Joe Raedle/Getty Images News

Given the challenging environment for stocks, and in particular long-duration growth assets, I argue that investors should focus on companies with strong and attractive financials. A company that I find particularly interesting is adidas (OTCQX:ADDDF). (1) adidas has a good competitive position based on strong brand equity and (2) a global distribution network, (3) has relative stable revenues and earnings power, and (4) trades at attractive multiples.

In this article, I present my thesis why I believe that adidas stock is a good buying opportunity. I supplement my analysis with a residual earnings valuation framework based on analyst consensus EPS (base-case). My analysis finds that adidas is about 50% undervalued.

Company Description

adidas is one of the biggest and most popular sports brands globally. The company designs, manufactures and distributes athletic lifestyle products such as athletic apparel, shoes and performance equipment. adidas operates globally and covers wholesale, retail and e-commerce activities. Geographically, Asia-pacific is adidas’ biggest market with approximately 35% of sales, followed by Europe and North America with 25% of sales each. With regard to revenue share according to product segments, footwear accounts for approximately 55% of sales and apparel 40%. In 2020, Forbes ranked adidas No.51 world’s most regarded brands, and in 2021 as NO.14 world’s best employers.

adidas Investor Presentation, 2022

Growth At Reasonable Price

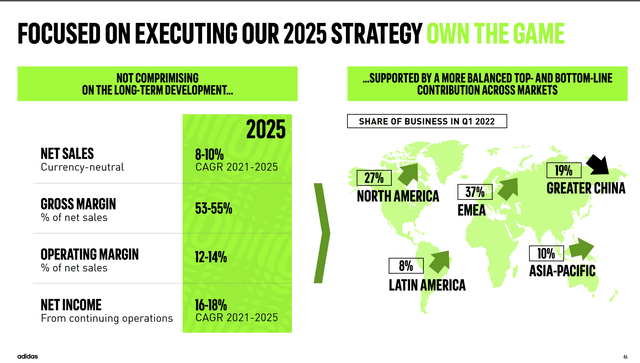

According to the adidas’ investor presentation, management expects the company to grow at an 8-10% CAGR until 2025. Moreover, net-income is expected to increase 16-18% over the same time period, mostly driven by a 5-percentage point increase in gross margin. While these targets appear ambitious, I argue they are justified as there are quite a few reasons why adidas can support strong topline-growth: First, the global sportswear market is estimated to grow at approximately 7% CAGR until 2028, reaching $267 billion in size (vs. $170.94 billion in 2021). Moreover, China and Asia Pacific–arguably adidas’ prime growth target markets–are expected to grow between 10% and 15%. Second, as adidas is increasingly focused on online sales, with total e-commerce revenue expected to double by 2025 to $9 billion in sales, the company should enjoy operating margin expansion as the strategy develops. Thus, adidas strategy should support per share earnings of approximately $15 by 2025.

adidas Investor Presentation, 2022

Financial Performance

adidas delivered solid financial performance in 2021. The company generated revenues of $23.11 billion and gross profit of $12.73 billion. Based on a net-income margin of 6.8%, adidas managed to generate net profits attributable to shareholders of $1.7 billion, or $8.76 per share.

Cash and cash equivalents held by adidas at the end of FY 2021 versus total debt were recorded at $6.15 billion. Cash from operations was $3.66 billion and free cash flow was $3.06 billion. Thus, adidas financial position is very strong and should support attractive shareholder distributions.

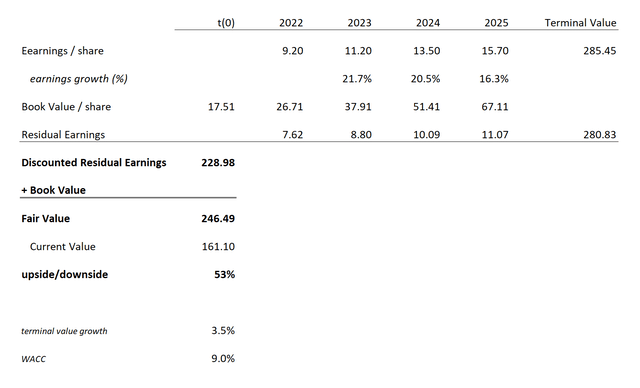

According to the Bloomberg Terminal, which tracks analyst consensus estimates of 17 analysts, adidas revenue growth is estimated at approximately 9% CAGR until 2025. With regard to growth in net-income, analysts forecast a CAGR of approximately 12%. Respectively, consensus EPS estimates for 2022, 2023, 2024 and 2025 are as follows: $9.2, $11.2, $13.5 and $15.7.

Valuation

In my opinion, a residual earnings valuation is well suited to value ADDDF stock, given adidas’ blue-chip status with relatively stable earnings-profile. Unless otherwise noted, all data is taken as of June 1, 2022, and my analysis is based on the following assumptions:

- Revenues: I use the consensus analyst forecast as available on the Bloomberg Terminal.

- Margins: I used the consensus analyst forecast as available on the Bloomberg Terminal.

- Beta for CAPM calculation: I modeled a three-year regression against the DAX30.

- Risk-free rate: I used the U.S. 10-year treasury yield as of June 1, 2022.

- Cost of Equity is based on the CAPM framework; Cost of Debt is taken from the latest trading data after tax equal to 3.4%.

- Cost of Capital is based on the WACC model, calculating 8.4%. I round up to 9% to reflect a conservative valuation.

- Tax Rate: I extrapolate the FY 2021 implied effective tax rate into the future

- I do not model any share-buyback and/or dividends.

With these assumptions, the calculation returns a fair value of $246.49/share — thus implying considerable upside potential for the stock (more than 50%).

Bloomberg analyst consensus, author’s calculation

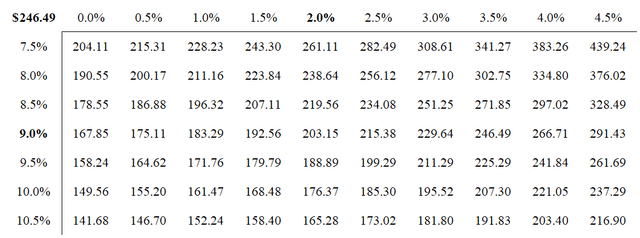

Interestingly, even if investors were to consider a different cost of capital and/or a different terminal growth rate, adidas appears undervalued. For reference, see the sensitivity table enclosed.

Bloomberg analyst consensus, author’s calculation

Please note: While I do not consider any buybacks in my valuation, adidas historically repurchased about 1-2% of the outstanding share annually. In 2021, for example, adidas bought back $1 billion worth of shares and until 2025 the company aims at repurchasing another $4 billion in total. I do not model any share-buybacks in order to reflect a conservative valuation. However, investors should consider that 1-2% buyback yield should give additional upside, both due to buying pressure and due to EPS accreditation.

Multiples

Finally, investors might also want to consider a valuation based on multiples. Personally, I suggest using a 30% discount to the company’s 2-year average P/E multiple of 32.2x. If we apply this multiple to adidas’ 2023 estimated EPS of $13.05, and use a 9.0% discount rate, we can derive a fair target price of $247.57/share. Thus, the target price derived from the multiple valuation is very much in line with the residual earnings framework.

Downside Risks

Although I believe that ADDDF is undervalued, investors should note the following downside risks to my target price of $246.49/share.

First, although less impacted than other consumer discretionary businesses such as PC and Automotive, adidas’ financials are exposed to business cycles. Thus, if we see a recession in late 2022/early 2023, adidas fundamentals will likely suffer from a slowing consumer confidence and discretionary spending. However, as adidas stock is down more than 30% YTD, I argue that much of the recession worries have already been priced in.

Second, adidas is operating in a relatively mature market and the company is competing with notable brands such as Nike (NKE) and Lululemon (LULU). Thus, investors should monitor industry competition and if competitive forces pressure adidas financials more than expected, investors should be prepared to adjust their valuation accordingly.

Third, adidas has significant exposure to China, both on the demand and the supply side. That said, investors should monitor the current economic situation in China, including COVID lockdowns in Shanghai and other cities. The company’s future earnings calls might be a good reference to get a feeling how the situation is impacting adidas business operation.

Fourth, given rising interest rate and slowing risk-appetite for stocks, investors should consider that adidas share-price might see increased volatility. Thus, investors should be prepared to stomach equity depreciation, even though the fundamental thesis for adidas remains unchanged.

Conclusion

adidas is trading cheap. In fact, adidas current P/E multiple of less than 12x is 2.2 standard deviation below the company’s historical 2-year average of 32.2x. But the current discount is not justified, in my opinion. adidas financials are very solid, and I argue adidas is well positioned to benefit from strong structural tailwinds such as the global consumer’s quest for healthier lifestyles and the casualization of sportswear. I conclude my article with a confident buy recommendation and a base-case target price of $246.40/share.

Be the first to comment