jetcityimage

Thesis

ChargePoint Holdings, Inc. (NYSE:CHPT) FQ3 earnings release demonstrated that the company continued to be hampered by supply chain headwinds relating to semi chips while navigating a product redesign challenge.

Notwithstanding, the company emphasized that it has caught up with its revenue recognition in Q4, as its FY23 guidance suggests that it should mitigate the impact of Q3’s temporary weakness.

We also highlighted in our pre-earnings update that the market had already de-rated CHPT heading into its Q3 report card. Therefore, we believe a significant downside has been reflected, even though substantial volatility has likely hampered buyers’ conviction lately.

We discuss why the company’s updated guidance suggests it could continue to gain operating leverage, despite a significant downward revision in its gross margins outlook. While ChargePoint could face considerable execution issues on its supply chain, we postulate that the improvement in logistics and freight should alleviate its headwinds partially moving forward.

Also, the ongoing chip supply glut in consumer electronics should mitigate some foundry capacity shortfalls in semi chips, but the impact remains uncertain. It’s critical to note that while foundry capacity utilization has fallen for consumer electronics, the capacity is not entirely fungible. As such, it takes time for chip supply to improve further.

Notwithstanding, we assess that ChargePoint needs to arrest a further decline in its gross margins guidance to lift buyers’ sentiments and confidence in its execution.

Maintain Speculative Buy with a reduced price target (PT) of $16.5 (implying a potential upside of 40%).

CHPT: Demonstrates Operating Leverage Prowess Despite Gross Margins Weakness

ChargePoint posted an adjusted gross margin of 20% in FQ3, down significantly from last year’s 27%. It also came well below the consensus estimates of 23.6%.

Hence, the supply chain impact seems to have worsened for ChargePoint, despite the alleviation of logistics and freight headwinds globally. As a result, investors could be perplexed why the company has been unable to resolve its chip supply constraints. However, a look into the industrial and auto chip supply chain suggests that the market conditions remain tight even as the consumer chip supply has fallen into a glut.

However, while we could cut management some slack as it navigates significant headwinds, the market needs to see sharper execution moving ahead.

Nevertheless, ChargePoint showed that it could still turn in a better-than-expected adjusted EBIT performance despite the gross margin underperformance.

Our analysis indicates that ChargePoint delivered an adjusted EBIT margin of -43.7%, ahead of the previous consensus estimates of -58.2%.

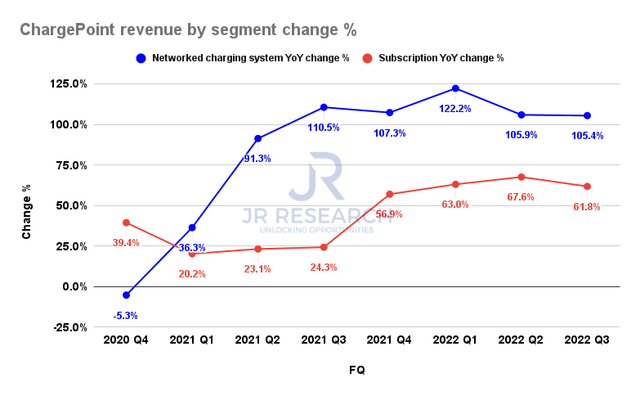

ChargePoint Revenue by segment change % (Company filings)

Therefore, the inherent operating leverage in its software + hardware model has continued to improve, as it posted another quarter of robust topline growth in its crucial revenue segments.

For its full-year guidance, our analysis suggests that ChargePoint’s gross margins should fall to 19.6%, down markedly from the previous consensus of 21.5%.

However, its ability to drive operating leverage should see its full-year EBIT margins improve to -49%, ahead of the previous consensus of -64.8%. As such, we believe management remains on track with its commitment to deliver free cash flow profitability exiting Q4CY24.

With ChargePoint reporting $400M in cash and equivalents as of FQ3, we believe it should be adequate to finance its cash burn through CQ4’24. Street estimates have also reflected a sufficient runway through CY24.

Therefore, we postulate that ChargePoint’s ability to drive operating leverage despite posting weaker gross margins in FQ3 and FY23 suggests it could outperform the Street’s estimates if it could improve its execution moving ahead.

Is CHPT Stock A Buy, Sell, Or Hold?

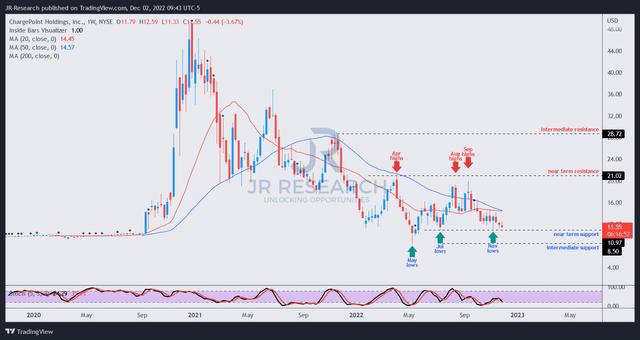

CHPT price chart (weekly) (TradingView)

Despite the post-earnings selloff, CHPT remains supported above its near-term support. However, the lack of a bear trap price action is concerning, as we didn’t glean robust buying support at the current levels.

Therefore, investors are urged to apply appropriate risk management plans to protect their position if the market decides to de-rate CHPT further.

Maintain Speculative Buy on ChargePoint Holdings, Inc. with a price target of $16.5.

Be the first to comment