make CAG’s stock a buy at the current price levels.

Consumer confidence

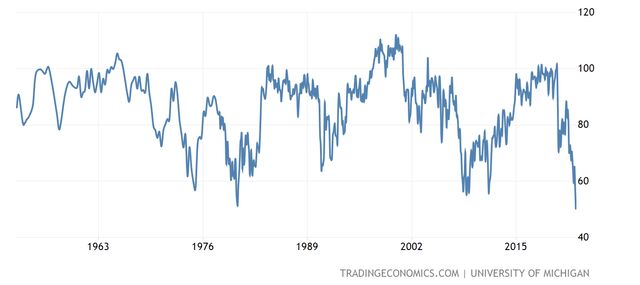

Consumer confidence is often regarded as a leading economic indicator, which could be used to forecast potential changes in the consumer spending trends. This indicator has been steadily declining during the past months, declining even below levels seen during the 2008-2009 financial crisis.

U.S. Consumer confidence (Tradingeconomics.com)

Although consumer spending has remained strong so far this year, we believe that the low consumer confidence is likely to lead to a change in the spending behaviour of the consumers. Such a change could severely impact firms that are selling durable goods, as the purchase of the products can normally be completely cut or delayed to a future point in time. Firms selling non-essential, consumer discretionary items could also be impacted as consumers are likely to switch to lower cost alternatives.

On the other hand, firms in the consumer staples sector, such as Conagra, are likely to remain relatively unaffected as the demand for their products are not likely to decline significantly.

Let us take a look how Conagra’s stock price has actually developed during times of low consumer confidence and how this performance compares with the performance of the broader market.

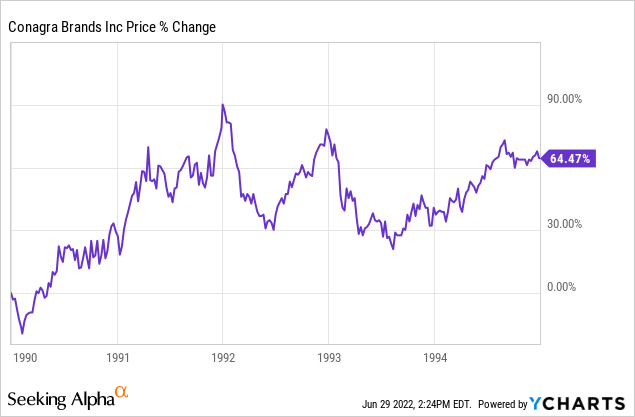

1990-1995

Between 1990 and 1995, CAG’s stock price has increased by an impressive 64.5%, which is a more than 10% growth annually.

In the same time period, the broader market has gained approximately 52%, which is also an impressive growth, however still poorer than CAG’s performance.

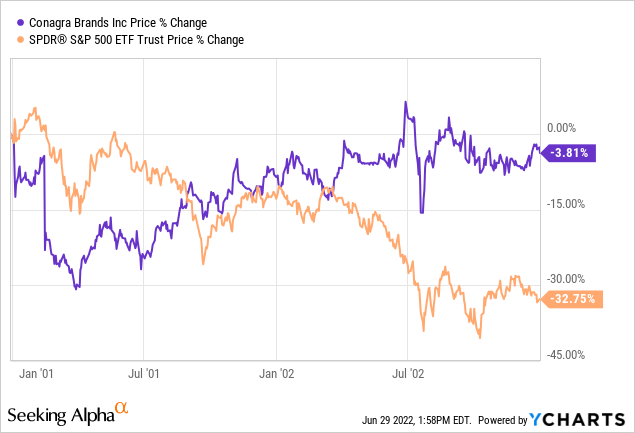

2001-2002

In this 2 year period, both CAG’s stock price and the broader market (SPY) have declined. However, while CAG’s stock price has fallen about 4%, SPY was down by more than 32%.

In this time frame, CAG again outperformed the broader market.

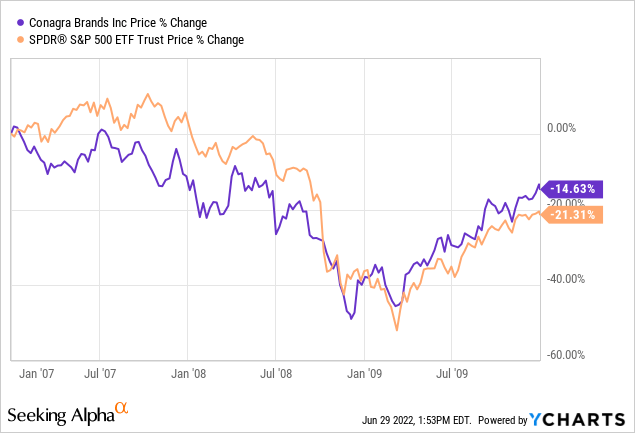

2007-2010

Just like in our previous example, in this period both CAG and SPY have declined, but once again Conagra has outperformed the broader market by more than 6%, as it lost only ~15% of its market cap.

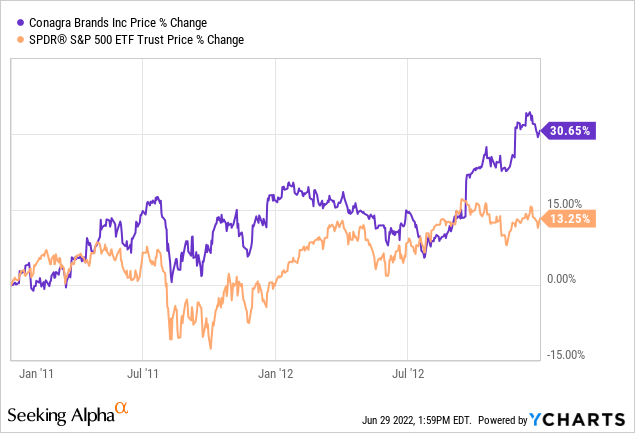

2011-2013

Between 2011 and 2013, both CAG and the broader market have performed well, generating positive returns. While the SPY has only gone up by 13%, Conagra’s stock price has increased by as much as 30%.

To conclude, in all four observed time periods, CAG’s stock has managed to outperform the broader market. This is actually in line with our expectations, as we mentioned earlier that low consumer confidence is not likely to negatively impact the demand goods in the consumer staples sector.

Although historical data does not always have strong predicting power, we believe that Conagra could be an attractive choice for investors in the current macroeconomic environment.

Not only the past performance makes Conagra attractive.

Dividends

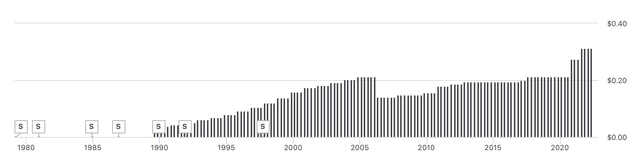

Conagra has a strong track record of returning value to its shareholders through dividend payments. In fact, the firm has been paying dividends for the last 32 years, consecutively.

In April, the firm has declared a quarterly dividend of $0.3125 per share, which represents a forward dividend yield of about 3.7%.

Although the Dividend Payout Ratio (TTM) (GAAP) is about 58%, which appears to be relatively high, we believe that the firm will likely be able to maintain its dividend payments, as we do not expect the financial performance of the firm to deteriorate in the near term.

Due to these reasons, we believe that Conagra’s stock could be an attractive choice for dividend investors.

Valuation

When looking at a set of traditional price multiples, CAG also appears to be trading at a discount compared to the consumer staples sector median.

The firm’s P/E Non-GAAP (FWD) is about 14.5x, representing a 20% discount compared to the sector median of 18x. In term of P/CF we can observe a similar trend, while in terms of EV/EBITDA the firm is in line with the sector median.

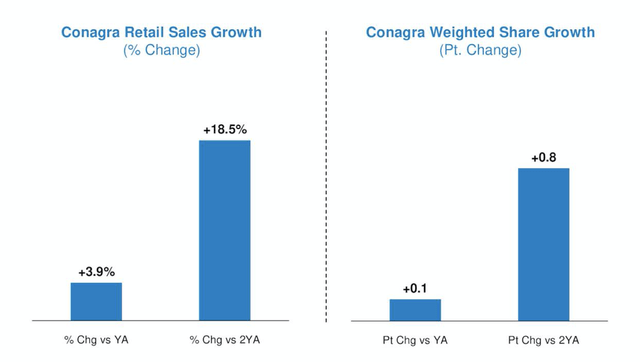

As we expect the demand for Conagra’s products to remain high, we believe that this discount is not justified. Also, the firm has managed to increase its market share in the first quarter, which is also a promising indication.

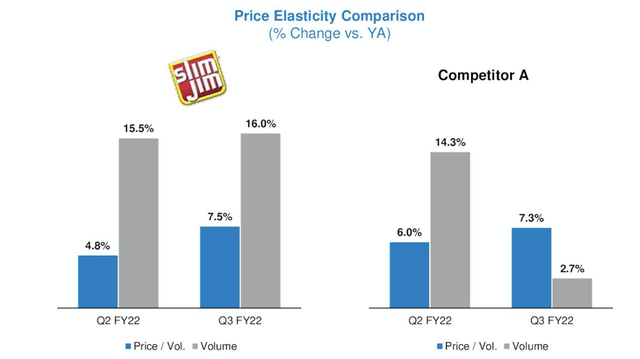

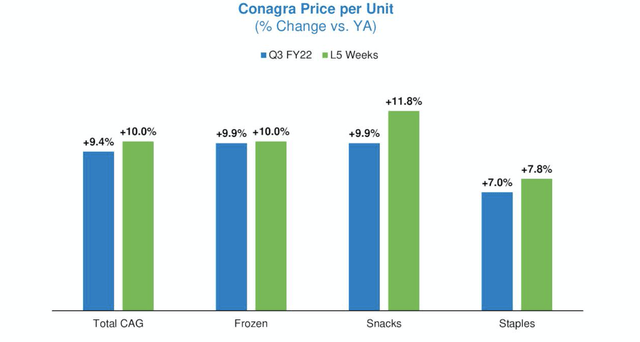

Although macroeconomic headwinds, including elevated commodity prices, higher transportation costs, supply chain disruptions, are likely to put downward pressure on CAG’s margins and therefore on their earnings in the near term, in our opinion these factors are already priced in at the current price levels. Also, Conagra has a well diversified product portfolio, with strong brand recognition, which gives the firm a significant pricing power, which could potentially offset the negative impacts, although likely with a lag.

In total, CAG has increased its prices by about 9% in the last quarter.

As an example of strong pricing power, the following chart shows, how the demand for CAG’s Slim Jim products have even increased, despite the elevated prices.

Price elasticity comparison (Conagra)

Last, but not least, due to the historical outperformance, we believe that Conagra’s stock is a buy at the current valuations.

Key takeaways

Conagra is facing macroeconomic headwinds associated with elevated commodity prices, higher transportations costs and supply chain disruptions, which are likely to put downward pressure on the firm’s margins and their earnings.

On the other hand, in the first quarter the firm has proven that due to customers’ strong brand loyalty they have a significant pricing power, which could at least partially offset above mentioned factors.

Conagra has also a strong track record of outperforming the broader market during times of low consumer confidence, and we believe the firm is well-positioned to outperform in the current market environment as well.

As the valuation of the firm appears attractive and it has a strong track record for dividend payments, we believe that the stock is a buy at the current price levels.

Be the first to comment