Khaosai Wongnatthakan/iStock via Getty Images

Investment thesis

U.S. Global Investors, Inc. (NASDAQ:GROW) has been slightly shifting towards the crypto space with several investments in crypto-related companies. Despite this shift GROW is a stable asset manager with reliable monthly dividends and 3 passive ETFs. In addition, the external economic factors are turning in GROW’s favor. The management’s aggressive share buyback program further supports the undervalued stock theory. With the company trading very close to its 52-week range low I think it is a buying opportunity.

Business model

GROW primarily provides its services to investment companies and it also provides its services to retail investors via ETFs. The firm also manages equity and fixed income mutual funds for its clients. GROW manages eight mutual funds and three U.S. traded ETFs: U.S. Global Jets ETF (JETS), U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU), and U.S. Global Sea to Sky Cargo ETF (SEA). In 2017 the company also made a strategic investment in Toronto-based HIVE Blockchain Technologies (HIVE) and with the wider acceptance of cryptocurrencies, this investment will continue to bear fruit in the long term. The company’s operating revenue is earned from investment advisory and administrative services provided to clients. Their actively managed funds are slowly but steadily on the decline however their ETFs have a bright future. The vast majority of the company’s revenue comes from the 2 ETF-related fees. (The third one has just been launched with an AUM of slightly over $5 million at the moment.)

Positive external factors and crypto investments

The external economic factors are turning in GROW’s favor with more and more countries opening borders after the pandemic and lifting travel restrictions. Due to these regulations, the airline industry started to recover and this recovery has had a great effect on GROW’s JETS ETF. The interest rate rises and the high inflation are also in GROW’s favor. “It may seem counterintuitive, as gold does not generate any income, but the yellow metal has performed well in rising-rate environments – Frank Holmes, CEO and CIO.” This will very likely mean more inflows into its Gold and Precious Metal Miners ETF. In addition, the Ukrainian conflict further increased the demand for safe havens such as gold and also pushed up the price.

GROW also invested in the cryptocurrency world via HIVE Blockchain Technologies. This investment had a brilliant return in 2021 but the future is uncertain and volatile like for any crypto asset. One thing is clear: GROW’s CEO believes in taking the crypto path and because HIVE has massive mining capacities they can remain profitable despite the Ethereum 2.0 changes (Ethereum will no longer be available to mine soon). The company also announced that it has purchased 1 million shares of Network Entertainment, Inc. (Network) This investment is intended to provide exposure to Network’s emerging non-fungible token (NFT) business. In addition, GROW continues to attract investors and positive inflows to its 3 ETFs. With the airline industry slowly recovering, more capital can be expected to flow towards GROW’s JETS ETF in 2022 which provides the backbone of income for the company.

U.S. Global Investors also launched a brand new ETF on January 20th, 2022, the U.S. Global Sea to Sky Cargo ETF. This ETF mainly invests in stocks of companies operating in cargo, transportation, and logistics. In addition, the collaboration with HANetf helped GROW to register JETS on the EU market as well which will help to increase its AUM. (In the EU all ETFs must have special KID documentation and be registered as Undertakings for Collective Investment in Transferable Securities: UCITS, to be available for retail investors).

GROW valuation

Based on a simple DCF model and on GROW’s dividend yield the stock is undervalued. In addition, the fundamentals are making the company more attractive with a new ETF launch and positive external economic factors in their favor. For the calculations, I used Graham’s DCF model. To see a real intrinsic value I also added all the crypto assets which can turn GROW from a traditional investment manager to a slightly crypto-related company. Let’s see the intrinsic value: for the last 4 quarters, I used a more realistic figure than the EPS ttm which was $1.28 because that is only a temporary spike in the company’s history so I used $0.2. To the expected growth rate, I added a moderate 5% due to hectic crypto price movements and the launch expenses of the new ETF. Put all this data together and we can have an intrinsic value for GROW stock between $7.2-7.5. I believe this is a realistic figure in the longer turn with its new ETF, favorable external conditions, and all of its crypto-related investments.

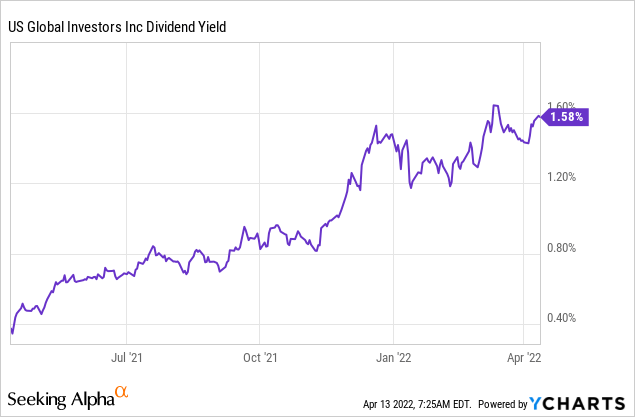

In addition, GROW trades at a relatively high dividend yield compared to the last 12 months which further supports the undervalued stock theory. You could only buy GROW above 1.5% dividend yield approximately 4% of the time in the last 12 months.

Company-specific risks

The company competes with a large number of investment management firms, commercial banks, broker-dealers, insurance companies, and other financial institutions and most of its peers are larger ETF providers with much greater capital. Average ETF fees in the U.S. have tumbled around 40% over the last eight years. According to Financial Times’ study in 2021 management charges for exchange-traded funds have stopped falling, and in some cases started to rise for the first time in a decade but I still think that is only a small uptrend in the constant falling of fees. Since GROW recognizes more than 80% of its revenue from ETF advisory fees the decline in these fees can seriously hurt the bottom line and the company’s profit margins. Precious Metal ETF’s average expense ratio is 0.49% based on 24 precious metal ETFs available in the U.S. market. GROW’s ETF expense ratio is 0.6% which is above the average and investors might choose the cheaper options when investing in gold.

A substantial amount of assets under management is concentrated in the U.S. Global Jets ETF (82% and 35% of average net assets for fiscal years 2021 and 2020). Consequently, the company’s revenues followed a similar pattern of concentration (76% and 33% of total operating revenues for fiscal years 2021 and 2020). As a result, their operating results are particularly dependent upon the performance of one fund and their ability to maintain and grow assets under management in that fund. If this fund were to experience a significant decrease in market value or redemptions, GROW’s AUM would be reduced, adversely affecting its revenues. To battle this concentration the company successfully launched a new ETF but its AUM is still tiny compared to JETS.

Since the company is moving deeper and deeper into the crypto world a potential longer-term decline in major crypto asset prices can have a significant influence on the stock price. Not on profitability because the major income sources are far from crypto but the overall growth estimates can decline and speculative traders can cash out on the stock.

My take on GROW’s dividend

Current dividend

GROW has been paying consecutive dividends for 14 years on a monthly basis while the sector median is 13 years. The management made a massive cut in 2013 lowering the dividend from $0.24 per share yearly to $0.06 per share and now they are trying to build back the dividend with 2 increases in the last year I also expect a dividend increase in late 2022 with the growing AUM into JETS ETF and positive inflows into their gold ETF. GROW is yielding at 1.58% which is not a very attractive dividend yield for income investors not even with a potential increase in 2022. Comparing this yield to the S&P 500’s current dividend yield we can see a slight difference with the S&P 500 yielding 1.37%. GROW could be more interesting for growth investors because of its profitable ETFs and investments in the crypto world.

Future sustainability

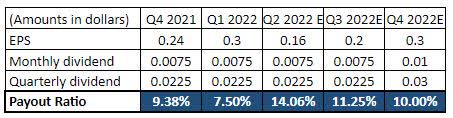

GROW has a stable and secure dividend and plenty of room to grow its future payments. Their dividend payout ratio is very low compared to any of GROW’s peers. I expect a dividend increase in the second half of 2022 based on its opportunities to grow the dividend. In addition, the company is in a relatively good position for the overall trend and future growing demand for passive investment vehicles.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Summary

GROW can be a potential target for growth investors who want to get exposure to the crypto mining and NFT business but with the safeguards of a traditional asset manager. The majority of the company’s income comes from its 2 ETFs (at the moment) and has several other funds like the recently launched third ETF. Almost all of the external economic factors are turning to GROW’s favor. The interest rate rises and high inflation are favorable for its Gold Miners ETF, the lifting of travel restrictions are favorable for its JETS ETF while the supply chain disruptions are favorable for its new ETF due to skyrocketed logistics prices. I believe those who are willing to buy and hold the stock for the upcoming years may see significant stock price appreciation.

Be the first to comment