Just_Super/E+ via Getty Images

Many times throughout human history, data has proven to be one of the most important resources, if not the most important resource, for ultimately creating value. In this modern era, where technology is baked into almost everything, data collection and analysis is more valuable than ever. And one company that is dedicated to the mission of collecting and analyzing data, primarily for the vehicles that are on the road today, is a firm called Wejo Group (NASDAQ:WEJO). This incredibly small company generates just a modest amount of revenue and is responsible for significant net losses and cash outflows. However, current forecasts offered up by management do you suggest that sales are finally ramping up. On top of this, the company has a significant amount of cash in excess of debt that could pave the way to further scaling the enterprise so that it can become self-sustaining. By no means is this anything other than a risky prospect. But for investors who believe in the mission that management has set out to achieve, the risk might well be worth it.

Taking Wejo Group for a ride

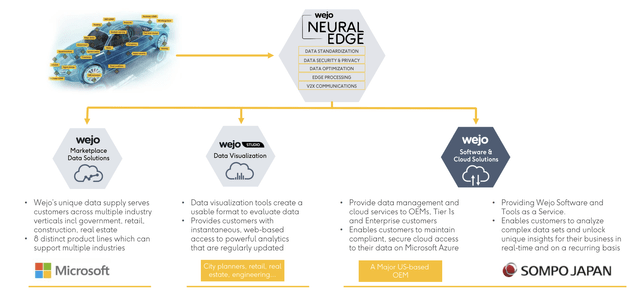

According to the management team at Wejo Group, the company provides software and technology solutions to different market verticals. It does this in combination with services that utilize ingested and standardized connected vehicle and other high-volume, high-value, datasets. The company does all of this through its cloud software and analytics platform that it developed called Wejo Neural Edge. This platform filters and analyzes large amounts of data for the purpose of delivering valuable insights to its customers. One such use case includes connecting to vehicles in order to understand driver behavior such as what media they absorb while in the car, including they’re listening preferences. The company can also use vehicle sensor data to optimize automotive retail advertising through various stages of the customer lifecycle. In the carsharing and rental services market, the company can provide data regarding vehicle health and diagnostic issues, as well as searching for ways to maximize rental fleet asset residual value by optimizing repairs and other activities. The data can also be used to inform on alternative pricing models for its customers.

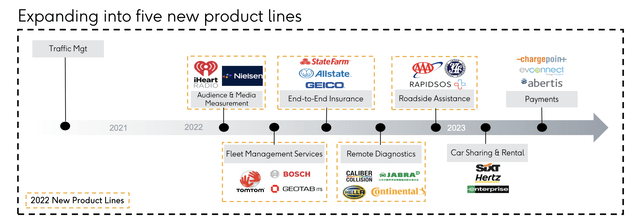

Operationally, the company is broken up into two primary business lines. The first of these is the Wejo Marketplace Data Solutions business, which interacts with customers through its Wejo Studio platform for the purpose of enabling the visualization of data so that valuable insights can be easily gleaned by its customers. Some of the solutions the company offers or wants to offer under this business line include traffic management services that seek to provide near real-time and historic intelligence about traffic patterns, roads, and other related infrastructure. The platform also provides audience and media measurement services to help customers better understand advertising metrics and user behavior. Its end-to-end insurance services are currently in development, but will allow customers to offer pay as you drive and pay how you drive solutions. The other major business line operated by Wejo Group is called Wejo Software & Cloud Solutions. Through this, the company uses the same datasets to support design and development solutions like software platforms, analytical tools, data privacy solutions, and more for OEM partners, insurance companies, and other firms.

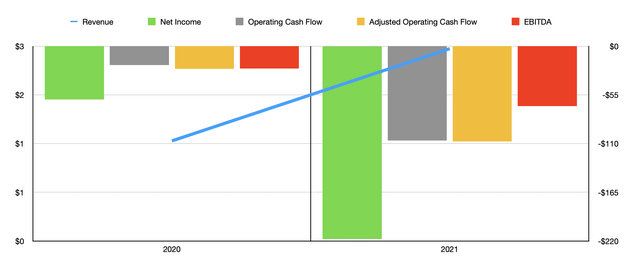

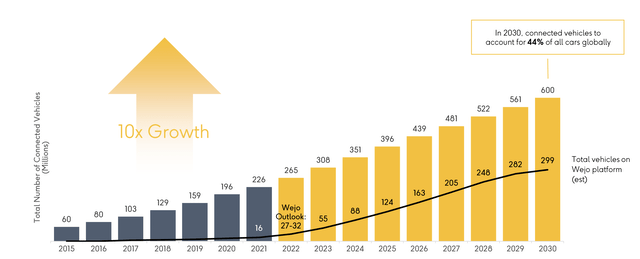

Over the past couple of years, revenue for the company has been sparse. Sales totaled just $1.34 million in 2020. This number increased to $2.57 million in 2021. This increase in sales came in part because of the company’s expansion into more than 16 million different vehicles. The good news for investors is that growth is forecasted to come in strong for 2022. With between 27 million and 32 million vehicles expected to be on its platform by the end of the year, management expects revenue of about $10 million. That is 285% above with the company generated in 2021. Although this may seem like an impossible leap, the company did say the annual recurring revenue by the end of last year was already up to $4.5 million.

When it comes to profitability, the picture for the company really does look bad. In 2020, for instance, the company generated a net loss of $60.3 million. This number ballooned to a loss of $217.8 million in 2021. Clearly, expansion into new verticals and into additional vehicles the company never worked with, has proven to be a costly endeavor for the business. There are, of course, other profitability metrics that we should pay attention to. For instance, operating cash flow. In 2020, the company saw a net outflow of $21.5 million. This number soared to $106.6 million in 2021. Even if we adjust for changes in working capital, the picture was similar, with a net outflow of $25.7 million in 2020 increasing to a net outflow of $107.5 million in 2021. Meanwhile, EBITDA for the company expanded from a negative $25.2 million in 2020 to a negative $67.7 million last year. Management has not provided very much in the way of guidance for the company’s bottom line for the 2022 fiscal year. However, what data they did provide suggests that profits and cash flows will be even worse for the year. I say this because EBITDA for the company is forecasted to be negative to the tune of between $110 million and $120 million.

The bad thing about a company like this is that you can’t really value it. Having said that, there is one positive for investors. At present, the business has cash in excess of debt of $33.62 million. This stacks up against a market capitalization of $96.03 million, which translates to an enterprise value of $62.41 million. The surplus of cash on hand will certainly help investors as the company continues to expand. But investors should also anticipate either further share issuances and/or the sale of additional debt on the market if management is going to generate significant cash outflows like it’s forecasting.

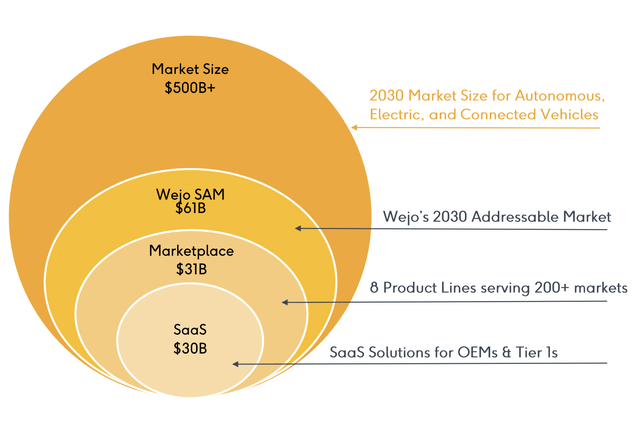

The other side of the argument here is that the company is operating in a market that could become rather large. For instance, they expect the number of connected vehicles in the world to grow to 600 million by 2030. That’s up from the 261 million estimated for the 2022 fiscal year. By that point, the company expects to have about 299 million vehicles connected to its platform. All combined, the company estimates that the market opportunity for it will be worth $61 billion by the end of the decade. If the firm can capture even a meaningful portion of that, due not only to the organic growth of its existing products but also because of the new product lines the company plans to bring on, it could very well generate significant value for its investors.

Takeaway

Based on the data provided, Wejo Group strikes me as an interesting business but not one that you can value fundamentally. At the end of the day, the company’s fortunes are tied to how rapidly it can grow and eventually reach cash flow neutrality. Given the current trend the company is experiencing, it does not look like this will be anytime soon. It would be different if the company’s market capitalization was significantly higher, since it could raise more cash without fearing significant dilution for its investors. At the end of the day, this does appear to be a significantly volatile prospect that will either result in a significant loss of capital or a significant appreciation for its investors. Although I believe that the company’s business model has potential, I believe that the downsides of the firm are problematic and take away from the value to some degree. At the end of the day, this all leads me to be rather neutral on the business for the current moment.

Be the first to comment