EtiAmmos/iStock via Getty Images

To Deliver Alpha, Be Obsessed With High Quality at a Reasonable Price.

In July of 2020, I wrote an article called If I Had To Build a Portfolio Today. For that article I selected 14 stocks of household-name blue chip stocks of US and international companies that share four key characteristics:

(1) All have at least A-rated credit (which is why I decided to nickname the portfolio the “A Team”)

(2) all pay dividends

(3) all have steady profit margins

(4) all had reasonable price/ earnings ratios at the time I created the portfolio

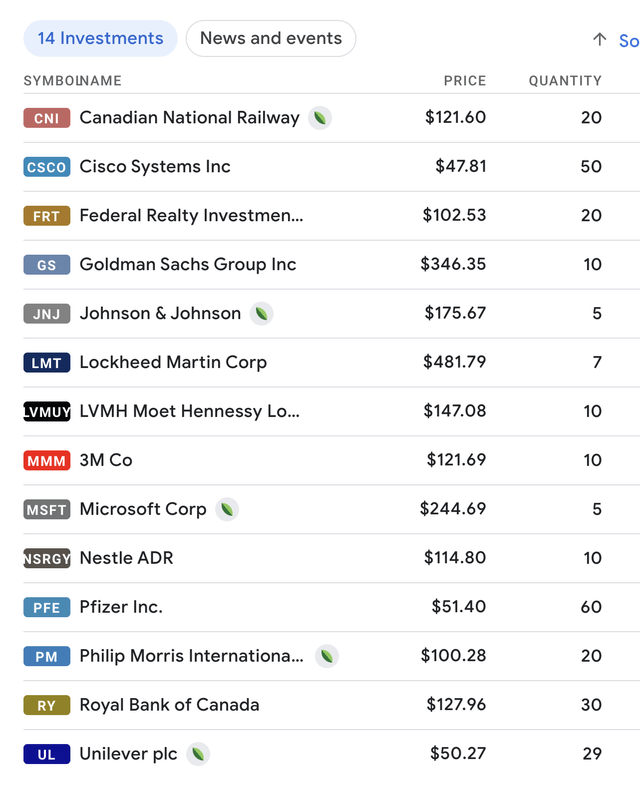

Here are the original 14 stocks I selected for the A Team portfolio on July 20, 2020.

Now close your eyes and drift back in time to late July in the year 2020. The world was a very different place then from what it has become. Funds like ARK Innovation ETF (ARKK) had surged roughly 100% from its low at the bottom of the Covid-19 crisis. Shares of Tesla (TSLA), which hit a low of about $24 at one point during the Covid-19 bear market, had surged over 400% to $100 in just a matter of months… and from there would go on to climb another 400% by November of 2021. Gripped by enthusiasm for purported world-changing digital technologies (and goosed by frequent tweets from a certain pundit billionaire), a giddy new generation of investors had pushed prices for cryptocurrencies to never-before-seen highs. Even cryptocurrencies like Dogecoin, originally conceived as a joke, would soon climb from .3 pennies per token to 64 cents per token, minting millionaire speculators completely out of thin air. Euphoria was only just starting to percolate through the financial market’s veins during the Summer of 2020, but while shares of “next new big thing” assets were spiralling higher, my A Team portfolio of dividend paying, value companies plodded along like an unwilling mule, prompting some apt reader comments like “this portfolio has no mojo.”

Oh… but then reality descended like a noxious fume, and those heady days of quick 22,000% returns now seem long-forgotten as the capital market shifts its gaze towards… well…. towards what the market ALWAYS looks towards in the end: steady earnings per share. We’ve seen it before and will probably see it again, but you know that you’re in a financial bubble when any quaint consideration of corporate earnings goes out the window. But without actual earnings and profits, a company’s stock price is often left to the whimsical mercies of market fads and manias… and to the agonized howling financial comeuppances that invariably follow.

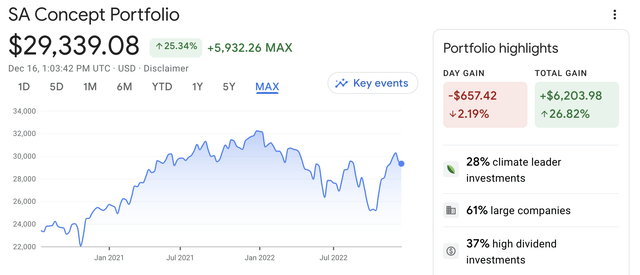

How has my A Team portfolio performed since inception? According to Google Finance, the portfolio has appreciated by 26.82%.

Portfolio performance for the A Team (Google Finance)

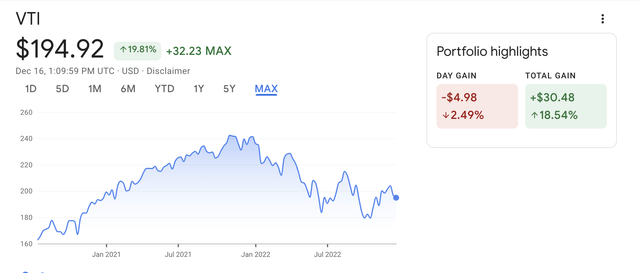

That’s about an 8.3% higher capital gain than the Vanguard Total Stock Market ETF (VTI) earned over the same period according to Google Finance, PLUS an extra annual dividend yield of 1.4% per year once you compare the current 3.06% dividend yield on the A Team portfolio against the 1.6% dividend yield for VTI.

VTI Performance (Google Finance)

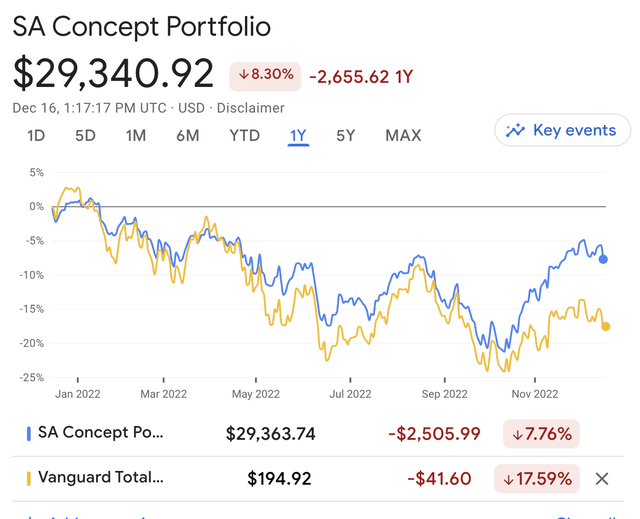

What accounts for the outperformance? Simple. The A Team portfolio lost roughly 10% less money than the overall market has lost so far this past year. And why was that? My hypothesis: the A Team portfolio was (and is) completely devoid of companies with high debt, low earnings, and high price/ earnings multiples. It’s probably just that simple, but maybe you can tell me if you see other salient factors that I’ve missed.

A Team vs. VTI (Google Finance)

Lessons Learned.

Past performance is no guarantee of anything – let alone future performance. That said, here’s my best guess about what comes next for the A Team portfolio. As I think I mentioned in my latest article, I foresee a multi-year process of lower returns and losses on the more speculative side of the financial spectrum. This year has been a major bust for innovation and growth stocks, cryptocurrencies and earnings-free companies, and those losses underscore a fundamental truth that is probably no longer lost on the broader investment community: it is very hard to earn money by investing in companies that don’t. But not only is it very hard to do so, it is increasingly no longer necessary to do so, either. For example, as the Federal Reserve continues efforts to raise interest rates and lower inflationary pressures, investors may find opportunities to earn positive risk-free returns, reducing the need and impetus to seek highly speculative returns in either riskier assets or in pseudo-assets (such as non-fungible tokens that some people are still somehow able to hawk to the public).

Financial beatdowns rarely conclude whilst stubborn hope, chicanery, carnival barking and pie-eyed optimism as yet prevail.

For that reason, I suspect that darker days lay in wait at certain crossroads of the financial markets, but the pain will not be shared equally and may not even be shared universally. Even if a recession next year bites deeply into corporate profits, I surmise that most of the companies in the A Team portfolio will continue to generate positive (albeit perhaps reduced) corporate earnings. Why? For two reasons: (1) they sell world-class products and services with profit margins that can easily absorb reduced revenues and higher costs; and (2) the debt loads are sufficiently manageable for the companies to absorb rising borrowing costs if interest rates continue to climb (which the Federal Reserve has assured us rates shall do next year). But even if I’m right about the A Team portfolio companies’ relative earnings durability (and I might be entirely wrong about that, too), I still don’t necessarily expect that the stock prices will go up next year. In fact, I have literally no idea whether those stocks will go up, down or nowhere, but I somehow suspect that I’ll have to just be content with cashing dividend checks until the next bull market comes along. Speaking of which…

Looking Ahead

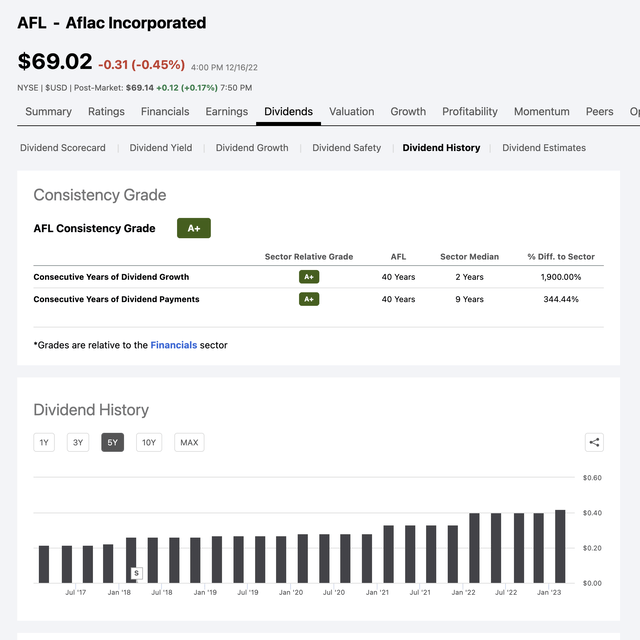

Based on starting dividends and today’s dividends, the A Team Portfolio has delivered over $2,000 worth of dividends since inception. That’s enough money to buy around 30 shares of Aflac (AFL) as of yesterday’s closing price and so as of that date, I have added those shares to the A Team portfolio. Why AFL? Simple. It fits the four requirements described in this article, with one added bonus: the company plans to buy back 100m shares of its own stock. According to Seeking Alpha, the outstanding float for AFL stock as of September stood at roughly 632 million shares, making the 100m share buyback a very substantial reduction in the number of hungry shareholders who will be dividing up the company’s earnings pie in the future.

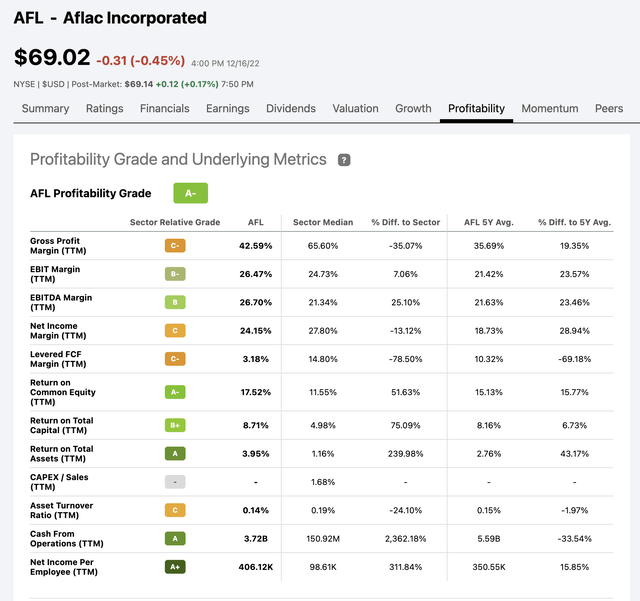

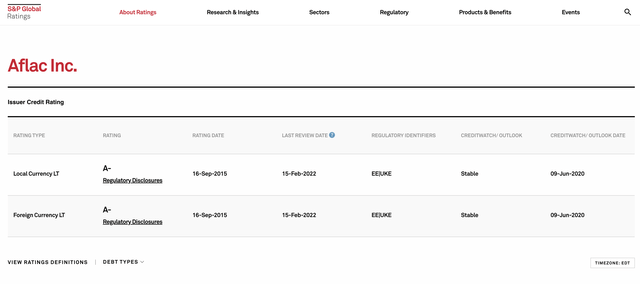

Those who know me also know that I am a neither subtle nor deep-thinking man. To the contrary, I tend to confine my stock analysis to fit onto a small paper napkin of the type you might find at a diner. So here goes my entire thesis for buying AFL: huge share buybacks, 40 years of dividend growth, a reasonable P/E ratio of about 13, 24% net income margins according to seekingalpha.com, and an A- credit rating according to S&P Global. Are you starting to notice that I obsess over credit ratings and corporate debt?

Aflac Dividends (SeekingAlpha.com) Aflac Profit Margin (SeekingAlpha.com) Aflac Credit Ratings (S&P Global)

In full disclosure, let me loudly highlight that I own a substantial number of AFL shares in my actual portfolio and that I plan to add even more over the next year. And with that, I shall now disclose any other bias or possible conflict I might have by sharing the entirety of my personal portfolio.

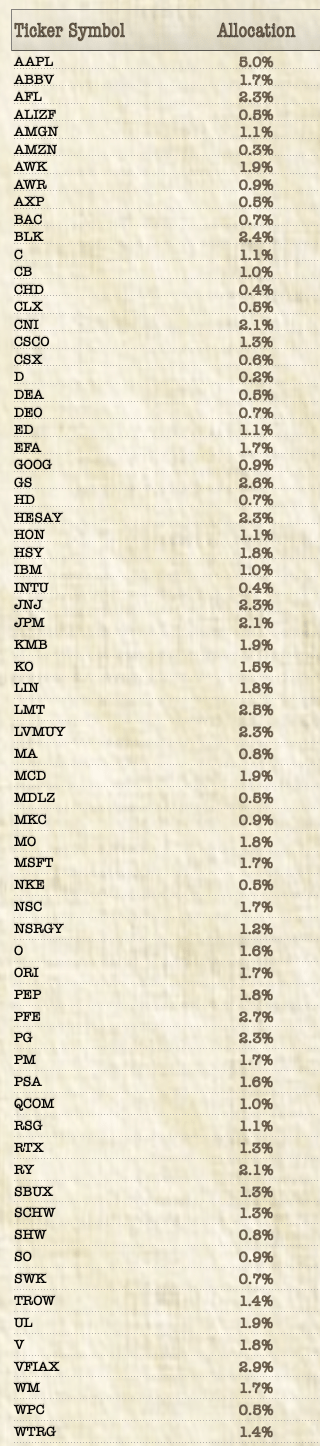

Author’s actual personal portfolio (Author’s spreadsheet)

Be the first to comment