PM Images

Introduction

What to buy in 2023? It’s a question I’ve been asked a lot in recent weeks. And although I don’t really like to make (new) investments dependent on a given year (it doesn’t really matter), I broke my rule as I believe 2023 will come with tremendous buying opportunities. In this article, I want to highlight two stocks that I do not own yet are on my watchlist. In this article, I will give you one stock with a somewhat low yield, yet high dividend growth. A stock that goes very well with my existing holdings, and one stock with a rather high yield (my definition of high yield) that also comes with high potential dividend growth.

These are two stocks that I believe will bring tremendous value to every dividend investor’s portfolio.

2023 Buying Opportunity?

Readers who have followed my articles in the past 2-3 months know that I expect a bit more weakness before we get to a sustainable market bottom.

That’s based on my expectation that the Federal Reserve will likely have to hike until something breaks. That could likely be the market, forcing the Fed to pivot. After all, high inflation looks to be persistent. I do not believe we could see normalized inflation rates in the 1-2 years ahead. Yes, we’re beyond peak inflation, but that doesn’t matter too much.

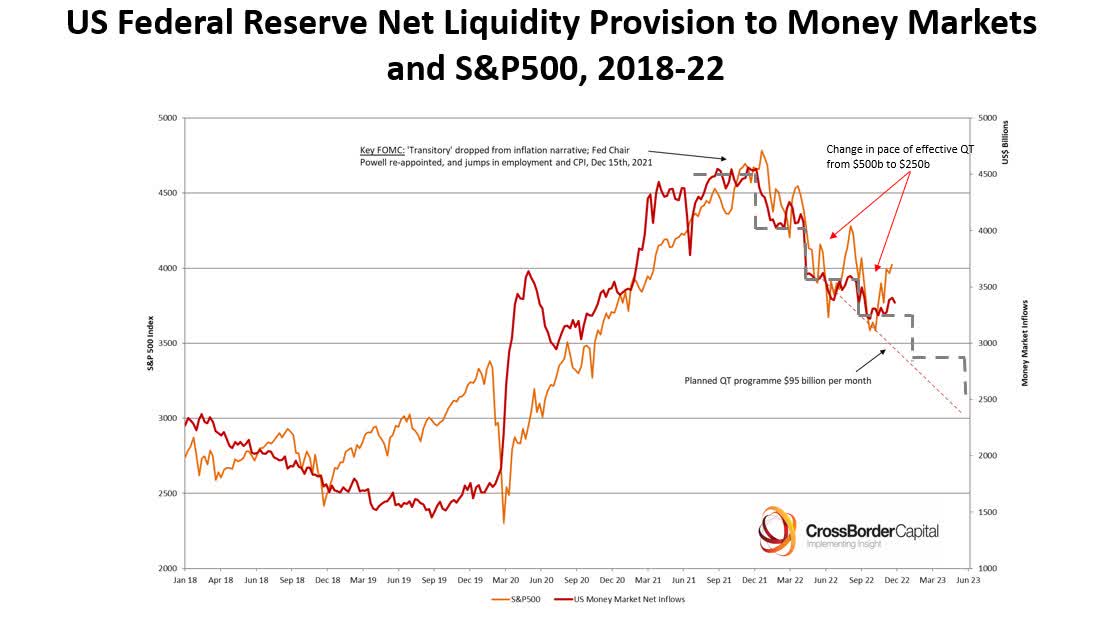

The Fed will have to continue draining liquidity from the markets if it wants to undo the massive QE boost before 2021. Looking at the chart below, changes in liquidity are a much better predictor of market movements than the outright level of liquidity.

Cross Border Capital

Recently, the New York Post published a story on the internal power struggles at the Fed and Treasury Department, which some of my friends contributed to.

Essentially, the Fed is keen on getting inflation down. It’s its job and high inflation is more or less the worst thing that can happen to a consumer-focused economy.

However, not everyone agrees with that as some like to protect the markets for political reasons.

I believe that the following quote perfectly sums up the risks to the market.

“Powell has been very, very clear in what he says, that he wants to raise interest rates and slow the economy. He says it won’t be a soft landing, that it might take a recession in order to slow down inflation.

“So, when Powell is raising interest rates, he doesn’t want the market to go to all-time highs

“Where it gets tricky or conflicted is because not everyone who works at the Federal Reserve likes each other [and] various members are more hawkish than others.”

Hawkish in this context means adhering to Powell’s traditional view that interest rates need to rise to combat runaway inflation, even if that means a crashing stock market and a short, sharp recession,” he said.

Hence, I stick to my view that we could see 3,300 again in the S&P 500.

However, I haven’t shorted anything. My strategy is to buy stocks whenever I like the valuation. That’s why I have a long watchlist next to my keyboard. So far, I added quite aggressively to certain holdings this year when the market went below 3,700.

Moreover, I could be wrong. Predicting the short- and medium-term movements of the S&P 500 is tricky and often pointless, as most investors might be wrong anyway.

After all, time in the market beats timing the market.

If we know that we won’t be able to predict short-term market movements, what should we focus on?

One of my favorite investors of all time, Howard Marks, recently wrote a great memo on this topic.

I think most people would be more successful if they focused less on the short run or macro trends and instead worked hard to gain superior insight concerning the outlook for fundamentals over multi-year periods in the future. They should:

study companies and securities, assessing things such as their earnings potential;

buy the ones that can be purchased at attractive prices relative to their potential;

hold onto them as long as the company’s earnings outlook and the attractiveness of the price remain intact; and

make changes only when those things can’t be reconfirmed, or when something better comes along.

It’s a great summary of issues that I try to incorporate into my investment decisions. After all, my favorite holding period is forever.

Despite having said all of this, I will continue to time the market. I may sound a bit cocky, but it has worked out quite well for me so far. I bought energy at terrific prices in 2020, I mainly added new exposure on significant dips, and I was able to stay away from the worst-performing sectors and assets (like tech, crypto, and related stuff).

Now, let me give you two of my favorite stocks that I do not own yet.

- Two companies, I believe, will do very well when the Fed is eventually forced to pivot.

- Two stocks that have the power to outperform the market on a long-term basis.

- Two stocks with decent yields and tremendous dividend growth. Two stocks with great balance sheets.

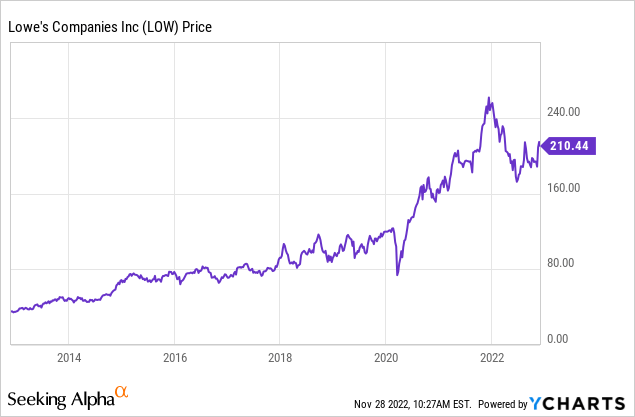

1. Lowe’s Companies (LOW) – 2.0% Yield

Lowe’s is one of the most well-known dividend stocks on the market. This dividend king has hiked its dividend for more than 50 consecutive years. The company is the second-largest home improvement retailer behind one of my holdings Home Depot (HD), operating close to 2,000 stores. This includes Canadian RONA stores, which the company acquired in 2016.

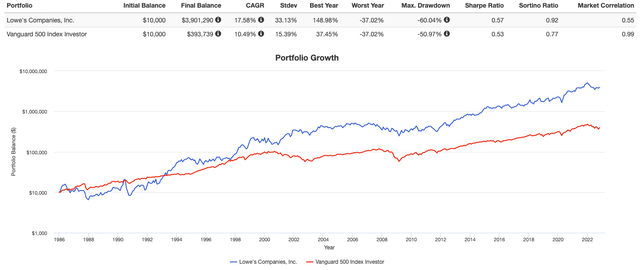

Since 1986, the company has returned 17.6% per year, outperforming the S&P 500 by more than 700 basis points. This performance has lasted as the company is a consistent outperformer. The standard deviation during this period was a bit elevated at 33%. That number has come down a bit in recent years to the lower 30% range. However, the stock is still beating the market on a volatility-adjusted basis (Sharpe/Sortino ratios).

Lowe’s has excellent supply chain operations, good pricing power, a very recognizable brand, and a lot of growth potential through market penetration and Pro exposure (on top of its retail business).

So far, the company is doing a tremendous job withstanding headwinds like an imploding housing market, high inflation, and related consumer demand weakness.

As reported by Seeking Alpha:

“We delivered better-than-expected results this quarter, with U.S. comps up 3%, driven by Pro growth of 19% and improved DIY sales trends,” he commented. “Sales on Lowes.com grew 12%, on top of 25% growth last year. We also drove substantial improvement in adjusted operating margin through disciplined execution and cost management.”

Ellison noted that the company was able to offer significant bonuses to employees and increase wages as a result of the performance. Additionally, the above-expectation Q3 report increased management confidence enough to raise forecasts for the full-year.

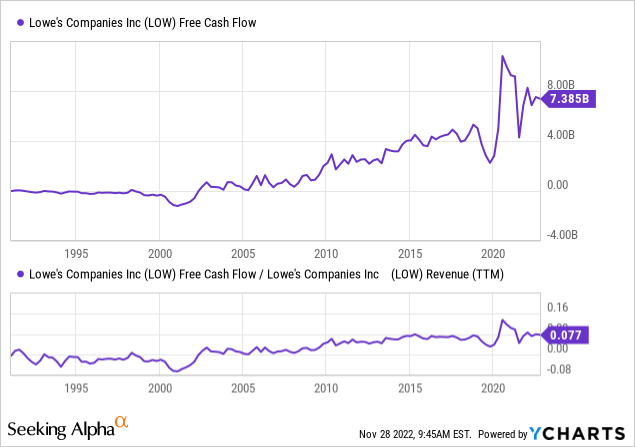

Almost equally important is the fact that LOW is a cash machine. Over the past 12 months, it has generated $7.4 billion in free cash flow. FCF is cash a company can use to distribute dividends, as it is net income adjusted for non-cash operating items and capital expenditures. Moreover, the company is now turning 7.7% of every revenue dollar into FCF. This ratio, too, is in a long-term uptrend.

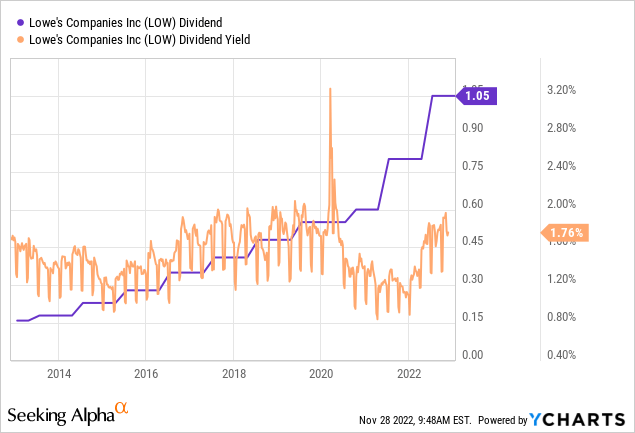

As a result, dividend growth has accelerated. The company’s current dividend yield is 2.0%. That is based on a $1.05 per quarter per share dividend and its $211 stock price. This is one of the highest yields of the past ten years. Note that the YCharts chart below has not been updated for some reason. After all, the dividend per share number is correct.

It also helps that LOW has terrific dividend growth. Over the past 10 years, the average annual dividend growth rate was 20.0%. Again, we’re dealing with a dividend king here, which makes these numbers even more impressive.

These are the latest hikes:

- May 2022:+31.3%

- May 2021: +33.3%

- August 2020: +9.1%

- July 2019: +14.6%

- June 2018: +17.1%

Moreover, the payout ratio remains subdued, indicating a high likelihood of strong dividend growth in the future. The adjusted payout ratio is at 28%. The sector median is 29%.

Using the company’s FY2024 free cash flow estimate of $8.6 billion, we’re dealing with an implied FCF yield of 6.7%. That’s based on its $129 billion market cap. In other words, there is plenty of room to hike the dividend.

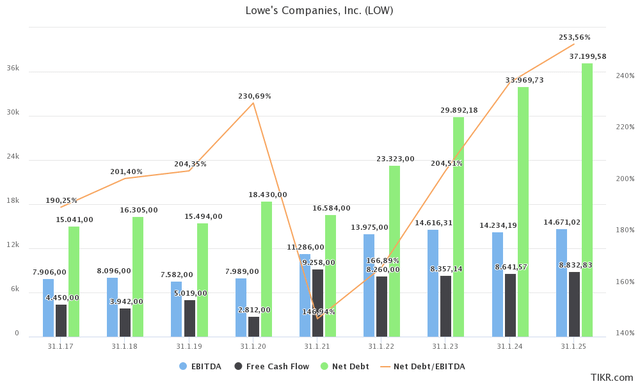

It also helps that the balance sheet is healthy. The company’s net debt is expected to end the year at just 2.0x EBITDA. The company can use this balance sheet to accelerate buybacks and/or to invest in acquired growth if it wants. The company has an investment-grade BBB credit rating.

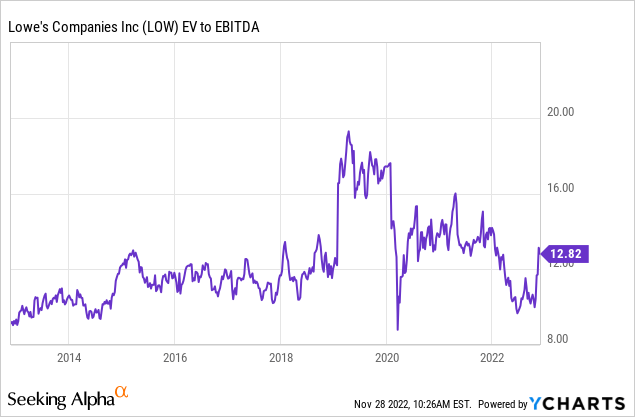

Moreover, the company is trading at 11.5x next fiscal year’s EBITDA. That valuation is very fair.

However, due to housing market risks (as discussed in this article), I remain on the sidelines, for now.

Given my view on the market and my risk tolerance (also for missing potential upside), I’m trying to buy this stock as close to $160 as possible.

Stock number two is similar. At least when it comes to bringing tremendous dividend value to the table in an industry hurt by the Fed.

2. Extra Space Storage (EXR) – 3.9% Yield

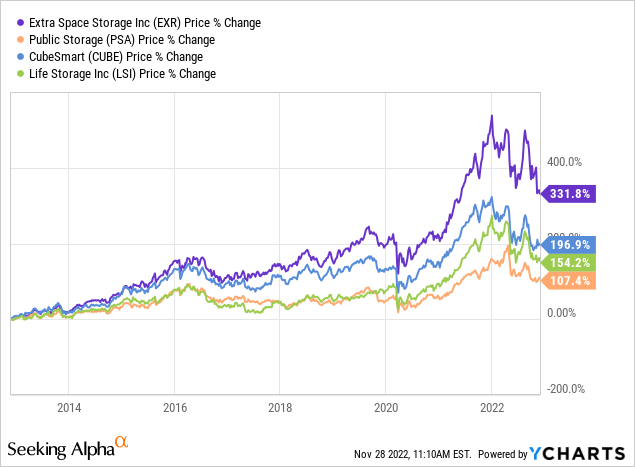

Just like Lowe’s, Extra Space Storage is a company whose largest competitor is already a part of my portfolio. I bought Public Storage (PSA) in 2020, and I wanted to add EXR ever since.

EXR is a self-storage company. Besides that I like the secular tailwinds like the need for more space (smaller average homes), it’s a great industry to buy assets in bulk. I believe that will be the case once rates start to drop. Large buyers (institutions) are now pulling out of the real estate market. The plan is to start buying once unemployment is high and rates (have to) come down.

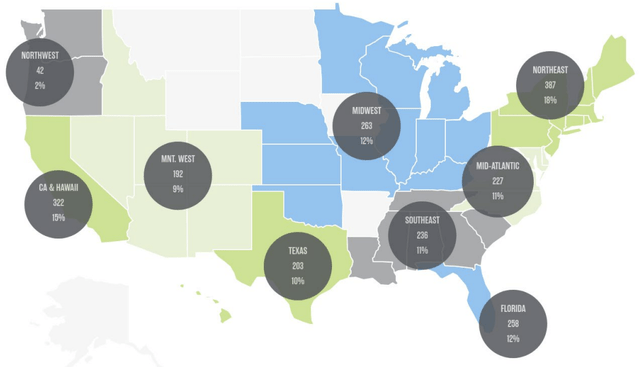

Founded in 1977, EXR operates in 41 states, renting 1.5 million units, managed by more than 4,000 employees.

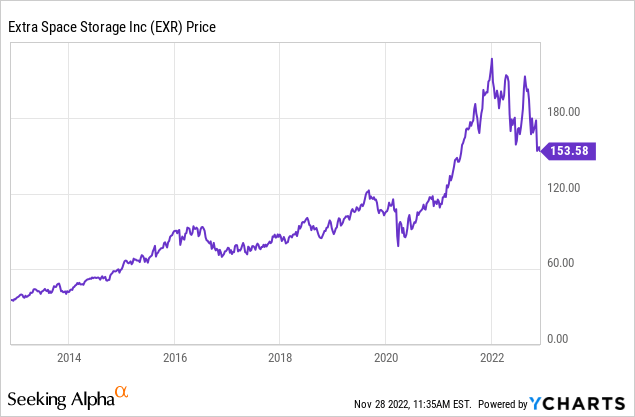

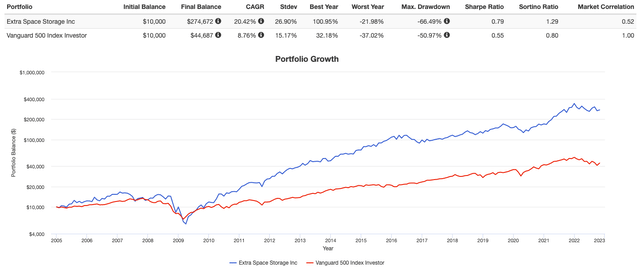

Going back to 2005, the company has returned 20.4% per year. That’s not just because the company had a good start, but this performance actually lasted. On a three, five, and ten-year time horizon, the stock has returned more than 20% per year. The standard deviation was subdued at less than 27%. This results in a terrific volatility-adjusted return (Sharpe/Sortino ratios).

Moreover, over the past ten years, EXR shares have consistently outperformed their peers. Excluding dividends, EXR has outperformed its closest competitor by more than 130 points.

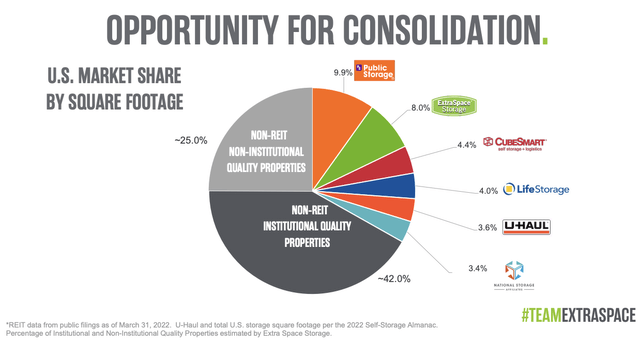

This is what the highly fragmented industry looks like:

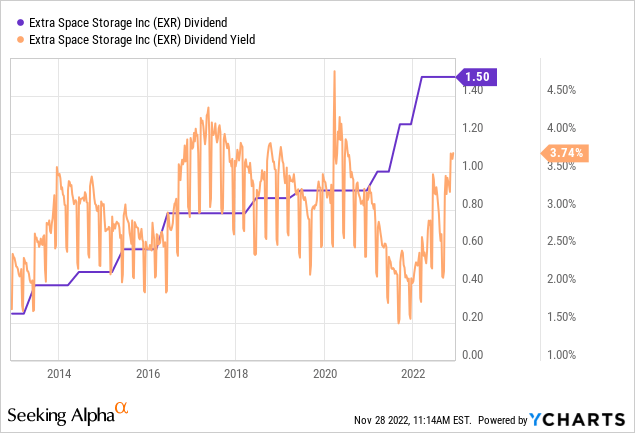

It also helps that the company’s dividend yield has come up to 3.9%.

That’s based on a $1.50 per quarter per share dividend and its $154 share price. Again, the YCharts chart below hasn’t been adjusted for the recent stock price slump. The 3.9% dividend yield is one of the highest yields since the Great Financial Crisis.

Over the past ten years, the average annual dividend growth rate was 22.8%.

These are the latest hikes:

- February 2022: 20.0%

- August 2021: 25.0%

- February 2021: 11.1%

- May 2019: 4.7%

Moreover, despite headwinds, industry fundamentals remain favorable. One of the biggest issues is new supply (it’s an industry with low entry barriers).

According to the most recent Yardi Matrix national self-storage report, fundamentals remain strong, backed by high demand.

Essentially, while growth has moderated after a rapid pandemic-fueled expansion, demand is maintaining steady growth in rates according to the report:

As street rates have leveled at record highs, year-over-year growth has decelerated. The slowdown in growth was to be expected, as much of the industry’s anticipated gains in 2022 were unlikely to match the above-trend increases posted last year. Nationwide, the overall average street rate, which includes all unit sizes and types, grew 2.1% year-over-year in July, a 210-basis-point drop compared to June’s annual rate growth.

The reason why EXR is down 33% from its 52-week high is higher rates and investors betting on more favorable buying conditions down the road.

Hence, it’s important to mention that EXR has a terrific balance sheet, protecting itself and investors against the current environment.

The company has a BBB/BAA2 investment grade credit rating. EXR has a weighted average interest of 3.6% on its debt, which is a great deal. Its interest coverage is 6.7x.

The net debt to EBITDA ratio is a mere 4.6x. That’s down from 6.2x prior to the pandemic.

Valuation-wise, we’re dealing with an attractive price. The company is trading at 18.4x core funds from operations for the 2022 fiscal year. That’s not a no-brainer valuation, in general, but it fits the company’s growth potential.

Given this valuation, I believe that EXR is even closer to a buying opportunity than LOW. It is highly likely that I add EXR to my portfolio before the end of this year. For that, I will use my dividends, and some other spare cash. I have a bigger war chest, which I will deploy in 2023.

Takeaway

In this article, we discussed my view on 2023 and two stocks that I am looking to add to my portfolio. I expect more market weakness, as the Fed is forced to maintain its hawkish hiking cycle. This could eventually cause a somewhat rapid pivot as the economy is everything but strong. The housing market is weakening, consumer sentiment is terrible, and ongoing supply issues make a return to normal quite unlikely.

To be prepared to a pivot, I have been working on my watchlist. In this article, we discussed two stocks that I want to buy in the months ahead. Both Lowe’s and Extra Space Storage offer decent yields, great business models, a history of outperformance, and strong (expected) future dividend growth.

Moreover, both companies have strong balance sheets to withstand the pressure put on the economy by the Fed.

While it’s hard to say when exactly the stock market will bottom, I believe both LOW and EXR should be on people’s watchlists.

(Dis)agree? Let me know in the comments!

Be the first to comment