onurdongel/iStock via Getty Images

Temperature has a significant impact on our daily lives. This is true not only outside, but also inside. One company dedicated to providing the goods and services needed to properly heat, cool, and ventilate residential and commercial properties alike, is Carrier Global Corporation (NYSE:CARR). The firm also provides fire and security products to its customers as well, such as portable fire extinguishers, fire alarms, and more. Recently, the market has been rather volatile, but shares of Carrier Global have held up relatively well by comparison. This comes even at a time when revenue is falling and as cash flow figures are following suit. When you dig deeper into the numbers, however, you understand why the firm has not been punished all that much. And when factoring in how cheap shares are now, I do think that it makes sense to increase the rating on the firm from a ‘hold’ to a ‘buy’.

Hot and cool

Back in April of this year, I wrote an article that took a rather neutral stance on Carrier Global. I talked in that article about the company’s mixed financial performance, but ultimately concluded that the picture was fundamentally positive. I came to realize that the company would very likely continue to generate value for its investors for the foreseeable future. But given how shares were priced, my conclusion was that the stock was more or less fairly valued, leading me to rate it a ‘hold’, to reflect my opinion that it would likely generate returns that more or less match the broader market for the foreseeable future. Since then, the company has held up slightly better than expected compared to the market. While the S&P 500 is down by 15.7%, shares of Carrier Global have generated a loss of 9.7%.

What’s really interesting is that, during these difficult times, investors are more likely to punish the shares of companies that report any weakening in financial performance. Having said that, the opposite here appears true. Although Carrier Global has experienced a decline in price, that decline has been fairly small when you factor in how the company has performed on both the top line and when it comes to cash flow. To see what I mean, we should first touch on the firm’s revenue in the latest quarter. This is the only quarter for which data is available that was not available when I last wrote about the enterprise.

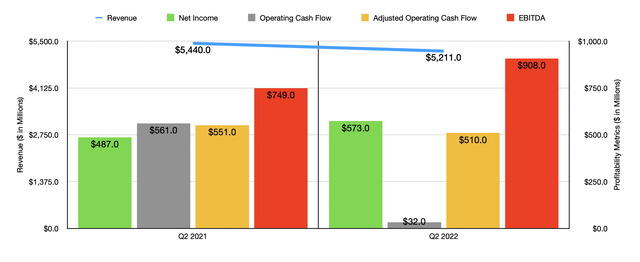

During the second quarter of the company’s 2022 fiscal year, sales came in at $5.21 billion. This is down by 4.2% compared to the $5.44 billion generated the same quarter one year earlier. It’s important, of course, to dig deeper to truly understand what’s going on. For instance, during the quarter, organic revenue at the company actually expanded by 7%. The decline, then, came from a 3% hit caused by foreign currency fluctuations, and because of an 8% hit caused by asset divestitures. Breaking it up further by segment, we can see that the company actually had strength in its largest segment, also known as HVAC. Revenue there expanded by 8.6%, driven by an 8% rise in organic revenue and a 2% rise caused by the net impact caused from acquisitions and divestitures. Foreign currency fluctuations did hit revenue to the tune of 1% in this segment. The Refrigeration segment also grew, with revenue climbing by nearly 2% thanks to a 9% organic increase that was largely offset by a 7% hit caused by foreign currency fluctuations. The real pain, then, came from the Fire & Security segment, with revenue plunging by roughly 37%. Although the segment experienced organic revenue growth of 3%, foreign currency translation hit sales to the tune of 2%, while the company suffered from a 38% decline associated with the $3.1 billion sale of the company’s Chubb unit.

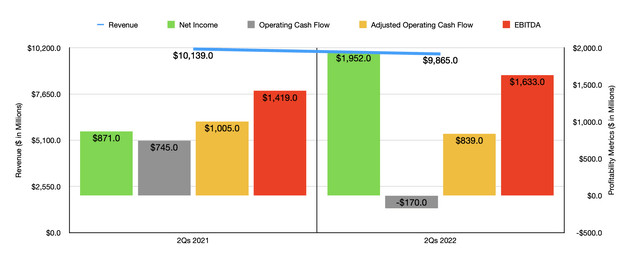

On the bottom line, Carrier Global experienced some mixed results. Net income, for instance, rose from $487 million in the second quarter of the 2021 fiscal year to $573 million the same time this year. Although this rise in profitability is nice to see, operating cash flow at the enterprise dropped from $561 million in the first quarter of 2021 to $32 million the same time this year. This drop is not as painful if we adjust for changes in working capital, making the metric fall from $551 million to $510 million. Meanwhile, EBITDA for the business actually improved, rising from $749 million to $908 million. When it comes to the first half of the 2022 fiscal year as a whole, results have been similarly mixed, with the impacts of the aforementioned divestiture muddying the waters.

When it comes to forecasting what the financial performance for the rest of the 2022 fiscal year will look like, we need to keep in mind not only the changes that were experienced in the first half of the year, but also other changes that the company is engaging in. For instance, at the end of July, the firm announced the completion of its purchase of the stake it did not already own in Toshiba Carrier Corporation in a $900 million deal that will bring in around $2 billion in annual revenue to the company. Fortunately for investors, management has been very clear about the impact that all of these changes should have for the current fiscal year. For instance, revenue in 2022 is now forecasted to be around $20.8 billion, driven largely by organic revenue rising at a high single-digit rate. Earnings per share should be around $2.25 to $2.35, with a midpoint placing net income at approximately $1.98 billion. No guidance was given when it came to other profitability metrics. But if we analyze the results seen so far for the year, we would get adjusted operating cash flow of $2.19 billion and EBITDA of $3.05 billion.

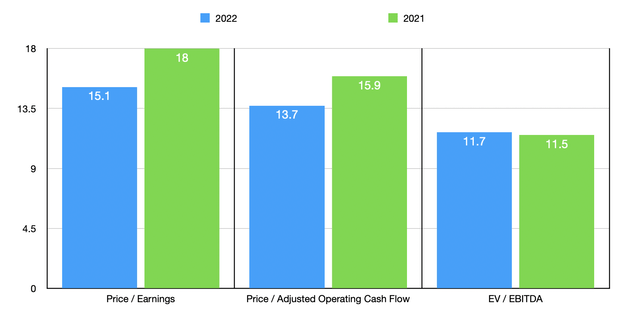

Using these figures, we can calculate that the company is trading at a forward price to earnings multiple of 15.1, at a price to adjusted operating cash flow multiple of 13.7, and at an EV to EBITDA multiple of 11.7. If, instead, we were to use the data from 2021, these multiples would be 18, 15.9, and 11.5, respectively. As part of my analysis, I decided to compare the data from the 2021 fiscal year to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 28.4 to a high of 42.9. On a price to operating cash flow approach, the range was between 18.9 and 31.3. And using the EV to EBITDA approach, the range would be between 17.4 and 21.6. In all three cases, Carrier Global was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Carrier Global Corporation | 18.0 | 15.9 | 11.5 |

| Trane Technologies (TT) | 34.4 | 30.8 | 21.6 |

| A. O. Smith Corporation (AOS) | 28.4 | 21.6 | 18.5 |

| Johnson Controls International (JCI) | 37.0 | 24.3 | 17.4 |

| Carlisle Companies (CSL) | 31.3 | 31.3 | 19.7 |

| Masco Corporation (MAS) | 42.9 | 18.9 | 19.9 |

Takeaway

Shares of Carrier Global look to be cheap compared to similar businesses. They also seem to be cheap on an absolute basis as well. I wouldn’t exactly call them deep-value territory by any means. By considering we are dealing with a quality company and when factoring in why revenue has declined as of late, it stands to reason that the market reacted appropriately by pushing shares down only modestly. Due to these factors, and the fact that shares have fallen recently, I have decided to increase my rating on the business from a ‘hold’ to a ‘buy’, reflecting my belief that is likely to continue to outperform the broader market for the foreseeable future.

Be the first to comment