FotografiaBasica

I try to read as many articles as I can on Seeking Alpha, because like you, I’m trying to find ways to protect and grow my wealth. While I appreciate different opinions, I try to build my own understanding of each business, so I know what I own, why I own it, and how much I think the stock is worth relative to where it is trading today. One of the companies that is well covered is Altria (NYSE:MO), the tobacco giant and owner of the Marlboro brand here in the US.

I have seen a couple of articles with the terminal decline thesis when it comes to Altria. While the recent Juul write-down was a part of those articles, they were more focused on the price hikes combined with declining volumes. My question is this: what is the value of a company with a wide moat priced under 10x earnings, with a yield over 8%, that also happens to be a dividend king? The argument that the tobacco industry is in secular decline complicates things, but I’m still in the camp that Altria is very undervalued and will likely hold up better than the broader market over the next 3 to 5 years.

Investment Thesis

Altria is a dividend king that is due for another hike this fall. They recently wrote off the Juul investment, which isn’t ideal, but it wasn’t contributing much to the bottom line anyway. I will be watching to see what management does in the coming years as volumes are projected to decline, but I’m hoping for a pivot into another industry outside of tobacco at some point. The valuation is very cheap at 9.4x earnings, as Altria is still a high-margin cash cow. They continue to buy back chunks of stock, which is very rewarding for long-term shareholders at these valuations. Investors can get paid 8% to wait for the share price to get closer to fair value, and I’m expecting double-digit returns for several years to come.

Terminal Decline or A Future Business Pivot?

I’m assuming that management will pivot at some point from tobacco, especially if the terminal decline with the main business becomes obvious. While Altria doesn’t have a wide offering of so-called reduced risk products, that doesn’t bother me. While I’m not a chemist or health expert, I am curious to see how the next two decades play out when it comes to vaping and heated tobacco products. I wouldn’t be surprised if we find out that the chemicals that go into the newer products turn out to be worse than cigarettes. I prefer cigars myself, and I could be completely wrong on my cynical take on the reduced risk products, but I think people will still be smoking Marlboro Reds in 20 years. Ideally, that would mean Altria has hiked the dividend for the next 20 years to keep its streak alive, but that will be something I will keep an eye on down the road and check every couple of years.

The other thing that I could see happening in the future is a pivot to another industry if the tobacco industry gets stuck in an irreversible decline. While the execution with outside investments has been poor, I think Altria could look to expand into an industry like alcohol or cannabis in the future. I think taking a stake in an American cannabis company would make more sense long term than the current Cronos (CRON) stake, but the regulatory environment is too complicated for now on US companies. That will be another thing to keep an eye on as a long-term shareholder.

Valuation

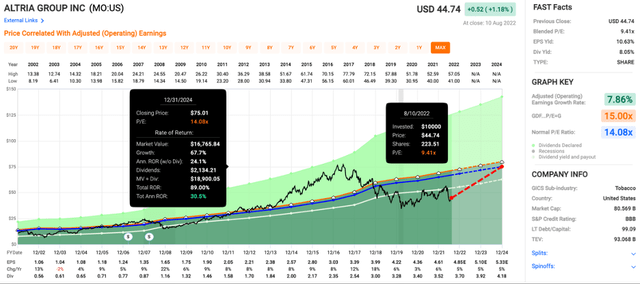

Altria’s valuation is even cheaper than it was a couple of months ago, but it has started to rebound in recent weeks. Shares trade at 9.4x earnings, which is too cheap, even if we are looking at a secular decline. One peek at the financials shows a high-margin cash cow, despite the recent Juul write-off (which wasn’t going to contribute much to the bottom line anyway). The current multiple is well below the average 14x multiple, and the likely multiple expansion should help investors easily clear double-digit returns.

Price/Earnings (fastgraphs.com)

Even if the multiple stays depressed, I still think the returns should be attractive. It also allows the company to buy back stock at better valuations. When you throw in an 8% yield, I like my chances of making money on Altria.

Dividends and Buybacks

The main draw in the investing community with Altria is the income. As a dividend king with an 8% yield, it checks off a couple of important boxes at first glance: a large current payout with a reliable history of annual increases. We are due for another raise this fall, and the company has also been returning capital to shareholders with buybacks.

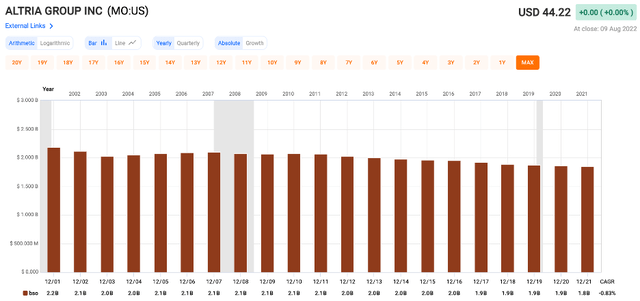

Shares Outstanding (fastgraphs.com)

Above is a graph of shares outstanding for Altria. I think we will continue to see share count decline as buybacks at these cheap valuations should be good for long-term holders as well as increasing EPS. In the second quarter, Altria bought back 10.1M shares at an average price just over $50. They have $742M remaining on the current buyback authorization and will probably authorize a new program once the current one runs out.

Conclusion

Altria isn’t a perfect company, and they have had their fair share of missteps in recent years with their outside investments. Despite that, they still have a high-margin cash cow business with a solid balance sheet to fall back on. I’m curious to see how they handle the next decade with their business, and I’m hoping we see a pivot into another related industry at some point to offset the declining volumes for their traditional tobacco products.

I’m still bullish on the company because the valuation is cheap enough to lead to solid returns. With shares trading under 10x earnings, I think we will see some multiple expansion as the company continues to grow EPS through a consistent buyback program. With an 8% yield that is due for another hike, it won’t take much price appreciation to get double-digit returns. I think it is a matter of time before shares grind past $50 and head towards $60, but investors looking for income can get paid a juicy dividend while they wait. I eventually plan to sell covered calls against my position, but that will be after the share price gets closer to fair value, which is near $60 in my mind.

Be the first to comment