iLexx/iStock via Getty Images

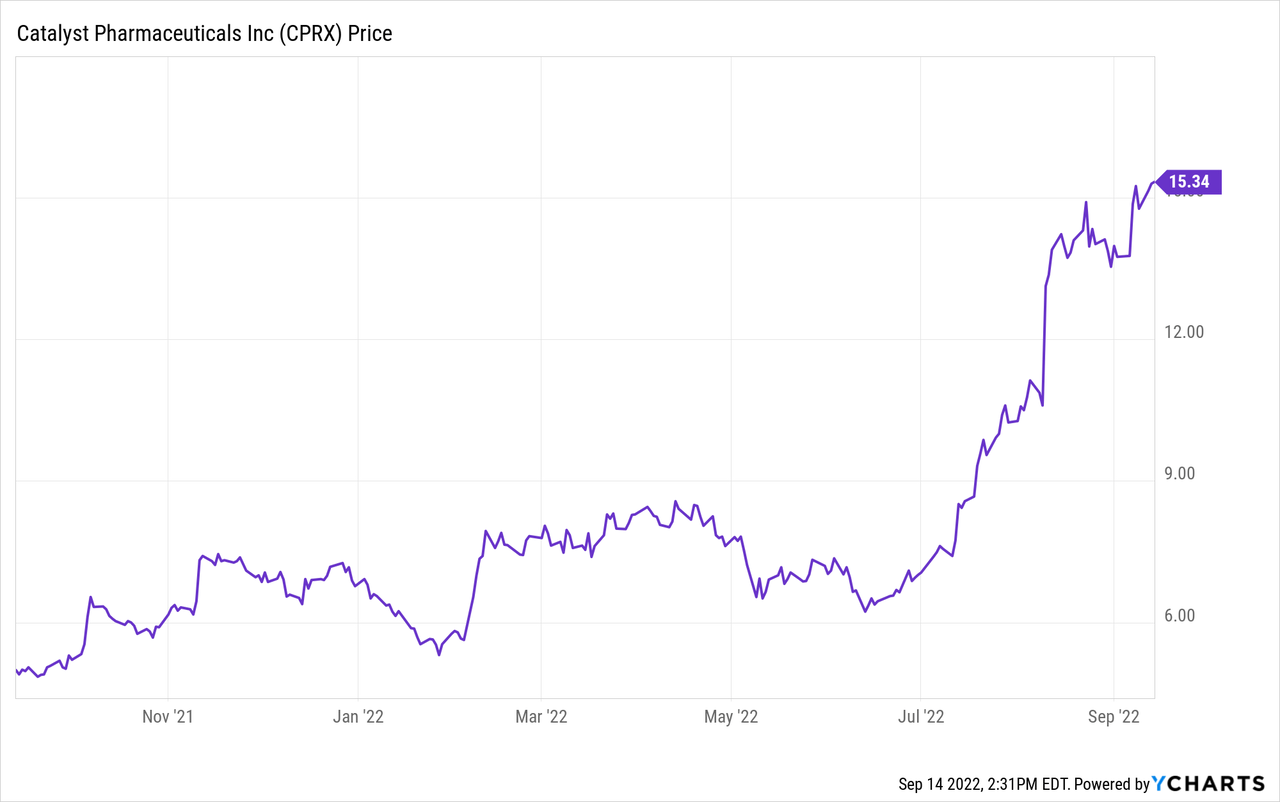

Catalyst Pharmaceuticals (NASDAQ:NASDAQ:CPRX) specializes in therapy for LEMS, or Lambert-Eaton Myasthenic Syndrome. The stock price has been on a roll this year, regularly hitting new 52-week highs, including $17.21 on September 13, 2022. On September 12, 2022, it was added to the S&P SmallCap 600. In this article, I will look at Catalyst’s products, pipeline, revenue, and profits to determine if the company is still a good bet for long-term investors at the current price.

Catalyst Pharmaceuticals Q2 2022 Results

Catalyst Pharmaceuticals Q2 2022 results were released on August 9, 2022. Revenue was $53 million, up 47% from $36 million in Q2 2021. Net income also grew rapidly to $21.6 million, up 77% from 12.2 million a year earlier. The resulting EPS was $0.20. On a non-GAAP basis, net income was $30.3 million, or $0.28 per diluted share. The company had $220 million in cash and equivalents, with no long-term debt. In short, it is in great shape financially.

In contrast to most pharmaceutical companies, in the quarter, the company spent only $4 million on research and development. To extend its growth beyond its current therapy, it will need to either use cash to buy therapies from other companies, or greatly expand its R&D outlay, or likely both.

Catalyst also issued guidance for 2022. It expects revenue in the range of $195 to $205 million, which is below the Q2 run rate. Operating expenses are expected between $65 and $70 million.

Lambert-Eaton Myasthenic Syndrome Therapy

Lambert-Eaton Myasthenic Syndrome, or LEMS, is a rare autoimmune disorder causing limb muscle weakness. It is typically secondary to other disease conditions, most notably small-cell carcinoma (lung cancer). In LEMS the body produces antibodies against calcium channels in nerve cells, causing nerve impulses to fail. That in turn means muscles are not properly directed. When caused by cancer, successful treatment of cancer usually leads to remission of LEMS.

Firdapse (amifampridine) has been available for use for LEMS since the 1990s, and so normally would be off-patent. However, a phosphate form of the drug was developed in 2000 and further developed by BioMarin (BMRN). It obtained EU regulatory approval in 2009, then in turn licensed it to Catalyst Pharmaceuticals in 2012. However, it was also marketed by Jacobus Pharmaceutical under the trade name Ruzurgi under a free compassionate use program. Amifampridine works by causing calcium channels to open longer. For more details, see the controversy about orphan drug status and pricing of Firdapse. In the end, The FDA approved the drug for Catalyst for use with adult LEMS on November 29, 2018. On July 12, 2022, Catalyst announced it had settled patent litigation with Jacobus. As a result, Catalyst acquired the rights to Ruzurgi in the U.S. and Mexico. That means no competition for Catalyst. An undisclosed cash payment was made, and Jacobus will receive a low-single-digit royalty on its U.S. sales of amifampridine. That July 12 announcement seems to be the main reason for the rise over the last few months in the price of Catalyst stock.

Catalyst Pharma’s Pipeline

The only Catalyst pipeline product is the expansion of Firdapse to pediatric patients, which is in a Phase 3 trial. I see no reason that the trial would not succeed. Catalyst does say it has a goal of in-licensing, developing, and commercializing novel therapies for rare diseases. I cannot find any announcement of specifics. They certainly have the cash to do it.

Revenue and Earnings Growth Prospects

Catalyst Pharmaceuticals is using a high-price, low-volume orphan drug model. Some companies, notably Alexion, now part of AstraZeneca (AZN), have been very successful with this model. There are only a few hundred potential LEMS patients in the U.S., so even at orphan drug prices, potential for growth is limited. My guess is that future average revenue will not be much above the 2022 guidance midpoint of $200 million. Revenue growth will depend on in-licensing new therapies or potential therapies. In the case of potential therapies, R&D costs will rise, so that could knock back net income.

Conclusion

At a high price of $17.21, Catalyst had a market capitalization of about $1.6 billion. The current PE (FWD) is 21.79. Rapid growth at a profitable biotech company usually results in a higher PE ratio. If revenue and profit growth are likely to continue to ramp rapidly, I would conclude Catalyst is undervalued and a Buy for long-term and even short-term investors. Understanding the history of Firdapse, I wonder how many patients who were on the low-cost rival will be able to get their insurers to pay orphan drug pricing. Given that uncertainty, for me, this is a Hold as I take a wait-and-see approach. I would be impressed if Firdapse revenue exceeds my expectations. Mainly what I want to see is the actual specific potential therapies that are in-licensed.

Be the first to comment