M. Suhail/iStock Editorial via Getty Images

It’s been a solid couple of months for Retail/Restaurants, with several names heading to or within striking distance of all-time highs, including Walmart (WMT), McDonald’s (MCD), Texas Roadhouse (TXRH), and TJX Companies (TJX). Unfortunately, former sector leader Chipotle (NYSE:CMG) has lagged this time around, making a lower high in Q3 2022 and struggling to hold above the $1,700 level. While the headline company’s Q3 results (14% sales growth, 35% EPS growth) might have suggested that it should have punched through former resistance easily, the details matter and make the story a little riskier.

Chipotle Quesadillas (Company Website)

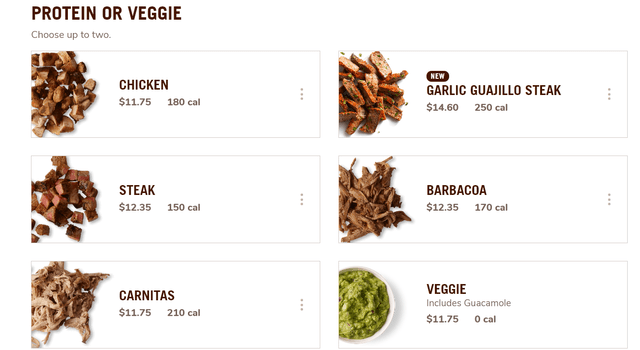

While few restaurant brands have been able to get away without raising prices this year, and it’s entirely understandable, some are making a concerted effort to protect their value proposition and looking long-term when it comes to pricing. One example is First Watch (FWRG), pricing at just 8.0%, which is well below its peers. However, Chipotle continues to price well above its peer group and will run at 14%+ pricing in Q4. I see it only as a matter of time before guests start noticing this, and with some lower-income guests being priced out and with the possibility of some resistance among its guests, I see an elevated risk to owning CMG due to it being priced for near-perfection into possible deceleration.

Q3 Results

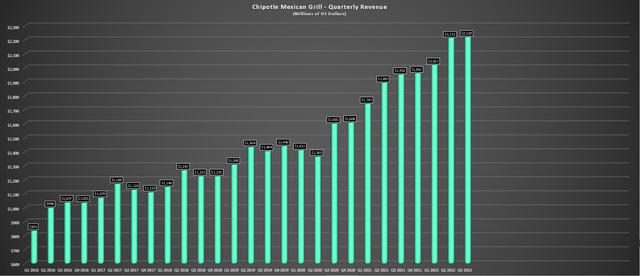

Last month, Chipotle released its Q3 results, reporting revenue of ~$2.22 billion, a 14% increase from the year-ago period. The company noted that this was driven by 7.2% comp sales growth and significant unit growth and that digital sales made up over 33% of sales in the period. During the quarter, the company opened up an impressive 43 new stores (38 being Chipotlanes) and is on track to open 235-250 restaurants for the year (including 10-15 relocations), translating to roughly 8% unit growth at the top end of guidance. As for FY2023, Chipotle is planning up to 285 new restaurant openings, translating to a slight acceleration in unit growth if it doesn’t have any further delays in construction/equipment availability.

Chipotle – Quarterly Revenue (Company Filings, Author’s Chart)

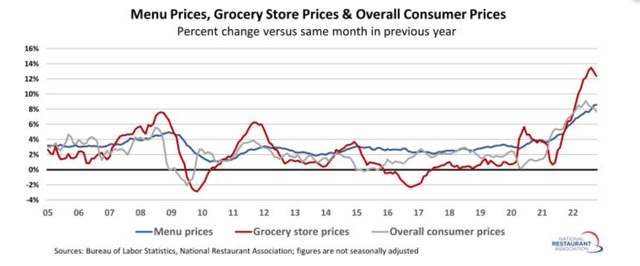

While this unit growth continues to be industry-leading for a company among the larger restaurant brands, and the headline results were quite solid (14% revenue growth and 7.2% comp sales growth), it’s important to look at pricing. As noted by the company, pricing was ~13% in Q3, dwarfing the 8.6% growth reported for the Consumer Price Index for Food Away From Home and above the ~8.0% increase in menu prices for limited service brands. With pricing at these levels (~450 basis points vs. the industry average), it’s no surprise that Chipotle could post record results because with menu pricing of this magnitude, who needs traffic growth?

Grocery Store, Menu Prices, Overall Consumer Prices (National Restaurant Association, BLS)

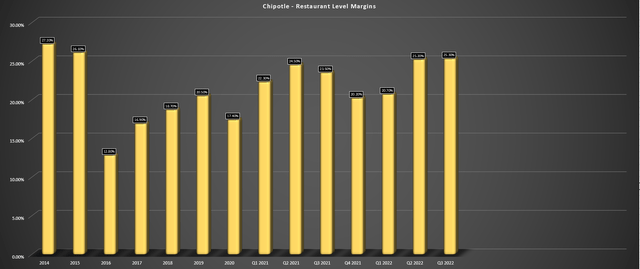

In the company’s Q3 Conference Call, the company defended its pricing actions noting the price for alternatives is higher and that prices at the grocery store are also a lot higher due to inflation. While this is a fair point, and Chipotle certainly offers a healthy option with high-quality ingredients made fresh daily, this somewhat misses the point. In the case of some other restaurant brands, they are trying to make things more manageable for consumers in a tough time and thinking long-term and are much less concerned with short-term margins. In Chipotle’s case, it enjoyed leverage on labor and cost of goods sold despite high dairy, packaging, avocados, and tortilla costs, with restaurant-level margins soaring 180 basis points year-over-year.

“Our average chicken burrito or bowl, which makes up about 50% of our orders across the U.S., is below $9 in our restaurants. This is a tremendous value when you consider the quality of our food, including our food with integrity standards, the fresh preparation utilizing classic cooking techniques, the customization, generous portions, and of course, the convenience and speed.”

– Q3 Conference Call

Chipotle – Restaurant Level Margins (Company Filings, Author’s Chart)

There is absolutely nothing wrong with recognizing that you have a product in high demand and pricing accordingly, and it’s especially excusable in the current inflationary environment. However, there comes the point when pricing is more than offsetting inflationary pressures and margins near multi-year highs, and this could backfire medium term. In terms of check management (passing on guacamole, trading down to non-premium proteins), Chipotle hasn’t seen evidence of this yet, emboldening the company’s belief that it does have pricing power and can price aggressively. In fact, in Q4, Chipotle will see year-over-year pricing of ~14.5%, more than 500 basis points above the industry average in October.

To summarize, I think the recent strong results that stand out vs. peers must be put in context, which is that Chipotle better be putting up record results if it is pricing well above the industry and above the grocery store average as well (12.4% year-over-year). In addition, while the company hasn’t seen any resistance to date on its menu prices, I’m not sure that this is the environment then one wants to be flaunting record results while most consumers are feeling the pinch. This isn’t to say that the company doesn’t have the right to price where it wants. Still, I think those brands pricing some conservatively could gain more loyalty and be seen more favorably. And, I think the worst mistake would be losing a loyal customer that can’t justify treating themselves at Chipotle after noticing their average check is up ~15% in December and well over 20% vs. December 2020 levels.

Margins & Industry Trends

While October was a stronger month for the industry, which was potentially helped by the pullback in gas prices (which could continue to benefit Q4) sales, same-store traffic growth was negative for the eighth consecutive month in October. So, the 5.2% increase in October same-store sales growth industry-wide has masked this displeasing figure. As highlighted by Chipotle’s high single-digit same-store sales growth in Q3, it’s been ahead of the industry but has not been entirely immune to the pullback.

During the company’s Q3 Conference Call, the company noted that transactions were down 1% in Q3. The silver lining is that most of the pullback industry-wide has been called out among less affluent customers. Chipotle over-indexes towards a higher-income consumer, making it more resilient to the pressure we’ve seen on discretionary budgets. That said, with what looks to be a rise to ~$10.00 non-premium burritos next year, with the company likely to continue to take price in 2023, Chipotle may be pricing lower-income consumers out of dining at Chipotle. Obviously, trade-down options may not be as healthy, with the alternative being quick-service, but Chipotle is now also working against brands that are promoting heavily, like Red Robin (RRGB) and brands with barbell strategies like Dine Brands (DIN).

Overall, this places Chipotle in a difficult position in Q4 and into 2023, and it’s also lapping a very successful smoked brisket LTO as it reports its coming quarterly results. At the same time that guests at Chipotle may start to notice their cost of eating there creeping higher, the reverse wealth effect is in full force with brokerage statements not set to end the year on a high note after the drop in 60/40 portfolios and most equity portfolios, plus the catastrophic decline in crypto prices and teetering housing prices. This could impact Chipotle’s more affluent customers, that might feel less rich and less inclined to get their regular burrito. In fact, we’ve already seen some shift to cost-savings measures among higher-income consumers, cited by Walmart, which sees $100K+ household income customers shopping with them more often.

So, when we combine difficult comps ahead in Q4, extremely elevated pricing, and the mix of the reverse wealth effect and low personal savings rates, I would be shocked if Chipotle managed to beat earnings/sales estimates in Q4. That said, the industry will be benefiting from lower gas prices which could boost industry traffic, but this may benefit Chipotle less, given that this is likely a bigger item for less affluent consumers that were pinched the most, with gas prices called out as being their biggest worry in Citi Trends (CTRN) focus group, discussed in its Q2 Earnings Call. Let’s look at Chipotle’s valuation and see whether any deceleration worries are priced into the stock:

David Makuen – CEO, Citi Trends

“Hi, Chuck, yes, good question. You had probably recall in the last earnings call, we talked about speaking to our customers and associates in a couple of informal focus groups and what we heard then was gas by far was the biggest concern followed by rent, utilities and actually food was in kind of fourth place.”

– Q2 Conference Call

Valuation

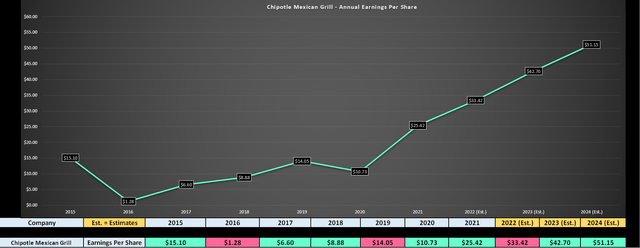

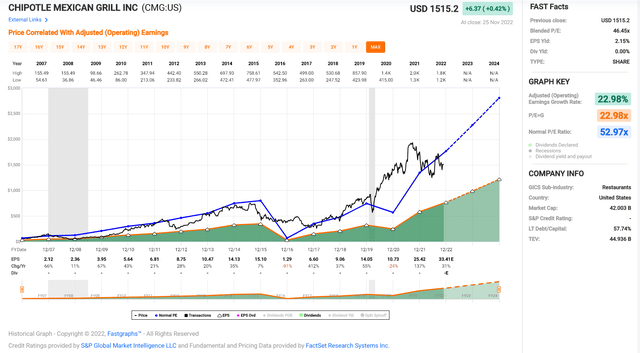

Based on ~27.7 million shares outstanding and a share price of $1,529, Chipotle trades at a market cap of $42.4 billion, giving it one of the highest market caps in its peer group and one of the highest earnings multiples sector-wide. This premium multiple can be explained by the company’s industry-leading unit growth and incredible earnings growth, with Chipotle on track to maintain a 35% plus compound annual earnings growth rate since FY2017 (FY2022 estimates: $33.42 vs. $6.60) and with minimal deceleration on deck, at least based on current estimates (FY2023: $42.70, FY2024: $51.15).

Chipotle Earnings Trend & Forward Estimates (Company Filings, FactSet, YCharts.com, Author’s Chart) Chipotle – Historical Earnings Multiple (FASTGraphs.com)

However, even despite the stock’s recent pullback, the considerable multiple compression in growth stocks, and the challenging operating environment, Chipotle continues to command its premium multiple, with it being one of the few restaurant names trading at over 35x forward earnings. While some investors might point to the fact that Chipotle has historically traded at ~53.0x earnings and it’s therefore undervalued at this price, I believe this is far too rich a multiple even if the company does continue to execute successfully. Instead, I think a more reasonable multiple is 40.0x earnings, a 25% discount from its historical multiple during a period of outstanding and difficult-to-replicate growth. After multiplying this figure by FY2023 estimates ($42.70), Chipotle’s fair value (18-month price target) would come in at $1,708 per share.

While this points to a 12% upside from current levels, this assumes that the stock can continue to command a premium multiple and that there is no pushback to its above-industry-average pricing. To date, one could argue that it’s not seen any shift in consumer behavior among its largest cohort, but the effects of higher pricing taken this year could take some time to show up in the results. In addition, we see reduced frequency among lower-income consumers. Like casual diners have had to be careful not to price their customers out of casual dining visits, Chipotle may be pricing lower-income consumers out of burrito visits.

Chipotle Canada Prices (Company Website)

Given that this price target relies on zero pushback to higher burrito prices from consumers in a period where we’re seeing the reverse wealth effect and evidence of higher-income consumers trying to save money (trading down to Walmart for groceries), I see elevated risk to earnings estimates and its earnings multiple in the face of any slowdown. In fact, it’s often when a stock is firing on all cylinders and has a strong 5-year return (CMG: 460%) that it’s the highest risk to own, given that any speed bumps can have an outsized impact on the stock. So, with limited upside (even if Chipotle meets estimates) and the added risk of a shift in consumer behavior as Chipotle appears more focused on margins than retaining its value proposition, I currently see the reward/risk as poor.

Technical Picture

Moving to the technical picture reinforces the view that the stock is not in a low-risk buy zone, with the stock trading slightly above the mid-point of its support/resistance range. The weekly chart shows that Chipotle has strong support at $1,255 and resistance at $1,740, and its current reward/risk ratio sits at 0.76 to 1.0 based on a current share price of $1,529 ($210 in potential upside, $275 in potential downside). Generally, I prefer a minimum of a 4.5/1 reward/risk ratio to justify starting new positions in large-cap growth stocks. Chipotle would need to drop below $1,340 per share to become interesting, but solely from a swing-trading standpoint due to its stretched valuation.

From a valuation standpoint, and based on requiring a 30% discount to fair value to become attractive, Chipotle would need to dip below $1,200 per share.

Summary

Chipotle delivered another set of solid results in Q3, and it’s been one of the few restaurant brands that have continued to enjoy margin expansion without skipping a beat. However, this margin expansion is being driven by aggressive pricing. So, while the company may have few peers when it comes to a combination of value, convenience, and quality/healthy ingredients, I would be shocked if this didn’t have any adverse effects. This is because guests could start noticing costs increasing at a rate well above other brands. That could reduce customer satisfaction for some if they feel that while the quality is excellent, they’re being taken advantage of a little, especially when the average consumer feels tighter.

Given this setup of elevated pricing vs. peers combined with a weaker macro backdrop, I prefer clear trade-down beneficiaries with lower average checks that could benefit from a trade-down from casual dining. In addition, I prefer names trading with a large margin of safety in case traffic remains negative and decelerates from the slight improvement we saw in October. Given that Chipotle is neither a clear trade-down beneficiary like McDonald’s nor offers any margin of safety at ~36x forward earnings, I don’t see any way to justify being long the stock here at $1,530. In fact, I would view rallies above $1,640 before year-end as profit-taking opportunities.

Be the first to comment