guvendemir/iStock via Getty Images

Park Aerospace Corp (NYSE:PKE) is an aerospace company that produces solutions, and hot melt advanced composite materials to develop composite structures for the global aviation markets. These materials are generally used to make the primary and secondary structures of the jet engine, transport aircraft military aircraft, and various aircraft models.

The company produces composite parts and structures in its manufacturing unit located in Newton, with its proprietary composites such as SigmaStrut and AlphaStrut. Also, the composite materials produced by the company are used to fabricate lightweight, high-strength structures. These materials are made by resin formulations, which generally are highly specific and proprietary. But despite having proprietary rights over the period, business performance has declined, contributed to by intense competition, pricing pressure, and customers’ preference shift towards new technology.

Furthermore, the company works with aerospace OEMs and aircraft manufacturers. Generally, these manufacturers seek a low-cost provider to maintain their thin margins. As a result, Park Aerospace suffers from significant pricing pressure.

Historical development (Company website)

In 2019, Management decided to expand the manufacturing facility located in Newton, which has been in progress; the 90000 sq ft expansion will be expected to double the size of the existing facility. The expansion includes a new resin mixing and delivery system, new hot melt films and tape manufacturing line, a new R&D lab and various related capacities, which can strengthen the business performance. Although the company desires to expand its operations, the consistently declining revenue and profitability show a different picture.

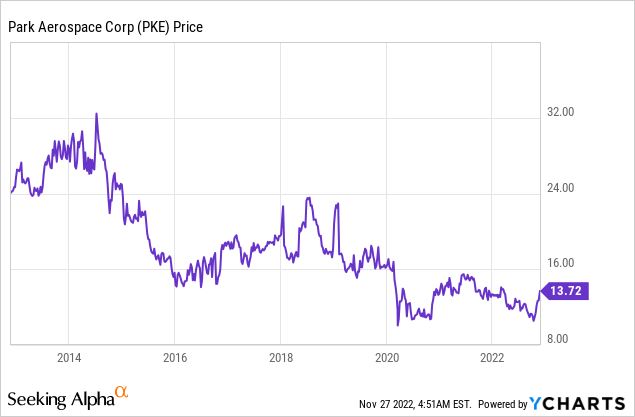

Share price (YCharts)

As a result of a consistent decline in operating performance, the stock has been dropping consistently. Since the peak of 2011, the stock has lost nearly 57% of its value to date, leading to significant destruction in shareholder value.

Currently, the stock price has dropped, but due to its strong financial position, it has been trading at a significantly higher multiple of 35 times its earnings. And as profitability has been decreasing, it might take a very long time to recover the profit margins. I believe the stock doesn’t offer a margin of safety from this price. Therefore, I assign a sell rating to the stock.

Historical performance

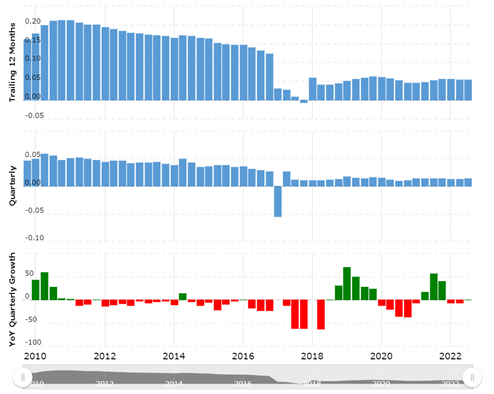

Revenue (macrotrends.net)

In the last ten years, revenue has been dropping consistently from $193 million in FY 2012 to about $53 million by FY 2022. As a result, stock prices have declined significantly, resulting in substantial value destruction. Also, profit margins have reduced considerably over the same period and reached $8.4 million by 2021. But it is appreciated that despite declining business prospects, shares outstanding have remained at nearly the same levels.

Despite low margins, the company has no long-term debt and over $102 million in cash, which shows that the company’s financial position is substantially strong. Over the same period, cash flow from operations has been positive and the company has paid down generated cash through high dividends.

Having a consistent cash flow history along with strong liquid assets provides the business model with significant strength; as a result, despite the significant deterioration in the business model, the stock has been trading for significantly higher multiples.

Strength in the business model

Despite significant fluctuations in operating performance, the company has maintained a robust financial position. The company is debt free and has significant liquid assets, which substantially strengthen the business model. When various aerospace manufacturers have been struggling with a huge debt burden, having such a strong liquid asset gives the company an edge over its competitors.

The company provides composites that are made through specific resin formulations which are proprietary, such proprietary rights have been protecting profitability even in the intensely competitive environment.

Risk factors

As the operating performance has been dropping consistently, it might drop further due to intense competition and recent trouble that the airline industry has been facing. And if the company can’t maintain profit margins it will have to incur losses which might affect the stock price, as the stock is trading for a significantly higher valuation.

The material composite industry is intensively competitive and most of the time the company has to work with aircraft manufacturers. If the customer demand changes towards new innovative products, the company might incur huge expenses to develop new products.

Over the period of time, the top ten customers contribute more than 70% of the total revenue, and in 2021 about 27% of total revenue came from the General Electric company alone, such a high customer concentration might put the business model at significant risk. As the airline industry has been substantially cyclical, and has a thin margin, the loss of its main customers might affect the business model significantly. Also, during the cyclical downturn, these big airline manufacturer might exerts high pricing pressure which might hurt the profitability.

Recent development

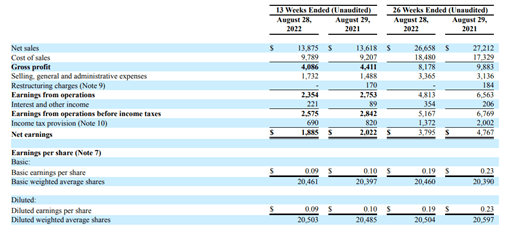

Quarterly results (Quarterly report)

Recently, due to high oil prices, low fares, and decreased traffic the airline industry has been facing significant backdrops. As a result, airline manufacturers are getting troubled. But in the case of park aviation, despite significant issues the company has maintained its revenue and margins at considerable levels.

In the latest quarter, revenue increased slightly to about $13 million but due to higher selling charges, the net profit declined 10% to 1.8 million. which shows that the business model is substantially strong to maintain its profitability even in adverse conditions. Also, the company ends the quarter with more than $98 million in marketable securities.

Although the company has been focusing on supply chain issues and is expected to grow its revenue in the upcoming quarters, the cyclical nature of the airline industry might hurt business performance. The company has been trading for about $280 million whereas it has produced around $8 million in net profits, which shows that the company has been trading for about 35 times its 2021 earnings. Although the financial position is substantially strong, my major concern is consistently declining operating profits along with high valuation. Therefore, I assign a sell Rating to the stock.

Be the first to comment