JHVEPhoto

Teva Pharmaceutical (NYSE:TEVA) is one of the world leaders in the development and commercialization of generic and patent medicines aimed at combating neurological diseases. Over the past 12 months, 302 million prescriptions have been filled for the company’s drugs, accounting for 8.2% of total generic prescriptions in the United States. In addition, sales of Austedo and Ajovy are growing at double-digit percentages year on year, which has a positive impact on Teva Pharmaceutical’s cash flow. Decreasing the company’s debt, reaching settlement agreements with the states on the opioid crisis, and expanding its biosimilar portfolio make Teva Pharmaceutical an attractive candidate for investors with a long-term investment strategy.

Teva Pharmaceutical Financial Improvement in Recent Quarters

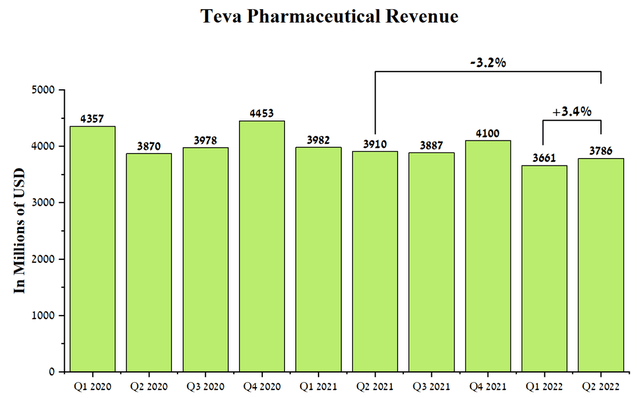

The CEO of Teva Pharmaceutical is successfully managing the business during a period of continued growth in inflation and legal battles caused by the opioid crisis, earning $3,786 million in Q2 2022, up 3.4% from the previous quarter.

Source: Author’s elaboration, based on Seeking Alpha

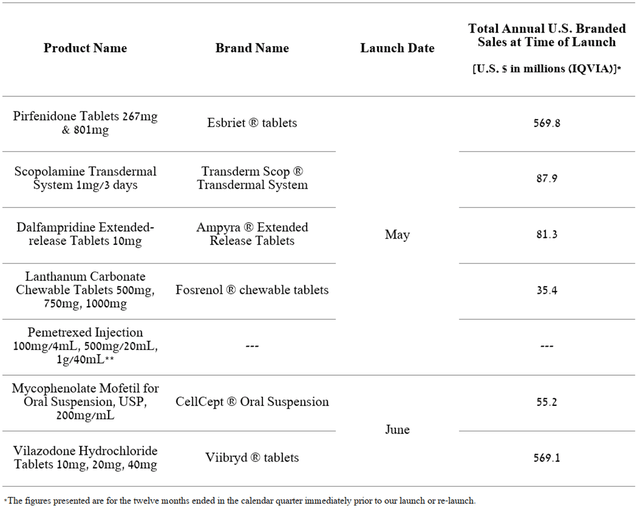

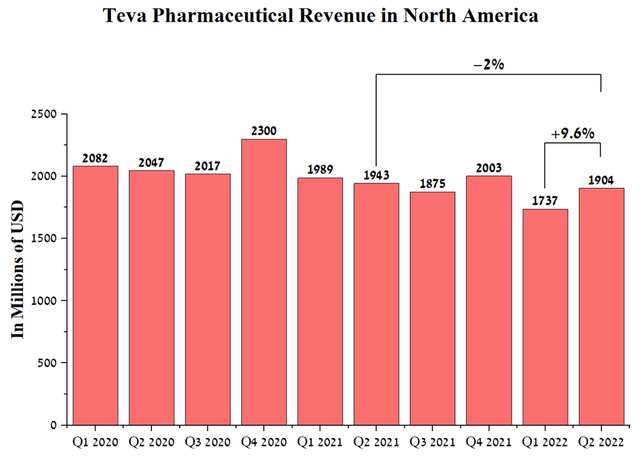

Drug sales in North America generated $1,904 million for Teva Pharmaceutical in Q2 2022, up 9.6% from Q1 2021. This increase was due to many factors, one of which is the increase in revenue from generics, even despite increased competition in this area. Analyzing the generic portfolio, the most important for the company’s financial position are Biogen’s (BIIB) Rituxan biosimilar and the recently launched generic version of Revlimid, which brought in about $12.8 billion for Bristol Myers Squibb (NYSE:BMY) in 2021 and provides an opportunity for Teva to get a big piece of this pie. In addition, in the 2nd quarter of 2021, the company began commercializing several generic versions of patented medicines, with total sales of over $1 billion.

Source: Author’s elaboration, based on quarterly securities reports

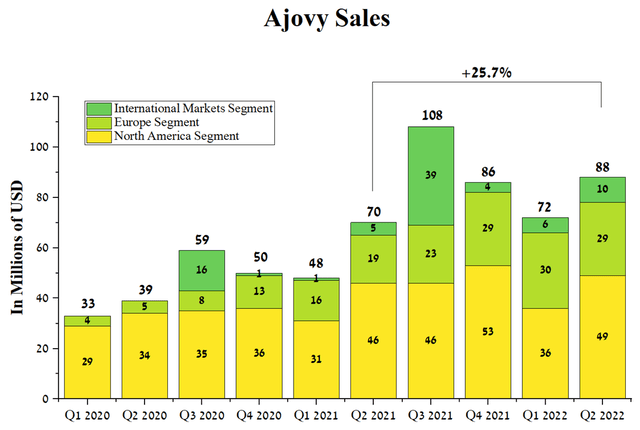

Moreover, sales of patent medicines also did not disappoint, which is especially important as they have high margins and help improve Teva Pharmaceutical’s cash flow. For example, Ajovy (fremanezumab), used to prevent migraine in adults, made a significant contribution, with sales of $49 million in Q2 2022, up 36.1% QoQ, driven primarily by higher prescriptions. In addition, Austedo’s potential blockbuster continues to be introduced into medical practice in the treatment of certain symptoms associated with Huntington’s disease and dyskinesia, resulting in a 32.5% increase in sales compared to Q1 2022. On the other hand, sales of Copaxone, the former key drug, after losing exclusivity in 2015, continue to decline and amounted to $94 million in Q2 2022. I estimate that the average annual decline in sales of this medicine will be about 15%, mainly due to increased competition from side generics and more effective drugs such as Roche Holding’s (OTCQX:RHHBY) (OTCQX:RHHBF) Ocrevus and Novartis’s (NVS) (OTCPK:NVSEF) Kesimpta.

Source: Author’s elaboration, based on quarterly securities reports

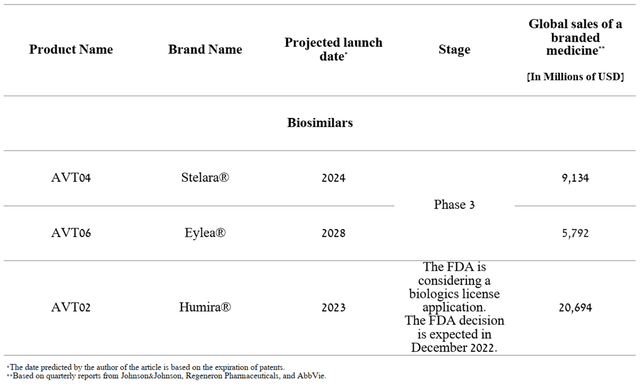

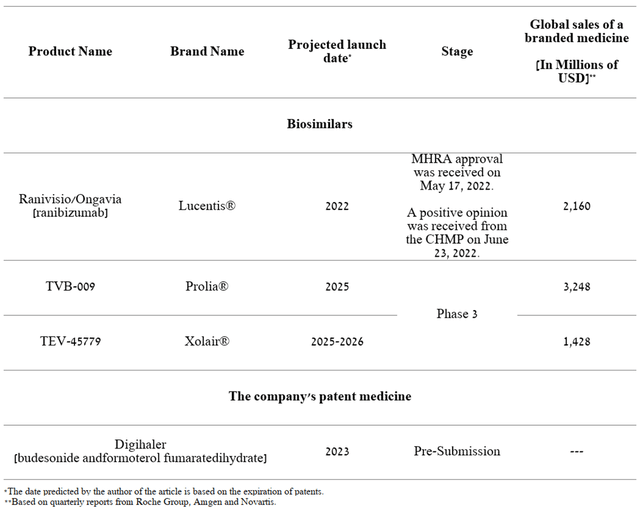

The effective business model built by the CEO of the company contributes to maintaining a high pace for expanding the portfolio of generic drugs, and by the end of July 2022, the company expects to receive a decision from the FDA on 178 drug applications. What’s more, according to IQVIA, sales of the patent medicines underlying these filings are around $109 billion per year, opening up new commercial opportunities for the company, and offsetting negative sales trends for Copaxone and Bendeka. The company’s management puts high hopes on biosimilars of patent drugs, whose total sales amount to tens of billions of dollars a year. As a result, Teva continues to increase R&D spending by accelerating its biosimilar portfolio expansion through in-house development and partnerships with other pharmaceutical companies. I agree with the company’s assessment of the potential of this area and, combined with Teva Pharmaceutical’s strong presence in North America, it is highly likely that the company will be able to take 10-15% market share from patent drugs whose biosimilars are under regulatory review or phase 3 clinical trials. The most important of these are AbbVie’s (ABBV) Humira, Johnson & Johnson’s (JNJ) Stelara, and Regeneron Pharmaceuticals’ (REGN) Eylea, whose patents expire in the next five years.

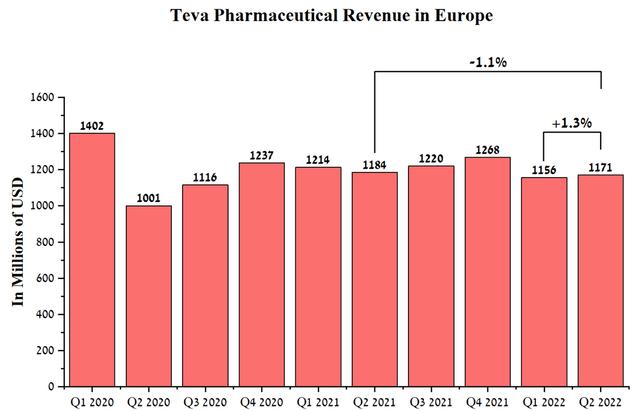

Given the growth in revenue for most drugs, which partially offset the decline in sales of others, according to my estimate, the average annual increase in revenue of Teva Pharmaceutical in North America until 2025 will be about 2.5%. The second region in terms of revenue was Europe, which generated $1,171 million for the company in Q2 2022, down 1.1% year-on-year. This decrease was mainly due to the weakening of the euro against the dollar, however, taking into account the sales of generics in local currency, they increased by 8%. The increase was due to the launch of new medicines and the lifting of restrictive measures introduced by the government of countries to reduce the negative impact of the COVID-19 pandemic.

Source: Author’s elaboration, based on quarterly securities reports

Ajovy’s sales were $29 million in Q2 2022, up 52.6% year-over-year mainly due to the start of commercialization in additional European countries.

Source: Author’s elaboration, based on quarterly securities reports

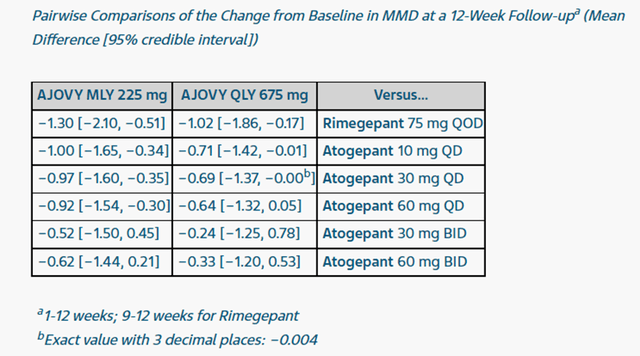

Based on quarterly dynamics, Teva’s drug sales have been slowing down in the last 3 quarters, and I believe this is due to increased competition from Biohaven Pharmaceutical’s (BHVN) Nurtec ODT. Given the results of a meta-analysis that indirectly assessed the effectiveness of Ajovy, AbbVie’s atogepant, and Nurtec ODT in the preventive treatment of episodic migraine, Teva Pharmaceutical showed an advantage over competitors.

Teva Pharmaceutical press release

So, despite a slight advantage in the effectiveness of Teva’s drug, Nurtec ODT, and atogepant, whose approval is expected in the European Union in 2023, have oral administration, which is an advantage over subcutaneous injections of Ajovy. As a result, I believe that Ajovy’s average annual sales rate will be lower than in the period 2019-2022 and will be 20% in the period from 2022 to 2025. In general, the company does not stop at the progress made, and in addition to the approval of generics, Teva expects the launch of a patent medicine and several biosimilars before the end of 2026. So on May 17, 2022, Teva’s Lucentis biosimilar received approval in the UK, and at the end of Q2 2022, a positive CHMP opinion was received. As a result, I expect the European Union to launch sales of this drug in early Q4 2022, opening hundreds of millions of dollars of commercial opportunities for the company.

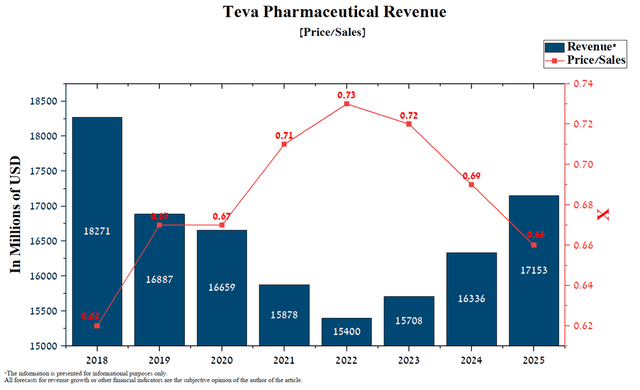

I estimate that the company’s average annual revenue growth in Europe until 2025 will be about 1.2%, thanks to the expansion of the portfolio of generic versions of patent medicines and biosimilars, which partially offset the decline in sales of Copaxone and respiratory products. Taking into account the financial performance of other segments of the company, I estimate that Teva Pharmaceutical’s total revenue will grow from $15.9 billion in 2021 to $17.2 billion in 2025, showing a CAGR of 2%. Moreover, the company’s Price/Sales ratio is 0.71, which is 85.7% below the average for the pharmaceutical industry. Thus, this indicates an underestimation of Teva Pharmaceutical by Wall Street in this indicator.

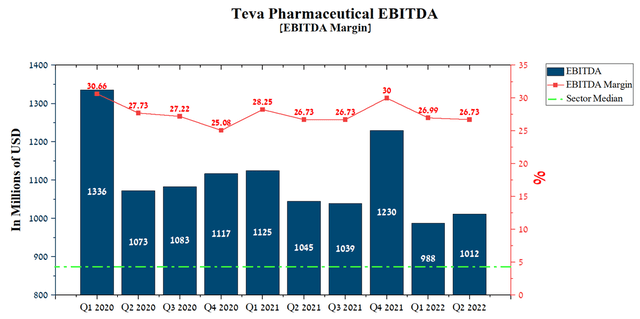

EBITDA was $1,012 million in 2Q 2022, up 2.4% QoQ, driven primarily by lower cost of sales of medicines and expansion of the product range in Europe.

Source: Author’s elaboration, based on Seeking Alpha

However, despite rising global inflation, the business model built by Kåre Schultz helps keep Teva Pharmaceutical’s EBITDA margin relatively high compared to other generic pharmaceutical companies. At the end of Q2, the EBITDA margin was 26.73%, unchanged from the previous year, but significantly higher than the average for the healthcare sector.

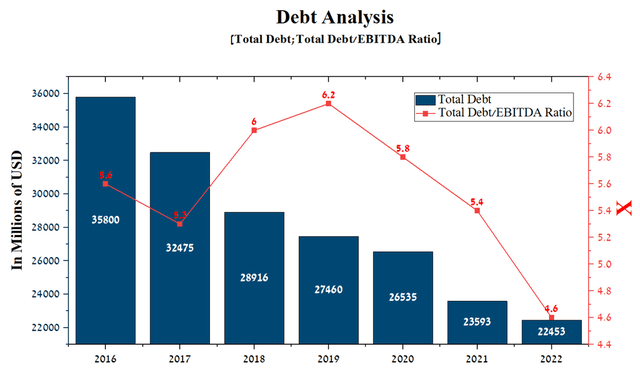

Improving Teva Pharmaceutical’s debt burden

The company’s debt reduction policy is starting to pay off, as the company’s total debt stood at $22,453 million in Q2 2022, down 4.8% from 2021 and down 33.6% from peaks. Moreover, thanks to the continued high margins of the business, Teva Pharmaceutical’s Total Debt/EBITDA ratio continues to decline year on year to 4.6x at the end of Q2 2022, which indicates the company’s CEO’s ability to control the situation and restore the company’s financial position in the current difficult macroeconomic conditions.

Source: Author’s elaboration, based on Seeking Alpha

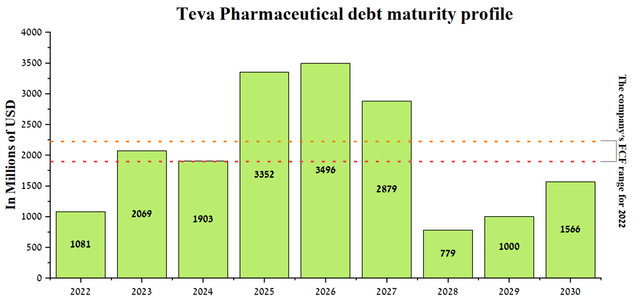

At the end of June 2022, the overall situation with the repayment of Teva Pharmaceutical’s debt by years is as follows.

Source: Author’s elaboration, based on quarterly securities reports

The company forecasts a free cash flow of $1.9-$2.2 billion in 2022, more than $1 billion more than the senior notes’ redemptions between 2025 and 2027. Thus, I believe that the company’s management will have to resort to debt refinancing to fulfill obligations to bondholders.

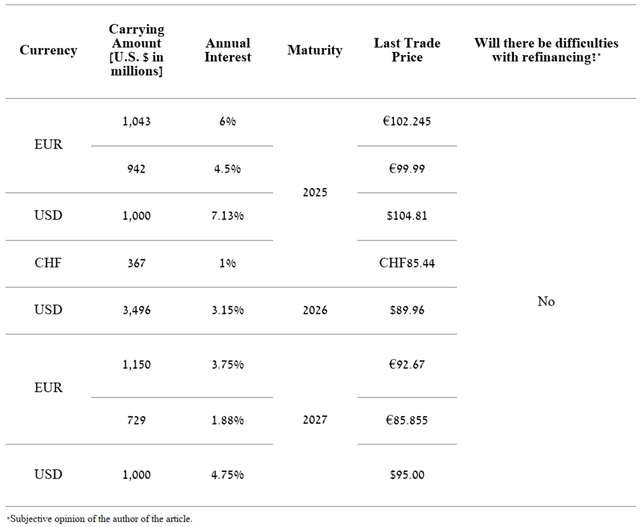

Source: Author’s elaboration, based on FINRA Bond Center, Frankfurt Stock Exchange

As can be seen from the table above, it is unlikely that the company will have difficulty refinancing because most of the senior notes trade well below par, have a fixed interest rate and have low volatility over the past six months.

The status of the opioid crisis lawsuits

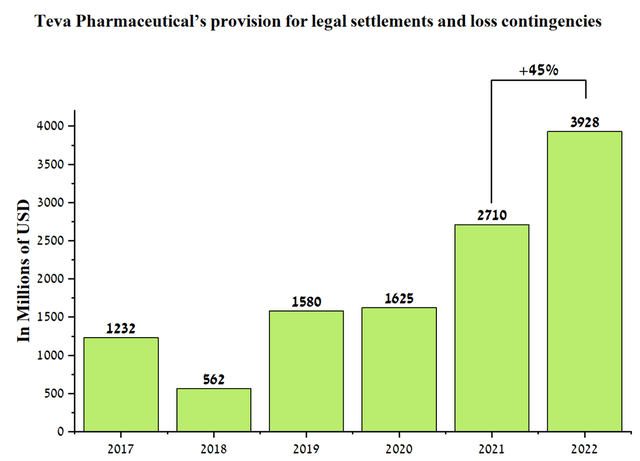

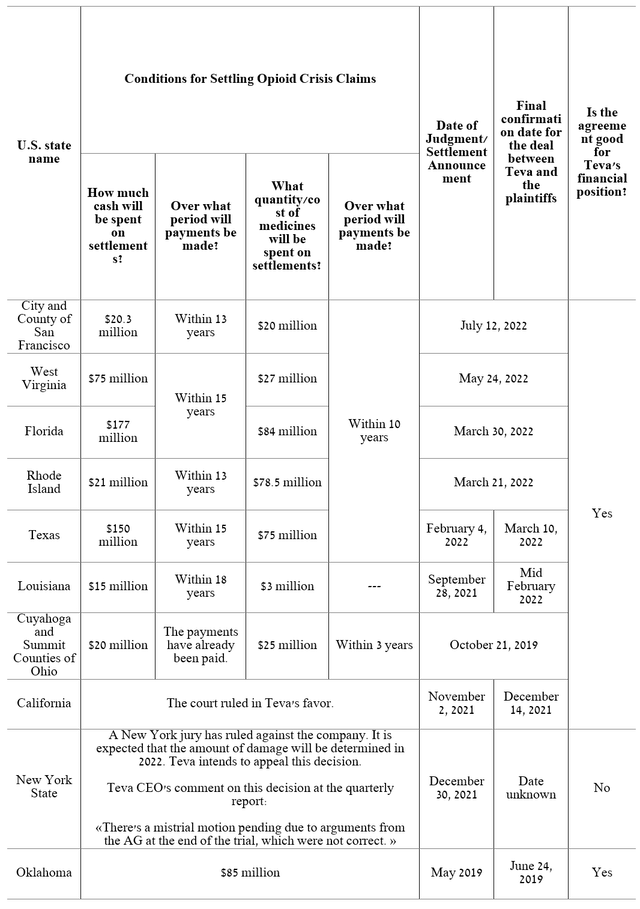

Since writing my last article, “Teva Pharmaceutical: Prepare For Takeoff,” the company has made tremendous progress in resolving most lawsuits over the opioid crisis. This eased the pressure on the company and made Wall Street look positively on the prospects of the former pharmaceutical industry mastodon. Teva Pharmaceutical’s management has continued to increase the company’s legal and contingency reserves, which will be used to pay out plaintiffs under agreements. These reserves currently stand at $3,928 million, up 45% from 2021, and I estimate they will be enough to settle most opioid crisis lawsuits. As a result, this will allow the company’s management to start allocating a larger share of net income to R&D and M&A transactions, relative to current values and thereby increase the number of next-generation product candidates.

Source: Author’s elaboration, based on quarterly securities reports

The law firms hired by Teva Pharmaceutical continue to reach pre-litigation agreements, and the terms on them put the company in a comfortable financial position, as payments on them will be spread over a period of at least ten years.

The most important victory for the company’s lawyers is the preliminary achievement of the financial terms of a nationwide settlement agreement totaling $4.25 billion concluded in July 2022. Under this agreement, Teva is committed to supplying a generic version of Narcan for ten years for a total of $1.2 billion, with the remainder to be paid in cash over 13 years. New York was not included in the agreement, making litigation with that state the only one possible over the late 2022 opioid crisis.

Conclusion

Teva Pharmaceutical continues to be a leader in the development and commercialization of generic and patent medicines targeted at neurological diseases. Under the management of Kåre Schultz, the company continues to effectively manage its debt load, which has been one of the main risks to Teva Pharmaceutical’s financial position. Moreover, law firms representing companies in the opioid crisis reach optimal agreements with the states, which increases investment interest from large institutional funds. After the completion of the corrective movement indicated in my previous article in the range of $6.85-$7.35, the company’s shares have grown by 52.7% since then. Moreover, given the increase in EBITDA, the number of product candidates, and the continued high margins of the business amid rising global inflation, the company has huge potential for the future. Based on the latest quarterly reports and business development, my target price remains unchanged at $25 per Teva Pharmaceutical share.

Be the first to comment