Leon Neal

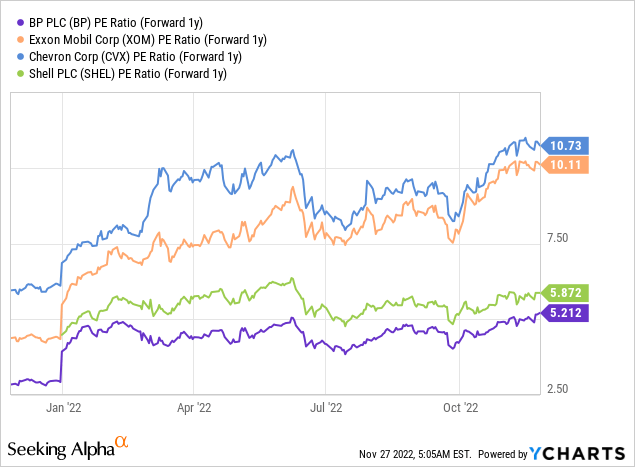

The valuations of petroleum companies like BP (NYSE:BP) or Exxon Mobil (XOM) have soared lately due to a very favorable pricing environment, especially in natural gas, which has led to record profits for the companies in question as well as for the entire industry in FY 2022. Although I don’t believe that BP is overvalued — the energy firm has a forward P/E ratio of 5.2 X — there is nothing wrong with taking profits in names that have broken out to the upside lately and out-performed expectations. I recently closed out my investment in Exxon Mobil and I am going to do the same thing with BP next week!

Changing recommendation for BP’s shares

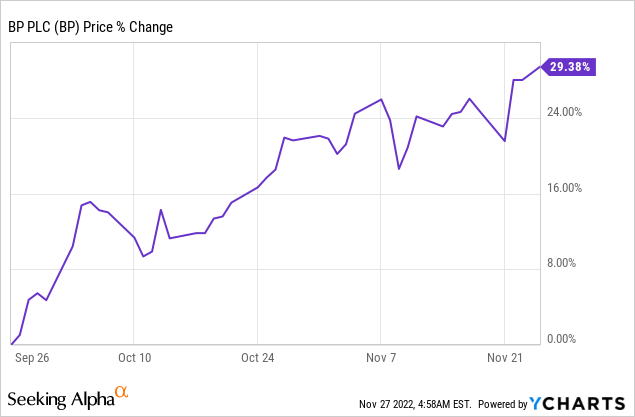

I have strongly recommended energy companies at the beginning of the year as the setup in petroleum and natural gas markets has shifted to an extremely favorable one for production-focused energy enterprises. Shares of BP, for example, have revalued 29% since September 26, 2022. While I recommended BP about two months ago — BP: 5% Dividend Yield, 4x P/E, Recovery Potential — I believe it is wise to take some profits after such a dramatic revaluation of BP’s shares to the upside. Above average prices in energy markets are also the reason why I have sold my investment in Exxon Mobil.

BP’s Q3’22: Gas prices soared, petroleum prices remained high

Shares of BP moved into a new up-leg in September as energy prices soared over energy supply fears related to the sabotage acts on the Nord Stream pipelines in the Baltic Sea. The pricing environment for BP and other producers, at least for now, remains highly favorable… so there is definitely the possibility that shares of BP make new highs in the short term and that the firm will continue to report profits and cash flow above the historical average.

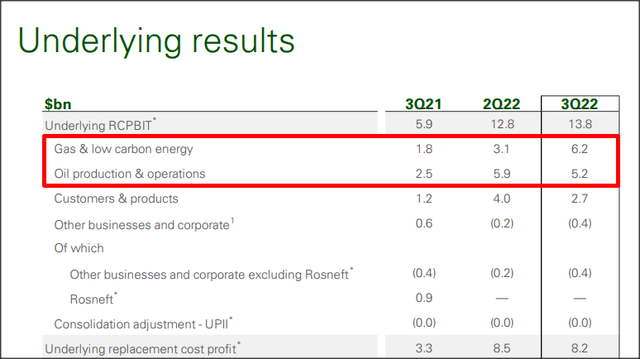

BP generated $8.2B in adjusted profits in Q3’22, which was slightly below the firm’s record earnings of $8.5B in Q2’22. Strong profits were supported chiefly by BP’s gas business (marketing & trading as well as higher market prices for gas): the firm’s gas profits soared 103% quarter over quarter to $6.2B in Q3’22 due to the factors explained above while profits from oil production declined 12% quarter over quarter to $5.2B.

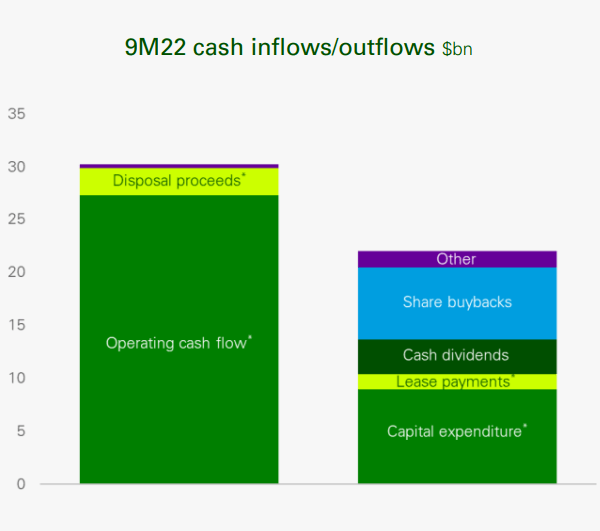

BP’s operating cash flow and surplus cash flow soared in FY 2022

BP also generated strong cash flow in the third-quarter due to record performance in the gas business. BP’s operating cash flow totaled $8.3B, showing an increase of 39% year over year. The firm’s surplus cash flow — the cash flow remaining after cash capital expenditures, dividends, lease liability payments — was $3.5B, showing an increase of 278% year over year. BP’s operating cash flow easily exceeded the firm’s total cash required to pay for capital expenses, dividends and stock buybacks in FY 2022.

Source: BP

A significant portion of this surplus cash flow is going to be returned to shareholders. BP has said that it plans to repurchase $2.5B of its shares before its reports fourth-quarter earnings… which translates to 71% of BP’s Q3’22 surplus cash flow. BP can, at least right now, clearly afford to pay both a higher dividend and announce more stock buybacks in the fourth-quarter.

BP’s P/E ratio may be set to rise

Based off of earnings, BP is still cheap. The firm’s shares are valued at a P/E ratio of 5.2 X which beats the P/E ratios of other international energy producers in the US and in Europe. However, with earnings currently highly inflated due to energy supply fears influencing markets, I believe BP’s P/E ratio, going forward, will see a bit of a normalization.

Risks with BP

The energy supply situation in Europe is still strained and an unusually cold winter could drive record pricing for petroleum and natural gas in Q4’22 and Q1’23… which help international producers expand their gains. A material drop in pricing for energy products (both petroleum and natural gas), however, would likely be a major excuse for investors to sell energy producers and reprice their earnings prospects. In this case, BP would most likely see a significant deterioration in its free cash flow, earnings and margins going forward.

Final thoughts

I am going to sell BP into the strength at the start of next week because I believe BP has delivered exceptionally strong returns since the Nord Stream pipeline attack in the Baltic Sea in September and there is nothing wrong with taking profits. Although shares of BP are still relatively cheap based off of earnings, I believe BP has reached a point where the stock, from a long-term perspective, has now more downside than upside potential. BP may be a re-buy in a couple of months, but the setup is currently very favorable for investors to sell a profitable investment position!

Be the first to comment