kgtoh

Ever wish you could invest like the big boys, and get a slice of that high yield Venture Capital action? Well, it’s not just another Walter Mitty daydream – you can do this, via investing in certain Business Development Companies, BDC’s.

BDC’s offer retail investors high yield exposure to private companies, and some of them, like TriplePoint Venture Growth (NYSE:TPVG) focus on companies which are already backed by other venture capital firms. These other firms don’t want to lose their investments, and will continue to support these companies. This has been crucial during the pandemic and post-pandemic era.

TPVG’s specific area of concentration is with VC-backed firms in the venture growth stage, which haven’t yet gone public:

Profile:

TPVG is an internally managed BDC, founded in 2005. It’s headquartered on Sand Hill Road in Silicon Valley, with regional offices in New York City, San Francisco, and Boston. Since inception, TPVG has committed over $10B to 900+ companies throughout the world. It generally does 3-4-year financings, with a loan-to-enterprise value of less than 25%. The portfolio companies are typically preparing for an IPO or M&A in the next 1-3 years.

Holdings:

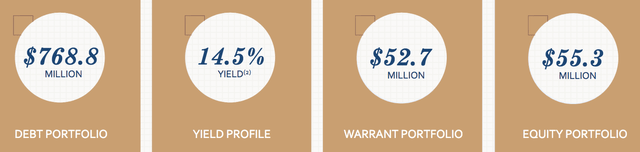

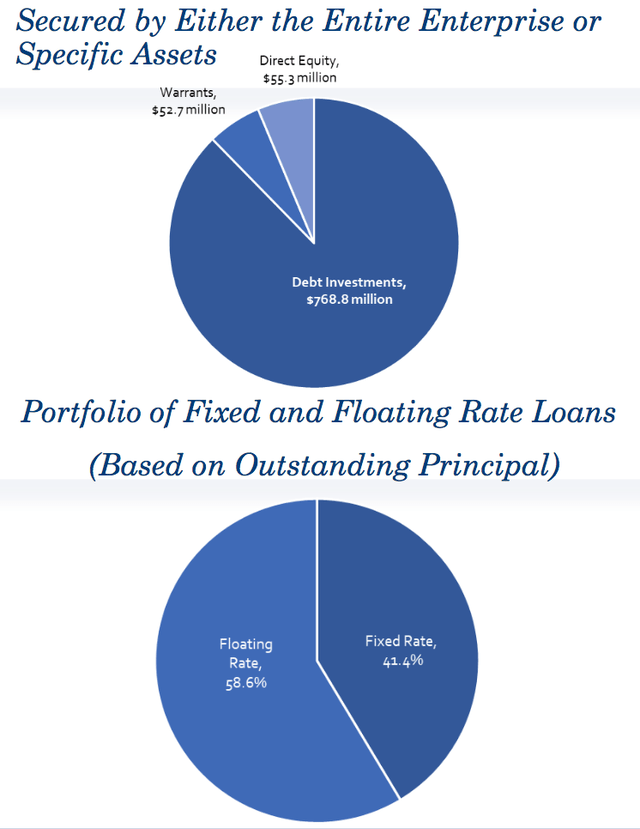

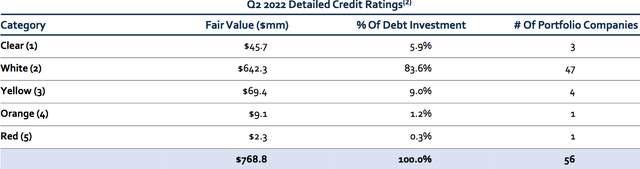

As of 6/30/22, TPVG’s debt portfolio was $768.8M, comprised of 129 loans to 56 obligors. Its Warrant portfolio was valued at $52.7M, comprised of 110 warrants in 95 companies. The Equity portfolio was valued at $55.3M, with 54 investments in 45 companies. The overall portfolio yield was 14.5%.

58.5% of TPVG’s $769M debt portfolio is at floating rates, with 41.4% on fixed rates, secured by either the entire Enterprise or by specific assets:

Rising Rate Beneficiary:

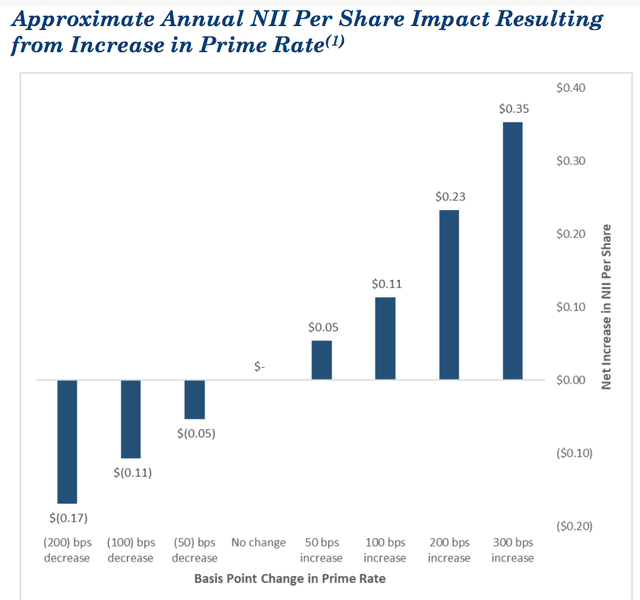

With ~59% in floating rates, management estimates that TPVG would earn $.11/share more in NII for a 100-basis point rise in the prime rate, while a 200-point rise would earn $.23/share, and a 300-point rise would earn $.35 annually.

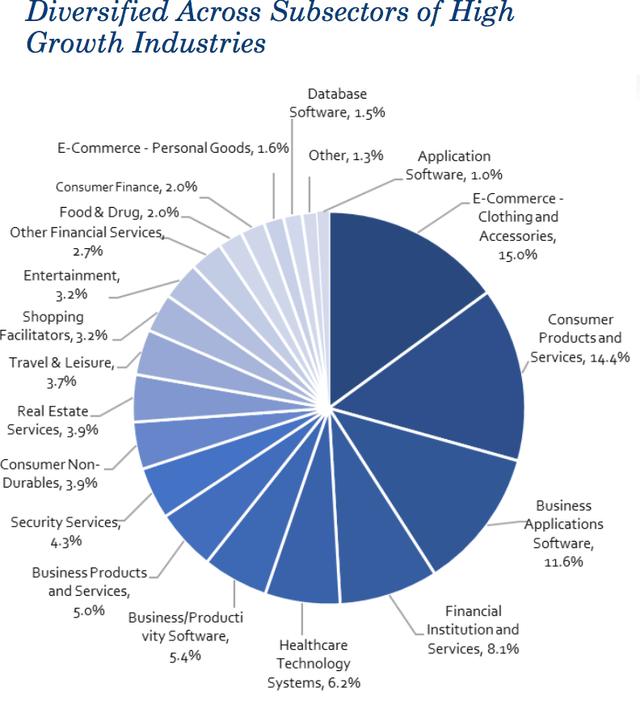

Its largest 5 industry holdings, which form ~59% of the portfolio, are E-Commerce Clothing, at 15%, Consumer Products & Services, at 14.4%, and Business Applications Software, at 11.6%. Financial Institution & Services, at 11.6%, and Healthcare Tech, at 6.2%. Management tends to avoid cyclical industries.

Portfolio Ratings:

A big concern during the pandemic lockdowns was how well the BDC industry’s portfolio companies would weather the economic pressures. BDC’s management usually review and rate their holdings each quarter. The good news is that most BDC’s holdings came though the crisis in pretty good shape.

TPVG uses a 1-5 tier system, with “clear” or 1 being the highest rating, and “red” or 5, being the lowest.

As of 6/30/22, TPVG’s overall companies’ rating score improved to 2.06, vs. 1.87 as of 12/31/22. 89.5% of its companies were in the top 1-2 tiers, with only 1.5% in the lowest 4-5 tiers.

Management downgraded one company to Category 5 as a result of its formal M&A process falling apart at the last minute and the company selling its assets in Q3. The principal balance was $15M and they marked the loan down to $2.25M.

Earnings:

TPVG signed a record level $803.6M of term sheets with venture growth stage companies in Q2 ’22, and closed a record level $259.9M of new debt commitments. It funded $157.6M in debt investments to 20 portfolio companies with a 13.6% weighted average annualized portfolio yield at origination.

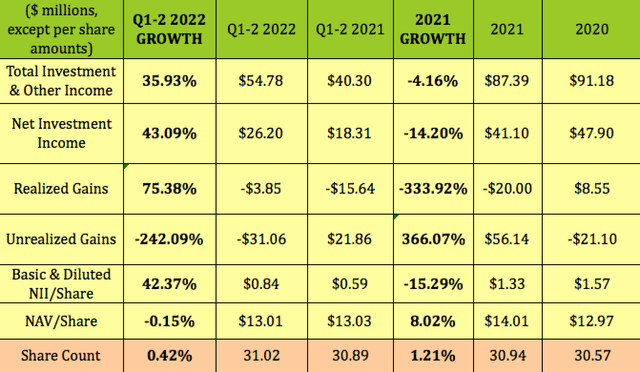

Total investment and other income was $27.4M in Q2 ’22, up 35% vs. $20.3M in Q2 ’21, due to higher interest rates and a larger portfolio. Net investment income was $12.7M, up 35% vs. $9.4M in Q2 ’21, with NII/Share rising to $.41, vs. $.30 in Q2 ’21.

For the 1st 6 months of 2022, total Investment & other income rose ~36% vs. Q1-2 ’21, while NII rose 43%, and NII/Share rose 42%. NAV/Share was flat, at $13.01, but during that period, TPVG also paid $.72/share in dividends. While Realized Gains improved by 75%, Unrealized Gains went from positive to negative, primarily due to fair value adjustments.

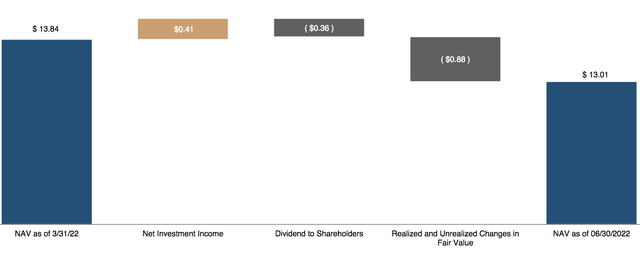

This Q2 ’22 NAV bridge breaks down the inputs for the Q2 ’22 NAV/Share decline to $13.01, vs. Q1 ’22’s $13.84. Other than the regular $.36 dividend, the main NAV markdown was due to -$.88/share in Realized and Unrealized Gains.

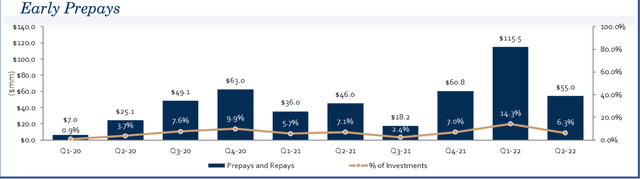

TPVG received $50.2M of principal prepayments, $4.8M of early repayments and $10.3M of scheduled principal amortization in Q2 ’22. As you can see from this chart, prepayments can be quite lumpy from quarter to quarter, which can affect NII. For example, there were a record amount of prepays, ~$116M in Q1 ’22, but that dropped to $55M in Q2 ’22:

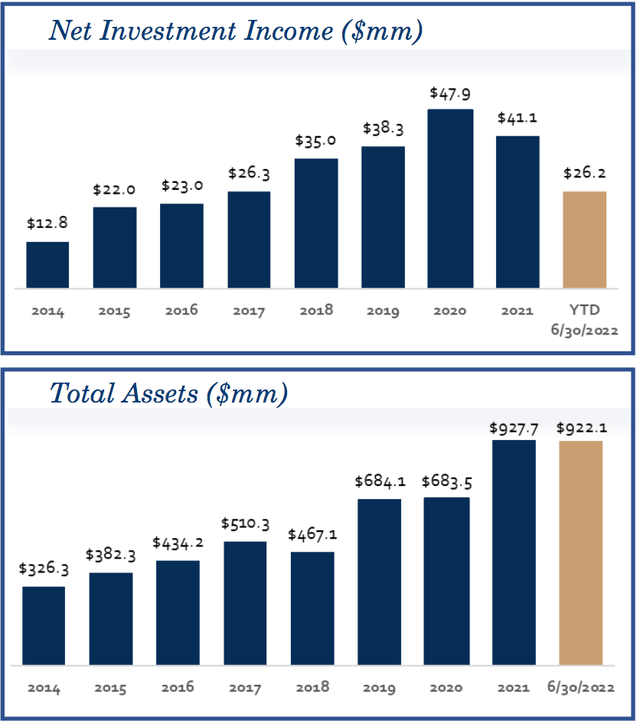

Compared to $41.1M in NII in 2021, it looks like TPVG is poised to earn much higher NII in 2022, possibly over $50M, which would be ~22% growth.

Dividends:

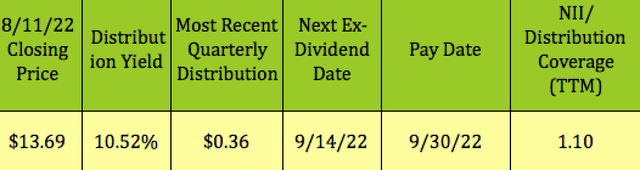

At its 8/11/22 $13.69 closing price, TPVG yields 10.52%. It goes ex-dividend next on 9/14/22, with a 9/30/22 pay date. Management has held the quarterly payouts at $.36 since Q4 ’14, with occasional special distributions of $.10 in Q4 ’18 and Q4 ’20.

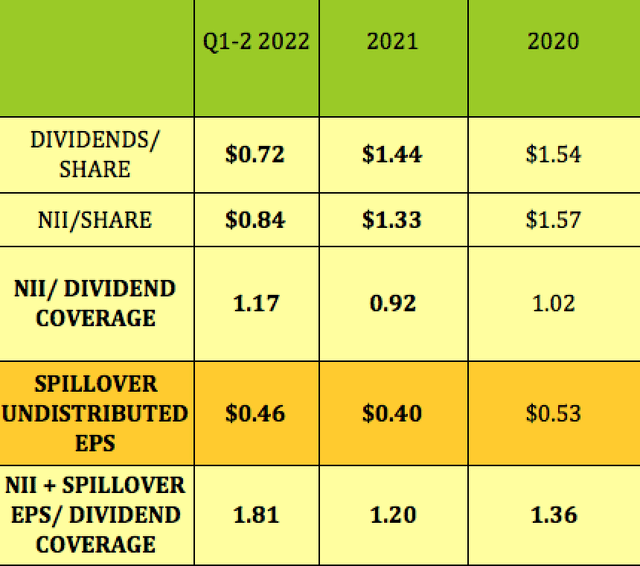

Dividend coverage has been very strong so far in 2022, with NII/share covering the $.72 in dividends by 1.17X, much higher than in 2021 and 2020. The trailing NII/dividend coverage is 1.10X.

In addition to NII, TPVG also has a solid cushion of $.40/share in UNII, undistributed NII, which gives it massive coverage factor of 1.81X:

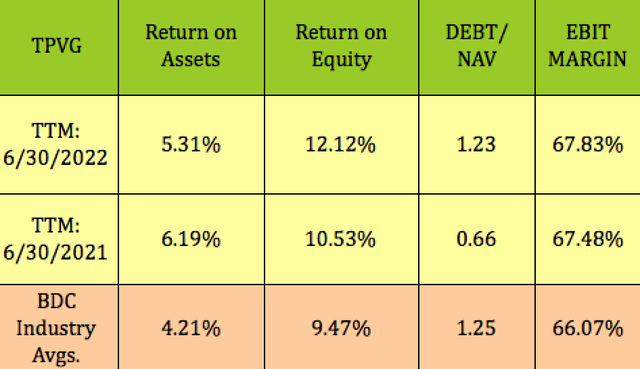

Profitability & Leverage:

ROA slipped a bit, while ROE rose, with both remaining above BDC industry averages. The EBIT margin was stable, and roughly in line with the industry average. Management ramped up the leverage over the past 4 quarters, in order to grow earnings.

As we’ve previously noted, higher leverage in BDC-Land isn’t unusual, as BDC’s must pay out 90% of their earnings to shareholders. The trick is finding BDC’s with a management team that knows how to manage debt, and not get over-leveraged.

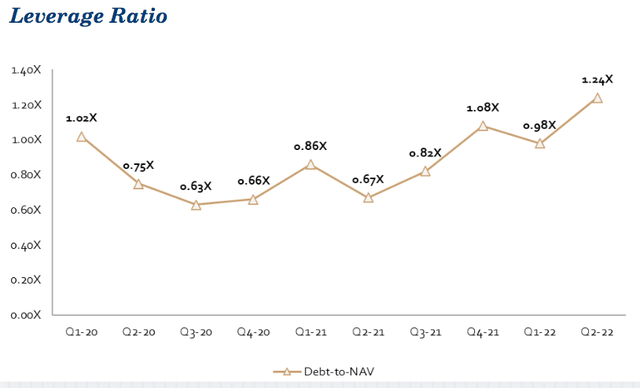

Like many other BDC’s, TPVG’s management decreased leverage during the pandemic, bringing it down a low of .63X. They raised it back to 1X-plus by the end of Q4 ’21, and it ended Q2 ’22 at ~1.24X:

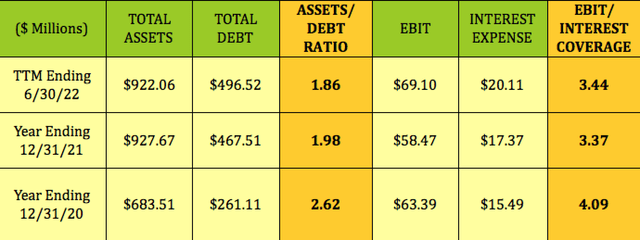

The Interest coverage ratio improved slightly in Q1-2 ’22, while the Asset/Debt ratio was down slightly vs. year ending 12/31/21:

Debt & Liquidity:

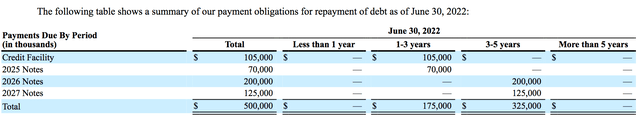

TPVG had total liquidity of $288.1M, consisting of cash and cash equivalents of $43.1M, and available capacity under its Revolving Credit Facility of $245M, as of 6/30/22.

The earliest maturity is on May 31,2024, when the $350-$400M Credit Facility comes due:

TPVG’s debt is rated BBB by DBRS.

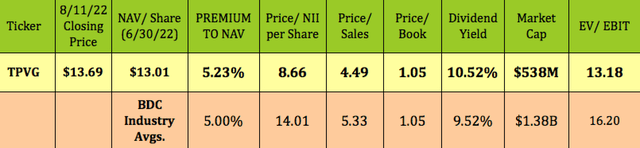

Valuations:

At its 8/11/22 $13.69 closing price, TPVG is trading at a 5.23% premium to NAV/Share, which is a much lower premium than we saw in early 2022, and in 2021, which saw premiums in the 30%-plus range.

But since NAV is affected by distributions, it’s often more useful to focus on a BDC’s earnings valuation, Price/NII. TPVG’s P/NII per share of 8.66X is cheap – it’s 38% lower than the BDC industry average.

Its P/Sales and EV/EBIT are also lower than industry averages, while its dividend yield is higher:

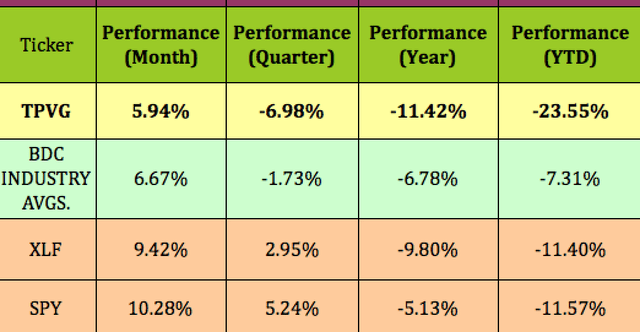

Performance:

Mr. Market has given TPVG the cold shoulder, due most likely to recession fears, which could affect its portfolio companies. He should remember though, that those companies are backed by VC firms, with much larger stakes, who can help cushion them during hard times, like they did during the lockdowns.

Parting Thoughts:

We rate TPVG a BUY, based upon its very well-covered dividend, its much lower than average Price/NII, and its strong history of creating shareholder value.

If you’re interested in other high yield vehicles, we cover them every Friday and Sunday in our articles. All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment