visualspace/E+ via Getty Images

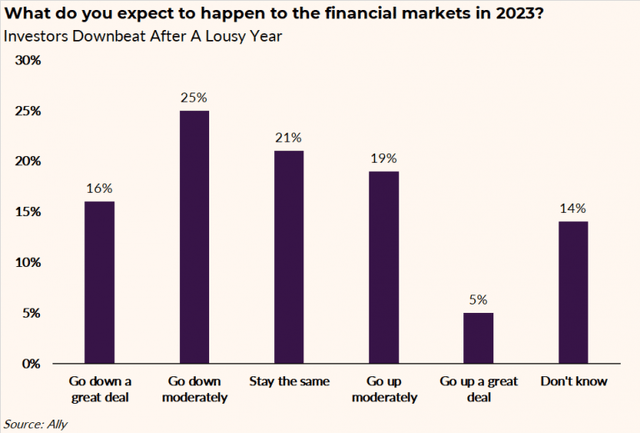

Investors are pessimistic about 2023’s prospects according to a recent survey conducted by Ally Financial. More than 40% of respondents said they expect stocks to generally decline next year after a poor 2022. That Main Street dour tone is also heard in C-Suites across the country.

As such, one small I.T. stock beat on profit expectations in its latest report, but shares were taken to the woodshed due to a weak outlook for the coming quarters. Is CommScope now a buy? Let’s assess the playing field.

Pessimism Abounds

According to Bank of America Global Research, CommScope (NASDAQ:COMM) is a leading provider of antennas, cabling, connectors, and other connectivity equipment for enterprise and service provider customers. The company is a market leader in its three segments: Wireless, Enterprise, and Broadband.

The $1.6 billion market cap Communications Equipment industry company within the Information Technology sector trades at a low 4.5 trailing 12-month operating price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal. Back in early November, the firm reported a solid Q3 earnings beat, but shares cratered 23%. A weakening demand environment and soft macro outlook from the management team were the culprits for the massive decline through to important support at the time on the chart.

The firm is still in the early stages of its NEXT restructuring plan so there is a high degree of execution risk around that endeavor. Still, Credit Suisse upgraded the stock in October, citing ‘multi-year tailwinds,’ but the market thinks otherwise. BofA meanwhile has an underperform rating on CommScope due to slow growth and soft margins following the ARRIS acquisition. Upside potential stems from increased industry spending on wireless and fiber cables and cost synergies around its acquisitions. Investors must monitor the firm’s high debt/EBTIDA ratio.

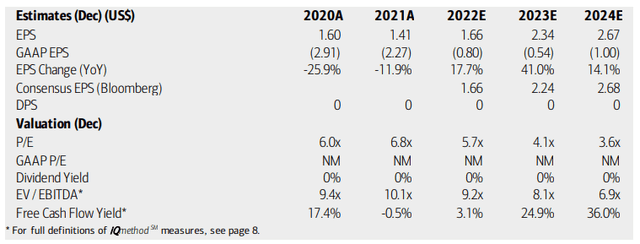

On valuation, analysts at BofA see non-GAAP earnings rising sharply over the coming years while GAAP per-share profits will likely remain in the red. The Bloomberg consensus outlook is about in line with what BofA expects. Dividends should remain at zero despite robust free cash flow in 2023 and 2024. With a low operating earnings multiple and fair EV/EBTIDA ratio, the stock looks decent on valuation for long-term investors.

CommScope: Earnings, Valuation, Free Cash Flow Forecasts

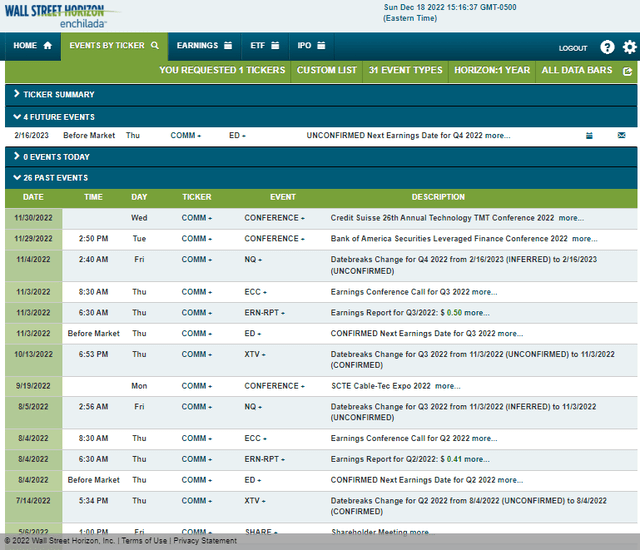

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Thursday, February 16 BMO. The calendar is light until the earnings report, however.

Corporate Event Calendar

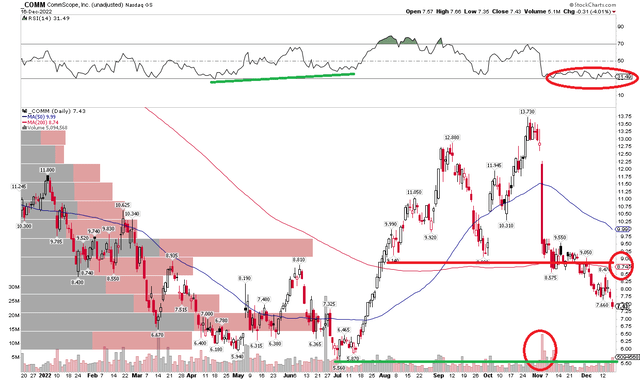

The Technical Take

With a low valuation and light in the way of upcoming volatility catalysts, how does the chart situation look? I see bearish risks. Notice in the 1-year view below that shares are below critical support at the $9 spot. There’s also a high amount of volume by price in the $9.20 to $9.70 zone that will tough for the bulls to climb the stock through on a rebound.

On the downside, I see support at the July low near $5.56 and buyers could step to the place starting near $6 based on the May low. With bearish volume trends since late October and an RSI that is firmly in poor territory, I see more risk lower with COMM. It is important to note that the RSI, or so-called “oversold” levels can persist for a lengthy period, so investors should be careful interpreting that as a reversal signal. Finally, the 200-day moving average is something to keep an eye on – for now it’s trendless.

COMM: Shares Below Important Support/Resistance Line

The Bottom Line

COMM’s valuation looks fine, but there are balance sheet risks. The chart, however, is bearish with risks of significant downside from here. I would avoid the stock for now, but it could be a buy under $6.

Be the first to comment