RobsonPL/iStock Editorial via Getty Images

Restaurant Brands International, Inc. (NYSE:QSR) remains a formidable contender in the quick-service restaurant industry. Its fast-food brands- Tim Hortons, Burger King, and Popeyes, have a solid customer base. In addition, it balances its capacity and efficiency as inflation and demand upsurge coincide. Near-term headwinds are expected due to the looming recession. But its financial adequacy can sustain its operations and potential expansion. Growth prospects may become more enticing once the economy becomes more stable. Also, it continues to cover dividends, CapEx, and borrowings maturing within the year. Even better, the stock price is in adherence to fundamentals. It has a clear uptrend with reasonable upside potential.

Company Performance

In the face of uncertainties and pandemic fears, QSRs are vulnerable to disruptions. Yet, Restaurant Brands, Inc. continues to withstand the blows. It remains one of the largest QSRs worldwide. Although it is relatively newer, its growth has been impressive in recent years. It remains one of those companies capitalizing on prudent expansion and investments.

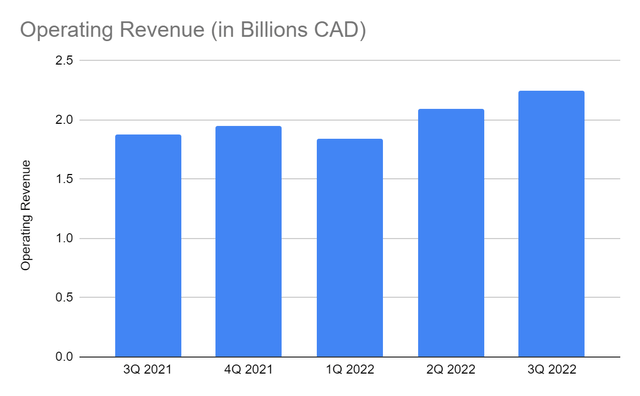

Its most recent revenue amounts to 2.25 billion CAD, a 15% growth from the year-ago quarter. This impeccable outcome reflects the sustained momentum of its diversified business model. Its increased investments and continued product enhancements are its core drivers. One of its brands, Tim Hortons, remains a well-loved spot for coffee lovers. Thanks to the continuous enhancement of its menu items and digitalization. Its current sales have already exceeded pre-pandemic levels. In addition, Burger King expands through its marketing strategies and digitalization. As it focused on its key areas, customer engagement drove more returns.

Operating Revenue (MarketWatch)

What makes it a durable QSR company is the well-balanced revenue mix. Revenues from company-operated restaurants comprise 43-44% of the total value. Franchises and property revenues comprise 38-40%. Meanwhile, advertising is 15-16% of the operating revenue. The diversified portfolio of the company works best in mixed market conditions. With the upsurge in the QSR demand, restaurant sales have an ideal YoY increase. Its improved marketing strategies drove higher customer engagement. Likewise, its franchise revenues ensure a consistent revenue stream. Fixed fees will help cushion the impact of unfavorable economic conditions. Lastly, its advertising segment works hand-in-hand with marketing enhancement and digitalization. All components are showing robust performances this year. Recessionary headwinds may hamper near-term growth, but the setup should help insulate the impact and help it bounce back.

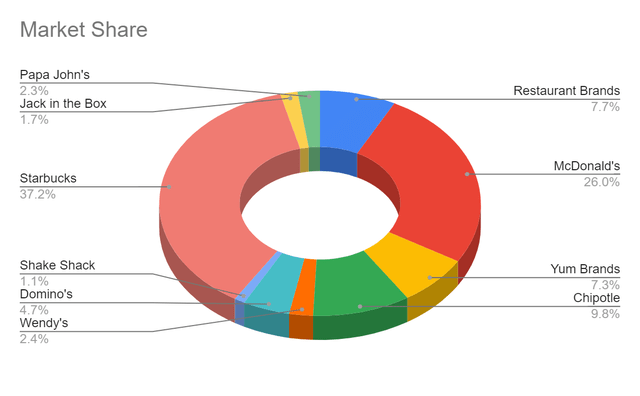

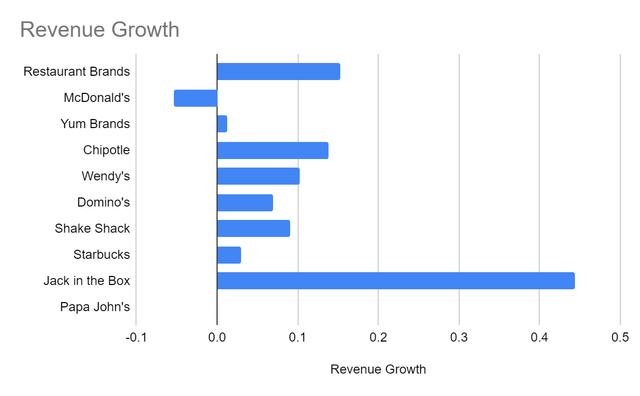

With regard to its competitors, RBI remains an industry staple. Its recent trend shows it can go head-to-head even with industry giants. It holds a market share of 7.7%, a notable increase from 6.8% in the comparative quarter. Also, its revenue growth is way above the market average of 9.9%. It shows its potential to sustain growth by capitalizing on expansion and innovation.

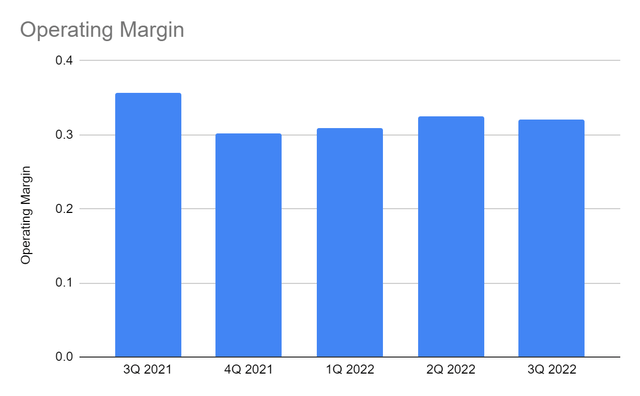

Moreover, RBI is a prudent and efficient QSR company as it keeps its costs and expenses low. After its contraction in 4Q 2021 and 1Q 2022, it adjusted to market movements. It continues to expand despite the skyrocketing prices, thanks to the maintained customer base, matched with its increased market presence. Its strategies offset the impact of inflation in recent quarters. Its operating margin of 32% reflects efficient asset management and prudent portfolio diversification.

Operating Margin (MarketWatch)

Potential Headwinds And Opportunities

Restaurant Brands International, Inc. faces near-term headwinds despite its impeccable performance. Inflation remains elevated at 7.7%, although it has become more stable compared to its 8.8-9.1% peak a few months ago. As the high-flying interest rates persist, it must watch out for a looming recession. It may climb up to 4.5-5% next year, leading to lower purchasing power. The good thing is that bps increments may also cool down in the next twelve months. We must also note that inflation is demand-pull. In my opinion, the movement is still at the right path. It is part of the economic rebound, driven by business openings and pent-up demand. It contradicts the essence of cost-push inflation, which can be more unstable.

The continued digitalization of RBI is excellent preparation for these headwinds. It may improve efficiency, leading to more stable costs and expenses. Its Reclaim the Flame plan may completely materialize by 2024. In turn, it will invest in advertising, digitalization, restaurant technology, and PPE. Its expansion and innovation will pay off once the economy stabilizes.

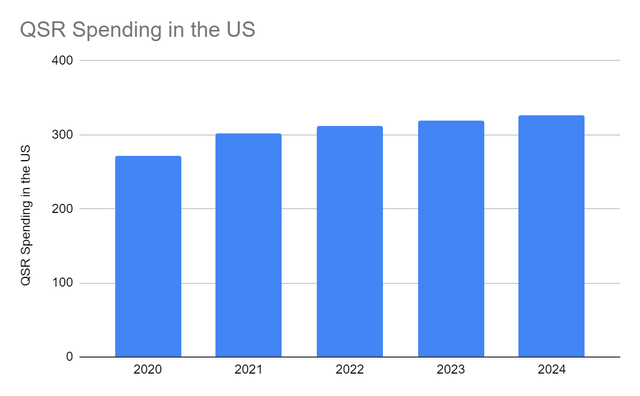

There are more long-run tailwinds in the form of increased consumer spending. In 2021, QSR spending in American households was over $300 million. More studies show that the Global QSR spending will be over $900 billion by 2027, with a 5% yearly growth. Another tailwind for its digitalization is the prevalence of hybrid work setups. A recent study shows the preference for remote work setups by 87% of the respondents. The majority of them want a fully remote work setup. With that, its delivery capabilities will be a staple for employees working at home.

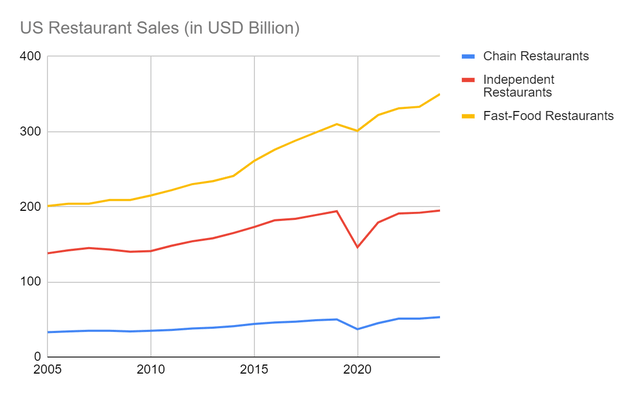

QSR Spending in the US (Statista, Author Estimation)

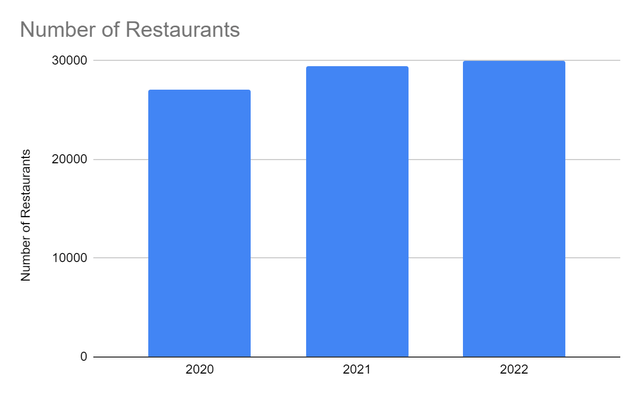

Moreover, the company continues to make impressive developments. These include its expansion of Burger King and Popeye’s in Eastern Europe. As of 3Q 2022, the company has 29,968 restaurants, 2% higher than in 4Q 2021. Its brands have a higher number of restaurants. But the primary driver is the addition of Firehouse Subs, allowing it to compete with Subway. I am confident in its potential as it ramps up Burger King and boosts Tim Hortons and Popeyes worldwide.

Number Of Restaurants (3Q Report)

Another question we must answer is whether or not QSRs are ‘recession-proof’. I already explained that recession may impact the purchasing power of customers. Yet, the unemployment rate is still stable and far from 9.5% during the Global Financial Crisis. It is also important to consider the elasticity of demand. For instance, QSRs may be part of discretionary spending, but customers may still prefer to have their food delivered to save more time. It makes sense as people working from home may put a value to it. It may also be a means of convenience and a way to spend less money on commuting to the supermarket. Even more, the easing of restrictions may allow many customers to dine out to distract themselves from their busy schedules and stress.

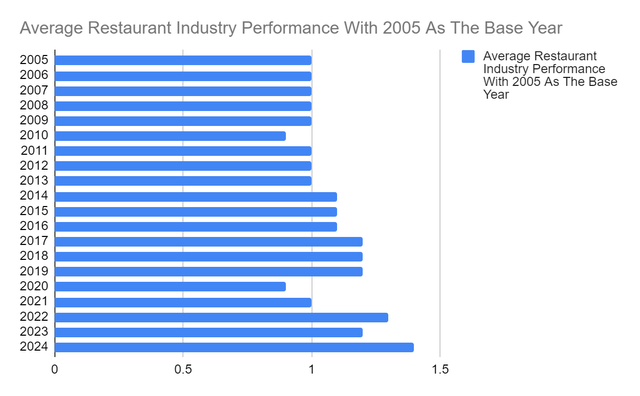

If we check the historical data, we can see the QSR industry being relatively shielded from downturns. A deeper observation can indicate that QSRs have learned to cope with the changing economic cycles. We can also say that the pandemic restrictions transformed the QSR landscape. Those who could not adapt to volatility had to shut down. Meanwhile, those who have already adapted to it have a higher chance of insulating the impact of recession. The demand is on its way back to pre-pandemic levels, easing the difficulty of keeping margins stable.

Even more, they have become cheap alternatives for consumers reducing their spending habits on restaurants. As you can see, the trend of QSRs has been relatively stable. It can be attributed to the relatively inelastic demand and people eating at fine-dining restaurants shifting to fast-food restaurants. Again, recession may have a near-term impact on QSRs, but they can adjust to it. The historical data can show a relatively inelastic demand for QSRs compared to other restaurants. The historical analysis amplifies my supposition of a maintained uptrend once the economy becomes more stable.

The same scenario is applicable to RBI. It appears to be stimulating its revenue growth while keeping costs and expenses stable. Its brand popularity is helping it keep its goals. Also, its enhancements and digitalization increases its value proposition for its market. It reflects the returns it generates from incremental investments and expansion. It is shown by its impressive operating margin. Its increased domestic presence and expansion in other regions may help it spread out overhead costs to stabilize margins. It proves that the optimistic view of RBI may be logical and consistent with the potential QSR industry expansion.

US Restaurant Sales (IBIS World, Author Estimation)

Average Restaurant Industry Performance Index (2005 Base Year) (IBIS World, Author Estimation)

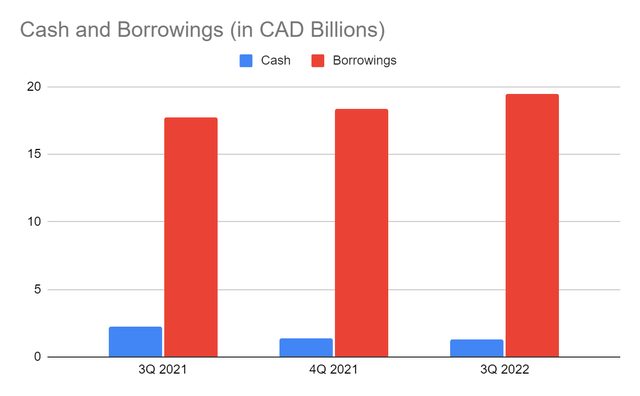

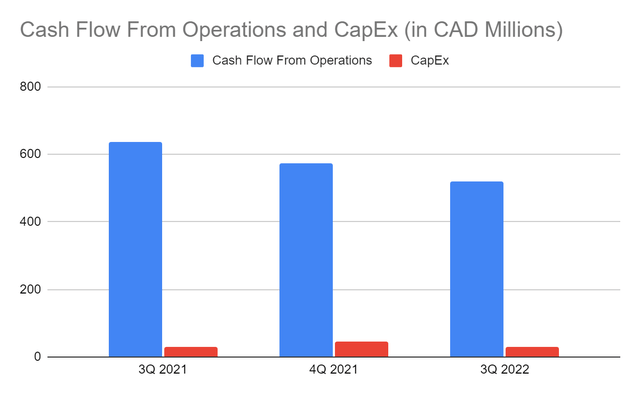

More importantly, I think it can sustain its expansion and digitalization. Its quick ratio may not be impressive, but it has improved from 0.92 to 0.95. Cash has been in a downtrend, attributed to its expansion, as shown by its operating assets. Meanwhile, borrowings are higher due to increased financial leverage and interest rate hikes. Fortunately, cash can cover short-term borrowings and accounts payable. The company must only watch out for its liquidity since it’s more capital-intensive today. Its Net Debt/EBITDA is high at 5.9x. Even so, its EBITDA margin is 35%, showing stable viability. The actual cash transactions of the company can confirm these figures. Its cash inflows of 520 million CAD show it can cover more operating assets and liabilities. It has an FCF of 487 million CAD after deducting CapEx. Even better, its borrowing repayments of 31 million CAD are almost thrice as much as in 3Q 2021. Also, FCF/Sales Ratio is 22%, showing an impressive capacity to turn revenues into free cash. It proves the company can cover its financial leverage while sustaining its expansion.

Cash And Borrowings (MarketWatch)

Cash Flow From Operations And CapEx (MarketWatch)

Stock Price Assessment

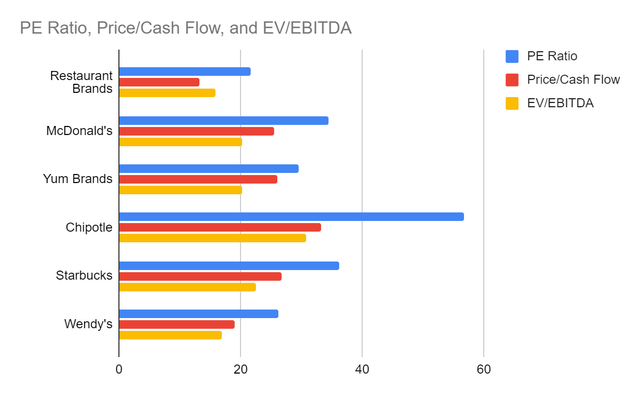

The stock price of Restaurant Brands International, Inc. has been in a sustained uptrend. It has increased following its 24% retreat from the highs earlier this year. At $66.31, it has already increased by 14% from the starting price. It is currently trading at a 21x price-earnings multiple, which is way better than its peers. Its Price/Cash Flow also shows the same thing. The price remains reasonable despite the sustained increase in recent months. I think it is an underrated company that appears to be the optimal choice versus peers. I expect potential downsides due to recessionary headwinds; but with the potential opportunities and excellent positioning, the potential rebound is worth the risk in my opinion.

Likewise, its dividends are attractive, with a dividend yield of 3.3%. It is way better than the S&P 500 average at 1.82% and its peers. Dividend growth has been sustained even in the face of uncertainties. It can also cover its dividends with a dividend payout ratio of only 36%. To assess the stock price better, we will use the DCF Model.

FCFF $1,202,000,000

Cash $946,000,000

Current Borrowings $255,000,000

Perpetual Growth Rate 5%

WACC 9.2%

Common Shares Outstanding 305,904,620

Stock Price $66.30

Derived Value $88.81

The derived value adheres to the potential undervaluation thesis. There may be a 33% upside in the next 12-18 months in my view. Investors may take this opportunity for possible returns.

Bottomline

Restaurant Brands International, Inc. remains a solid company with a potential for further expansion. Revenues and margins are expanding at a steady rate. Cash inflows are stable enough to cover financial leverage, CapEx, and dividends. Also, it has enticing and reasonable growth prospects with its expansion and digitalization. Likewise, the stock price is still enticing with potential undervaluation, and I think a potential increase is justified by its sound fundamentals. Although there may be headwinds to put downward pressure, it’s still worth trying. The recommendation is that Restaurant Brands International, Inc. is a strong buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment