Jonathan Kitchen

It’s been about 52 months since I first bought Value Line Inc. (NASDAQ:VALU). Four months later, I took a 32% profit after I spotted some risks, and wrote an article to that effect with the very unoriginal title “Value Line: Growing Risks.” I bought back in once again in mid-May of last year when the shares were trading at a PE of ~13, though I didn’t publish this fact on this forum. Since then, the shares have gone parabolic, so it’s time to review the name once again. I want to determine whether or not it makes sense to buy more, hold, or sell the position. I’ll make this determination by looking at the latest financial results and by looking at the valuation.

Welcome to the “thesis statement” portion of the article. It’s here where I regale you with the gist of my thinking about a given company in case you couldn’t infer my thoughts from the title and the bullet points above. I offer these “thesis statement” paragraphs in each of my articles because I understand that not everyone wants to expose themselves to the full “Doyle experience.” The thesis statement allows you to enter the article, get the highlights, and get out before you suffer the effects of my bad jokes or naked bragging. I think the weight of averages is that Value Line’s revenue and net income will begin to slow over the next year, and I would only be willing to buy more if the shares were trading at a reasonably cheap valuation. The problem is that not only are the shares not cheap, they are trading at all time high valuations. This is a dangerous combination in my view, and for that reason I’ll be selling. If you own shares, I would recommend you follow suit. If you were considering buying, I would recommend you hold off until the price falls to match value. Given that the dividend yield is currently less than a third of the 10-year Treasury Note, I think there are far better alternatives out there at the moment.

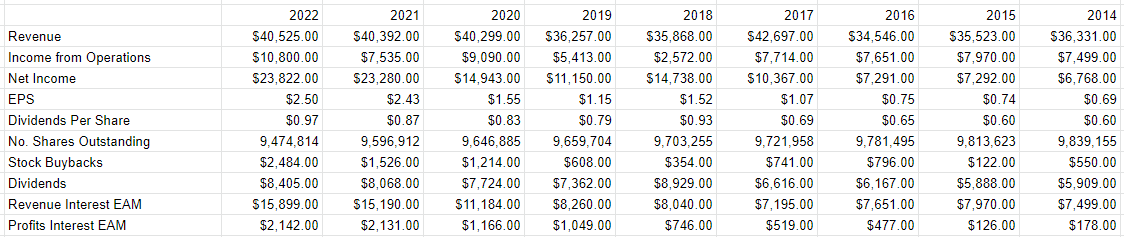

Financial Snapshot

I’d characterise the financial results over the past few years in some ways as “steady Eddy.” For instance, revenue in FY 2022 is about 0.5% higher than it was in FY 2020. At the same time, though, net income is up by about 59%, primarily driven by a $2.3 million gain on “forgiveness of SBA loan” and the 83% uptick in profit interest in the EAM Trust, the company’s asset management arm.

Writing of EAM, I’m of the view that this is the engine of growth here. For instance, way back in 2014, about 20.6% of revenue came from EAM, and by FY 2022, that figure had spiked to 39%. Given this, and given the fact that total EAM managed net assets dropped 32.4% from FY 2021 to FY 2022 (from $4.964 billion in 2021 to $3.357 billion in 2022) is troubling in my view.

On the bright side, both the capital structure, and the dividend are quite secure in my view. In particular, cash on hand represents about 60.5% of total liabilities. Additionally, dividends in FY 2022 represented only about 34% of cash from operations, and 35% of net income. So my expectation is that revenue and net income, especially from the EAM business, will likely drop from current levels. That said, I’d be comfortable adding to my position here assuming the price is right.

Value Line Financials (Value Line investor relations)

The Stock

Since last I checked it seems that I’ve just experienced yet another bump in followers, which is simultaneously flattering and confusing. Anyway, welcome. You knew people haven’t been exposed to my thoughts about the difference between a company and a stock, so welcome to the party. I am of the view that the business and the stock are very different things, and as such, we need to consider each of them separately when making a buy or sell decision. I’m of the view that a reasonably strong company can be a terrible investment at the wrong price, while a struggling company can be a decent investment if you pick it up at a sufficient discount to intrinsic value.

Another way to conceive of this idea is that business is an organization that buys a number of inputs, like the time of stock analysts, performs value-adding activities to those, and sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate expectations about the long-term prospects for a given company. If you’ve invested in stocks previously, you may have noticed that the crowd can be capricious and has a tendency to drive prices up and down relatively frequently as it changes its mind about a given company’s distant future. Additionally, a company’s stock can be buffeted by our collective view about “stocks” as an asset class, and Value Line may be particularly affected by this, as it may be seen as a proxy for the overall market. This disconnect between “company” and “stock” can be frustrating in some ways, but it also represents opportunity for us. In my experience, the only way to profitably trade stocks is by spotting a disconnect between current market expectations about the future performance for a given company, and subsequent results. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. In my world, “down in the dumps” means “cheap.” You may remember from the discussion about the company that I expect revenue and profits from the EAM business to drop.

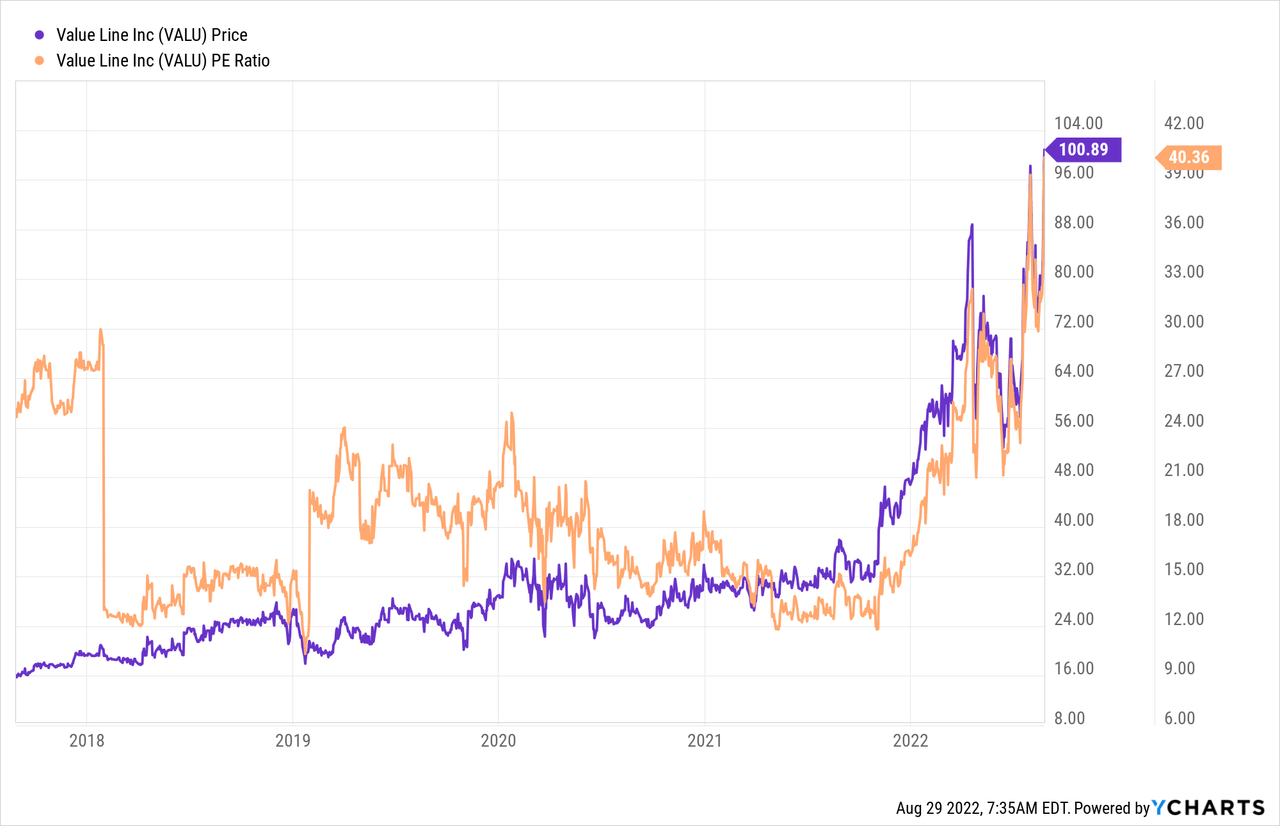

Those who read my stuff regularly know that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complicated. On the simple side, I track multiples of price to some measure of economic value, like earnings, free cash flow, book value, and the like. Ideally, I want to see a company trading at a discount to both the overall market and its own history. To put the current valuation in context, I became excited about an investment in Value Line when the shares were trading at ~12.5 in April of 2018. I sold when the shares hit a PE of 16.5 about four months later. I bought back in mid May of last year when the PE was hovering around 13. It’s a much, much different world per the following.

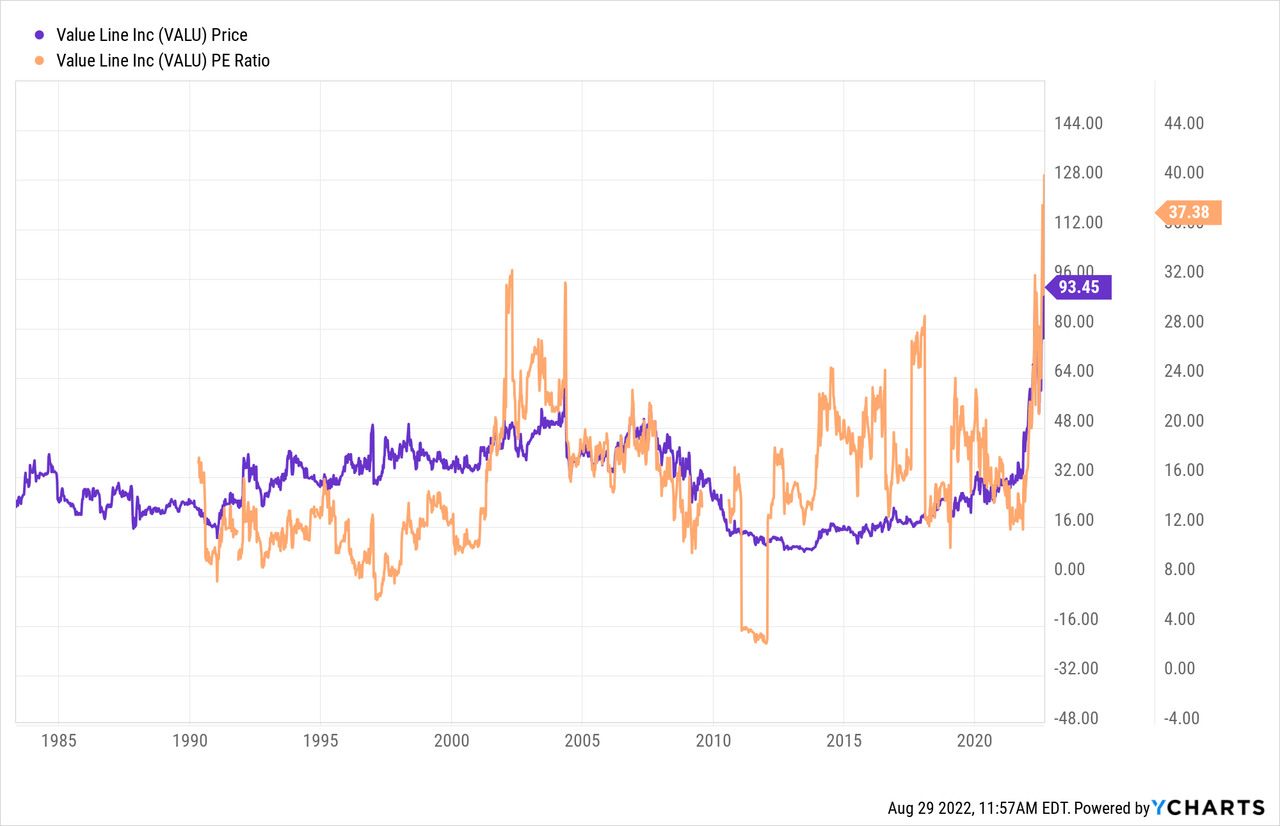

To drive home the fact that current valuations are unprecedented, please feast your eyes on this chart that goes way back to the mid 1980s. These shares have never been more expensive.

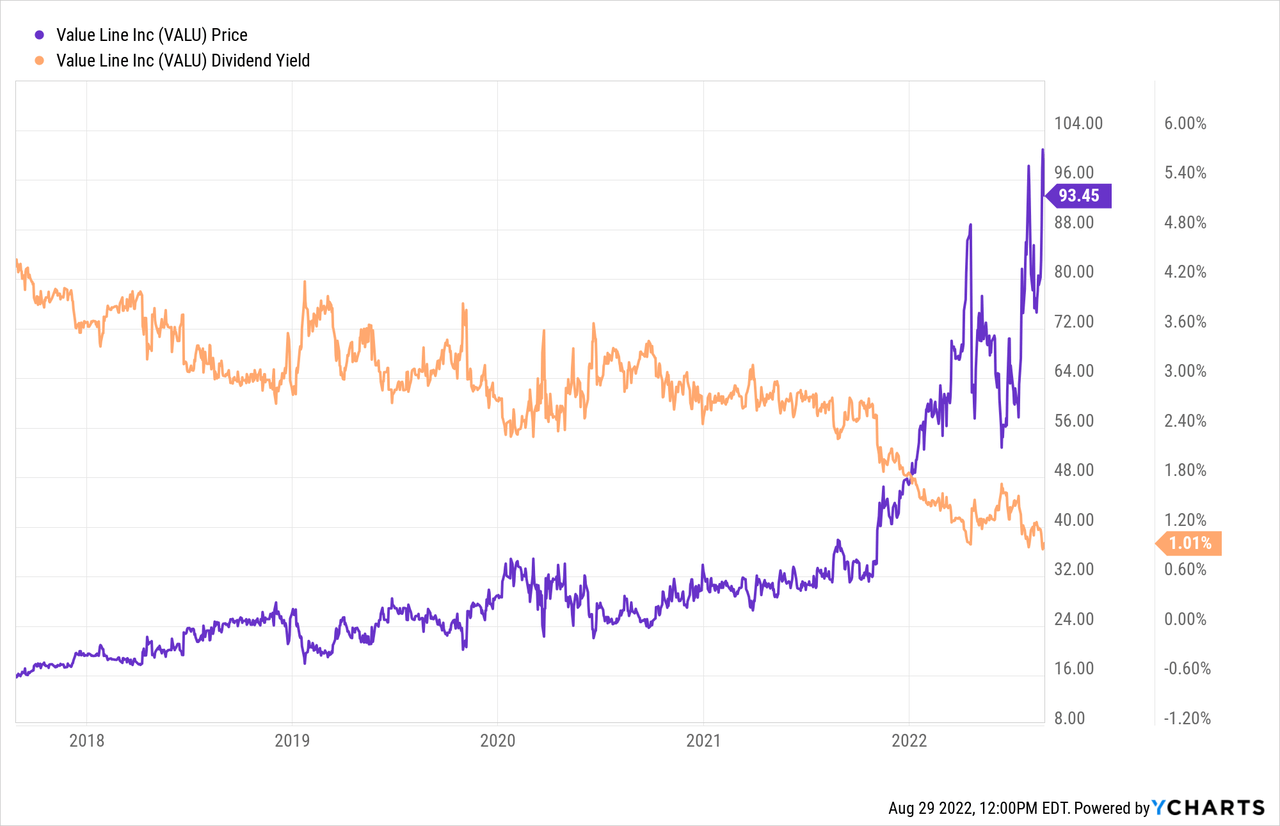

While investors are paying more for $1 of earnings than they ever have, they are receiving multi year low dividend yields per the following:

In my view, paying more and getting less is not a formula for success in the domain of investing. While I’m of the view that EAM revenue and profits will moderate from here, the market seems more optimistic than ever about the future for this business. Given the above, I will be selling my shares, and I recommend investors either do the same if they’re currently long, or eschew the shares if they were considering buying.

Conclusion

I think this is a fine business in many ways, and, as I wrote above, I think the dividend is very well covered. The problem is the valuation. This well covered dividend is giving investors approximately a third of the income they can receive from a 10-year Treasury Note. In the relativistic game of investing, that’s a problem. It’s especially troubling in light of the fact that I expect growth to moderate here. Just as I’m of the view that the “stock” and the “company” are distinct elements, I think “price” and “value” are also distinct and can remain unmoored from each other for some time. While I’m open to the possibility that the market may drive these shares higher from current levels, any gains from here will be inevitably given up in my view.

Be the first to comment