FreshSplash/E+ via Getty Images

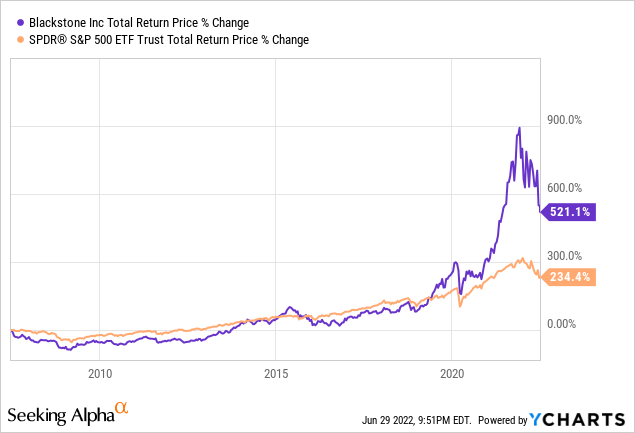

Blackstone (NYSE:BX) is arguably the world’s greatest alternative asset manager. First and foremost, it has over $900 billion in assets under management as of the end of Q1 2022, making it the largest alternative asset manager on the globe. Second of all, it has a phenomenal track record of generating market crushing total returns for shareholders:

Last, but not least, it has an A+ credit rating, tops in the industry.

On top of that, BX has two other major factors working in its favor. In this article, we will discuss these factors, assess the current risks facing the business, and provide investors with a general buy price target that could prompt us to add it to our Core and Retirement Portfolios at High Yield Investor.

#1. The Medium-Term Outlook Is Very Bullish For Alternative Asset Managers

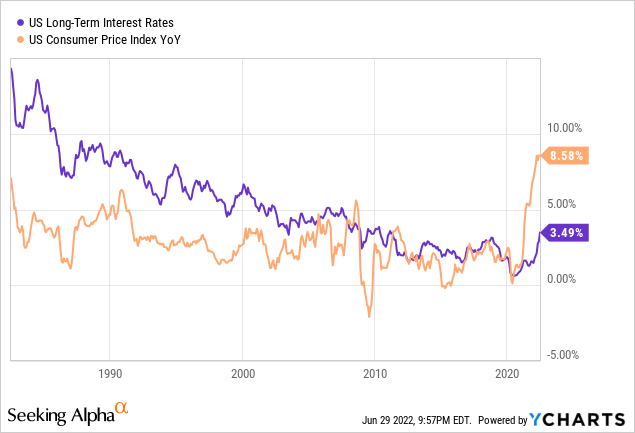

With interest rates remaining near historic lows and well below inflation rates despite rising rapidly in recent months, the environment remains highly favorable for alternative assets.

We also believe that interest rates are poised to remain in a lowish band – and real interest rates are almost certain to remain negative – for the foreseeable future because massive government and corporate debt burdens incentivize negative interest rates and low nominal interest rates.

This will prove to be a boon to alternative assets and alternative asset managers like BX because high inflation will boost the replacement cost of its vast empire of high-quality real assets while keeping competing yields from traditional income investments like bonds at bay.

We also believe that BX is poised to benefit from growing investments in infrastructure in order to meet the demands of the fourth industrial revolution, as well as update critical infrastructure that has fallen into obsolescence and disrepair across the Western world.

As peer competitor Brookfield Asset Management (BAM) put it on slide 7 of their September 2021 Investor Presentation, institutional allocations to alternatives have increased from a mere 5% in 2000 to 30% in 2021. By 2030, analysts expect that allocation to have doubled yet again to 60%. This should provide a massive tailwind for BX’s fundraising efforts.

#2. Blackstone Runs A Truly Wonderful Business

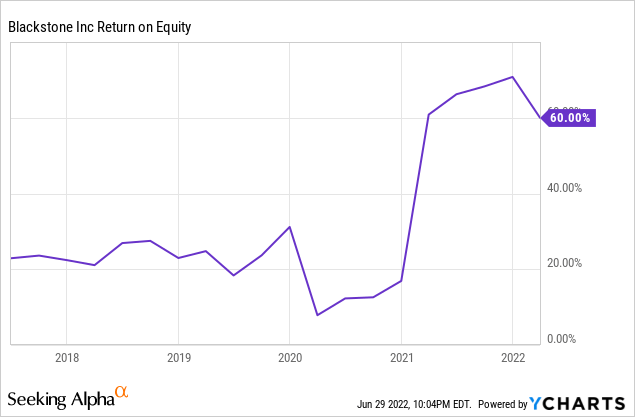

The best businesses are those where you can deploy retained cash flows at extremely high incremental rates of return. BX – which consistently posts returns on equity north of 20% (other than a brief blip into the still impressive teens during the 2020 COVID-19 pandemic) – is the epitome of such a business:

The company runs a very capital-light business model by effectively profiting off of client’s capital. Meanwhile, given BX’s powerful brand and unmatched global network of clients and partners, the company is able to rapidly scale the business with minimal capital investment. This results in sky-high returns on investment and enormous sums of free cash flow, which it has a policy of passing a high percentage of on to shareholders via dividends, while sustaining a very strong balance sheet.

What makes BX’s business model stand apart even more is that it commands substantial pricing power and considerable client stickiness. In contrast to publicly traded debt and equity asset managers like BlackRock (BLK) which really do not add much value at all to their investments and therefore offer little differentiation beyond minimizing asset management fees, BX has plenty of differentiation from peers and therefore enjoys vastly superior pricing power.

BX operates in much less liquid and less efficient sectors of the global economy, where only the largest scale players can even compete for deals. As a result, it offers clients access to exclusive deals and asset classes where it also implements its expertise and unmatched market data to optimize returns. This means that it can charge hefty fees to its clients and also lock them in for longer terms, resulting in greater profits and greater stability of earnings.

BX Stock Risks

That said, BX is not a risk-free investment. We believe the biggest challenge facing the company today – and likely the reason why the share price has plummeted in recent weeks – is that the globe appears to be on the verge of entering a recession.

The reason this is a big deal is that BX’s earnings stream is partly dependent on incentive fees. When the economy falters, asset values often decline and so does fundraising momentum. This means that BX may see a dip in earnings. During the Great Recession in 2008-2010, BX saw earnings suffer significantly, posting a per-share loss of $4.36 in 2008, followed by losses of $2.46, $1.02, and $0.57 per share in 2009, 2010, and 2011, respectively. For perspective, in 2007, it posted earnings per share of $1.45 and recovered to an earnings per share total of $1.77 in 2012. In 2021, the earnings per share were $4.77.

Clearly, BX survived the recession and emerged significantly stronger on the other side, and we expect it to do it again in the event of a recession. However, investors should still keep in mind that BX could suffer steep losses during a recession, which could lead to disappointing returns over the next few years.

BX Stock Buy Price

While we think that the share price is currently attractive for long-term investors, there are also numerous other attractively priced alternative asset managers which we invest in instead at present. That said, as BX’s share price continues to plummet, we are getting increasingly interested in possibly purchasing it as well.

The stock looks quite cheap based on its price to free cash flow ratio at 7.71x, below its historical average ratio of 8.60x. However, its price to normalized earnings ratio remains elevated at 16.03x compared to its historical average of 14.20x. Meanwhile, the dividend yield is also below its historical average of 5.91%, though still attractive at 5.29%.

While these ratios – particularly the price to free cash flow ratio – would be fine if we were convinced that the company would continue growing for the next few years, the fact of the matter is that a recession would likely decimate the stock price given that the margin of safety is not large right now. Analysts expect earnings per share to grow from $5.68 in 2022 to $7.19 in 2025. Assuming the price to earnings ratio reverts to its historical average of 14.20x by then, the share price would stand at $102.10. When combined with an expected total dividend payout of $20.72 over that time span, we get an adjusted share price of $122.82. This would equate to an 8.9% CAGR from the current share price of $91.07. While we think this is a pretty good return, it is not even close to being enough to warrant us adding it to our portfolio.

We would likely add BX to our portfolio at ~$80 per share, because at that level we would expect to see ~13% annualized total returns between now and 2025.

Investor Takeaway

BX clearly has a lot going for it and has a tremendous track record. However, a recession appears to be on the horizon, which will likely slow growth over the next few years. On top of that, despite the recent sharp pullback in the share price, the stock is still not particularly cheap relative to its historical averages. We believe the stock warrants a Buy rating at present, but is not attractive enough relative to some of its peers to prompt us to purchase it at the moment. If it were to drop by another 12-15%, we would upgrade it to a Strong Buy and consider it much more seriously.

Be the first to comment