Alan_Lagadu/E+ via Getty Images

Although it may sound morbid to say, the death care space is a particularly interesting area for investors to explore. In a world where the population continues to grow, the demand for these services is also destined to grow. And one of the few companies that operate in this space that investors should be paying attention to is Carriage Services (NYSE:CSV). In recent years, the company has exhibited steady growth on both its top and bottom lines. This includes its cash flow. In addition to that, shares of the enterprise are attractively priced, especially on a forward basis. They are also trading near the low end of the scale compared to similar firms. On the whole, this leads me to rate the enterprise a solid ‘buy’ at this time.

Monetizing the Grim Reaper

According to the management team at Carriage Services, the company operates as a leading provider of funeral and cemetery services and merchandise in the US. As of the end of its 2021 fiscal year, the enterprise operated 170 funeral homes across 26 states. It also had 31 cemeteries spread across 11 states under its belt. During that year, 70% of the company’s revenue came from its largest segment. This is the Funeral Home Operations segment which, as you might imagine, generates revenue from sales of burial and Cremation Services, as well as related merchandise like caskets and urns. Services also include consultation, the removal and preparation of remains, the use of Funeral Home facilities for visitation and memorial services, and related transportation services. Customers have the ability to pay for services on an ‘at-need’ basis, which basically refers to services paid for abruptly upon time of death. Or they can engage the company on a ‘pre-need’ basis, which involves planning ahead for one’s demise. The other segment of the company is referred to as Cemetery Operations. It generates revenue from the sale of cemetery interment rights, as well as of related cemetery merchandise and services. Like the Funeral Home Operations segment, it also engages in both ‘at-need’ and ‘pre-need’ services and, on the whole, the segment accounts for about 30% of the firm’s revenue.

There are other aspects to this company that deserve consideration. Perhaps the most significant would involve the trust funds that the company operates. Pursuant to state laws, the ‘pre-need’ sales the company engages in require deposits that are then made to a trust or purchase of a third-party insurance product. The company ultimately invests these proceeds and various investment securities, generating a return on them. And they also get to realize the amount paid to them as revenue once the services underlying the deposits are completed. As of the end of the company’s 2021 fiscal year, these trusts accounted for $214.6 million in all. Separate from this, but also an important part of the company, are the perpetual care trust investments the company makes. These represent a portion of the proceeds from certain revenue-generating activities the company engages in, with the income earned from the investments in question offsetting maintenance expenses for cemetery properties and memorials.

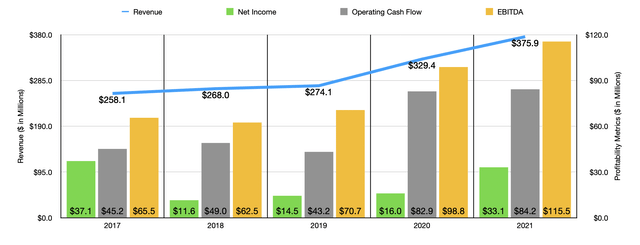

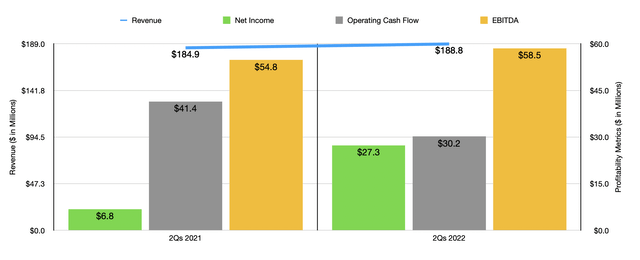

Carriage Services has performed exceptionally well over the past few years. Between 2017 and 2021, revenue expanded consistently, climbing from $258.1 million to $375.9 million. This growth has continued into this year. In the first half of the year, revenue came in at $188.8 million. That’s a modest increase compared to the $184.9 million generated the same time last year. The company’s cemetery operations reported only a slight decline in sales, dropping from $53.3 million to $52.5 million. Funeral home operations, meanwhile, actually increased for the company. Sales here jumped from $131.6 million to $136.3 million. The total contract volume handled by the company increased modestly, but the average revenue per contract, including pre-need funeral trust earnings, rose nicely. For same-store locations, this increase was only 1.1%, while for acquired properties the rise was 9.1%.

On the bottom line, the picture for the company has also generally improved. After seeing net income drop from $37.1 million in 2017 to $11.6 million in 2018, it then began a consistent incline, eventually hitting $33.1 million last year. Other profitability metrics have also followed suit. For instance, operating cash flow has risen from $45.2 million to $84.2 million over the past five years, while EBITDA has risen from $65.5 million to $115.5 million. Profitability continued to improve this year. Net income of $27.3 million dwarfed the $6.8 million achieved during the first half of 2021. Operating cash flow, on the other hand, fell from $41.4 million to $30.2 million. But EBITDA for the company increased, rising from $54.8 million to $58.5 million.

When it comes to the 2022 fiscal year as a whole, management does not really provide much guidance. Instead, they offer guidance based on a rolling four quarters. Right now, that implies revenue of $380 million to $390 million. Either way, that would imply some increase over what the company generated last year. Earnings per share should come in at between $2.85 and three dollars. At the midpoint, that should imply net income of roughly $43 million. Meanwhile, EBITDA for the company is expected to come in at between $115 million and $119 million. No guidance was given when it came to other profitability metrics. But if we assume that operating cash flow will increase at the same rate that EBITDA should, then we should anticipate a reading this year of $85.3 million.

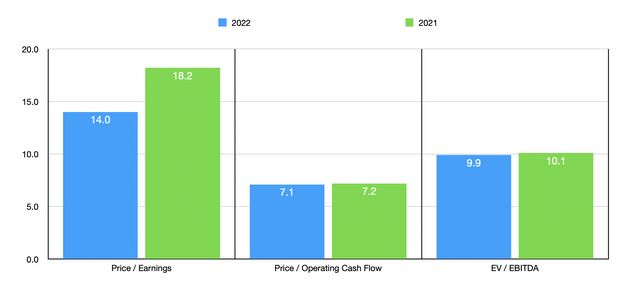

Using these numbers, we can calculate that the company is trading at a forward price-to-earnings multiple of 14. This compares to the 18.2 reading we get using 2021 results. The price to operating cash flow multiple should decline from 7.2 to 7.1, while the EV to EBITDA multiple should improve from 10.1 to 9.9. In addition to being cheap on an absolute basis, this is also cheap relative to some similar firms. As part of my analysis, I compared the company to five similar companies. Using the price-to-earnings approach, only two of the five firms had positive readings, with their multiples being 1.1 and 17.1, respectively. Using the price to operating cash flow approach, the range is between 5.9 and 18.5. That’s based on three of the companies having positive results. And when it comes to the EV to EBITDA approach, the range for the five firms is between 8.4 and 37.8. In all three cases, only one of the companies was cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Carriage Services | 14.0 | 7.1 | 9.9 |

| Service Corporation International (SCI) | 1.1 | 11.8 | 10.2 |

| Matthews International (MATW) | N/A | 5.9 | 11.2 |

| Hillenbrand (HI) | 17.1 | 18.5 | 8.4 |

| StoneMor (STON) | N/A | N/A | 37.8 |

| Park Lawn (OTCPK:PRRWF) | N/A | N/A | 14.6 |

Takeaway

Carriage Services is, right now, an intriguing company with a nice track record. Long term, I have no reason to believe that the fundamentals for the business will worsen. Shares of the company are also trading at attractive levels, both on an absolute basis and relative to similar firms. All these things considered, I do believe that a ‘buy’ rating would be appropriate at this time.

Be the first to comment