KenWiedemann

Monthly paying dividend stocks are great for matching one’s expenses to a steady income stream. Realty Income Corp. (O) is perhaps the best known monthly payer, with fellow net lease REIT Agree Realty (ADC), having recently followed suit. This brings me to Phillips Edison (NASDAQ:PECO), which is likely the only shopping center REIT that pays a monthly dividend. This article highlights why PECO remains a quality up and comer in this space.

Why PECO?

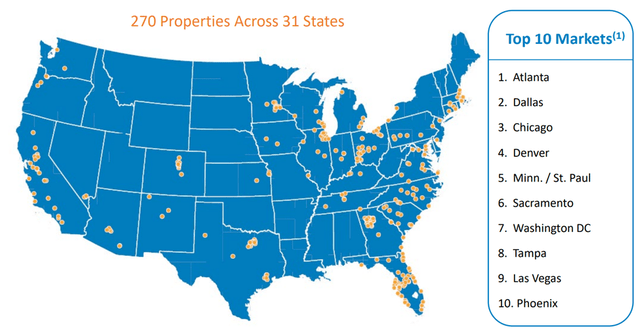

Phillips Edison is a large shopping center REIT that’s self-managed and was founded 31 years ago. It only recently became a publicly-traded after its IPO in mid-2021. PECO manages 290 shopping centers (270 of which are wholly-owned) comprising 31 million square feet across 31 states. Its top grocery tenants include familiar names such as Kroger (KR), Publix, and Albertsons (ACI). As shown below, PECO participates in many top markets, with high exposure to the growing Sunbelt region of the U.S.

PECO Locations (Investor Presentation)

Phillips Edison differentiates itself from traditional shopping center REITs with its high exposure to omni-channel grocery anchored centers, which comprise 97% of its annual base rent. Moreover, 71% of PECO’s ABR comes from necessity based tenants, which beyond grocery anchors include drugstores, cellular service providers like AT&T (T) and Verizon (VZ), shipping companies such as UPS (UPS), and large retail banks Chase Bank (JPM) and Bank of America (BAC).

Meanwhile, PECO is demonstrating strong portfolio fundamentals, with leased occupancy rising to a record high 97.1%. Importantly, PECO isn’t giving rent concessions or discounts to drive this growth, as comparable new and renewal rent spreads were a high 21% and 16%, respectively. This helped to drive strong same-store net operating income growth of 4.3% YoY.

Importantly, PECO maintains a strong balance sheet with a net debt to EBITDAre of 5.4x, comparing favorably to 5.6x at the end of last year. This lends support to PECO’s monthly dividend, which was recently raised by 4% to $0.0933 per share, equating to a 3.5% dividend yield at the current price. Also encouraging, Core FFO per share of $0.58 during the third quarter results in a low 48% payout ratio, and giving management plenty of headroom for internal growth and or dividend increases down the line.

Looking forward, PECO is well-positioned to benefit from population shifts towards suburban communities, especially in ones with warmer climates where many of PECO’s properties exist. Also, contrary to headline risk around physical retail, community centers form an important last mile solution to get products into the hands of consumers. This is considering the fact that 90% of PECO’s grocers offer a “buy online pick up in store” option, which helps to further drive foot traffic and sales at physical locations.

Near-term risks include higher interest rates, but that also mean that the best operators with strong balance sheets are in a position to capitalize, as weaker players are shut out from doing deals. This is supported by recent industry trends of higher cap rates on new acquisitions, and management has recently upped its targeted return on new acquisitions to an unlevered internal rate of return of 9%. The recent announced merger between Kroger (KR), the acquiring firm, and Albertsons (ACI) is also viewed as a net positive, as noted by management during the recent conference call:

I would like to briefly comment on the recently announced proposed merger between Kroger and Albertsons. Based upon what we currently know, we believe that overall this is positive news for PECO. With an expanded footprint post merger, we will see our largest neighbor become stronger and more profitable. Following the merger, these grocery stores will be managed by an operator, who has generated higher sales productivity at the store level, invest in their physical stores and has a proven ability to drive strong customer traffic to our centers.

Turning to valuation, PECO remains attractively priced at $32 with a forward P/FFO of 14.4. Considering the strong balance sheet and strong portfolio fundamentals, with rental growth on new and renewal leases well outpacing inflation, I would expect for PECO to trade in the P/FFO of 16 to 18x range. Analysts have an average price target of $35.25, translating to a potential ~13% total return including the dividend.

Investor Takeaway

PECO maintains a strong balance sheet and continues to benefit from its tenant mix, with necessity-based tenants driving strong occupancy and rental growth, which appears sustainable through the current cycle. In addition, management remains focused on shareholder returns, demonstrated by a healthy dividend accompanied with a low payout ratio. Given these attributes, I see potential upside for PECO at the current price.

Be the first to comment