Bigpra/iStock via Getty Images

Investment Thesis

The sanctions imposed by Western countries on Russian oil and gas imports have resulted in a significant increase in demand for North American and Middle Eastern crude oil. Flowserve’s (NYSE:FLS) presence in these regions should help the company grow its order book and strengthen its future backlogs. The company entered 2022 with healthy backlogs, which should also help its revenue. As part of its 3D (Diversify, Decarbonize, Digitize) strategy, the company plans to diversify its business portfolio by expanding into end markets other than oil and gas and power, as well as capture opportunities in energy transition activities. The stock is trading at a discount to its historical averages, which, along with good earnings growth prospects, make it a good buy.

Last Quarter Earnings

FLS missed the company’s guidance as well as consensus estimates when it reported its fourth quarter earnings in February. Sales for the quarter were $919.5 million, down 6.7% year-over-year and below the consensus estimate of $956.13 million. The adjusted EPS for the quarter was $0.45 (vs. $0.48 consensus), down 15.1% year-over-year from $0.53 in Q4 2020. The impact of the supply chain, logistics, and labour unavailability resulted in a lower conversion rate of backlog to revenue, which in turn led to a decrease in sales. This impacted the company’s original equipment business which saw sales decrease of 13.7% year-over-year. It was partially offset by 0.7% year-over-year sales growth in the company’s aftermarket business. Poor sales growth during the quarter, combined with frictional costs associated with labour overtime, and the use of air freight rather than water and ground freight to deliver products to the company’s facilities, resulted in a significant cost differential, resulting in a drop in EPS. The stock initially reacted negatively post-earnings correcting ~5%. However, the stock has moved up by over 20% since then as the Russia-Ukraine war has dragged on and sanctions on Russia are expected to be positive for Flowserve.

Well Positioned to Benefit from Sanctions on Russia

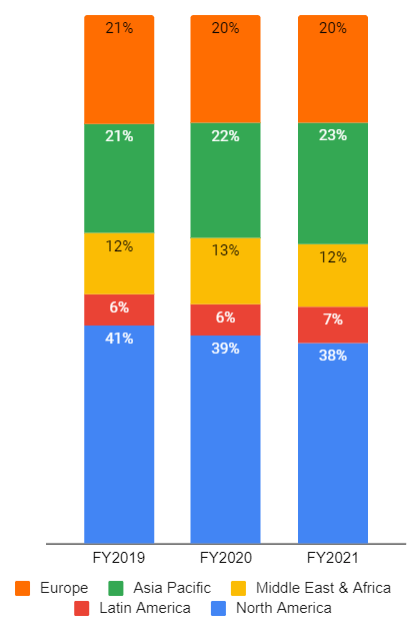

Flowserve’s Geographical Revenue Mix (Company Data, GS Analytics)

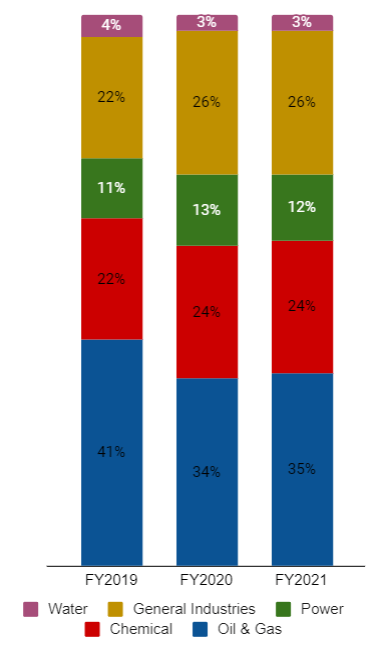

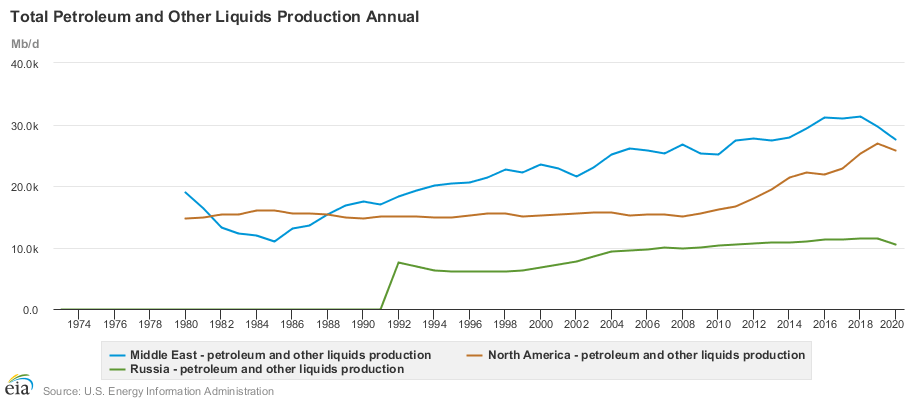

Oil and gas customers have been a major source of revenue for the company in recent years. In 2021, as demand improved, this industry accounted for ~35% of Flowserve’s new orders. The United States, the European Union, the United Kingdom, and several other countries have imposed sanctions on Russia, including oil and gas imports as a result of the current geopolitical tensions caused by the Russia-Ukraine conflict. This bodes well for Middle Eastern and North American countries as they are among the world’s largest producers and placed well to fill some of the supply gaps that Russian sanctions have created. These two regions account for roughly half of the company’s revenue, which could be advantageous for FLS in the current situation as demand for flow control products is expected to rise with oil and gas companies ramping up their operations to meet current demand.

As the utilization rate of refining and petrochemical plants rises, more consumable products will be churned, resulting in the repair and replacement of parts such as valves, mechanical seals, and other components, potentially increasing aftermarket sales of FLS. The company’s strong global network of 155 QRCs (Quick Response Centers) should assist in improving customer service and increasing sales.

Flowserve Bookings End Market Mix (Company Data, GS Analytics Research)

Petroleum Production from North America, Middle East and Russia (US Energy Information Administration)

Bookings and Backlogs

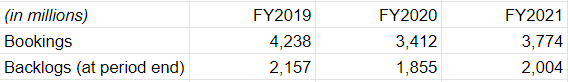

FLS sales declined 5.3 percent year-over-year in 2021 due to the impact of Covid in 2020, which lowered the company’s starting backlog for 2021. This should not be the case in 2022, as bookings increased by $362.8 million to ~$3.8 billion in 2021, compared to ~$3.4 billion in 2020, owing to increases in all end markets except the power generation industry. FY 2021 ending backlog increased by $148.7 million to ~$2 billion, up from ~$1.85 billion in 2020. Because of the increase in bookings, the company’s book-to-bill ratio improved from 0.92x in 2020 to 1.07x in 2021. An increase in new orders and backlogs, as well as an increase in pricing, should support Flowserve’s revenue growth in 2022. The current supply chain constraints and labour availability situation are some of the headwinds and they might slow the backlog conversion. However, these are short-term concerns and the conversion rate should improve from mid-2022 onwards.

Flowserve Bookings and Backlogs (Company Data, GS Analytics Research)

New Strategic Framework

The launch of FLS’ long-term 3D (Diversify, Decarbonize, Digitize) strategy should be the first step in the company’s next phase of growth. The company plans to take advantage of the opportunities in its line of business by diversifying its business portfolio, utilizing technology to better serve its customers, and assisting customers who are transitioning to renewable energy sources. The goal of this strategy’s diversification component is to broaden the company’s exposure to other end markets while remaining committed to its oil and gas customers. Even as traditional markets (such as oil and gas and power) are returning to growth, the company plans to aggressively reengage its offering across its water, speciality chemical, and other general industries. This will be accomplished by hiring experts in the fields of water and speciality chemicals, as well as repositioning its products. The company’s recent partnership with Gradient shows that it is committed to its strategy and expanding its water market offering.

The strategy’s second pillar is Decarbonization, which focuses on seizing the opportunity offered in the energy transition activities. The company booked projects worth ~$45 million in the fourth quarter of 2021, with $15 million coming from a Gulf Coast customer for flare gas recovery equipment. The revenue generated from their decarbonization pipeline was $100 million in 2021, with the company aiming for $400 million in 2022. This growth should be supported by their existing customers who are moving towards energy transition.

The company’s third component of this strategy is digitalization with its Red Raven IoT platform focusing on digital growth. This platform is expected to reduce unpredictability in maintenance and downtime, allowing customers to save money. FLS may need some time to convert this solution into profitable recurring revenue because the platform is still in its early stages. But the long-term benefit of digitalization should be significant.

When we look at all these three strategies combined, FLS seems to be well placed for multi-year transformation and growth acceleration in its business.

Valuations and Conclusion

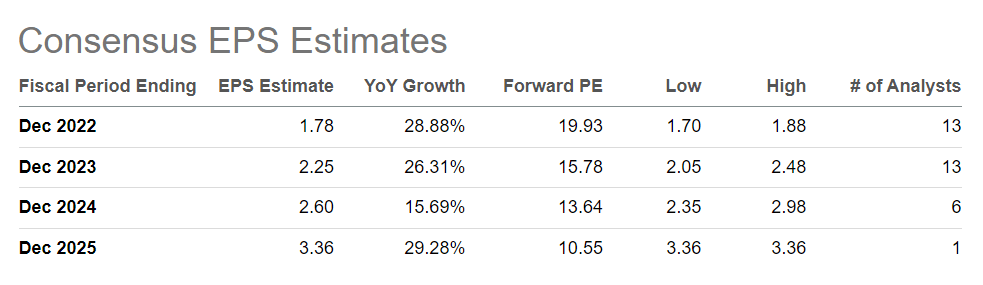

If we look at the current consensus estimates, Flowserve’s EPS is expected to post healthy growth over the next few years.

Flowserve Consensus EPS Estimates and Valuation (Seeking Alpha)

Flowserve is trading at ~19.93x FY2022 EPS and ~15.78x FY2023 EPS. Over the last five years, the company has traded at an average forward P/E of 23.38x. It also has a good dividend yield of ~2.26%. I believe the stock is undervalued given its future growth prospects and hence has a buy rating on it.

Be the first to comment