JHVEPhoto/iStock Editorial via Getty Images

Things can always be worse, but Q2 was extremely poor for Intel Corporation (NASDAQ:INTC). Shares traded down -8.56% on 7/29 and, at one point, dipped below the -10% threshold. INTC missed Q2 earnings by a whopping $0.41 as their Non-GAAP EPS came in at $0.29 while their revenue of $15.3 billion missed by -$2.63 billion, which was a YoY decline of -17.3%. INTC revised its full-year guidance to $65B to $68B vs. a consensus of $74.35B, and they are expecting Q3 to be ugly as their revenue is expected to be in the range of $15B to $16B vs. a consensus of $18.67B and EPS of $0.35 vs. consensus of $0.66. Nothing about INTC’s current numbers looks promising, and it looks as if INTC’s history is coming back to haunt them. Ultimately, INTC is becoming a story where you either believe that the management team can execute on their vision or they are going to remain in purgatory with International Business Machines (IBM).

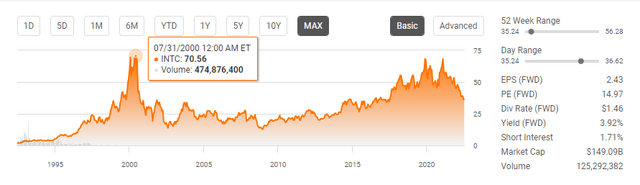

Intel has never broken out past its dot-com highs and its more than 2 decades into the future

INTC is one of the most well-known and established companies in the United States. During the dot-com bubble, INTC wasn’t one of the pre-revenue companies catching a bid, they were on the forefront of building out the next generation of computing with other companies such as Cisco Systems (CSCO) and Microsoft (MSFT). Regardless of the fact that INTC was a real company generating tens of billions in revenue, it still got caught up in the dot-com bubble.

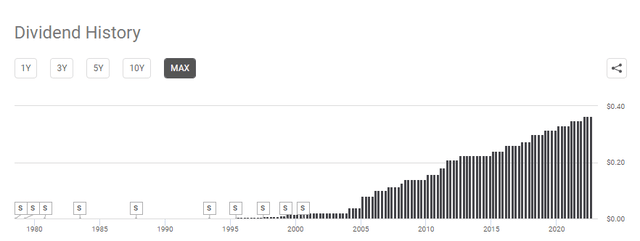

Investors, who really study INTC look at the value proposition and question if INTC can actually provide long-term value? It’s a fair question because INTC’s history suggests that answer leans more toward the no side than the yes side. It’s a loaded question because from the late 70s throughout the 90s, INTC was the pinnacle for value creation. Shares of INTC split 10 times since 7/30/78, and INTC started paying a dividend in 1995. If you had purchased 100 shares of INTC in 1978 prior to the first split and never touched them you would have 36,000 shares today.

- 100 shares initial purchase

- 5-4 split 7/30/78

- 100 shares becomes 125 shares

- 3-2 split 4/23/1979

- 125 shares becomes 187.5 shares

- 2-1 split 10/8/80

- 187.5 shares becomes 375 shares

- 2-1 split 6/30/83

- 375 shares becomes 750 shares

- 3-2 split 10/28/87

- 750 shares becomes 1,125 shares

- 2-1 split 6/6/93

- 1,125 shares becomes 2,250 shares

- 2-1 split 6/18/95

- 2,250 shares becomes 4,500 shares

- 2-1 split 7/13/97

- 4,500 shares becomes 9,000 shares

- 2-1 split 4/11/99

- 9,000 shares becomes 18,000 shares

- 2-1 split 7/31/2000

- 18,000 shares becomes 36,000 shares

- 5-4 split 7/30/78

If you were fortunate enough to be in a position in the late 70s and early 80s to invest in tech companies such as INTC and hold them, the long-term value creation is staggering. The 36,000 shares created over the past 4.5 decades doesn’t include reinvesting the dividends along the way. It’s easy to look backward and see the long-term value that was created, but the likelihood of someone actually holding shares of INTC since 1978 is slim.

Today the main question is can INTC create value for shareholders going forward? While its previous value creation over the previous 4.5 decades seems difficult to outright impossible to replicate, INTC’s stock hasn’t done much in the past 2 decades to inspire a value proposition for potential shareholders.

A company and a company’s stock are two separate things. The simplest bear case is to look at INTC’s chart and make the following claims. Over the past 22 years, INTC’s stock has never surpassed its dot-com price. The bear case can be extrapolated into the numbers and they can say in 2000, INTC generated $30.28 billion of revenue, $8.01 billion of net income, and $8.71 billion in free cash flow (FCF). At the close of 2021, INTC generated $77.71 billion in revenue, $18.6 billion in net income, and $19.2 billion in FCF. INTC closed 2021 with a share value of $51.50, which is -$19.06 lower than its 2000 highs of around $70.56. INTC’s share price finished 2021 -27.01% lower than it was in 2000, while its annual revenue grew by $47.43 billion (156.64%), its net income grew by $10.59 billion (132.21%), and its FCF grew by $10.49 billion (120.44%). The numbers validate the bear case, and they are correct that INTC as a company has grown significantly over the past two decades, but even though the numbers have continuously improved, its had little impact on the shares and, ultimately for all of the success INTC has had, its shares have been negatively impacted.

The bears have been correct and while INTC as a company has executed its shares have yet to surpass where they were more than 2 decades ago. Excluding the recent Q2 earnings, which I will discuss next, I had looked at INTC as an undervalued opportunity. For the same reasons bears disliked INTC, I liked INTC because of how much the company had progressed, and yet the stock never followed along. In my eyes, this had created a value opportunity. While the dot-com bubble was in fact, a bubble, many companies that survived have well surpassed the heights which were reached in 2000. Split-adjusted MSFT reached roughly $51 per share in 2000 and closed 2021 out at $336.32. Shares appreciated by $285.32 or 559.45%, and as a company revenue increased by $137.05 billion (597.94%), net income by $46.81 billion (508.25%), and FCF by $40.24 billion (296.97%). Based on how MSFT’s numbers had driven its share price higher, along with other companies outside of the tech industry, INTC has looked like an incredible value play, trading at value-level fundamentals with financials that kept growing.

It’s important to look at INTC’s prior history in this way because even if management can turn the ship around, this has been a stock that hasn’t impressed the market or the investment community. Based on its prior history, INTC could execute its plan, turn the ship around, and the stock could be dead money. There could still be value and capital appreciation trapped in its shares, but if INTC could grow this much in 22 years and not get past where they were in 2000, the question becomes what does INTC have to do to break out past those levels in the future? Putting the previous financials aside, the bears have been correct on INTC, and before investing in INTC, understanding, these points is critical.

Intel’s Q2 was horrible, Q3 guidance is outright bad, and investors need to figure out if management has lost its credibility or if they can execute

I am not a trader, I don’t buy equities with a short time horizon, and when I make an investment, I am looking 5-10 years out. Sometimes my investment thesis will change as new information becomes available. Q2 of 2022 has me and probably other investors reassessing positions in INTC. Q2 2022 was bad, revenue missed by -$2.63 billion (-17.3%), and EPS missed by -$0.41 as it came in at $0.29. Intel revised 2022 revenue guidance to $65-68 billion from a consensus estimate of $74.35 billion. The annual revision is not good, and Q3 is ugly as revenue is expected to be in the range of $15B to $16B vs. a consensus of $18.67B and EPS of $0.35 vs. a consensus of $0.66.

As an investor and previous INTC bull, the questions I need to answer for myself are the following:

- Is my capital better off invested somewhere else?

- What is my investment goal for this investment?

- Do I believe what management is selling and can they execute?

- What will the relevancy of their products be in the future?

- Do I see new competitors entering their sector?

- Where do I see INTC in 2025 – 2030?

This is a lot to unpack, and everyone’s situation is different, so as an investor, you should be taking an objective look at each investment. Prior to answering these questions, I want to highlight some aspects from the Q2 report and INTC’s press releases.

The earnings call had a massive amount of insight as to what is occurring and what management is expecting. INTC expects the PC TAM to decline roughly 10% in the calendar year 2022. Their Q2 PC unit volume suggests that INTC is shipping below consumption as some of their largest customers are reducing inventory levels at a rate not seen in the last decade. INTC believes that its turnaround is taking place and that Q2 and Q3 will be the financial bottom. The interesting aspect is that management was clear that they are committed to the strategy and financial model communicated at Investor Day. Management is standing by what they believe will be a long-term financial opportunity of future revenue growth outside of 2022 with an FCF rate of 20%. They discussed the dividend and indicated that INTC paid $1.5 billion in dividends, which was a 5% increase YoY, and remains committed to growing the dividend over time.

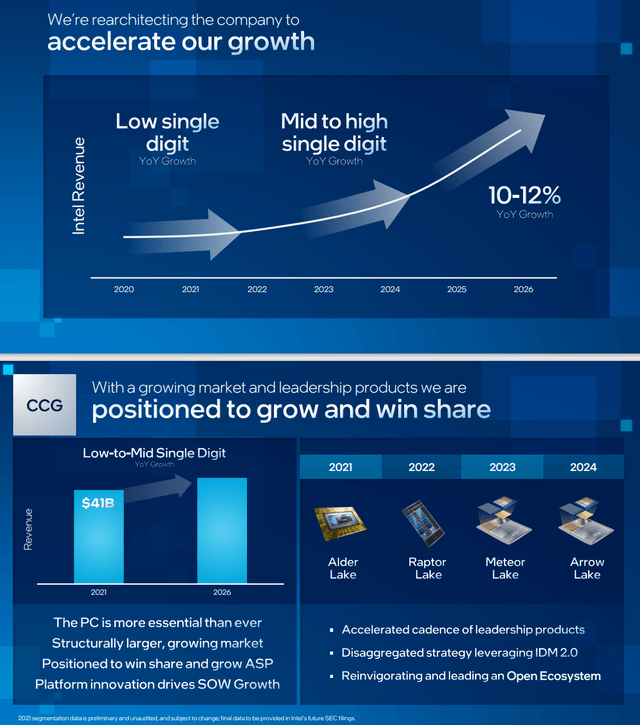

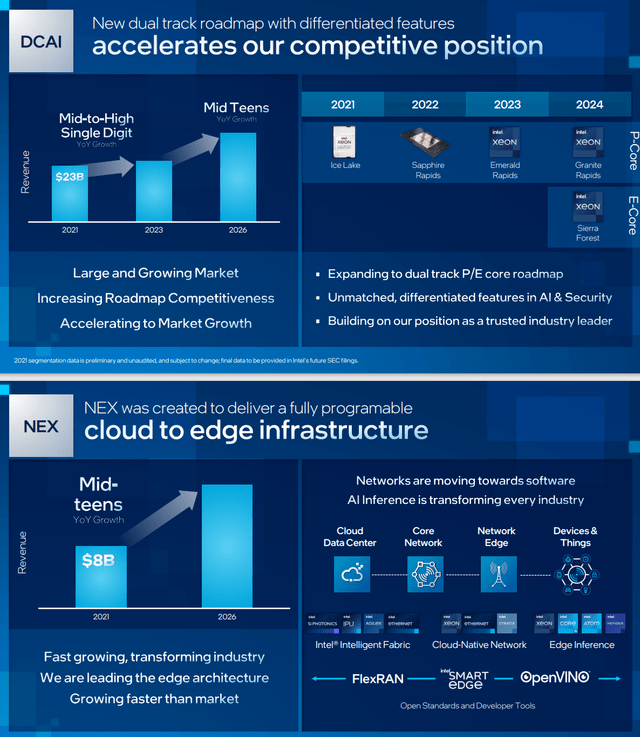

Management referenced INTC’s investor day (link), so I am going to insert some slides that give an indication of what they disclosed to shareholders.

If Q2 and Q3 become anomalies, INTC should see mid to high single-digit revenue growth in 2023 and 2024, then low double-digit grow in 2025 and 2026.

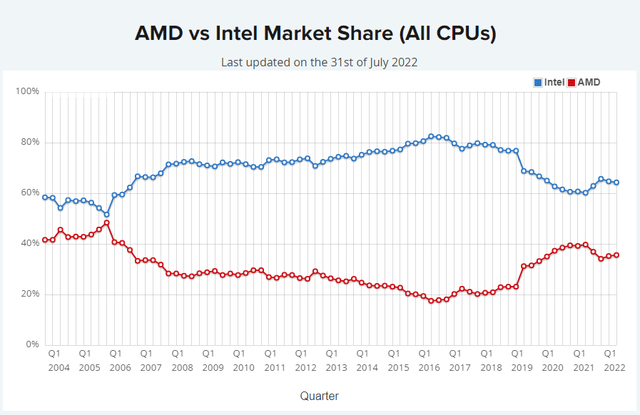

So what happened in Q2? Client computing group which is PC chips, declined from $10.3 billion to $7.7 billion YoY, and its operating income dropped 73% from $4 billion to 1.1 billion due to PC demand softening, increased unit costs, and investments in the product roadmap. INTC’s data center and AI group saw its revenue decline from $5.5 billion to $4.6 billion YoY, while its network and edge group increased from $2.1 billion to $2.3 billion YoY. Since PC chips are still the largest revenue segment, I wanted to see how much pressure Advanced Micro Devices (AMD) has put on INTC regarding markets share. I look at CPU Benchmarks to get an idea of industry market share. AMD certainly made a run on INTC, but it looks like in Q1 2021, it topped out at 40% of the market and is now around 35% or so. This makes me feel a little better that the revenue decline isn’t from AMD taking away more market share and it is actually from a decline in the PC market.

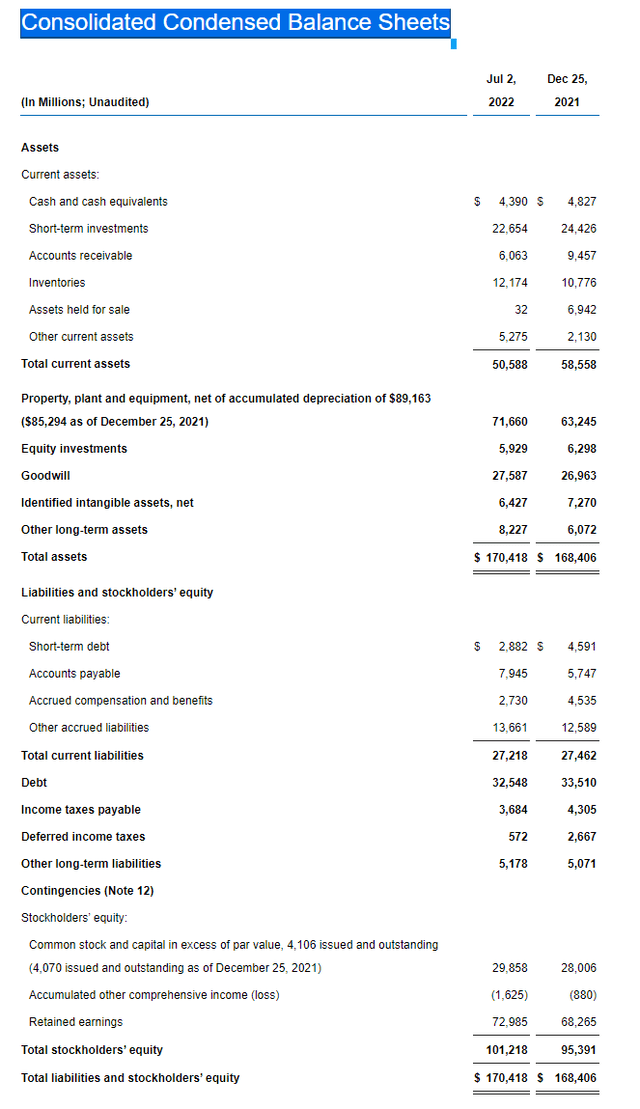

Next I wanted to make sure the balance sheet is intact due to the major decline in Q2 earnings. INTC is still a fortress with $4.39 billion in cash and $22.65 billion in short-term investments, essentially outing their immediate access to liquidity at $27 billion. INTC also has $5.93 billion of equity investments which include marketable equity securities and non-marketable equity securities under its long-term assets. When this is combined with their short-term liquidity INTC has $32.93 billion that can be tapped if needed. This war chest makes me feel much better as INTC has $2.88 billion in short-term debt and $32.55 billion in long-term debt.

From a numbers standpoint, Intel has more than enough cash on hand to whether the storm. This becomes a situation where your buy into what management is selling, or you cut your ties and say they lost their way. Here are 4 things from the conference call that I am taking into consideration.

- We believe our turnaround is clearly taking shape and expect Q2 and Q3 to be the financial bottom for the company

- We remain completely committed to the strategy and financial model communicated at Investor Day

- The long-term financial opportunity of compelling revenue growth and free cash flow at 20% of revenue remains

- We paid dividends of $1.5 billion, a 5% increase year-over-year, and remain committed to growing the dividend over time.

Now I am ready to answer my investment questions. These answers pertain to my investment situation so please keep that in mind.

- Is my capital better off invested somewhere else?

- What is my investment goal for this investment?

- INTC has been a component of an overall income-generating strategy from dividends within my portfolio. INTC, along with several other companies, has provided diversification outside of traditional income sectors and also offers the possibility of capital appreciation. Since the income side of my portfolio is specifically geared toward income generation, I am less concerned with capital appreciation and more capital mitigation on my entire investment mix.

- Do I believe what management is selling, and can they execute?

- I do. INTC has a long track record of execution, and I am willing to give management some rope after reading through the analyst day report and the earnings call

- What will the relevancy of their products be in the future?

- Yes, as I don’t see PC manufacturers going the same route AAPL did with their M series of chips. (I could be wrong)

- Do I see new competitors entering their sector?

- I don’t see another company competing in this sector. This isn’t a SaaS company where you can just hire engineers and try to make a better product. It’s possible the way Tesla (TSLA) took on Ford (F) and General Motors (GM), but I don’t see it as being probable. Not only do you need to design better chips than INTC and AMD, but you also need to manufacture them and get companies such as HP Inc (HPQ) and Dell Technologies (DELL) to buy your chips to put in their computers. I see this as improbable.

- Where do I see INTC in 2025 – 2030?

- I see INTC playing an important role in computing as their chips power a significant portion of the overall industry. I don’t see them going away, and there is a possibility they will deliver on their expectations.

Conclusion

Q2 was horrible, and 2022 isn’t going to be a blockbuster year for INTC. Ultimately I think this is a long-term buying opportunity for INTC. INTC is a battle-tested company that is responsible for countless innovations in the computing sector and is a critical supplier of components to the personal and enterprise computing sectors. INTC has a strong balance sheet and, going off its past history, I am compelled to take management at their words. Based on its long-term share price, I am not expecting INTC to break all-time highs any time soon, but I think this can be a solid income play with future capital appreciation prospects. The two very compelling things are that INTC sees a 20% FCF operating level and is committed to growing its dividend over time. I am willing to collect the monthly dividends and reinvest them while I wait for the turnaround.

Be the first to comment