Lucas Ninno/E+ via Getty Images

Buying into fundamentally cheap companies that continue to grow at a nice clip can be a great way to increase the value of your portfolio. Although nothing is guaranteed to turn a profit, this type of strategy is more likely than others to be accretive to your own net worth. A great example of this strategy and action can be seen by looking at TravelCenters of America (NASDAQ:TA), an owner and operator and franchisor of travel centers, standalone truck service facilities, and standalone restaurants. In recent months, robust financial performance achieved by management has continued to push the stock higher. And even so, shares look very undervalued at this moment, leading me to believe that further upside could be around the corner. Due to this, I still think that the company warrants a solid ‘buy’ rating at this time, reflective of my belief that it should outperform the broader market for the foreseeable future.

A great few months

One of the worst things about running a highly concentrated portfolio is that many of the companies that you believe will go up our companies that you ultimately don’t acquire stock in. If there’s one firm that I regret not buying shares in, it is TravelCenters of America. The last time I wrote an article about this enterprise was in May of this year. In that article, I talked about the tremendous growth the company had seen over the prior several months, growth that was driven by a mixture of high-volume sales and higher pricing for fuel. Overall, I felt as though shares of the company were at incredibly cheap levels, leading me to rate the company a ‘buy’. Since the publication of that article, the stock has gone up nicely, surging by 26.2% at a time when the broader market is down by 4%. But even this pales in comparison to when I first started writing about the company regularly back in June of 2021. From the time I rated the enterprise a ‘buy’ back then, shares are up by 79.9% while the S&P 500 is down by 4.8%.

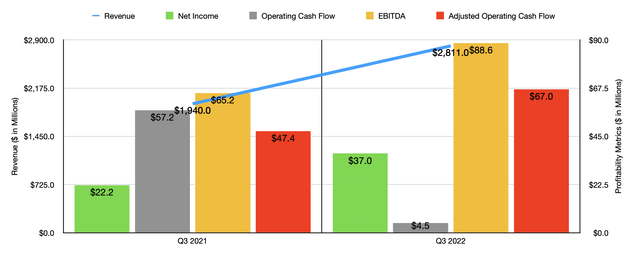

Such strong upside for shareholders has been driven by robust financial performance achieved by management. To see what I mean, we should first look at data covering the third quarter of the 2022 fiscal year. This is the most recent date for which results are available. During that time, sales came in at $2.81 billion. That’s 44.9% higher than the $1.94 billion generated the same time last year. Much of this upside came from a 57.4% surge in sales from fuel. Having said that, non-fuel sales also rose by 10.5% year over year. On the fuel side of the equation, the sales increase came entirely from petroleum product price changes, with a change in volume actually negatively impacting the company’s top line. On the non-fuel side, however, the company benefited from diesel exhaust fluid sales that were pushed higher because of a growth in newer trucks on the road that require it. Truck services and full-service restaurants also help to add to the company’s top line thanks mostly to inflation-driven pricing increases and the continued reopening of the economy.

This surge in revenue brought with it a nice increase in profitability as well. Net income of $37 million dwarfed the $22.2 million generated in the third quarter of 2021. Operating cash flow did fall, dropping from $57.2 million to $4.5 million. But if we adjust for changes in working capital, it would have risen from $47.4 million to $67 million. Meanwhile, EBITDA for the company also improved, rising from $65.2 million to $88.6 million. Now, some who are bearish about the company may argue that the rise in profitability may be temporary given that elevated energy prices might not be here to stay forever. This is a perfectly fair point to make. But as I detailed in my aforementioned prior article, management remains adamant that structural conditions within the industry changed as a result of the pandemic that should ultimately result in permanent margin improvement for the enterprise even if energy prices fall.

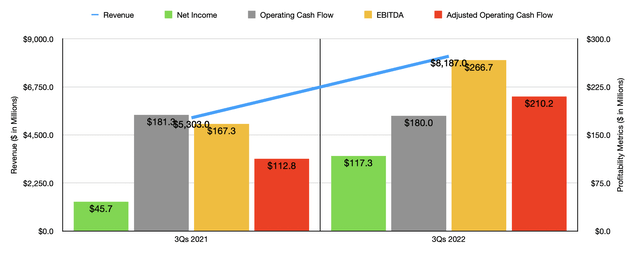

The strong performance management achieved in the third quarter was not a one-time thing. For the first three quarters of 2022 as a whole, sales came in at $8.19 billion. That’s 54.4% higher than the $5.30 billion generated the same time last year. The same factors that were instrumental in pushing sales up for the third quarter were also instrumental for results for the first three quarters of the year as a whole. It’s also worth noting that management continues to grow the enterprise through a variety of activities such as acquisitions, franchising, and even new construction. On October 26th, for instance, management announced the opening of four new travel centers, the planned opening of four additional locations by the end of this year, and the completed enhancements of over 50 travel centers as part of a site upgrade plan that it announced last year. Such investments being made by management should be considered as net positives for investors. With the increase in sales, profits also improved. Net income of $117.3 million beat out the $45.7 million reported last year. Operating cash flow did fall, dipping from $181.3 million to $180 million. But if we adjust for changes in working capital, it would have risen from $112.8 million to $210.2 million, while EBITDA for the company rose from $167.3 million to $266.7 million.

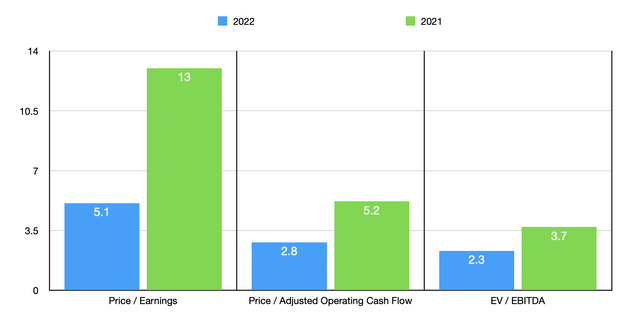

Truth be told, we don’t really know what to expect for the 2022 fiscal year in its entirety. But if we annualize results experienced so far, we should get net income of $58.5 million, adjusted operating cash flow of $146.5 million, and EBITDA of $218 million. Given these figures, we would get a price-to-earnings multiple for the company of 5.1, a price to adjusted operating cash flow multiple of 2.8, and an EV to EBITDA multiple of 2.3. Using the data from 2021 instead, these multiples should be 13, 5.2, and 3.7, respectively. Normally, I like to compare the companies I write about to other similar firms. But based on my research, there aren’t really any good comparables to look at here. The best thing I could do was to compare the business to other companies in its sector, which would be the automotive retail space. As you can see in the table below, TravelCenters of America is cheaper than all of these particular firms, except for when it comes to the price-to-earnings approach where it ties with one other.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| TravelCenters of America | 5.1 | 2.8 | 2.3 |

| Asbury Automotive Group (ABG) | 5.1 | 4.6 | 5.6 |

| Sonic Automotive (SAH) | 5.6 | 3.1 | 6.0 |

| Murphy USA (MUSA) | 10.7 | 7.8 | 7.2 |

| O’Reilly Automotive (ORLY) | 24.9 | 18.0 | 17.3 |

| Penske Automotive Group (PAG) | 6.7 | 8.0 | 6.2 |

Takeaway

If I could go back in time, I would have purchased shares of TravelCenters of America beyond any doubt. The kind of return the company has experienced over the past year or so has been astounding, certainly placing it as one of the best-performing stocks that investors could have purchased shares of. I do believe that the easiest money has certainly been made by this point. But given the fundamental health of the company and management’s continued focus on reinvesting into the firm, I would make the case that shares offer some additional upside moving forward. This has, in turn, led me to keep my ‘buy’ rating on its stock for now.

Be the first to comment