halbergman

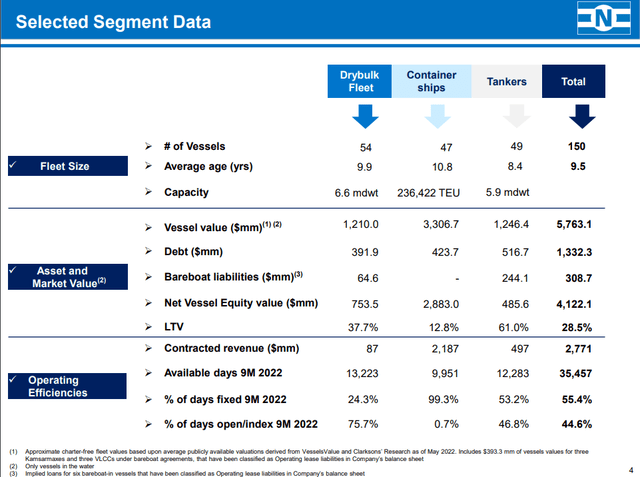

Navios Maritime Partners L.P. (NYSE:NMM) owns 54 dry bulk vessels, 47 containership vessels and 49 tanker vessels. At $20.55 it seems like a bargain to me. At this price, its market cap comes to $633 million, although the enterprise value is more like $2.1 billion because it has a lot of debt. That’s not unusual in shipping. Companies have a lot of hard assets to use as collateral. Their fleet is on the young side of things. The average ship in their fleet is less than 10 years old.

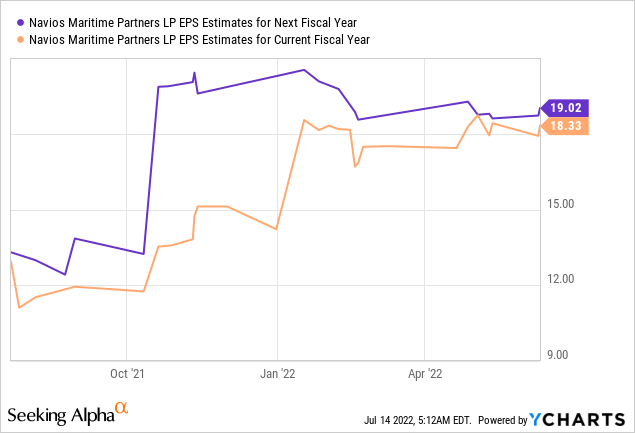

Just in the first quarter, Navios hit revenue of $236.6 million, EBITDA of $126.1 million, and a net income of $85.7 million or $2.78 per common unit. If you look at the analyst estimates, they are something like $18/share for this year and $19 per share for next year. Kind of a headscratcher, if you remember, the shares go for ~$20 each.

The issue seems to be here that NMM isn’t returning a lot of money to shareholders directly through buybacks or a high dividend. In addition, the company has a major debt load and the market has lately started to up the odds of a recession hitting in ’22 or ’23. I’m under the impression a lot of market participants believe shipping is enjoying peak earnings currently. They want to see big payouts to shareholders and don’t like companies reinvesting operating profits to buy more steel at “peak prices.”

Another reason the company may have come under some pressure is that quite a large portion of its borrowings is in the form of credit facilities. In the recent 6-K, it said the following about its credit facilities:

Credit Facilities

As of March 31, 2022, the Company had secured credit facilities with various banks with a total outstanding balance of $801,699. The purpose of the facilities was to finance the acquisition of vessels or refinance existing indebtedness. All of the facilities are denominated in U.S. dollars and bear interest rate (as defined in the loan agreement) plus spread ranging from 225 bps to 350 bps, per annum. The facilities are repayable in either semi-annual or quarterly installments, followed by balloon payments with maturities, ranging from the first quarter of 2023 to the first quarter of 2027. See also the maturity table included below.

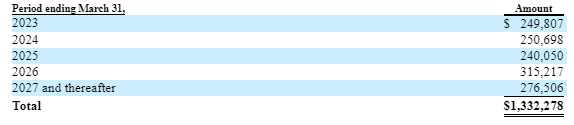

The maturity profile looks like this:

NMM 6-K (NMM)

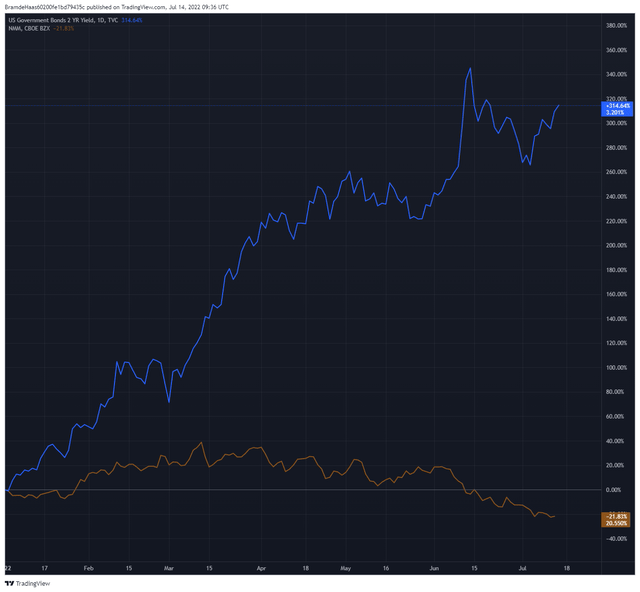

The chart below shows the 2-year has been on a tear this year. The 2-year rate is very sensitive to the Fed funds rate. It’s been going up because the market is pricing in more interest rate hikes by the Fed. At first, NMM could handle those increases. I think this coincided with a very strong market for containers and a boost for bulkers due to the Russian invasion of Ukraine. But as the Fed has been getting more serious and fears for the economy increase; the stock can’t withstand these interest rate hikes. If all your debt is a fixed rate, interest rate hikes and high inflation are really great. If your interest rate gets adjusted… that’s not as great. The debt load at NMM is very large relative to market cap and/or liquidity. Under the wrong circumstances, think stagflation, the company could be put in an awkward situation.

2 year yield vs NMM share price (Tradingview.com)

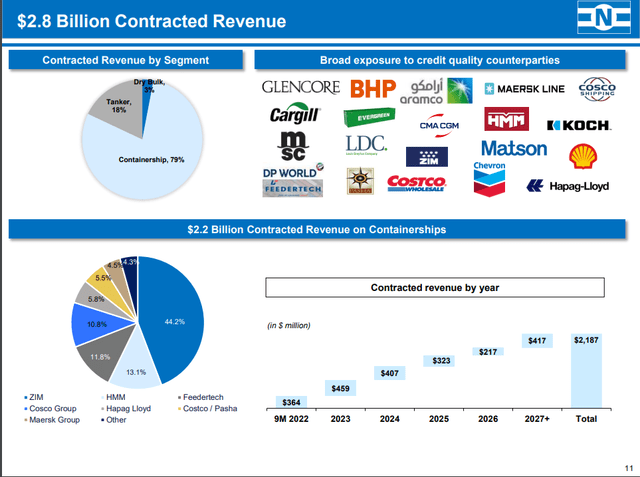

EPS may come in below analyst estimates because of higher than anticipated interest rates and/or lower revenue. However, they shouldn’t come in that much below analyst expectations. Shipping rates are notoriously volatile. But NMM has locked in a fair bit of cash flow. NMM has $2.8 billion in contracted revenue out to 2027 (see the slide below, taken from the most recent NMM deck). Most of that contracted revenue is in the container space. As far as I know, it’s much more common to sign longer-term charters in the container space. In bulk and tanker, I remember mostly seeing charters going out 2 years or so.

Last earnings call the company indicated it’s making $70 million in contracted revenue in excess of cash expenses for 2022 and that’s before considering ~15k days of open/index days (something like 3/4 is in dry bulk).

A great way to determine value in shipping is to look at the value of the fleet. NMM included a nice slide in its most recent presentation. The vessel’s values are a bit dated but based on VesselsValue and Clarksons research data. Total vessel value in May 2022 came out to $5.7 billion vs an enterprise value of $2.1 billion for the company.

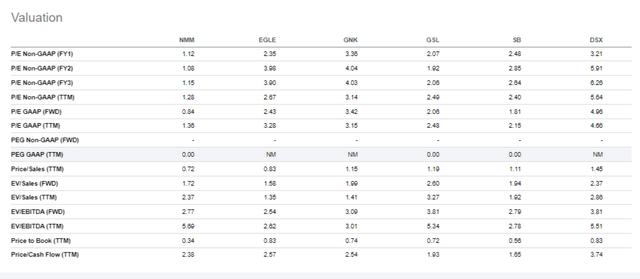

It is also interesting to look around what valuations look like across the industry. I pulled valuations from Seeking Alpha data for Eagle Bulk Shipping (EGLE), Genco Shipping (GNK), Global Ship Lease (GSL), Scorpio Bulkers and Diana Shipping (DSX).

Shipping valuation data (SeekingAlpha.com)

I especially like to look at EV/EBITDA, EV/sales and Price to Book ratios with shipping companies. NMM looks very attractive relative to this set of competitors on most metrics, including the ones I favor. Also, how many things trade at a forward GAAP P/E of 0.84x. The market seems to expect some disappointments (which I don’t disagree with). At the end of the day, the pessimism seems a bit overdone.

Conclusion

There are alternatives in shipping where investors get a lot more free cash flow thrown at them. Either through rich buyback programs, dividends or special dividends. This isn’t one of those. The company thinks it is better to be safe and wants to pursue opportunistic acquisitions. Investors generally are skeptical of management’s ability to allocate capital in a value-added way. Under the wrong circumstances, skyrocketing interest rates and diving shipping rates, NMM’s extremely favorable fundamentals could quickly deteriorate.

In my opinion, the market is ultimately down too much on this stock. It trades at an over 50% discount to net asset value. Analyst estimates suggest it trades at a forward P/E of 1x. Not all of its admittedly cyclical revenue can disappear because it locked in billions of revenue until 2027.

I’m happy to buy this in small quantities as I’m willing to sit on it for a couple of years. At some point, capital allocation policies could change and/or the market could become slightly less pessimistic and that should allow for a decent re-rate in multiples.

Be the first to comment