omersukrugoksu

Earnings of Community Bank System, Inc. (NYSE:CBU) will likely continue to grow on the back of organic loan growth. The loan additions will also help lift the margin, which will further boost the bottom line. Overall, I’m expecting Community Bank System to report earnings of $3.46 per share for 2022, down 0.6% year-over-year. For 2023, I’m expecting earnings to grow by 10.7% to $3.83 per share. Compared to my last report on the company, I’ve raised my estimates for both years following the third quarter’s performance. Next year’s target price suggests a moderate downside from the current market price. Based on the total expected return, I’m upgrading Community Bank System to a hold rating.

Commercial Segment Likely To Drive Overall Loan Growth

Community Bank System’s loan portfolio grew by 4.9% in the third quarter (19% annualized), which exceeded my expectations. This growth was purely organic, which is very unusual for the company. Historically, Community Bank has relied on mergers and acquisitions for growth. In the years 2021 and 2018, when the company did not do any M&A transactions, organic loan growth was abysmally low. The third quarter of 2022 is an honorable exception.

| CBU’s Merger and Acquisition History | ||||

| Year | Acquisition Target | Target’s Total Assets ($ million) | Change in CBU’s Assets for the Year * | Difference Attributable to Organic Growth |

| 2022 | Elmira Savings Bank | 579 | 42 | (537) |

| 2020 | Steuben Trust Corporation | 608 | 2,521 | 1,913 |

| 2019 | Kinderhook Bank Corp. | 643 | 803 | 160 |

| 2017 | Merchants Bancshares, Inc. | 1,999 | 2,080 | 81 |

| 2015 | Oneida Financial Corp. | 769 | 1,063 | 294 |

| Source: 3Q 2022 Presentation, Author’s Calculations | ||||

| * Nine months for 2022 | ||||

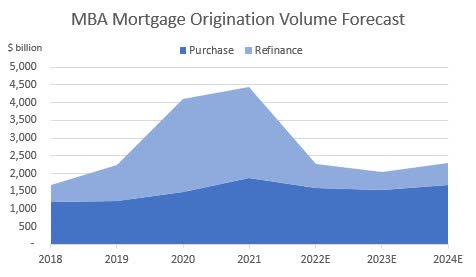

The high loan growth will eventually bust in the fourth quarter mostly because of high-interest rates. Consumer mortgages will suffer the most as home purchases depend heavily on borrowing costs. Consumer mortgage is a big part of Community Bank’s loan portfolio as it makes up around 35% of total loans. The Mortgage Bankers Association expects mortgage purchase volume to dip by 15% in 2022 and 3% in 2023, on a year-over-year basis.

Mortgage Bankers Association

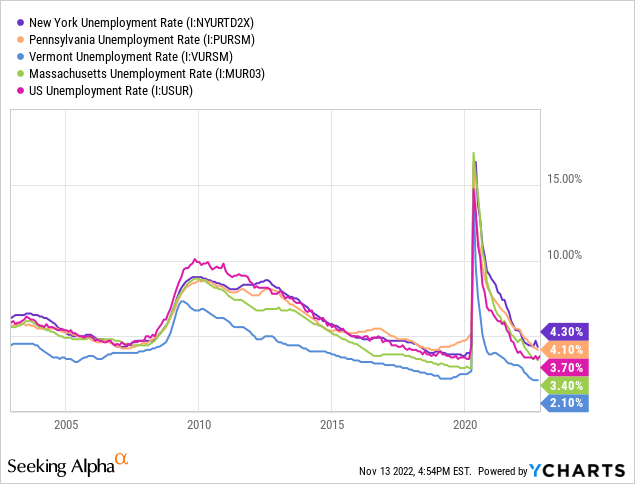

Meanwhile, strong job markets will sustain economic activity, which will, in turn, keep commercial loan growth afloat. Community Bank System operates in the northeastern states of New York, Pennsylvania, Vermont, and Massachusetts. New York and Pennsylvania currently have higher unemployment rates than most other states, while Vermont and Massachusetts have lower rates.

Considering these factors, I’m expecting the loan portfolio to grow by 0.75% in the last quarter of 2022, taking full-year growth to 16.7%. For 2023, I’m expecting the loan portfolio to grow by 4%. I have not incorporated any M&A transactions in my forecasts for the foreseeable future. Compared to my last report on Community Bank, I have not changed my growth estimates. However, my updated loan balance estimates are higher now because the third quarter’s performance beat my expectations.

Equity Book Value Erosion To Continue

Community Bank’s equity book value has plunged by 30% in the first nine months of 2022 mostly because of mark-to-market losses on the large available-for-sale securities portfolio. These securities made up 38% of total earning assets at the end of September 2022. As interest rates rose, the market value of these securities fell, leading to unrealized mark-to-market losses. These losses bypassed the income statement and flowed into the equity account through other comprehensive income, as per relevant accounting standards.

Further equity book value erosion is likely in the fourth quarter because of the 75-basis points fed funds hike in early November. Moreover, I’m expecting a further 75-basis point hike till the mid of 2023.

The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 6,232 | 6,841 | 7,355 | 7,324 | 8,547 | 8,894 |

| Growth of Net Loans | 0.4% | 9.8% | 7.5% | (0.4)% | 16.7% | 4.1% |

| Other Earning Assets | 2,982 | 3,088 | 3,597 | 4,979 | 5,280 | 5,494 |

| Deposits | 8,322 | 8,995 | 11,225 | 12,911 | 13,587 | 14,139 |

| Borrowings and Sub-Debt | 414 | 345 | 371 | 330 | 499 | 519 |

| Common equity | 1,714 | 1,855 | 2,104 | 2,101 | 1,479 | 1,590 |

| Book Value Per Share ($) | 33.1 | 35.5 | 39.4 | 38.6 | 27.3 | 29.4 |

| Tangible BVPS ($) | 18.9 | 20.7 | 23.6 | 22.7 | 10.5 | 12.6 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Margin To Be Slightly Higher Due To Loan Additions

Community Bank was able to slightly improve its deposit mix during the third quarter of 2022. Non-interest-bearing deposits rose to 31.7% of total deposits at the end of September, up from 30.6% at the end of June 2022. Unfortunately, liability repricing will still outweigh asset repricing in the first year of the up-rate cycle because Community Bank’s assets are quite slow to reprice. The stickiness of asset yields is attributable to large balances of fixed-rate consumer mortgages and investment securities. The results of the management’s rate-sensitivity analysis given in the 10-Q filing showed that a 200-basis points hike in interest rates could decrease the net interest income by 1.2% over twelve months.

On the other hand, the loan additions discussed above will likely be the chief driver of the net interest margin in the coming quarters. As new loans will be originated in a higher rate environment, they will raise the average portfolio yield.

Considering these factors, I’m expecting the net interest margin to grow by five basis points in the last quarter of 2022 and ten basis points in 2023. Compared to my last report on the company, I have raised my margin estimate because of the higher-than-expected margin expansion during the third quarter of the year.

Expecting Earnings To Grow By 11% Next Year

The anticipated loan growth and slight margin expansion will boost earnings through the end of 2023. Meanwhile, the provisioning expense for loan losses will likely remain near a normal level. I’m expecting the net provision expense to make up around 0.16% of total loans in 2023, which is the same as the average from 2017 to 2019.

Overall, I’m expecting Community Bank to report earnings of $3.46 per share for 2022, down 0.6% year-over-year. For 2023, I’m expecting earnings to grow by 10.7% to $3.83 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | ||||||

| Net interest income | 345 | 359 | 368 | 374 | 421 | 468 |

| Provision for loan losses | 11 | 8 | 14 | (9) | 16 | 14 |

| Non-interest income | 224 | 231 | 228 | 246 | 261 | 256 |

| Non-interest expense | 345 | 372 | 377 | 388 | 428 | 448 |

| Net income – Common Sh. | 168 | 169 | 164 | 189 | 187 | 207 |

| EPS – Diluted ($) | 3.24 | 3.23 | 3.08 | 3.48 | 3.46 | 3.83 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report on Community Bank System, I estimated earnings of $3.35 per share for 2022 and $3.69 per share for 2023. I have increased my earnings estimates for both years as I have increased my margin and loan balance estimates.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Upgrading To A Hold Rating

Community Bank System has a long-standing tradition of increasing its dividend every year. Given the earnings outlook, I’m expecting the company to increase its dividend by $0.01 per share to $0.45 per share in the third quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 47% for 2023, which is in line with the five-year average of 48%. Based on my dividend estimate, Community Bank is offering a forward dividend yield of 2.7%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Community Bank. The stock has traded at an average P/TB ratio of 3.01 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 18.9 | 20.7 | 23.6 | 22.7 | ||

| Average Market Price ($) | 59.3 | 64.0 | 60.6 | 73.8 | ||

| Historical P/TB | 3.13x | 3.09x | 2.57x | 3.25x | 3.01x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $12.6 gives a target price of $37.9 for the end of 2023. This price target implies a 42% downside from the November 11 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 2.81x | 2.91x | 3.01x | 3.11x | 3.21x |

| TBVPS – Dec 2023 ($) | 12.6 | 12.6 | 12.6 | 12.6 | 12.6 |

| Target Price ($) | 35.3 | 36.6 | 37.9 | 39.1 | 40.4 |

| Market Price ($) | 65.3 | 65.3 | 65.3 | 65.3 | 65.3 |

| Upside/(Downside) | (45.9)% | (44.0)% | (42.0)% | (40.1)% | (38.2)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 19.7x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 3.2 | 3.2 | 3.1 | 3.5 | ||

| Average Market Price ($) | 59.3 | 64.0 | 60.6 | 73.8 | ||

| Historical P/E | 18.3x | 19.8x | 19.7x | 21.2x | 19.7x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.83 gives a target price of $75.6 for the end of 2023. This price target implies a 15.7% upside from the November 11 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 17.7x | 18.7x | 19.7x | 20.7x | 21.7x |

| EPS – 2023 ($) | 3.83 | 3.83 | 3.83 | 3.83 | 3.83 |

| Target Price ($) | 67.9 | 71.7 | 75.6 | 79.4 | 83.2 |

| Market Price ($) | 65.3 | 65.3 | 65.3 | 65.3 | 65.3 |

| Upside/(Downside) | 4.0% | 9.8% | 15.7% | 21.6% | 27.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $56.7, which implies a 13.2% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 10.5%.

In my last report on Community Bank System, I determined a target price of $54.4 for December 2022 and adopted a sell rating. Since then, the stock price has fallen a bit, reducing the price downside. Further, I have rolled over my target price to the end of next year. Based on the updated total expected return, I’m now upgrading Community Bank System to a hold rating.

Be the first to comment