Sckrepka

I am very bullish on cannabis stocks. I shared my perspective on why investors should warm up to the sector a couple of weeks ago, and the market has increased now after a dip at the beginning of the month. In this article, I am going to explain my negative view on the leading cannabis ETF. This follows a negative report that I shared with subscribers at 420 Investor on August 28th.

History of MSOS

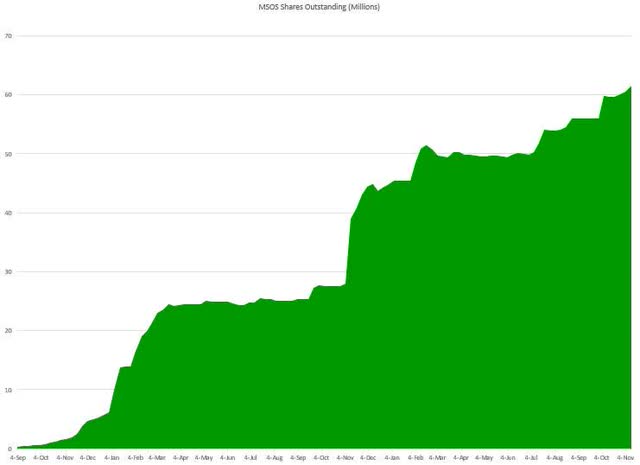

MSOS is the largest cannabis ETF, currently at $705 million. It is run by AdvisorShares, which launched it in early September 2020 at just a few million dollars. While the market cap is large, it was larger when the price was higher, exceeding $1 billion in early 2021. The ETF now has 61.275 million shares, which has grown steadily.

MSOS Shares Outstanding (420 Investor, based on disclosure from AdvisorShares)

The growth has been phenomenal despite the collapse in cannabis stocks since early 2021. Year-to-date, the number of shares has increased 57.6%, and it has more than tripled since October 2021.

I know and like the CEO of AdvisorShares, Noah Hamman, but I have never communicated with the portfolio manager, Dan Ahrens, who serves as the COO of AdvisorShares too. Vice has been a big focus of his professionally.

In my view, the fund isn’t really actively managed, as AdvisorShares claims. I have followed this ETF since the day it went public, and almost all of the activity is related to investing the inflows rather than exchanging positions.

MSOS Portfolio Is Poorly Structured

The cannabis market is very diverse, in my view, but MSOS focuses mainly on American multi-state operators, or MSOs. Great ticker for that!

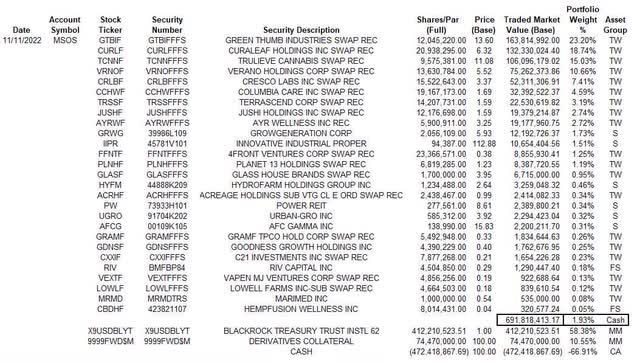

In addition to being very narrowly focused, the company invests in swaps that are 75% related to just five companies, the largest MSOs by revenue or market cap: Cresco Labs (OTCQX:CRLBF), Curaleaf Holdings (OTCPK:CURLF), Green Thumb Industries (OTCQX:GTBIF), Trulieve (OTCQX:TCNNF) and Verano Holdings (OTCQX:VRNOF). Here is the entire portfolio, sorted in descending order:

MSOS Holdings (11/11/22) (AdvisorShares data, arranged by 420 Investor)

The rest of the portfolio has 1.9% cash and mainly MSOs. The percentage of stocks that aren’t operators is just 4.7% (ancillary names).

I have a number of issues with the structure, including too much focus on the largest stocks and too much exposure to MSOs. There is no index, but I think a good question for AdvisorShares is to ask why there is no benchmark at all.

I am very bullish on cannabis stocks for 2023, but MSOs have been the best performers in a weak market this year. At New Cannabis Ventures, we have a broad index, the Global Cannabis Stock Index, that is down 59.5% year-to-date. Our American Cannabis Operator Index is down just 42.2%. Our Canadian Cannabis LP Index is down 51.4%. Our Ancillary Cannabis Index has been our worst performing index, losing 68.4%. It was up a ton last week, rallying 12.6% after posting an all-time low during the week on 11/9 at 16.57. On Friday, it closed 22.5% higher than that price on Wednesday.

At 420 Investor, I currently own none of the largest MSOs, which are 75% of the MSOS ETF. I am very overweight ancillary stocks, which are less than 5% of MSOS. So, my model portfolios, with 14 stocks, are very different from MSOS.

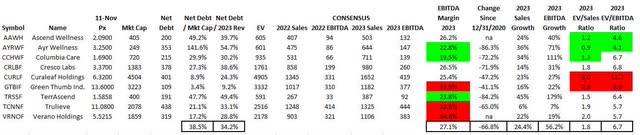

I have nothing against the largest MSOs except their price currently and the lack of relative value. I am very heavy on the group of Tier 2 MSOs, with my long-term focused portfolios at about 22% in three of them. I find the largest MSOs to be expensive relative to the entire group:

Top 9 MSO Valuations (420 Investor)

I have highlighted the EBITDA Margin column with low margins in green and high margins in red. I believe for many reasons that margins are at risk, and the higher margin companies, by expectation, may be at more risk. At the same time, the lower-margin companies are working to improve them and may succeed. I have also highlighted the valuation columns on the right for relatively low valuations in green and relatively high in red.

Again, MSOS has a huge bet on a part of the market that I don’t have any exposure to currently, the largest MSOs. I have a problem with how concentrated the ETF is. I also think that there are much better cannabis stocks to buy than what MSOS owns.

MSOS Performance Is Unsatisfactory

There is no official benchmark at all for MSOS, which I think is a huge yellow flag for its investors. Compared to the Global Cannabis Stock Index, the benchmark I use for my model portfolios at 420 Investor, MSOS has slightly outperformed in 2022. MSOS has dropped by 54.9% so far this year compared to the 59.5% return for that index. My model portfolios have declined less than MSOS despite being diversified away from what has been the strongest part of the market, MSOs.

I don’t think that the Global Cannabis Stock Index is appropriate, though. Our American Cannabis Operator Index is a better fit. That index, which is rebalanced monthly, currently has 16 names. At month-end, the 5 largest names in MSOS, which accounted for about 75% of the ETF, were 31% of our index. MSOs were 88% of our index, with the balance in CBD companies. Our index is doing a lot better than MSOS year-to-date at -42.2%. Looking at 2021, MSOS fell 29.9% and is down now 68.4% since the end of 2020. The American Cannabis Operators Index fell 33.9% in 2021 and is down 62.1% since the end of 2020. MSOS has lagged an appropriate index substantially over the past almost two years.

Why MSOS Is Not a Good Way to Invest in the Cannabis Sector

While we appreciate what the ETF MSOS did for the industry and for investors after launching and have seen the ETF improve a lot since it began about two years ago, we think that it is a dangerous way to invest. Not only is it overly concentrated in the largest names, it is also missing out on other important parts of the market. Betting on the biggest to be the best isn’t always a good idea. Larger cannabis operators can be limited by regulatory issues, such as in Massachusetts, which limits the production size of operators. I won’t argue that the largest operators will never be the best investment or that they are going to decline, but it’s wrong to make the same bet all the time, as MSOS does. Investors would be wise, in my view, to choose stocks and not narrowly focused, highly concentrated ETFs.

Alternatives to MSOS

For those who can buy cannabis stocks instead of ETFs, it’s pretty easy to capture the performance of MSOS by just buying the top 5 holdings that represent 75% of the assets. I also think an investor can create a better portfolio than MSOS by picking different stocks.

For those that want to invest in cannabis but are limited to ETFs, I would suggest evaluating others. To me, the important things are good stock pickers and good liquidity. I think that one ETF that is better is Tim Seymour’s Amplify Seymour Cannabis ETF (CNBS). It is a lot smaller than MSOS at $44 million, though. Tim has 35 stocks in the ETF right now. I am not a big fan of how it is currently structured, with the top holdings almost the same as MSOS except for Tilray (TLRY) instead of Verano Holdings, which is his 8th largest holding at this time. While I don’t like the large MSOs right now, as I have discussed, CNBS exposure is way below the MSOS exposure of 75% at a still-high 37.1%. The ETF even owns a 3.9% position in MSOS!

I want to be clear to readers that I am not recommending CNBS except as an alternative to MSOS. The ETF does own the three Canadian LPs that I include in my model portfolios, but the exposure is pretty low to the MSO positions that I own. I am not a fan of Tilray or Canopy Growth (CGC) either, but CNBS exposure to them is 11.9%. The part of the market that I think is most attractive, the ancillary stocks, is just 11.9% as well, substantially lower than the 50% exposure I maintain in my model portfolios at 420 Investor and the representation of 36.7% of the Global Cannabis Stock Index.

Conclusion

I was very excited when MSOS listed, and I became a lot happier about it when it surpassed $100 million assets under management within a couple of months of launching. I commend them for the growth in assets despite the dramatic decline in cannabis stock prices. With that said, I am not a fan of the way the ETF operates.

ETFs appeal to investors in general because they simplify the investment process at a reasonable cost. If one is interested in the cannabis sector, investing in MSOS might be an option. For those that can invest in stocks rather than ETFs, though, it isn’t the best option. For those who must invest in an ETF to invest in the cannabis sector, it’s not the best ETF either for the reasons I have discussed.

Be the first to comment