Falcor

It’s been a rough year thus far for the Gold Miners Index (GDX). While the softness in the producers makes sense given the misses on costs, the royalty/streamers have also been pummeled, with some down over 20% year-to-date. The fact that names that are inflation-resistant are also taking a beating suggests that the sector-wide bear market could be near its latter innings, with many companies now trading entirely devoid of fundamentals and being sold to halt the proverbial bleeding.

One name that’s been sold off sharply considering its size and risk profile is Royal Gold (NASDAQ:NASDAQ:RGLD), one of the top-3 precious metals royalty/streaming companies. This is even though the company has bolstered its growth profile with zero dilution and is still hunting for more growth with $500 million in available liquidity if new opportunities arise. Given RGLD’s improved growth profile and attractive valuation, I see this pullback below $94.00 as a low-risk buying opportunity.

Pueblo Viejo Operations (Barrick Presentation)

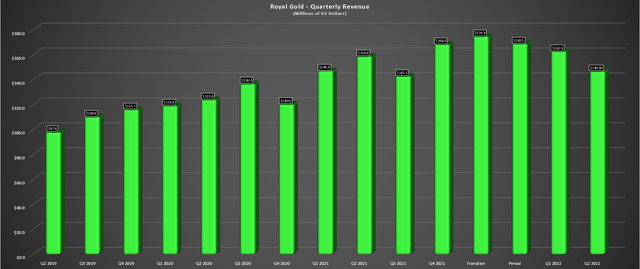

Q2 Results

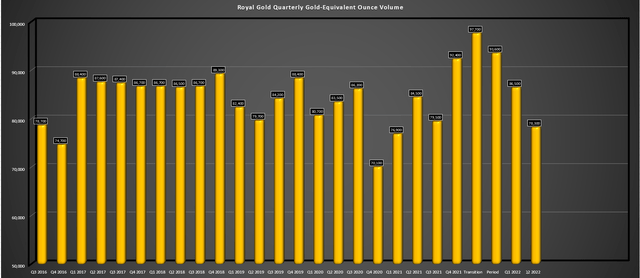

Royal Gold released its Q2 results last month, reporting revenue of $146.4 million, a 13% decline from the year-ago period. This was related to lower gold-equivalent ounce volume [GEO] in the period and weaker realized silver/copper prices. The assets which impacted volume in the period were Andacollo, and Pueblo Viejo from a sales standpoint, as well as lower gold production at Penasquito and Cortez. Fortunately, the lower production at these key assets was partially offset by ~247,000 ounces of silver delivered from the new Khoemacau stream and contribution from the NX Gold Mine in Brazil.

Royal Gold – Quarterly GEO Volumes (Company Filings, Author’s Chart)

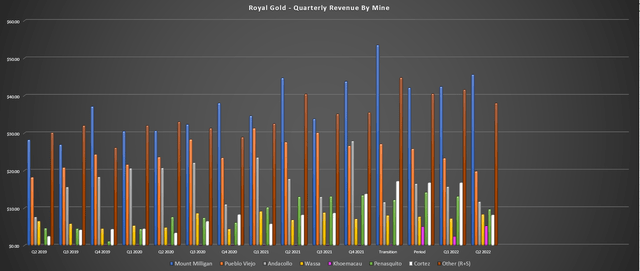

Looking closer at its contribution per mine below from a revenue standpoint, we can see that revenue from Pueblo Viejo [PV] declined for a fourth consecutive quarter, with a total of 484,000 ounces of silver now deferred from the asset. The good news is that Barrick (GOLD) continues to progress on its expansion at PV, with the site for its new tailings storage facility now selected, which, combined with a plant expansion, will allow the asset to maintain an ~800,000-ounce production profile out past 2040. At Khoemacau, underground production continues to improve (June: 7,300 tonnes per day), and Royal Gold’s attributable revenue more than doubled sequentially in Q2 vs. Q1.

Moving to Canada, New Gold (NGD) has had a tough year for costs and production at Rainy River due to flooding. However, with mining heading underground at year-end and the mine life extended, this asset will continue to contribute into the 2030s for Royal Gold, and there’s no reason to worry about the current elevated cost profile for the operator. Meanwhile, in Ghana, Wassa also got a material mine-life extension, with the new operator securing funding to expand the mine, in line with Golden Star’s Southern Extension PEA (adding a decade to the mine life).

Finally, Royal Gold’s royalties in Australia (Bellevue, King of the Hills) will contribute over the next year, with the first gold poured at KOTH in June and Bellevue set for initial production in H2 2022. Combined with a ramp-up to full production at Khoemacau by year-end and significantly higher production from Nevada (Cortez royalty acquisition), Royal Gold should see high single-digit GEO volume growth in FY2023 (~360,000 GEOs total), with further growth in FY2024 as Mara Rosa, Cote Gold, and Granite Creek progress towards commercial production levels.

Royal Gold – Quarterly Revenue by Mine (Company Filings, Author’s Chart)

Given this steadily improving attributable production profile, I don’t see any reason to worry about the dip in revenue and production in Q2 2022. Besides, Royal Gold remains on track to meet its FY2022 guidance of 315,000 to 340,000 GEOs (~164,000 year-to-date), with a slightly stronger H2 ahead vs. H1. While some investors may not realize this, the investment thesis for Royal Gold has arguably improved given the downturn in the markets, with the current environment being fertile for transactions.

The reason for this is that with equity markets being much less favorable, debt not being an option, and many developers and even weaker producers staring down half-price sales on their shares, streams, and royalties are one way to avoid significant share dilution. It’s possible that this could lead to a meaningful increase in opportunities over the next year. Royal Gold is saddled with ~$500 million in liquidity to take advantage of this situation. So, while gold may be considerably higher than 2016 levels, the opportunity to add royalties/streams is arguably as good, which many wouldn’t have guessed would occur with current metals prices.

Royal Gold – Quarterly Revenue (Company Filings, Author’s Chart)

Recent Developments

Speaking of adding new royalties/streams, Royal Gold hasn’t wasted any time and has had a busy start to Q3, adding royalties on one of the largest mining complexes in the world (behind Carlin) and arguably one of the top-3 most exciting development projects in Canada. This has increased the company’s exposure to Tier-1 ranked jurisdictions when combined with the Cote royalty acquired in Q1 and Red Chris royalty added last year, and with Back River now green-lighted by Sabina, the company is set to see a meaningful contribution from Canada in the latter portion of the decade (Back River: 2026, Red Chris Block Cave: 2027, Great Bear: 2029).

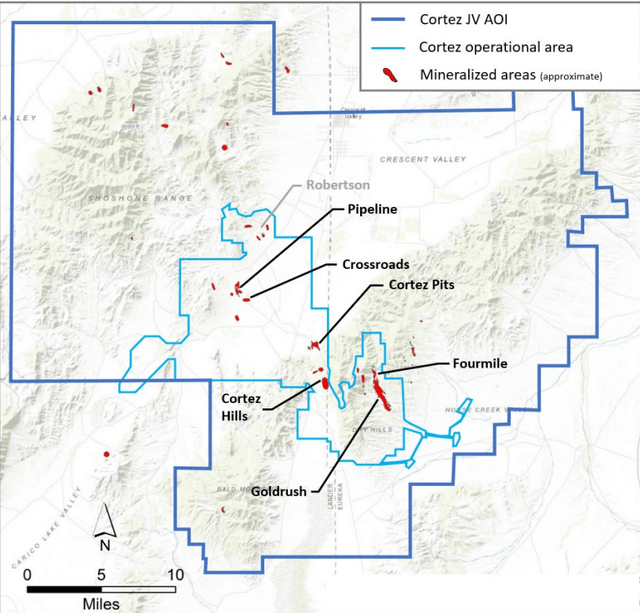

Digging into the recent acquisitions, Royal Gold unloaded nearly $700 million combined to pick up a 1.2% gross royalty on the Cortez Complex (excluding existing Robertson deposits) and a 2.0% NSR on the Great Bear Project in Red Lake, Ontario. This increased its exposure to an asset (Cortez) that has delivered an exceptional return on investment ($411 million in revenue since 1995 from $81 million investment) and has potentially added upwards of 9,000 GEOs per annum from 2029-2035 from Great Bear. Notably, the increased exposure to Cortez covers 300 square miles and will help smooth out its current exposure to just Pipeline/Crossroads deposits.

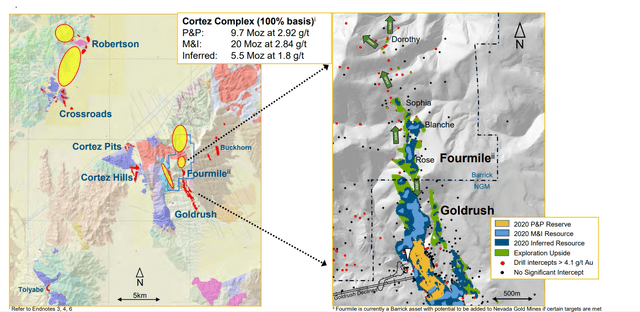

Cortez Royalty Area (Company Presentation)

The Cortez Complex is currently home to ~25 million ounces of resources, and Royal Gold’s geologists seem confident in this resource growing meaningfully with the potential for extensions to the extremely high-grade Fourmile and Goldrush deposits. For those unfamiliar, Fourmile is home to ~2.5 million ounces at 10.6 grams per tonne gold and is not currently in the Cortez production plan, being a newer discovery (2018). Meanwhile, Goldrush is expected to be a ~500,000-ounce per annum operation at industry-leading costs. Royal Gold noted that it expects ~1.1 million ounces to be produced at Cortez over the next eight years, excluding Robertson, making this a significant acquisition.

Cortez Complex (Barrick Presentation)

It’s important to note that all of these recent deals (Red Chris, Cote, Great Bear, Cortez) were completed with cash or its revolving credit facility, meaning there is no share dilution associated with this significant boost to annual revenue. Hence, these deals will all lead to meaningful growth in cash flow per share and net asset value per share, making RGLD even more undervalued than it already was before it completed these deals. The Great Bear Royalties acquisition was approved and closed last week, confirming that the 2.0% NSR has entered Royal Gold’s portfolio. Let’s take a look at the valuation:

Valuation & Technical Picture

Based on ~65.7 million shares and a share price of $93.30, Royal Gold trades at a market cap of $6.11 billion, which might appear to be a steep valuation at first glance for a company generating less than $700 million in annual revenue in a cyclical sector. However, it’s important to note that this is an ~80% margin business with an extremely low-risk business model, given that Royal Gold is inflation-resistant, not impacted by inflationary pressures sector-wide that have driven up operating and capital costs.

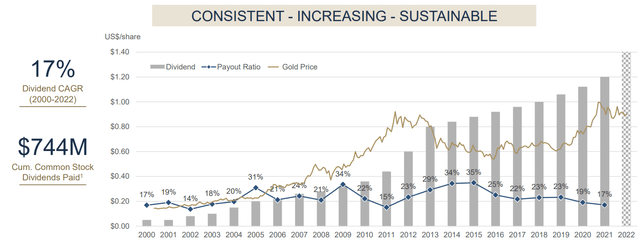

Royal Gold – Dividend Growth (Company Presentation)

It’s also worth noting that the company has one of the most efficient business models globally, with revenue per employee six times higher than Netflix (NFLX), Apple (AAPL), Meta (META), and Alphabet (GOOG) combined. Finally, the company has considerable optionality with royalties/streams on nearly 150 evaluation/exploration properties and a growing dividend with a growth rate that beats most Dividend Aristocrats (17% CAGR). So, with a business model this impressive that churns out cash on a recurring basis, it’s no surprise that the stock has historically traded at ~22.8x cash flow.

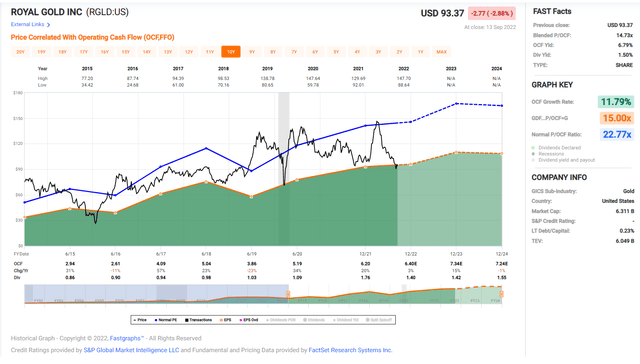

Royal Gold – Historical Cash Flow Multiple (FASTGraphs.com)

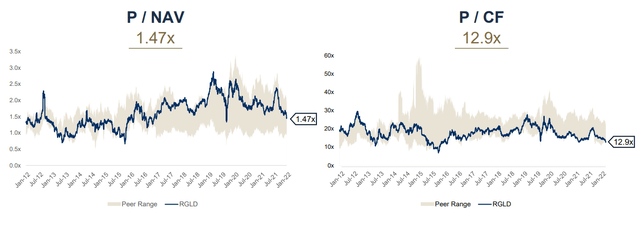

Based on what I believe to be a conservative cash flow multiple of 20 and FY2023 cash flow per share estimates of $7.30, I see a fair value for Royal Gold of $146.00. However, this doesn’t do justice to its development royalty portfolio, with cash flow from many of these assets not expected to be realized next year. Using an estimated net asset value of $4.83 billion and a P/NAV multiple of 2.00 to reflect its scale, diversification, and exposure to many of the best operators, I see a fair value of $147.30. Hence, Royal Gold is undervalued on both metrics.

Royal Gold – Current Valuation vs. Historical Multiples (Company Presentation)

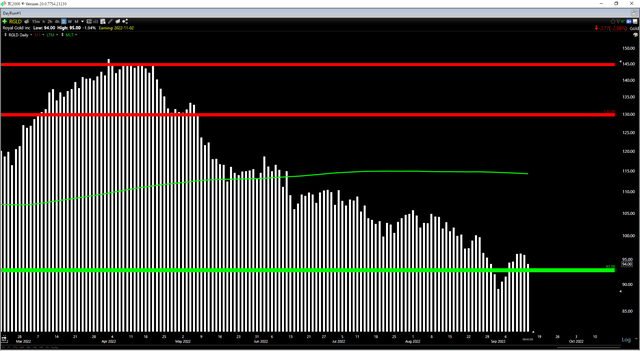

Finally, if we look at the technical picture, Royal Gold is hugging a key support level at $93.00, an area that I’m surprised it’s even re-tested given the more favorable environment for royalty/streaming companies and its recent acquisition, which have boosted net asset value. Meanwhile, its next strong resistance level doesn’t come in until its open gap near the $130.00 level, translating to an extremely favorable reward/risk ratio, with less than $1.00 in downside to support and over $35.00 in upside to resistance. Hence, from both a technical and fundamental standpoint, the stock has entered a low-risk buy zone.

RGLD Daily Chart (TC2000.com)

Summary

In a sector where more than 80% of stocks are very difficult to invest in due to their inability to meet targets, lack of diversification, or razor-thin margin profiles, Royal Gold stands out as a name that checks all boxes. Not only does the company benefit from industry-leading margins to its business model, but it is highly diversified, with over 40 paying assets and several set to come online in the next five years.

Cortez Complex Operations (Barrick Presentation)

Notably, the company is not resting on its laurels in the current operating environment, and it’s great to see the company taking advantage of the sector-wide weakness to bolster its portfolio. In fact, Royal Gold noted in its Q2 call that it’s still focused on growth in the $100 million to $300 million range, suggesting we could see another royalty asset added to the portfolio in the next 12 months to improve the production profile further. To summarize, I see Royal Gold as one of the sector’s best buy-the-dip options, and this pullback below $94.00 has provided an attractive entry point.

Be the first to comment