Editor’s note: Seeking Alpha is proud to welcome Tian Li as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

pictore/iStock via Getty Images

The market and institutional investors have yet to realize Clairvest’s (OTCPK:CVTGF)(TSX:CVG:CA) intrinsic value – or even discover the company – giving us an incredible investment opportunity to potentially generate great returns without incurring great risks. In other words, “heads I win big, tails I don’t lose much.”

Note that all dollar figures are stated in CAD unless stated otherwise.

Introduction

Recently I read a book called “The Dhandho Investor,” by Mohnish Prabai, which gave me insight into Clairvest Group. Prabai says that risk is different from uncertainty. Risk is the chance of capital loss, while uncertainty is when outcomes are less predictable and more variable. Prabai says that low risk with high uncertainty, otherwise “heads I win, tails I don’t lose much” is a great investment strategy. Upon researching Clairvest, I believe the company offers the potential for excellent risk-adjusted returns.

Company Overview

Clairvest Group is a Canadian growth equity focused private equity management firm that partners with both emerging and established firms throughout multiple countries. The firm began investing in public and private companies in 1987, its founding date. Clairvest currently operates four private equity funds called Clairvest Equity Partners (CEP), with a combined AUM of over $3.2 billion and looks to invest in companies with an EBITDA between $10 million and $50 million. Clairvest makes the bulk of its money through the fair value appreciation of its investments as opposed to management fees.

The company currently holds a stake in 22 companies, split across five core industries. The company has a heavy stake in Gambling and Gaming, which makes up 45% of Clairvest’s investment portfolio, followed by Renewable Energy (14%), Information Technology (13%), Aviation and Defense (13%), Waste Management (8%), and Others (7%). Unlike many other PE firms, Clairvest’s investments are fairly concentrated because rather than heavily diversifying, management chooses to buy only the industries in which they have expertise.

Simplified Private Equity Industry Overview

Private equity firms typically operate by investing a small sum of their own money, but mostly that of limited partners (investors). PE firms generally earn the bulk of their revenues based on management fees, a base fee of usually 2%, then additional performance fees tied to returns generated that year.

In addition, there are three main styles of private equity investing, ranging from most risky to least risky. Venture capital is the riskiest, where investors provide capital to startup companies that are often unprofitable but have the potential for quick growth. Clairvest mostly participates in growth equity, which has medium risk. Growth equity investors generally invest in relatively mature companies that undergo some transformational change in profitability, revenues, or strategic value. The third and least risky investment tends to be leveraged buyout, where the private equity investor acquires another company with, yes, a lot of leverage.

Simplified Private Equity Outlook

Over the past decades, private equity has generated greater returns than public equities. I have a fairly positive outlook on the PE industry over the following years because of quick capital raising, all-time high dry powder, and cheap valuations. When public equity valuations are higher than private equities, the investor should examine the private markets.

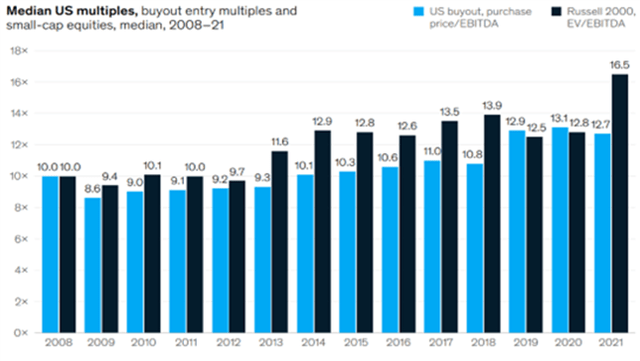

The chart below shows median U.S. multiples:

Median US multiples (McKinsey & Company)

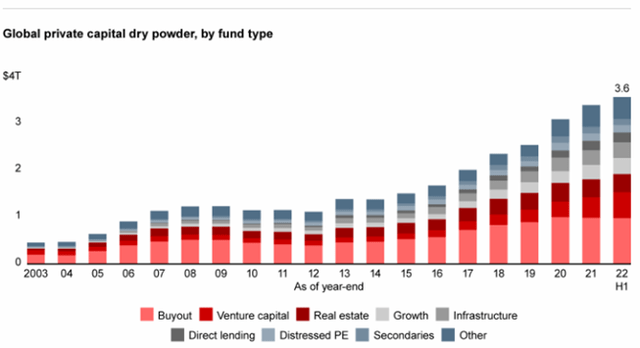

Dry powder is the excess cash reserve of PE funds. A rising level of dry powder means that investors have more money to invest, which can lead to higher bids/returns for investors.

The chart below shows global private capital dry powder, by fund type:

Global private capital dry powder, by fund type (Bain & Company)

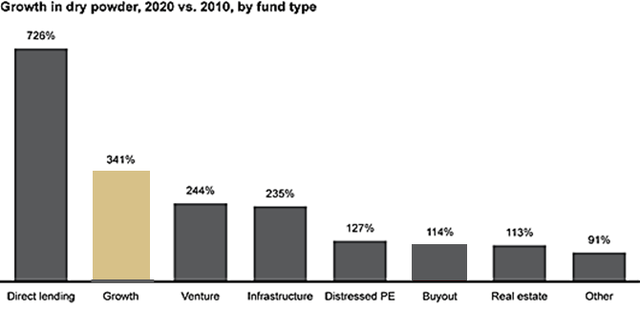

Dry powder growth has especially been strong in growth equity for the past decade.

The chart below shows growth in dry powder, by fund type (2010-20):

Growth in dry powder, 2020 vs. 2010, by fund type (Bain & Company)

With many recessionary fears, many worry if private equity is suitable for this macro environment. Interestingly enough, private equity has outperformed public equities in the past three recessions (2001, 2008, and 2020). In those three cases, PE valuations have generally fallen less, recovered earlier, and recovered to greater extents.

I believe that in the next decade private equity will likely perform as well as it has in the past decade, or potentially even better. Clairvest is positioned to sail the tides of the booming private equity industry.

Clairvest’s Differentiated Business Model

Conviction

Clairvest Group has more conviction in its investments than almost any PE firm. Typical private equity firms only hold 1%-3% of their own PE fund shares. These companies have almost no skin in the game, and most of their income comes from management fees. However, Clairvest holds 25%-30% of its PE fund shares (Clairvest Equity Partners). Clairvest also earns most of its money from unrealized investment gains – when the fair value of Clairvest’s investments appreciates. For the past five years, management fees made up only 2.4% of total revenue. Not only does Clairvest have a heavy investment in its funds, but Clairvest also directly invests a large portion of its money (frequently alongside CEP funds). Extreme conviction in Clairvest’s investments was likely the reason why Clairvest has generated exceptional returns, and that conviction continues to show.

Business Partnership Model

Many private equity firms seek to buy businesses, quickly restructure them, and flip them at a profit. Clairvest, however, seeks to partner with the business to create real long-term value. Clairvest seeks to partner with its acquired businesses rather than heavily reform them. Clairvest even allows the previous owners to retain a majority stake and continue running the business themselves. The partnership model gives Clairvest an advantage in employing and keeping talented business managers and receiving an acquisition discount (from emotional factors). Clairvest creates long-term value through building great businesses rather than “buy, strip, and flips” or financial engineering. Having a long-term and value-oriented view means that Clairvest will buy better businesses, employ better managers, and ultimately generate better returns for shareholders.

Exceptional Management Track Record

For the last 15 years, growth equity’s returns have been weaker than other PE strategies. Growth yielded a median net IRR of 13.1% since inception for fund vintages 2008-18, compared with 18.0 and 23.8 percent for buyout and VC, respectively. Despite the relatively weak performance of growth equity, Clairvest’s performance was stunning.

These are Clairvest’s results:

- Clairvest operated six private equity funds with a combined pooled IRR of 25%.

- Deals invested since 2006 have a weighted average MOIC of 5.1x, 52% IRR.

- Clairvest’s ROIC has rapidly grown in recent years. Clairvest’s historically lower ROIC reflects the firm’s very large cash balance.

- Clairvest operated with extremely high profit margins (usually around 65%).

- Compounded shareholder’s equity from 1996 to 2022 at 9.58% annually, while incrementally growing the company’s ROE.

Although past performance does not guarantee future outcomes, Clairvest’s exceptional track record can hint that management has consistently proven to be very skilled at deploying capital. And that, if extended into the future, will be extremely profitable.

Clairvest’s Incredible Safety Net

The central investment thesis of this article is to find a “heads I win, tails I don’t lose much” situation. I believe that Clairvest is perfectly positioned to prevent catastrophic losses because of its ability to always remain profitable and its impregnable balance sheet. Clairvest’s income stream has historically been very well positioned for times of boom and bust, only suffering one year of losses since 1996. The company’s balance sheet is also unbreakable. Clairvest’s cash and cash equivalents are almost as much as total liabilities. On top of that, Clairvest has extremely low financing expenses and barely any debt because the company has never excessively borrowed money – and uses very conservative leverage, if any, on acquisitions.

As per the Clairvest Group Q2 report (2022):

Clairvest Group Balance Sheet (Clairvest Group Quarterly Report)

Valuation

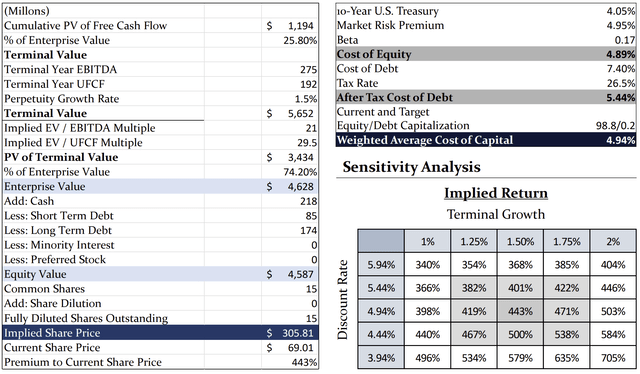

These valuations were created in mid-November, when CVG:CA was trading at $69.01. On Dec. 1, CVG:CA closed at roughly $73.25.

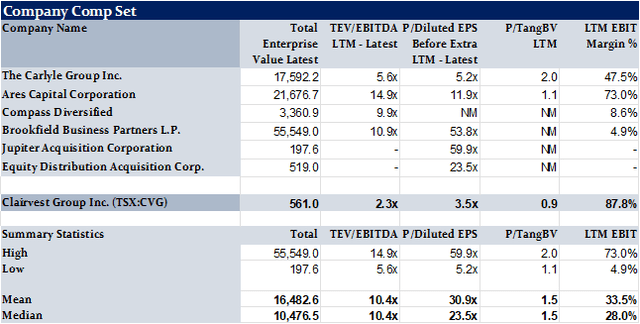

Comparable Valuation

Clairvest clearly trades at a discount relative to its peers. Despite Clairvest’s LTM net income unusually doubling from 2021, even if its EV/EBITDA or PE ratio doubled (CVG’s earnings returning to 2021 levels), the company would still trade cheaply compared to its peers.

Clairvest Group Comps (Tian Li, CapIQ)

Here is a summary of the statistics:

- The median diluted P/E ratio of these companies is 23.5x, while Clairvest’s is 3.52x.

- The median EV/EBITDA of comparable companies is 10.4x, compared to Clairvest’s 2.5x.

- Clairvest’s LTM EBIT margin of 87.8% compared to the median of only 28%.

- CVG trades at 0.9x tangible book value compared to the mean of 1.5x, but trades even cheaper to book value than stated since many comparable companies have negative TangBV.

- Clairvest’s revenue growth in past years has greatly exceeded that of the average comparable company.

A comps analysis is probably more appropriate than a “sum of the parts analysis” because most of Clairvest’s income comes from capital gains rather than earnings from individual holdings. Additionally, Clairvest’s holdings are highly subject to change, and its companies lack the publicly disclosed information required for individual valuation.

Clairvest trades at a much lower valuation than its peers. However, the cheaper valuation is most likely unjustified because Clairvest’s earnings and revenue growth rate exceed most of its peers. That gives us a potential bargain investment opportunity.

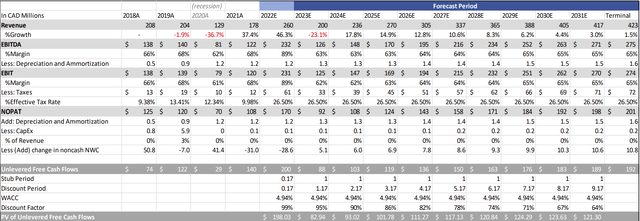

Discounted Cash Flow (With Assumptions)

- Total revenue projected is roughly 5% CAGR, conservatively lower than the forecast weighted average growth rate of Clairvest’s five core industries of 6.4%.

- Since 1996, the average effective tax rate has been 12.6%. But for conservatism, I will use 26.5% – the corporate tax rate.

- The average EBITDA margin was 63.5%, and the EBIT margin was 62.5%.

- The mean annual percent change in NWC is tied to revenue growth. The 2023 estimate starts from the average annual change of $5.1 million/year.

- Perpetual growth rate of 1.5%.

- Discount rate (weighted average cost of capital) of 4.94%. (I’m aware of are problems with WACC, but you can use another discount rate if preferred.)

Clairvest Group DCF Assumptions 1 (Tian Li)

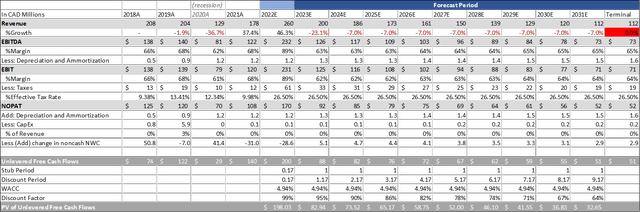

Calculation of share price, WACC, and sensitivity analysis:

Results

I found a similar story when I valued the company using comparable analysis – around a 400% upside with an implied share price of roughly $306. Using a conservative sensitivity analysis (raising the discount rate by 1% and lowering the terminal growth rate by 0.5%), Clairvest’s expected returns still amount to over 300% – or around $235 per share.

Using a Very Conservative Estimate – DCF

This time I used a 10-year DCF that projects revenue of $260 million for the current year (2022), -23% revenue growth for the next year (2023), -7% revenue growth for the following eight years, and a terminal growth rate of 0%.

Clairvest Group DCF Assumptions 2 (Tian Li)

Despite using such a conservative estimate, with negative revenue forecasts for the next 10 years (something investment bankers almost never do), the implied share price still sits at roughly $85, using the same calculation of share price. Even with such bearish forecasts, we still get a 16% implied return to our current share price of $73.25.

Risks/Uncertainties

The greatest uncertainty for Clairvest is the heavy reliance on management rather than moats. Due to the firm’s extreme reliance on management, Clairvest’s future performance has greater uncertainty. The quality of the purchase, management, and sale of each holding company is subject to Clairvest’s management. Poor management performance directly reduces Clairvest’s profitability – and the biggest risk is that our valuation could have overestimated management’s future investment performance.

Another potential worry is Clairvest’s high levels of non-cash earnings. Most of Clairvest’s earnings come from unrealized gains of fair value appreciation on investments. However, when the investments are sold, those unrealized gains are turned into cash, so the cash worry can mostly be eliminated.

Another risk that can impact Clairvest’s performance is the cyclical nature of Clairvest’s concentrated holding industries (gaming/gambling, renewable energy, IT, etc.). Additionally, interest rate fluctuations could reduce the fair value of Clairvest’s investments, and thus reduce Clairvest’s profitability. FX fluctuations (particularly a strong Canadian dollar) could also reduce the stated earnings of Clairvest’s foreign income because the company states financials in CAD.

In conventional value investing, it’s important to have a clear vision of what the future of a company looks like. That’s truly understanding a business. Unfortunately, what would potentially classify Clairvest as a risky investment would be the difficulty of predicting the company’s future.

The Catalyst

Clairvest Group is an uncertain business, but what makes it so interesting is its lack of market coverage/information. The company has an incredible ownership structure – both the extremely high amounts of insider ownership and extremely low levels of institutional ownership. Insiders own 66% of the company, and institutions only own 4% of the outstanding shares. Incredibly low levels of institutional ownership signal that this company either a) has not been discovered by institutional investors, or b) is entirely unattractive to institutional investors. I believe that b) is true because of all the reasons stated in this article.

Additionally, the CVG’s trading volume is extremely low, and the company’s bid-ask spread is extremely high. CVG’s three-month average trading volume is a sole 1700, which means that, on average, only 1700 shares are traded every day out of the 15,200,000 shares outstanding. Such a low trading volume creates an incredibly high (average) bid-ask spread of around $2, or almost 3% of the share price. These trading factors indicate that the market for CVG is likely inefficient, and there is room for improved price discovery.

Another important note is that the company is currently covered by zero analysts. The lack of any analyst coverage of Clairvest means that very few institutions even know of Clairvest Group. It is likely that institutions and analysts will realize Clairvest’s intrinsic value – and thus sharply push up the stock’s price.

Summary

CVG offers attractive growth potential, steady earnings, and a cheap valuation. Despite not having any moats, the company has a competitive advantage through its PE model, safety net, and management expertise. The heavy reliance on management, or the difficulty in predicting Clairvest’s future, is a risk. However, Clairvest is hedged with a healthy balance sheet and massive margin of safety, which reduces the likelihood and scale of potentially permanent capital loss.

Because the odds are so much in Clairvest’s favor, and investors are unlikely to lose big, I prefer to classify it as uncertainty – which also comes with investing in any actively managed fund. I would like to emphasize the importance of a big margin of safety in such an uncertain investment. The company is potentially so undervalued that even if Clairvest underperforms our base case expectations, we might still be profitable. The market and institutional investors have yet to realize Clairvest’s intrinsic value – or even discover the company – giving us an incredible investment opportunity.

Be the first to comment