Stefan Rotter

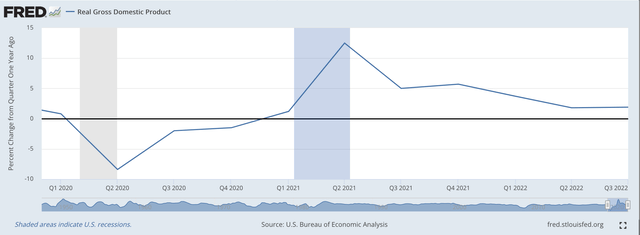

Well, the growth in the real GDP for the United States, in the third quarter, came in, year-over-year, at just 1.9 percent.

This is up from a revised rise of 1.8 percent in the second quarter.

In all of 2021, real GDP rose by 5.7 percent from December 2019 to December 2020.

Real Gross Domestic Product (Federal Reserve)

The economy is growing, but the rate of increase is very modest.

And, with the Federal Reserve conducting a “tight” monetary policy with the year-over-year rate of growth of the M2 money stock measure growing just above 1.0 percent, the prospects for the growth rate of the economy accelerating in the near future seems highly tenuous.

Recession ahead?

Term Structure Of Interest Rates

Recession ahead?

Well, the term structure of interest rates has been inverted for most of the year.

An inverted term structure yield curve is usually followed by an economic recession.

According to Sam Goldfarb, writing in The Wall Street Journal,

“Yield on longer-term U.S. Treasuries have fallen below those on the short-term than at any time in decades….”

This past week, the yield on the 10-year U.S. Treasury note was 0.78 percent, or, 78 basis points, below the yield on the 2-year U.S. Treasury note.

This large a gap has not been seen since 1981.

The prognosis: inflation is going to come down.

But, will there be an economic recession that will result in the lower interest rates and the return to a positive yield curve?

Analysts, of course, are building up all kinds of stories about what the inverted yield curve means at this time.

Many analysts are looking for a Federal Reserve pivot from their current path of monetary tightening.

To me, many of these efforts to support a pivot move by the Fed are on the wrong track and are just efforts to support their wish of what they would like the Fed to do.

To me, the Fed is in this battle against inflation to win and, consequently, they are operating in a way that results in an inverted yield curve, one that does predict a recession is coming in the near future.

Previous Period Of Expansion

The basic results pertaining to economic growth in the U.S. presented in the chart above, indicate that the U.S. economy is experiencing only modest economic growth. The economy is just not growing very rapidly, even with all the stimulus that has been provided over the last year or so.

As I have reported, for example, the M2 money stock grew by about 25.0 percent in 2020, and it grew by about 12.5 percent in 2021.

The velocity of circulation of the M2 money stock has collapsed during this time period and has remained very low.

Stimulus money seems to be going into financial assets, not into the real purchase of goods and services.

Even all the deficits created by the federal government have not been able to create more growth for the economy.

This, as is well known, is not that different from the economic growth records from the period of economic expansion following the Great Recession.

For most of the 10 years or so, of the economic expansion following the Great Recession, the U.S. economy grew by only a compound rate of about 2.3 percent.

Not very impressive.

It would not be surprising to me to see the U.S. economy go into a recession, beginning in the fourth quarter of 2022. I certainly expect a recession to take place in 2023.

And, I expect the recession to be a relatively painful one.

Going Forward

The U.S. economy is in a substantial state of disequilibrium at the present time, and not all of the disjointedness has been the fault of the Covid-19 pandemic.

To me, the Federal Reserve created in the 2020-21 period a major “asset bubble” that has distorted a lot of what is going on in the economy.

I have written a lot recently about how this Federal Reserve action has contributed to the bubble that has taken place in the cryptocurrency space in the world, and how this disequilibrium is just waiting to unravel and create more chaos.

The Fed contributed to the buildup of this situation. The Fed will have to oversee, as best it can, the unraveling of this situation.

The economic structure is not strong. The financial structure supporting the economic structure is very fragile. And, the policymakers face a real challenge.

I expect economic growth in the U.S. will be negative in 2023.

How weak the growth turns out to be will depend upon how the “financial mess” is handled.

Be the first to comment