jejim

We are buy-rated on Synopsys, Inc. (NASDAQ:SNPS). Our bullish thesis is because we believe SNPS is well-positioned in the Electronic Design Automation (EDA) industry. SNPS provides software, hardware tools, and services aimed at one goal: designing and manufacturing advanced semiconductors. We like SNPS because it enables technological advancements in semiconductors. According to IDC, the semiconductor industry is forecasted to grow at a CAGR of 13.7%. The demand for chip designs is constant because companies always need better ways to optimize chip performance and develop new applications which are hardware accelerated. For instance, companies worldwide are trying to develop chips for specific use cases – AI, Security, Encryption, etc.

While SNPS is not cheap, we believe its business is remarkably resilient even during downturns. Therefore, we recommend investors buy shares on any weakness.

EDA industry is remarkably resilient benefiting SNPS

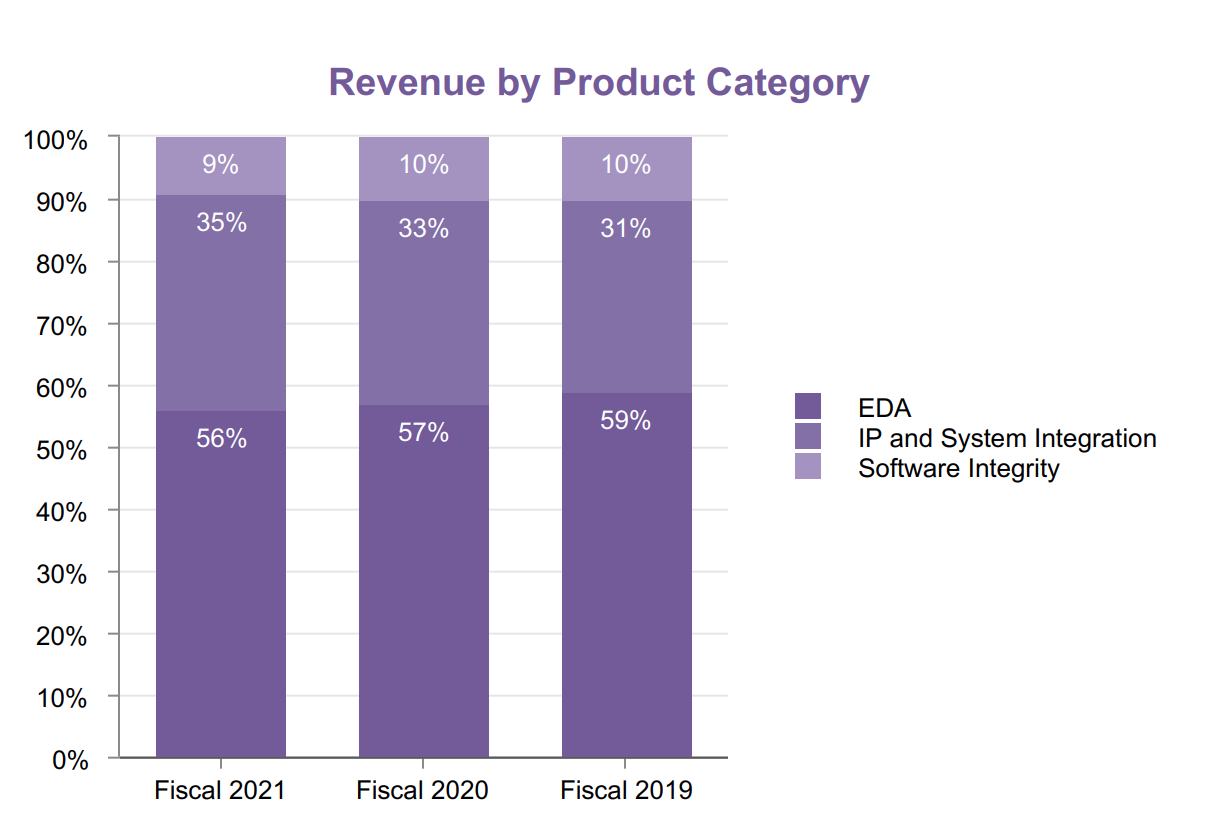

SNPS is primarily an EDA company. Today’s semiconductors consist of multiple chips and billions of transistors packed into ultra-small forms. For us to get the end-user experience we pay for, semiconductor companies must ensure chips and transistors work flawlessly, and that’s where SNPS’ hardware and software support comes to play. Around 59% of SNPS’ revenue comes from its work in the EDA industry. The following company earnings graph outlines SNPS’ revenue by product.

SNPS

We are optimistic about SNPS because of the pivotal role the company plays in the EDA industry. The EDA industry is forecasted to grow at 9.6% CAGR by 2027. We believe EDA growth will be reflected positively in SNPS’ stock.

Expanding the customer base means revenue growth.

We believe SNPS will continue to grow because it feeds chip design demand which is constant even during a market contraction. SNPS provides chip design and verification services necessary for companies to successfully design chips for everything from cars to Artificial intelligence (AI). The need for more complex electronic designs is increasing because of the growth of high-impact markets, including AI, industrial, automotive, and consumer electronics. SNPS gives customers a design edge over their competition—the following chart of SNPS market segments.

SNPS

Despite current chip shortage issues, the customer base for chip design services is expanding. In previous years, SNPS’ main customers were traditional semiconductor companies, but the company’s customer base is expanding. Software and other companies that once outsourced chip design are shifting towards designing their chips in-house. Tech giants like Apple (AAPL), Amazon (AMZN), and Tesla (TSLA) are rushing to develop their own chips. SNPS shares the demand for chip design products with its biggest competitor, CDNS. We are not worried about CDNS’ competition with SNPS because the two companies dominate the chip design market together. The demand from non-traditional chip companies will drive growth for SNPS and CDNS for the next several years, making the stock a buy.

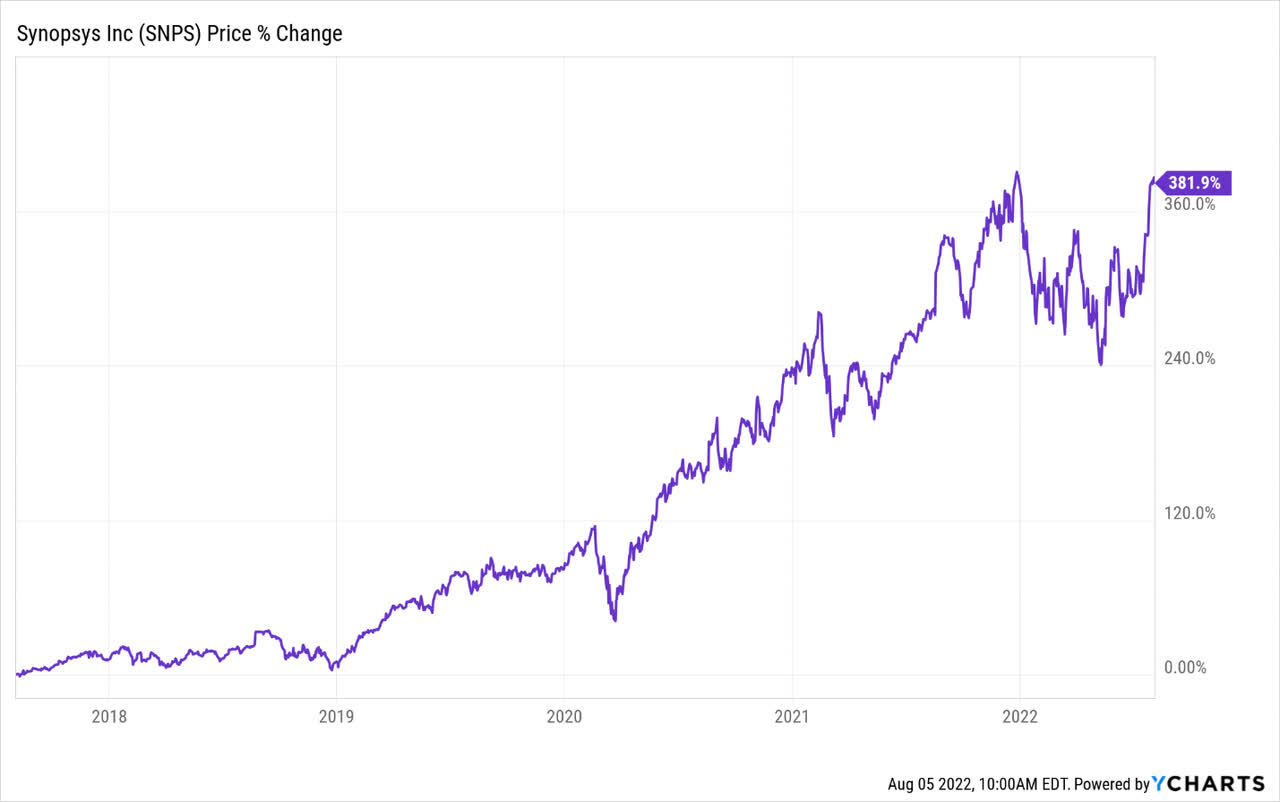

Stock performance

SNPS grew at a remarkable 380% over the past five years. The stock has appreciated about 162% since the beginning of the pandemic. Even on the one-year metric, SNPS grew 28%. YTD, the stock is up around 1%. We believe SNPS will continue to grow because it feeds chip design demand which is relatively constant even during market downtrends.

The following graphs indicate SNPS’ stock performance over the past five years.

Ycharts Ycharts

Valuation

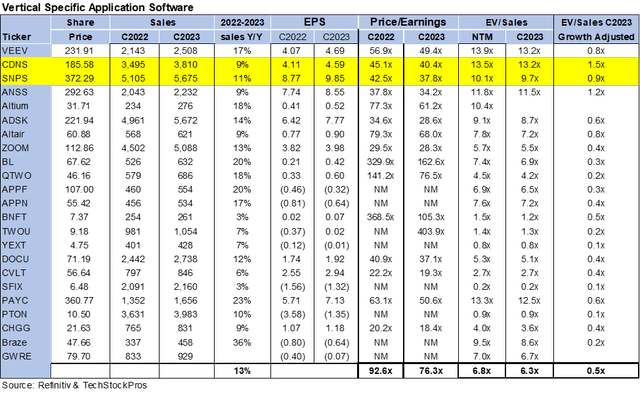

SNPS is trading around $372 and is not overly cheap. The stock is cheap compared to its peer group as it is trading at a P/E of around 38x C2023 EPS of $9.85 compared to a peer group average of 76.3x. The stock is trading at 9.7x EV/C2023 sales compared to an average of 6.3x. We believe the stock is a good pick for turbulent times and are optimistic about SNPS future within EDA. The following chart illustrates the semiconductor peer group valuation.

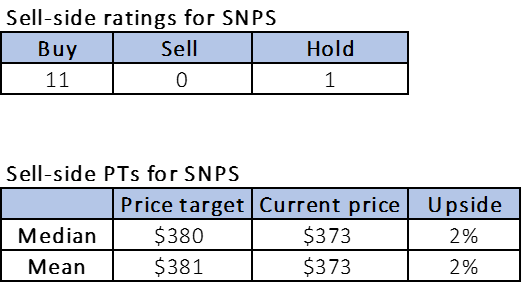

Word on Wall Street

Wall Street consensus on SNPS is a buy. Eleven of the twelve analysts are buy-rated, and the remaining are hold-rated. SNPS is trading at $380. The median price target is $380, and the mean price target is $381, with a potential 2% upside. But we expect many wall street analysts to hike their price targets over the next few weeks, driving the stock higher. The following chart indicates SNPS sell-side ratings and price targets.

Refinitiv

What to do with the Stock:

We believe SNPS is a buy because of its central role in chip design. We expect SNPS stock to appreciate irrespective of how the semiconductor market does, given that companies constantly invest in designing new chips to stay abreast of the competition. More importantly, many companies such as Apple and Amazon, who previously bought off-the-shelf chips, are now designing custom chips for their products, driving the demand for SNPS products. SNPS provides semiconductor companies the competitive edge they need to survive in the industry. We believe SNPS’ EDA business and new chip designs could potentially ease the semiconductor slowdown. We believe SNPS’ prospects are favorable, and investors should buy shares here.

Be the first to comment