chameleonseye/iStock Editorial via Getty Images

Dear Readers,

In this article, we’re going to look at Yara (OTCPK:YARIY) to see if an agribusiness investment might be suitable for your portfolio at this particular price. We have new quarterly results, updated assumptions for the macro we currently see, and somewhat improved visibility for the company’s 2022 operations.

Let’s see where this puts us for our updated thesis.

Updating on Yara International

In my last article, I went through the basics of the business that we’re seeing in this macro, namely the positive pricing delta Yara is seeing. The company is pushing significant price increases, but sales volumes are still somewhat curtailed by the simple fact that farmers are reluctant to buy expensive fertilizer in a market where they’re uncertain if they can get as much for their product.

Yara is seeing some incredible advantages from the simple fact that people are desperately in need of their products, and there, due to macro, is a shortage of fertilizer globally.

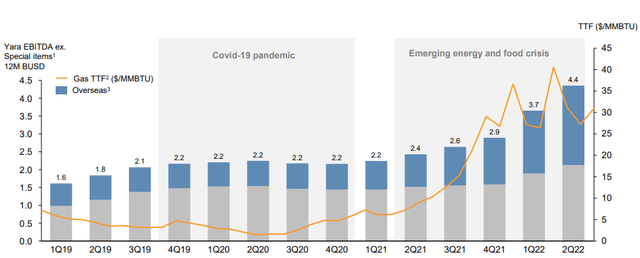

The net effect of this is additionally curtailing/limiting the European nitrogen market, which in turn helps Yara handling higher gas costs.

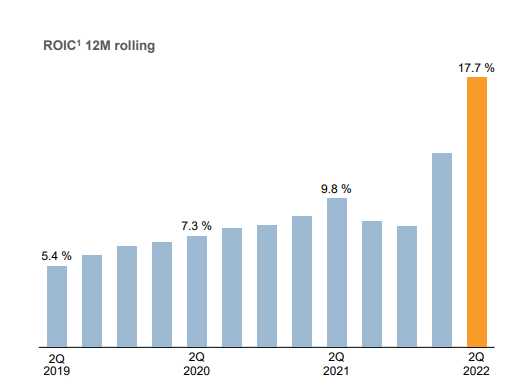

1Q22 saw a massive sales increase for the company, and 2Q22 increased this even further. The company saw even higher prices, resulting in higher 12-month rolling RoIC for the second quarter, and these numbers include the increased risk premiums to cover production cost exposure, which is currently one of the company’s main risks.

Yara International IR (Yara International)

However, dividend investors may rejoice. Because Yara is such an incredibly shareholder-friendly company that anytime it has excess capital not needed for continuing operations or ongoing financial plans, the company pays this to shareholders. It paid a 2Q22 dividend of $796M in total, and the company has already announced that it will consider supplementary dividends for the 3Q22 results if they continue to look like this (chances are that they will).

On the macro, not much has changed when it comes to perceived food security. Rather, things are still bad. The world is currently seeing close to 830M people affected by hunger, with 50M people in 45 countries living in famine due to climate shocks and macro. The ongoing crisis in Ukraine, a massive wheat producer, does not make things easier in the least.

There’s also the very real risk of nitrogen shortages and massive, further price spikes if the natgas situation in Europe grows worse – which is looking increasingly likely. Seasonally lower demands combined with natgas pricing have already led to production curtailments for nitrogen – and this could grow worse. Yara has closed several plants, meaning the company is short around 1.3M tonnes of ammonia and 1.7M tonnes of finished fertilizer.

Farmers are still making plenty of cash, but there’s a real risk of shortages here.

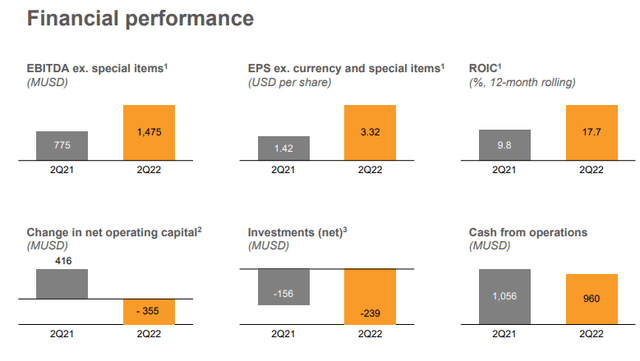

Company financial performance was stellar by most metrics.

Yara International IR (Yara International)

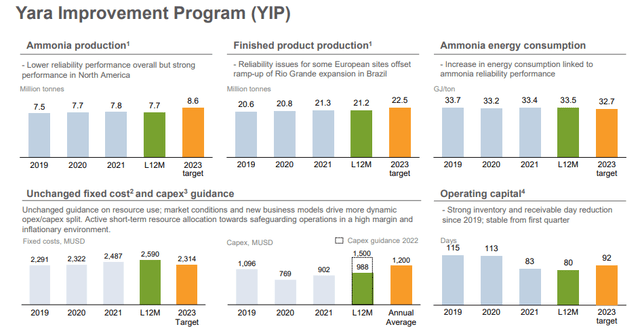

But these are not necessarily the issue, given that we’re looking at a temporary/extraordinary situation. Yara actually delivered a lot less products but managed to massively improve margins. For now, Yara manages to completely offset energy costs and lower deliveries by raising prices, and the improvement program continues to work forward as well.

Yara International IR (Yara International)

The company’s focus is to maintain its supply ability and securing the food chain as best it can. Despite this, the company’s deliveries are actually down – some areas in Europe as much as 24% (due to Ukraine), but even on a total basis, delivered are down double-digits 11% YoY.

Nay-sayers may say that Yara is in a dangerous position. I say no – not really “dangerous” for the company per se. The company can handle either overproduction or underproduction, and it can certainly handle a situation like this. The company’s production isn’t found only in Europe – it’s global – but the problem is the net effects on the global food chain and supply chain that this has.

Without Yara and similar fertilizers, our global food supply is unable to be held up to current volumes. The spot price for urea, gas, and other inputs is up between 100% and 300%, and things are growing worse.

Yara has, as I mentioned in my last piece, stopped sourcing from Russia and is highly utilizing its global sourcing. The company remains well ahead of the cost curve due to its very strong pricing power, more than offsetting the downside of energy prices.

Despite the lower deliveries in crop nutrition, Yara is committed to supplying customers and securing continuity in the food supply chain. Some initial countries (such as Lebanon, Egypt, and other African countries) are facing explosive prices for staple food, making it a challenge to feed not only people that typically are left going hungry, but also a growing middle class.

Remember that the Arab Spring was triggered by higher food prices and nowadays hunger is feared in many North African countries, potentially leading to instability that goes well beyond the food market and moves into the political sphere as well. Egypt is in a particularly bad situation again, if the situation doesn’t get solved soon.

Yara shareholders would do right to expect more rewards despite this. The company has strong cash earnings which more than funded the dividend payment and kept the company’s net debt essentially at an identical level for 2Q22.

Despite spikes in price, the company’s returns have retained their appealing characteristics.

Yara International IR (Yara International)

And the appeal of Yara fundamentally remains. It’s the #1 premium crop nutrition leader, and it’s transitioning in full toward more sustainable solutions. What’s more, it’s one of the most shareholder-rewarding companies in its sector on earth, while maintaining a strict capital discipline, but also paying out windfalls in cash to shareholders that have made possible triple-digit returns over the past 5-6 years.

Still, the company is facing a bit of a demand crunch. Producers’ nitrate stocks are at close to all-time lows, and because of the complex pricing situation, Yara hasn’t been able to up production of the finished products – not compound NPK, Nitrates, Urea, or other products.

All this flows to valuation – which we’ll look at now.

Yara’s Valuation

Yara currently trades at a price well below 450 NOK/share for the native, at around 416 NOK/share. This is well improved from my last article, which saw the company trade not that far from 500 NOK.

I remind you that my cost basis for the share was below 300 NOK – well below it, in fact. Unlike many of the companies I review where I say that it doesn’t matter how you view a company – it’s undervalued – the opposite is true for Yara. The company has been extremely volatile this year, giving us a 1-year native return of negative 6.45%.

At this point, the case is as simple as it was when the company was close to 500 NOK.

It doesn’t matter how you view Yara – DCF, NAV, yield, or book value – this great, Norwegian business is currently at fair value given its incredible upsides. While peers trade closer to 5-10X and Yara now still trades above 10x P/E, this company has yield and price upsides that the peers don’t have – especially BASF (OTCQX:BASFY).

Modeling for this crisis in a DCF model is near impossible. I could try and forecast a 10-15% EPS growth and try to guesswork energy pricing trends, but given how much volatility is in the market today, that’s not something I’ll do either.

In my last article, I made the following clear.

The best that can be said for the company, if we assign premiums for the various geographical sectors, is that the company isn’t massively overvalued, but at a fair sort of value given everything that’s happening – but even that is stretching things, given that a conservative NAV estimate for the company is closer to 420 NOK/share.

(Source: Seeking Alpha, Yara Article)

Well, as you can see, we now have a native share price of 416 NOK. Simply put, this means that the company is now below what I consider fair value, and therefore a “BUY”. In my last article, I showed you that most analysts considered the share price to be far higher – around 500 NOK – that is down to around 490 NOK now, coming to a 17.5% upside.

I will stick to my more conservative price target of 420 NOK/share.

Anything above 450 NOK is really stretching things here, outside of the current situation. I also don’t like investing because I believe we “might” be getting extraordinary dividends. It’s not my style.

For these reasons, I call this company a “BUY” here. I’m holding my large position in Yara, and I’m not divesting it at this time, and I’m considering adding more at this time.

The investors who tell you that this situation calls for yet another 100% upside, and there are those that stand for such an argument, disregard the historical, and the forecast accuracy for Yara, which at less than 50% is fairly abysmal.

It also completely disregards that for almost 10 years, this company was “dead money” which had the dubious honor of recording 6 straight years of EPS declines.

Starting in 2011, investors in Yara have below 3% annually.

But at the right price, this company becomes a “BUY” – and that valuation, as I see it, is now.

Thesis

My thesis for Yara is now:

- I have been neutral and “HOLD” on the fundamentally appealing Yara for a long time. At this point, I’m changing my stance on Yara.

- Yara has a potential longer-term upside at these fertilizer prices. The headwinds for Yara are very real, but none of them have, as I see it, the potential to seriously de-rail this company in the near term.

- Yara is a “BUY” here, though every investor, of course, needs to look at their own targets, goals, and strategies. I would also always consult with a finance professional before making investment decisions such as this.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

These are the things I usually look for in a company I invest in.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Yara is currently a “BUY”.

Thank you for reading.

Be the first to comment