MarsBars

Calavo Growers, Inc. (NASDAQ:CVGW) is an interesting consumer staple turnaround story. It capitalizes on strong ongoing consumer demand for avocados. With a new CEO and a turnaround strategy in place, there is a good chance Calavo can return to normalized profitability in the next few years. Investors have a rare opportunity to accumulate shares as the business was severely punished by temporary COVID-19 disruptions.

Introduction to Calavo

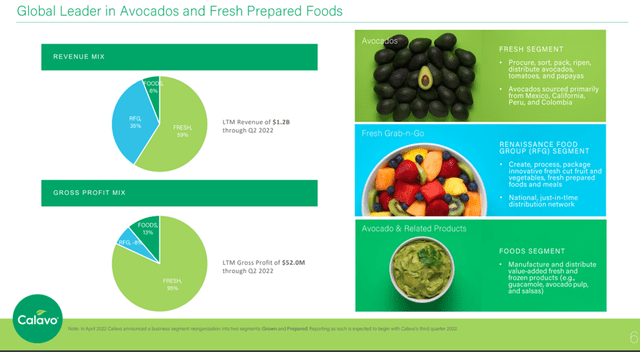

Calavo Growers was founded in 1924 as the California Avocado Growers’ Exchange to market the nascent avocado crops from California. After almost 8 decades as a growers’ cooperative, co-op members voted to take the company public in 2002. Today, Calavo is a leader in packaging and distributing avocados and other fresh fruits to grocery stores and restaurants. Through Renaissance Food Group, Calavo also processes and packages fresh cut fruit and vegetables. Figure 1 shows a revenue and gross margin breakdown for Calavo.

Figure 1 – Calavo revenue breakdown (Calavo investor presentation)

Avocado Is A Superfood With Fast Growth

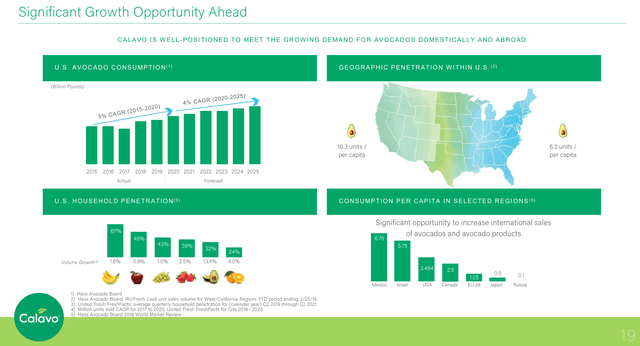

The avocado is widely considered a superfood as it is extremely nutrient dense; avocados contain over 20 vitamins, minerals, fiber, and phytonutrients. Consumer demand for avocados continue to increase as they become aware of avocados’ nutritional value, yet it is still underpenetrated relative to other fruits such as bananas and apples (Figure 2). US consumption of avocados have grown at a 5% CAGR from 2015 to 2020, and is forecast to grow at a 4% CAGR from 2021 to 2025.

Figure 2 – Consumer demand increasing for avocados (Calavo investor presentation)

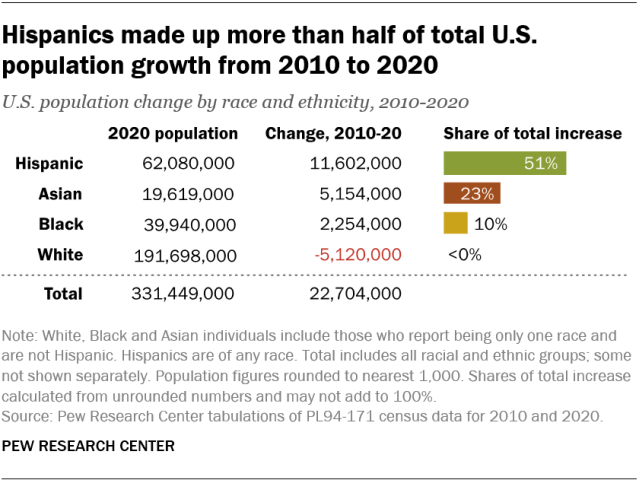

Another factor driving the continued growth of avocado consumption is demographics. I believe the consumption of avocados will continue to grow at a high rate beyond 2025, as it is a staple in Hispanic diets (think guacamole) and Hispanics are the fastest growing demographic in the US, growing 23% in the past decade versus 7% for the overall US population and contributing over 50% of the population growth in that time frame (Figure 3).

Figure 3 – Hispanics is the fastest growing demographic (Pew Research)

Calavo Stumbled During Covid

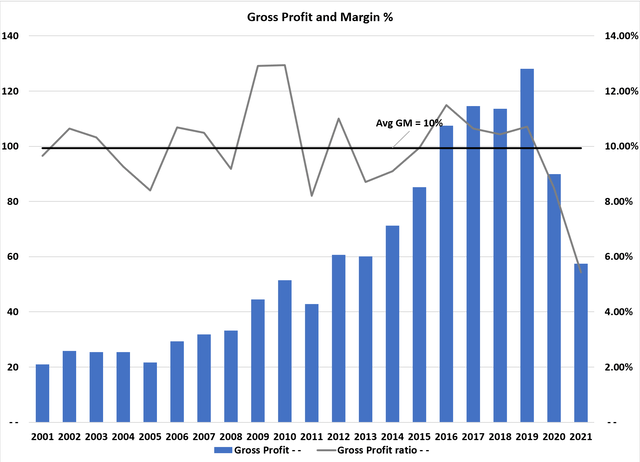

As with any commodity business, I usually begin my analysis by looking at the gross profit and gross margin. Calavo’s historical profits and margins are summarized in Figure 4.

Figure 4 – Calavo gross profit and margin (Author created with data from roic.ai)

Calavo has historically generated consistent gross margins of approximately 10%, as its core business is to provide packaging, marketing and distribution services to crop growers and passes through the avocado costs to consumers. However, from Figure 4, we can see Calavo’s business stumbled hard during the COVID-19 pandemic, with gross margin falling to 8.5% in 2020 and 5.4% in 2021. How did COVID-19 impact Calavo? The former CEO explained it as:

First, the strong supply of avocados from Mexico, California and Peru created an oversupply scenario in U.S. markets as demand was inhibited by the effects of the pandemic. Retail shopping habits changed as a result of the social restrictions. Our teams shifted product sets to capture new demand as the year progressed. The continued lockdown of the restaurant channel further diminished demand in the foodservice sector of the business. Margins in our Fresh segment were negatively impacted as the supply and demand imbalance weighed on pricing.

– Quote from James Gibson, former CEO, in 2020 Annual Report

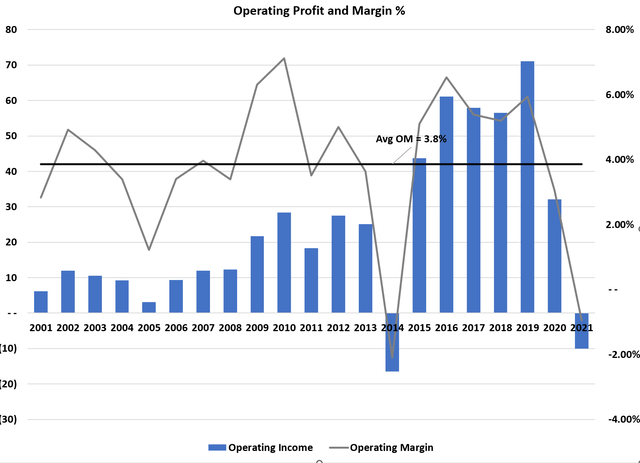

Operating margins likewise fell hard, with operating profit dipping negative in 2021, only the second time this has happened in the past 20 years (Figure 5).

Figure 5 – Calavo operating profit and margin (Author created with data from roic.ai)

Calavo’s business went through so much disruption and hardship that both the CFO and CEO left abruptly in June and September of 2021.

Turnaround Plan In Place – Uno, Dos, Tres, Vamos?

After an extensive search, Calavo named a new CEO, Brian Kocher, effective February 1, 2022. Mr. Kocher was formerly the CEO of Castellini Group of Companies, one of the largest distributors of fresh produce in the US. He has also held prior CFO and COO roles at Chiquita Brands, a leading distributor of bananas and other produce. Based on his resume, Mr. Kocher looks like an ideal candidate for the CEO role at Calavo.

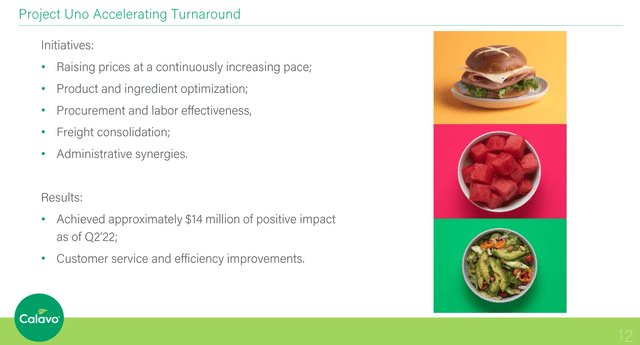

Along with a new CEO, Calavo also launched a restructuring and rebranding campaign called ‘Project Uno’ (Figure 6). The key initiatives of the turnaround plan is to fix the pricing of the fresh products while rationalizing and consolidating costs.

Figure 6 – Highlights of Calavo’s turnaround plan (Calavo investor presentation)

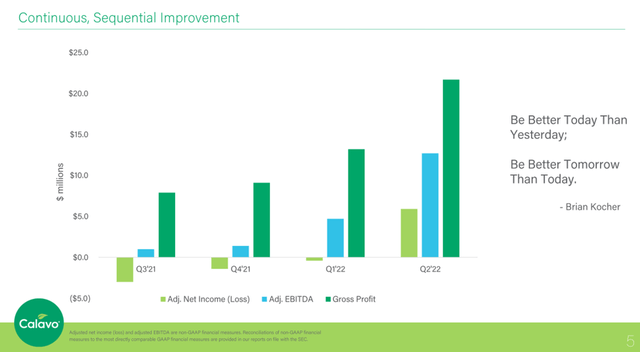

The turnaround strategy, combined with receding COVID-19 lockdowns, have started to show up in the financial reports with the company showing consecutive quarterly improvements in gross and operating margins. Encouragingly, gross margins bottomed at 2.8% in Q3/21 and have recovered to 6.6% in the most recent quarter (Figure 7).

Figure 7 – Calavo’s turnaround taking hold (Calavo investor presentation)

Valuation Is Attractive

What are Calavo shares worth? Assuming the business can recover to 10% gross margins by the next fiscal year and can keep operating expenses in check, I believe it’s possible Calavo can leverage the strong growth in consumer demand for avocados and return to, and/or exceed, peak profitability that was achieved in 2018/2019.

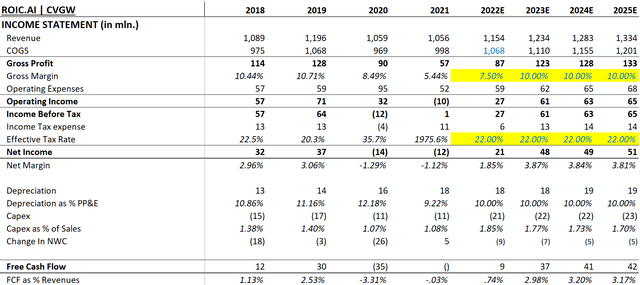

Figure 8 summarizes a forecast model I have created, which assumes avocado volumes (modeled by COGS) return to 2019 levels and grows at 4% p.a., while gross margin doesn’t recover until F2023. Core operating expenses are forecast to grow at 6% p.a. due to elevated rates of inflation, while depreciation and capex are set at 10% and 12% of net PP&E respectively.

Figure 8 – summary forecast model (Author created with data from roic.ai)

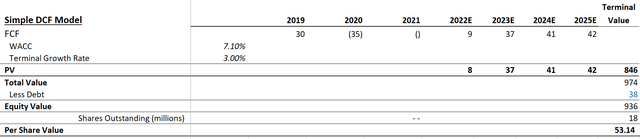

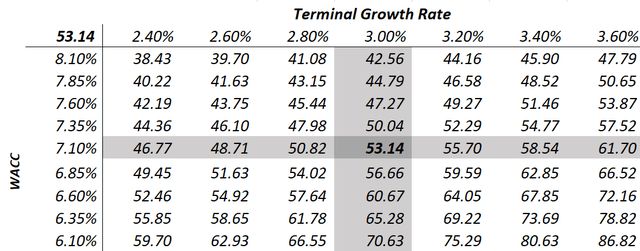

This simple forecast model generates a DCF value of $53 per share (Figure 9), a modest premium to the current price around $42. The key assumption is a WACC of 7.1% (8% cost of equity; 2% cost of bank debt), and a 3% terminal growth rate.

Figure 9 – Simple DCF forecast model (Author created)

I believe the assumptions in this model are not too aggressive. Varying the growth rates and WACC, I can derive values as high as $80 (Figure 10). For reference, Calavo has a 20, 10, and 5yr Revenue CAGR of 7.6%, 6.7%, and 2.4% respectively, inclusive of the COVID-19 impacted 2020 and 2021 figures. Not to mention the forecasted 4% growth rate in avocado consumption, as noted in Figure 2.

Figure 10 – DCF sensitivity to WACC and growth rate (Author created)

Another way to think about valuation is that prior to COVID-19, Calavo had been trading at a Price-to-Earnings ratio of between 32x to 58x (Figure 11). If Calavo can return to peak profitability of ~$2 a share, it is certainly possible that market valuations can re-rate the stock to above $60.

Figure 11 – Calavo P/E ratio from 2017 to 20219 (tikr.com)

Risk To The Calavo Turnaround Story

One risk with the Calavo turnaround story is that as the former CEO mentioned, there was an oversupply of avocados in 2020. If this oversupply persists, that could depress avocado selling prices and negatively impact Calavo’s gross margins.

Additionally, surging inflation can hurt Calavo’s cost containment strategy, particularly in fuel and labor costs that are a large part of Calavo’s operating expenses.

Finally, slowing economic growth could impact consumer demand, as avocados have cultivated a soft-luxury status (think $20 ‘avocado toast’). Consumers with pinched wallets may trade down to other lower priced fruits and vegetables.

Technical Analysis and Price Action

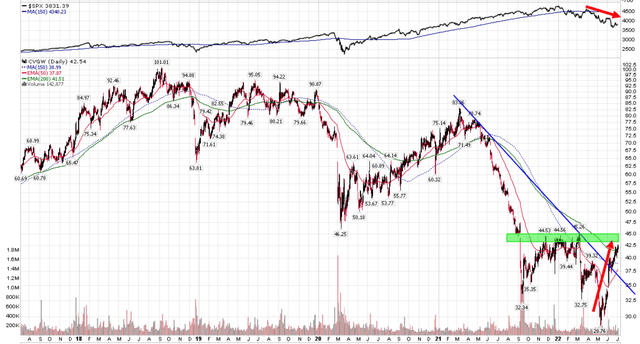

After peaking around $100 a share in 2018, Calavo has faced a couple of tough years due to the COVID-19 pandemic. As a result of poor operating results mentioned above, Calavo’s stock price plunged to a low of $29, or a fall of 70% from the peak (Figure 12). However, since Q2/2022 results were released, the stock price has recovered, showing relative strength relative to the market. It is facing resistance in the $43-$45 range. Clearing this resistance opens up for a further recovery.

Figure 12 – Calavo trying to form a bottom (author created with price chart from stockcharts.com)

Conclusion

Calavo Growers, Inc. is a steady growth consumer staples company that had fallen on hard times due to COVID-19 disruptions. As restaurants re-open and disruptions recede, there is a good chance Calavo can return to peak profitability, which should re-rate the stock much higher. Management has implemented a turnaround plan, and results are encouraging thus far. I would recommend investors accumulate shares at current depressed valuations.

Be the first to comment