JasonDoiy

Intel: The Market Is Still Unsure

After forming its November highs, Intel Corporation (NASDAQ:INTC) stock has pulled back significantly ahead of its Semiconductor ETF (SOXX) peers. However, even before Intel CFO David Zinsner highlighted in an early December conference that the company’s “visibility isn’t pristine” going into Q1’23, we believe investors still on board should be keenly aware of its multi-year investment roadmap.

Hence, we don’t think investors expect CEO Pat Gelsinger and his team to be posting solid H1’23 results as macroeconomic concerns continue to beset its downstream customers. Also, despite its data center leadership, Intel is projected to lose more share against AMD (AMD) and Arm-based competitors moving forward.

Accordingly, DIGITIMES estimates suggest that cloud computing would likely continue to drive server demand in 2023, despite the downturn in consumer electronics.

It also expects Intel and AMD to benefit from replacement demand in 2023/24 as they push out their next-gen platforms. However, it also cautioned that Arm-based processors could continue to gain share against x86 moving ahead, with AMD continuing to take share within the x86 space. DIGITIMES accentuated:

The US-based top-four cloud data center operators and Chinese first-tier data center operators have all adopted servers powered by AMD’s EPYC CPUs in 2022. Since their procurement of AMD-based servers is expected to continue rising, the share of AMD-powered servers is estimated to grow to over 17% in 2023, while that of Intel-powered ones will slump to below 75%, down from around 77% in 2022. Servers equipped with Arm-based processors will see their share rise to slightly below 7% in 2022 and uplift to nearly 8% in 2023 with the keen development of Amazon, Nvidia, and Ampere. – DIGITIMES

Can Intel Foundry Services Really Convince TSMC’s Leading Customers?

Hence, market strategists/investors/analysts are justifiably concerned whether Intel’s bid to return to process leadership in the medium term could work out.

Furthermore, Intel’s near-term growth drivers continue to face significant challenges, with inventory digestion in the consumer markets continuing to persist through H1’23. Even though Intel maintains that it’s on track to retake foundry leadership. However, the vital question is whether the market is convinced Intel is on track. Tom’s Hardware highlighted:

At the IEDM conference, Intel shared its process technology roadmap and its vision for chip designs that will be available in the next three to four years. As expected, Intel’s next-generation fabrication processes – Intel 4 and Intel 3 – are on track to be used for high-volume manufacturing (HVM) in 2023 and 2024, respectively. Furthermore, the company’s 20A and 18A production nodes will be ready for HVM in 2024, which means that 18A will be made available ahead of schedule, a slide published by IEEE Spectrum suggests. – Tom’s Hardware

Hence, it’s clear the company has staked the recovery of its market leadership through the success of Intel Foundry Services (IFS), as it competes with TSMC (TSM) and Samsung (OTCPK:SSNLF).

However, the recent resignation of IFS leader Randhir Thakur (slated to remain in Intel through Q1’23) likely didn’t inspire confidence as TSMC amped up its CapEx investments in Arizona. While TSMC’s Arizona fabs are not intended to be the most advanced process technology when completed, the company remains well-placed to compete for manufacturing capacity with Intel.

Notably, with AMD, Nvidia (NVDA), and Apple (AAPL) signing up as TSMC’s first customers in Arizona, Intel would likely to face serious competition as it looks to convince customers that it’s ready to take on TSMC in the US.

And to make things even more challenging for Intel, Samsung also plans to overtake TSMC in 2024, as DIGITIMES reported that the Korean semi leader “is preparing a ‘master plan’ for its foundry business to turn the tables against TSMC in 2024, utilizing its 3nm process to take back orders from major US clients like Qualcomm and Nvidia.”

Notably, the ‘master plan’ encompasses activating its Taylor plant in the US, leveraging the technological reshoring priorities of its fabless customers and “recreate the ‘dual-track’ strategy from 8 years ago and lure main clients back to Samsung.”

Therefore, we believe investors want to see more commitments from Intel’s “potential” customers beyond MediaTek (OTCPK:MDTKF). But, these potential customers need to have high confidence that the company is on top of its IFS recovery and can deliver the performance and yields that TSMC is leading. As seen in Qualcomm’s (QCOM) stumbles with Samsung, credibility once lost, is difficult to recover, as DIGITIMES reported:

After suffering poor production yields for its 5nm chips, Samsung has continued to lose orders for 4nm chips due to the same problem. Nvidia, for instance, has returned to TSMC for fabricating its latest RTX 40 series GPUs, and Qualcomm has also decided to contract TSMC to manufacture its newest flagship mobile AP, Snapdragon 8 Gen 2. – DIGITIMES

INTC: Valuations Are Likely Not Aggressive

But, has the market priced in these significant headwinds into INTC at the current levels?

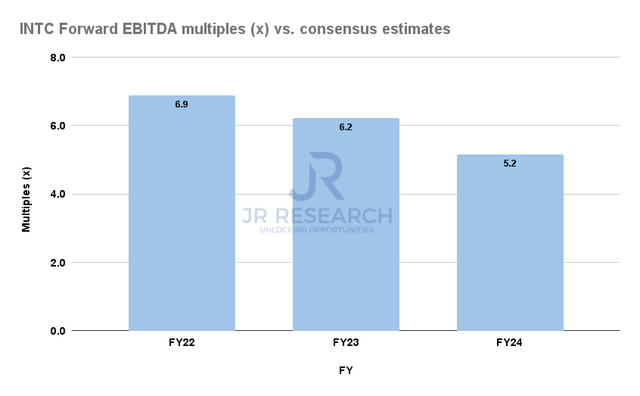

Intel Forward EBITDA multiples valuation trend (S&P Cap IQ)

With an NTM EBITDA multiple of 6.9x, it’s in line with its 10Y average of 6.8x. However, investors need to note that the Street has already slashed its forward earnings projections, leading to the surge in its valuation multiples.

Hence, unless the company expects to lower its forward earnings estimates further, we believe significant pessimism has been reflected.

Takeaway

Therefore, the market should be focusing on Intel’s execution through the cycle, with IFS’ ability to win more customers likely critical to a material re-rating.

Otherwise, investors should be ready for a long slog as INTC continues its consolidation.

With INTC down nearly 15% from its November highs, we assess it looks attractive again, even though investors should expect near-term volatility.

Maintain Buy.

Be the first to comment