luismmolina/iStock via Getty Images

Pretty much any industry that requires the production and/or transportation of goods must rely on a sophisticated supply chain in order to appropriately function. For most companies, supply chain solutions do not need to be specialized. But for some others, such as the life sciences space, extreme specialization is required. One company that operates in this market that has exhibited attractive growth on its top line and some interesting results on its bottom line is Cryoport (NASDAQ:CYRX). Paste on how the company has performed in recent years and the fact that the life sciences market should only continue to increase moving forward, it’s highly probable that this firm would continue to fare well for its investors. But this does not necessarily mean that it makes sense for investors to buy into at this time. The fact of the matter is that the stock looks incredibly pricey and investors who are value-oriented like myself would be wise to stay clear of the business for now.

A specialist in supply chain solutions

As I mentioned already, Cryoport operates as a specialist in the supply chain space. To be more specific, the company prides itself in offering end-to-end solutions for companies in the life sciences space. Examples of particular solutions include controlled temperature storage of life science products, packaging and labeling of said products, regulatory services related to sensitive items, drug return handling and destruction services, and even kit production that involves the production and distribution of kits that are dedicated to blood and tissue collection, drug administration, and more. Truly, this is just the tip of the iceberg. We could spend several hundred words of this article dedicated just to the line of solutions the company provides.

For instance, one solution the company offers is its Advanced Therapy Shipper, which operates as a fleet of shippers dedicated exclusively to cell and gene supply chain management for both clinical and commercial therapies. The company also offers a variety of other ways to move sensitive goods. One example is its CryoMax Lab Move shipper, while another is its standard dry vapor shipper. The company also provides solutions for cell-based autologous immunotherapy, allergenic therapy, gene therapy, and direct-to-patient uses, as well as various consulting services for its customers.

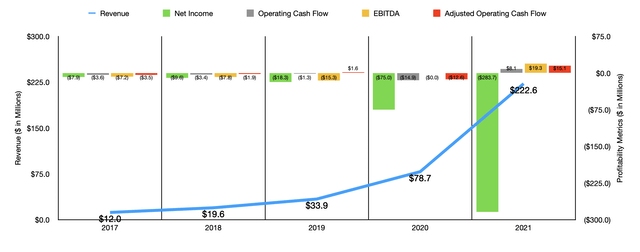

Over the past few years, the management team at Cryoport has done an exceptional job increasing the company’s revenue. Sales have increased in each of the past five years, skyrocketing from just $12 million in 2017 to $222.6 million last year. The increase from $78.7 million in 2020 to what the company achieved in 2021 came largely as a result of product revenue skyrocketing 342.5% from $23.4 million to $103.5 million. this was as a result of the firm’s acquisition of MVE Biological Solutions back in 2020. However, service revenue also rose, but by a more modest 115.3%, climbing from $55.3 million to $119.1 million. Once again, this was driven in large part by an acquisition. But this particular purchase was of CRYOPDP. For the company as a whole, there was some nice organic revenue growth, with that rise totaling 39.9%, or $17.1 million, for the year.

This increase in revenue was certainly nice. But at the same time this was taking place, we also saw profitability for the company worsen. The firm’s net loss widened from $7.9 million in 2017 to $283.7 million last year. Operating cash flow did finally improve, going from negative $3.6 million to positive $8.1 million. If we adjust for changes in working capital, the metric would have gone from negative $3.5 million to $15.1 million. Meanwhile, EBITDA for the business also showed some signs of improvement, turning from a negative $7.2 million to a positive $19.3 million over the past five years.

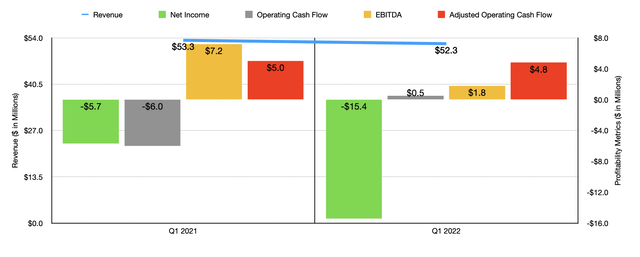

With the exception of net income, all other metrics for the company have generally improved in recent years. However, the 2022 fiscal year has started off a bit rough for the firm. Revenue actually decreased in the first quarter of the year, falling to $52.3 million compared to the $53.3 million generated one year earlier. The company’s net loss widened further from $5.7 million to $15.4 million. But on the other hand, operating cash flow went from a negative $6 million to a positive $0.5 million, while the adjusted figure for this ticked down modestly from $5 million to $4.8 million. Also worse was EBITDA, which declined from $7.2 million in the first quarter of 2021 to $1.8 million the same time this year.

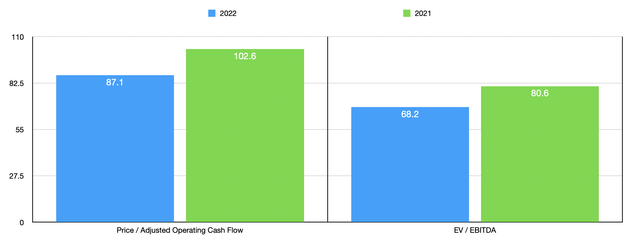

When it comes to the 2022 fiscal year as a whole, management does expect growth to continue. They currently anticipate sales of between $260 million and $265 million, implying a year-over-year increase of between 17% and 19%. However, there has not been any guidance when it comes to profitability. But even if we annualize results experienced so far, shares of the firm look very expensive. The price to adjusted operating cash flow multiple of the firm should be 87.1. That compares to the 102.6 multiple that we get if we rely on 2021 figures. Meanwhile, the EV to EBITDA multiple should fall from 80.6 if we use our 2021 figures to 68.2 on a forward basis. As part of my analysis, I also compared the company to five similar firms. On a price-to-operating cash flow basis, four of the five companies had positive multiples, ranging from a low of 23.3 to a high of 348.1. In this case, only one of the companies was cheaper than Cryoport. Meanwhile, using the EV to EBITDA approach, the four companies with positive readings ranged from a low of 19.5 to a high of 36.4. In this case, our prospect was the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Cryoport | 102.6 | 80.6 |

| Nevro Corp (NVRO) | 341.8 | N/A |

| Natus Medical (NTUS) | 23.3 | 21.6 |

| AtriCure (ATRC) | N/A | 28.7 |

| Mesa Laboratories (MLAB) | 26.4 | 36.4 |

| LeMaitre Vascular (LMAT) | 30.2 | 19.5 |

Takeaway

At present, Cryoport continues to improve on the top line. And in some respects, its bottom line has improved in recent years as well. However, the company still generates significant net losses and its most recent fundamental performance has been somewhat of a letdown. Add on top of this the fact that shares of the firm are incredibly pricey, and I cannot help but be rather bearish on it right now. This stance is further strengthened by management’s decision to announce a $100 million share buyback program. This makes no sense for a rapidly growing firm that is still generating net losses and struggling to achieve positive cash flow of a meaningful amount on a consistent basis. For all of these reasons, and in spite of the rapidly growing revenue for the firm, I have decided to rate the enterprise a ‘sell’ for now.

Be the first to comment