pick-uppath/E+ via Getty Images

As we look to position ourselves for a potential year-end rebound, stock selection remains top of mind for me, and particularly for tech stocks, I think valuations are going to be the key separator for which names will outperform the broader market through December. Tech multiples have gotten out of whack since the start of the year, and these stocks that have shed their multiples far below historical norms will have the biggest springboard to rebound, while those that have maintained rich valuations will likely perform much weaker.

Consider ZoomInfo (NASDAQ:ZI) against that backdrop. Now, I’ve never really thought of this company as “special”. ZoomInfo’s CRM and sales tools have long operated as a sort of glorified Yellow Pages (part of the company’s business model involves discounting/giving away its software to companies who voluntarily fill its database with its own contact information). As ZoomInfo’s scope has grown to fill multiple lines of business, it remains, in my view, a second-rate vendor that competes against much better-branded names in each of its product areas.

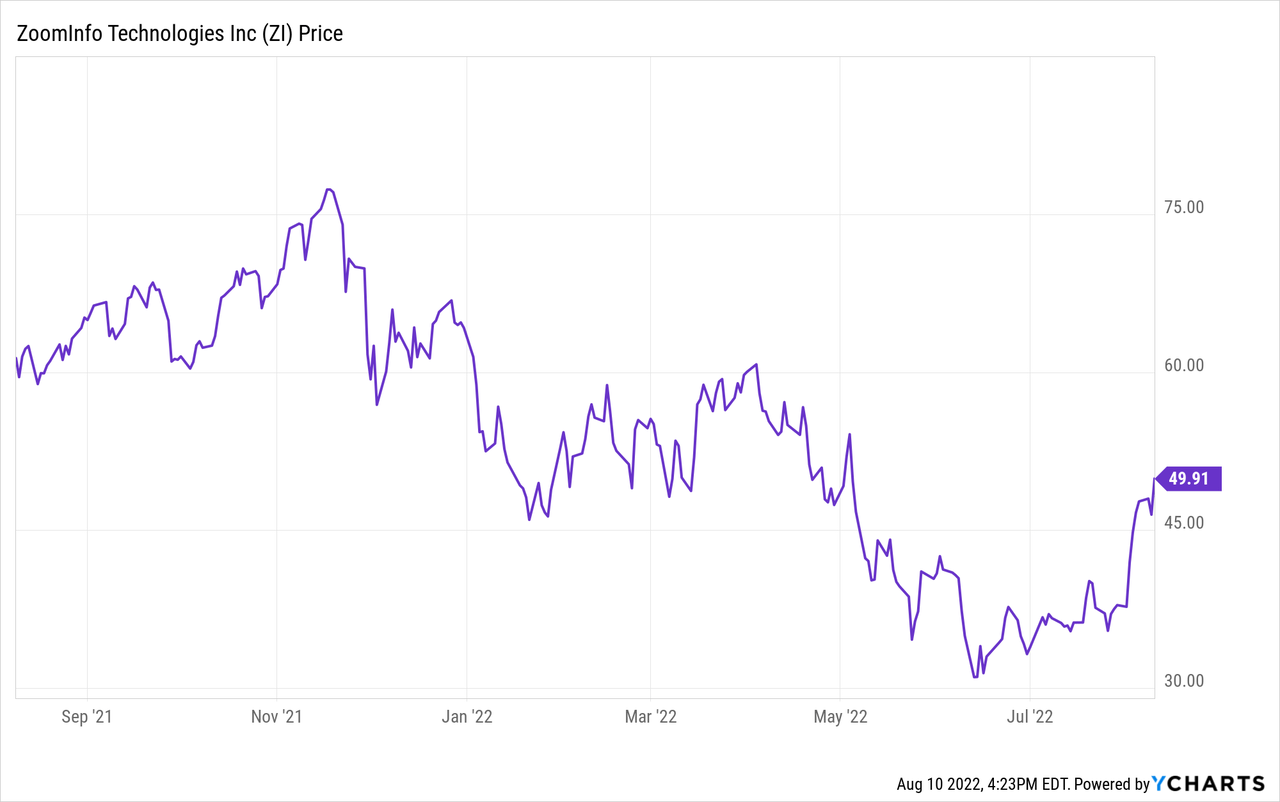

Year to date, ZoomInfo stock is down roughly about 20%, a slightly milder decline than most other SaaS names. ZoomInfo has been on a tear since June (up ~50% since then), and the stock has seen renewed optimism after its Q2 earnings release in early August.

Though market sentiment is gung-ho on ZoomInfo at the moment, I continue to swim upstream and remain bearish on ZoomInfo.

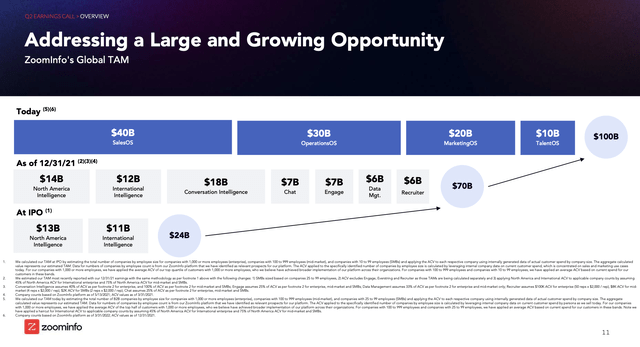

Now, to the company’s credit – it has done an admirable job at empire-building. The company has evolved substantially from its primary lead-sourcing product, and its TAM expansion has allowed the company to maintain terrific growth at scale. The slide below, taken from ZoomInfo’s most recent Q2 earnings deck, showcases how its four main products – SalesOS, OperationsOS, MarketingOS, and TalentOS – have gradually expanded its TAM over time. And by simplifying the company’s product suite under these simpler and broader umbrellas, the company has streamlined its go-to-market messaging for its customers and prospects.

ZoomInfo TAM growth (ZoomInfo Q2 earnings deck)

Now, there’s a drawback here. The first is that ZoomInfo has relied heavily on M&A to continue its growth streak, and it is carrying a sizable amount of debt – which is relatively unusual for a software company. As of its Q2 balance sheet, ZoomInfo had $365.6 million of cash and $1.23 billion of debt on its books, or a $868.7 million net debt position. Now, trailing twelve-month adjusted operating income was $367.2 million, so ZoomInfo’s leverage ratio is roughly 2.4x – which is the cusp of what many lenders would consider to be substantially leveraged. ZoomInfo does generate positive FCF ($234 million on an unlevered basis last year), but its ability to tap into its balance sheet to continue growing via M&A may be more limited from here on out.

The second is that the market has seemingly already put a lot of faith into ZoomInfo’s success, based on its current valuation and the fact that the stock hasn’t bled too much since the start of the year relative to other SaaS peers. At current share prices near $50, ZoomInfo trades at a market cap of $20.13 billion. After we net off the aforementioned $868.7 million of net debt, the company’s resulting enterprise value is $21.00 billion.

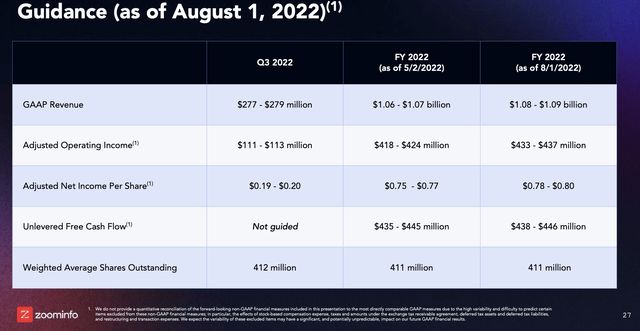

For the current fiscal year FY22, meanwhile, ZoomInfo has pegged its annual revenue at $1.08-1.09 billion, and unlevered FCF at $438-446 million:

ZoomInfo outlook (ZoomInfo Q2 earnings deck)

This puts ZoomInfo’s valuation multiples at:

- 19.4x EV/FY22 revenue

- 47.5x EV/FY23 revenue

These are very rich multiples for what I’d consider to be a high-growing company, but one that is ultimately outclassed by other SaaS vendors in each of its key products. In both Sales and Marketing software, ZoomInfo stands behind Salesforce (CRM); in recruiting, ZoomInfo is a distant competitor behind the likes of Microsoft LinkedIn (MSFT) and Workday Recruiting (WDAY).

In my view, ZoomInfo may get a little bit of a lift as the rest of the market drifts upward in a general rebound, but it will be very difficult for the company to outperform with its already-rich valuation. Steer clear here.

Q2 download

This all being said, we do acknowledge that ZoomInfo has been a crowd-pleaser with its recent results. In Q2, which the company released in early August, ZoomInfo delivered an impressive beat-and-raise that sent the stock up ~10%.

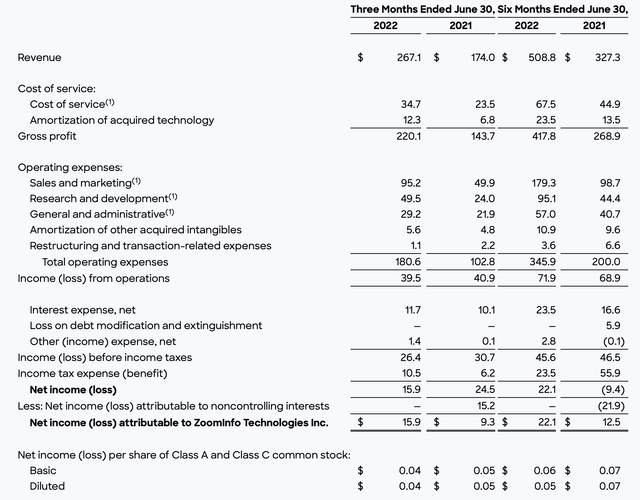

Let’s now go through the company’s latest results in greater detail; the earnings summary is shown below:

ZoomInfo Q2 results (ZoomInfo Q2 earnings deck)

Q2 revenue grew 54% y/y to $267.1 million, beating Wall Street’s expectations of $254.4 million (+47% y/y) by a seven point margin and barely decelerating over Q1’s 58% y/y growth pace.

Now, here’s one potential red flag: ZoomInfo notes that sales cycles may be elongating. We’ve all seen the news on recent hiring freezes. Among the types of headcount that are “discretionary”, sales and marketing hires can be delayed at the expense of growth in order to protect profitability. Slowdown in hiring here may hurt the company’s core SalesOS business; and needless to say that a cooldown in recruiting activity is also detrimental to the company’s TalentOS product as well.

Here’s some additional context from CEO Henry Schuck’s comments on the Q&A portion of the Q2 earnings call:

I think what we saw in the early days of COVID was somewhat similar. We had an elongating sales cycle with larger deals. But then kind of immediately afterwards, companies realized they needed to be investing in their sales teams and in their go-to-market efforts, that they needed to be investing behind digital transformation. And I think kind of what we see today is similar. We’re seeing that same elongation in sales cycles on some deals, specifically larger deals and international deals.

But then we are also seeing companies realize that if they are going to get more out of their sales resources that they need to continue to invest in their go-to-market motion. They need to continue to invest in software that drives productivity, specifically for their sales resources, specifically for their marketing resources. And we are just best positioned by a mile to be the provider for that.”

ZoomInfo’s growth over the past several quarters has been rosy, so investors may not be prepared if ZoomInfo sees a giant haircut to growth rates in Q2.

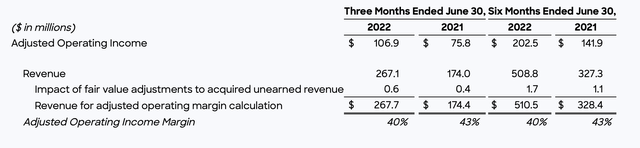

And while ZoomInfo’s pro forma margin profile also remains high, inflationary pressures were evident in Q2 as well, with adjusted operating margins coming down to 40% – down three points from the year-ago quarter.

ZoomInfo adjusted operating income (ZoomInfo Q2 earnings deck)

It’s also worth calling out that ZoomInfo’s massive pro forma operating margins are supported by huge stock-based comp addbacks. GAAP operating income margins in the quarter were only 15%.

Key takeaways

I don’t have much confidence in ZoomInfo’s ability to sustain its premium valuation, especially if the company is starting to warn of elongating sales cycles amid plenty of headline risk around hiring slowdowns. Sell this stock and invest elsewhere.

Be the first to comment