gremlin

Investment Thesis

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) remains on our conviction buy list, given the extremely critical role it plays in the semiconductor world, particularly in the consumer electronics market of smartphones and computers. Apple (AAPL) alone has accounted for easily a quarter of TSM’s revenues, worth nearly $14.3B for the latter in 2021 while delivering over $191B worth of iPhones then.

Furthermore, as the world continues to be digitalized moving forward, we expect the demand for semiconductors to expand aggressively, especially in the IoT and automotive segments. The global digital transformation market is expected to grow from $608.7B in 2021 to $3.8T in 2030 at a CAGR of 23.1%. This will directly aid the growth of the global semiconductor market, which is expected to grow from $527.8B in 2021 to $1.3T in 2029 at a CAGR of 12.2%. As a result, investors will not go wrong investing in the vital manufacturer of these critical commodities for the coming decade.

A Real Military Escalation Is Unlikely To Happen

The recent Pelosi visit has triggered the usual Chinese firearms show around Taiwan. This is also not abnormal since they have been a regular everyday occurrence since 2020. Even Taiwanese residents were used to these incursions as there was minimal impact on their daily lives.

In addition, all parties involved are aware of the global implication of the speculative invasion, since TSM accounts for 54% of the global market share for the manufacturing of semiconductor chips. In contrast, the US accounts for only 7%, while China similarly reported a 7% market share for semiconductor manufacturing in 2021. Part of the reason why an invasion is unlikely in the intermediate term, is that China still consumes the bulk of the global demand for these chips at 60% in 2020, much of which is imported. Therefore, the event would undoubtedly trigger a domestic economic collapse worse than the two years during the height of the pandemic and its current Zero Covid Policy.

Despite both the US and China’s best efforts in ramping up their manufacturing capacity and technologies thus far, it is essential to note that TSM remains the leading and dominant player in the semiconductor industry. The US had famously passed the recent $56B Chips Act in an attempt to boost domestic research and production, to reduce its reliance on imported chips. In the meantime, the Chinese government plans to pour $1.4T of capital through 2025, to boost its self-sufficiency by up to 70% then. Thereby, providing Taiwan with the ‘global silicon shield’ for so long that the world and the two superpowers remain highly dependent on TSM for its semiconductor chips for the next few years.

The recent Pelosi visit had only strengthened our conviction that TSM remains safe for now, given the aggressive show of support from the US government to Taiwan now. Martijn Rasser, a former senior intelligence officer at the US Central Intelligence Agency, said:

The big concern in Washington is the possibility of Beijing gaining control of Taiwan’s semiconductor capacity. It would be a devastating blow for the American economy and the ability of the U.S. military to field its (weapon) platforms. (Reuters)

Of course, if the invasion were to really occur, the whole stock market would crash anyway since TSM’s chip factories and global supply chain would be rendered inoperable for a long time. Most companies would be directly affected by the event, triggering a massive market-wide plunge at that time. So, the impact is definitely not just on TSM then. Only time will tell if it is only a bark, or a real bite.

TSM Continues To Outperform Consensus Estimates

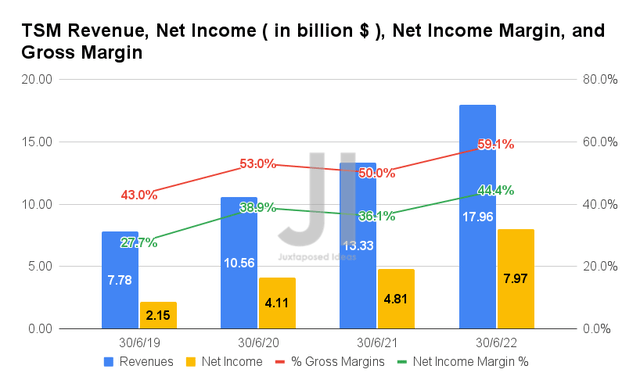

In FQ2’22, TSM reported stellar revenues of $17.96B and gross margins of 59.1%, representing YoY growth of 34.7% and 9.1 percentage points, despite the rising inflation on raw materials and natural resources. Thereby, indicating the company’s excellent mastery of the semiconductor global supply chain. In addition, TSM continues to break records with net incomes of $7.97B and net income margins of 44.4% in FQ2’22, representing a remarkable increase of 65.6% and 8.3 percentage points YoY, respectively. Thereby, indicating robust consumer demand despite the company passing on higher costs down the line.

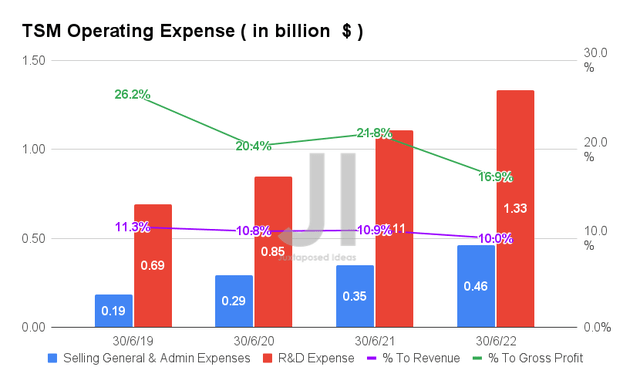

The rising costs are also evident in TSM’s operating expenses of $1.79B in FQ2’22, representing a notable increase of 22.6% YoY. However, it is also apparent that the ratio to its growing sales has been moderating thus far, accounting for only 10% of its revenue and 16.9% of its gross margins in the latest quarter. It is a notable difference from pre-pandemic levels of 11.3% and 26.2% in FQ2’19, respectively.

In addition, we must also note the importance of TSM’s continued investments in its R&D at $1.33B in FQ2’22, accounting for 7.4% of its revenue then. These would help the company maintain its leading edge in the highly competitive semiconductor market, since it continues to command the lion’s share at 53.6% in FQ2’22, compared to the second place, Samsung (OTCPK:SSNLF) at 16.3%.

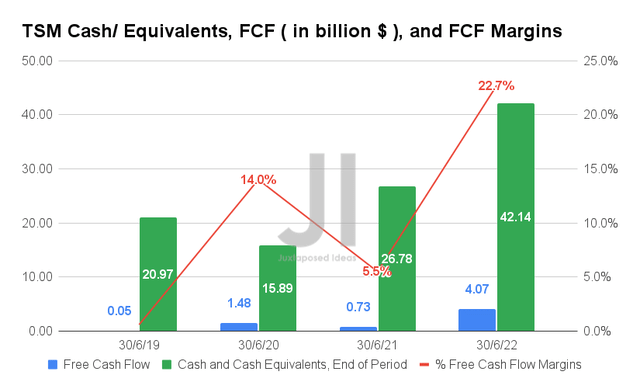

Therefore, we are not surprised by TSM’s improved Free Cash Flow (FCF) generation thus far, with an FCF of $4.07B and an FCF margin of 22.7% reported in FQ2’22. Needless to say, it represents an immense improvement from FQ2’21 levels of $0.73B and 5.5%, or FQ2’19 levels of 0.05B and 0.6%, respectively. The fact that TSM generated $16.9B of FCF in the last twelve months (LTM) had definitely helped the company grow a monumental cash and equivalents of $42.14B on its balance sheet, strategically unlocking a sustainable runway for long-term growth over the next decade.

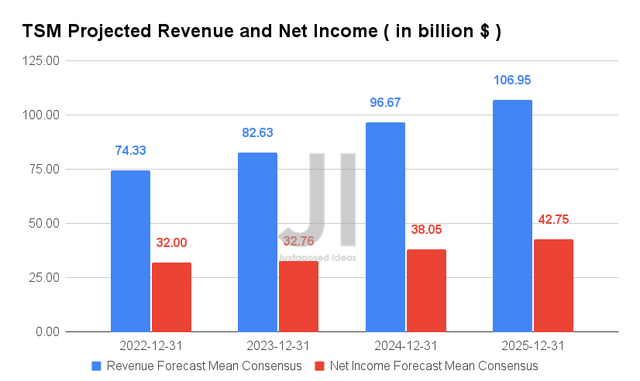

Over the next four years, TSM is expected to report excellent revenue and net income growth at a CAGR of 16.92% and 18.75%, respectively. These numbers represent a notable upgrade of 2.4% from previous consensus estimates in May 2022, indicating the market’s considerable optimism for the semiconductor market ahead despite the recent perceived destruction of demand and political issues. In addition, its net income margins will continue improving, from 32.3% in FY2019, to 37.6% in FY2021, and finally to a projected 39.9% by FY2025.

For FY2022, consensus estimates also upgraded TSM’s projected revenue by 5.9% to $74.33B and net income by 11% to $32B since our previous analysis in May 2022. It will represent a remarkable increase of 29.8% and 48.8% YoY, respectively. There is no wonder that the stock had experienced a notable recovery of 19% to $89.95 at the time of writing, since hitting the bottom at $75.56 on 6 July 2022 and its FQ2’22 earnings call on 14 July 2022. Despite the FUDs on the speculative Taiwan invasion, we expect continued strength ahead for TSM’s stock performance, given its exemplary performance ahead.

In the meantime, we encourage you to read our previous article on TSM, which would help you better understand its position and market opportunities.

- Taiwan Semiconductor: On 37% Sale – Own One Of The World’s Most Important Companies

So, Is TSM Stock A Buy, Sell, or Hold?

TSM 5Y EV/Revenue and P/E Valuations

TSM is currently trading at an EV/NTM Revenue of 5.52x and NTM P/E of 13.85x, lower than its 5Y mean of 6.67x and 19.72x, respectively. The stock is also trading at $89.95, down 37.9% from its 52 weeks high of $145, though at a premium of 21.8% from its 52 weeks low of $73.82.

TSM 5Y Stock Price

Even consensus estimates remain bullish about TSM’s potential, given their price target of $136.28 and a 51.5% upside from current prices. Due to its current monopoly, the insatiable demand for semiconductor chips, its growing production capacity, and its mastery of the global supply chains, there is no reason to doubt TSM’s stock potential moving forward. In addition, we would like to remind investors that Apple, Advanced Micro Devices (AMD), and Nvidia (NVDA) remain and will continue to be TSM’s most significant customers through the next decade. Of course, investors who remain skeptical should avoid the stock, given the political risk and potential volatility.

Therefore, given the above reasons, TSM remains a resounding Buy for us.

Be the first to comment