Joe Raedle

Block, Inc. (NYSE:SQ), otherwise known as Square, is a leading Fintech company which was founded by Jack Dorsey, who also co-founded Twitter (TWTR). Dorsey stepped down as Twitter CEO in November 2021, and thus this now means he should have more time to focus on Block, which is a positive. Square Changed its name to “Block” in December 2021, which I personally believe (along with most of Wall Street) was both unnecessary and random. I believe Blockchain can play a part in the company’s business moving forward, as they aim to build the future of Fintech “Block by Block,” but a name change can cause also embarrassment. Given the hype/speculation/volatility around Bitcoin (BTC-USD), it’s back to “Square One” for Block given the recent Bitcoin decline decimated revenues and we are now in a “Crypto Winter.”

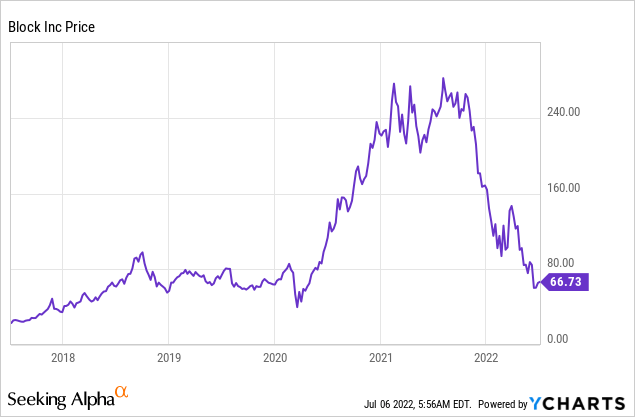

I highlighted in a previous post that the “Large concentration of Bitcoin trading volume which makes up Square’s total revenue is a major risk moving forward.” It looks as though my thesis is now playing out, as revenue is down 22% year over year, but without Bitcoin included it would be up 44%. Block’s share price is down an eye-watering 75% since the highs in August 2021, wiping out pretty much all pre-pandemic gains. The high-inflation, rising-interest-rate environment also hasn’t helped the situation and has caused a devaluation in the Growth stock sector.

The good news is Block still has a strong product offering, Jack Dorsey can now fully focus on the business and the long term secular tailwinds behind Fintech adoption is unchanged. The Global Fintech Market size is forecasted to grow at a blistering 19.8% CAGR and reach a value of $332 billion by 2028. Given the decline in stock price, Block is now undervalued intrinsically and relative to historic multiples. Let’s dive into the Business Model, Financials, and Valuation for the juicy details.

Ecosystem Business Model

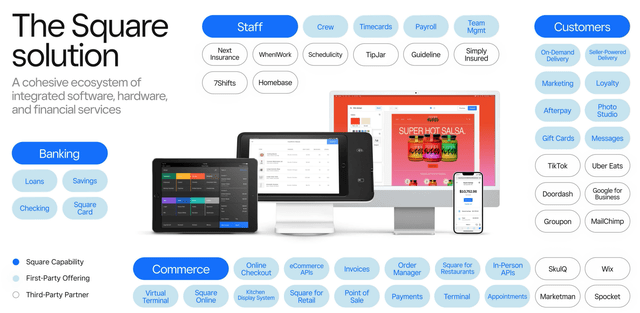

Block’s business model is based around two “Ecosystems” which I call the “Twin Engines” of the company. These include the Square Merchant Ecosystem and the Cash App. An Ecosystem of “remarkable products” enable easy Cross selling and Up-Selling to customers, which ultimately drives more transaction volume and can also help to lower customer acquisition costs. Let’s dive into each of these Ecosystems and what makes them so special.

1. Square Ecosystem

The Square Ecosystem is the most iconic part of Blocks business which focuses on helping small business merchants with their payments and financing. Square accomplishes this through it’s Point of Sale (POS) hardware, which it sells to merchants and then makes revenue from their transactions (~1.75%).

I noticed Squares hardware has a much better user interface than competitor products such as those from European giant Adyen (OTCPK:ADYEY, OTCPK:ADYYF), and similar to Zettle, which was acquired by PayPal (PYPL) in 2018. Its POS system has many features including; Secure Payments; Team Management; Cash Management; Marketing; Gift Cards; Loyalty programs; and even Website Store integrations. I personally love the customer relationship management (CRM) system, as it allows customer preferences to be tracked and offer’s tailored to them. For example, Merchants can see a customer’s Birthday and offer a “Birthday gift.”

Square POS Product (Investor Day Presentation 2022)

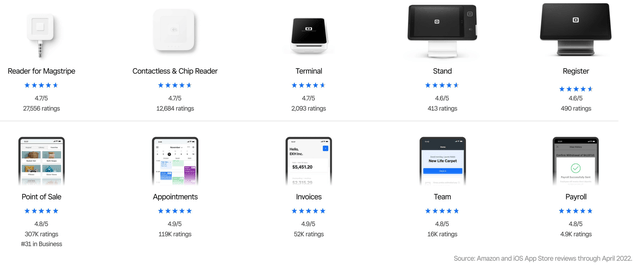

Square has built an API (application programming interface) which enables easy integrations with a variety of platforms. These include Social Media platforms such as Facebook, Instagram, and even TikTok which can all help to drive payment volume. The iOS App Store and Amazon reviews below show that many Square products are highly rated by customers.

Square Products (iOS and Amazon reviews)

In the first quarter of 2022, Block completed the acquisition of Buy Now Pay Later (“BNPL”) provider Afterpay, which it acquired for $29 billion. Square has rapidly integrated Afterpay via its API and this is now used by over 13,000 merchants in the US and Australia. This grew total active sellers for Afterpay by 10% to ~20 million globally, which shows some “synergies” from the acquisition are already starting to show up.

Square originally focused on small business payments before “growing up market” to larger businesses. For instance, in 2021 Square announced a substantial 10-year partnership with the SoFi Stadium to be the exclusive Point of Sale payments system for the home of the LA Rams and LA Chargers. With 917 stadiums in the U.S., this offers a significant market opportunity for expansion with a stable customer base.

Personally, I believe management should focus on this, as stable cash flows from Stadiums can help balance Bitcoin’s volatility. Although the vast majority of stadiums already have point of sale systems, Squares version offers rich data insights. This is a game changer for businesses as if you can measure it, you can manage and optimize it. For example, the system enables the tracking of best selling items to the busiest buying times, this allows optimization of inventory, staff and upsell promotions.

The company is also expanding internationally and have introduced Square Loans and On Demand Delivery in Canada. As Square collects all the transaction data for a business, it can use this to offer tailored credit offerings suitable to the businesses’ needs. While its On Demand Delivery System enables online merchant customers to choose third party delivery options and thus get cheaper prices.

2. Cash App Ecosystem

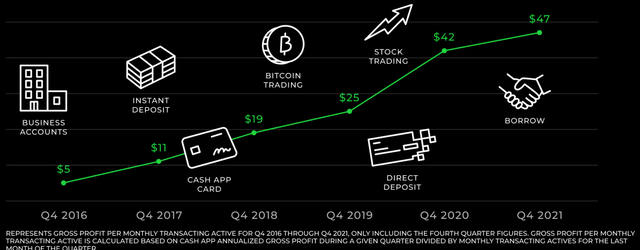

This Cash App Ecosystem is a mobile application which offers a one stop shop for financial services. The application has 45 million monthly active users and has been the number one finance app in the app store for the past 5 years. The platform started as an instant deposit and payments service in 2016 before expanding to Bitcoin Trading, Stock Trading and even lending. Historically, each time a new product feature has been added the gross profit per monthly active user has increased, this is the power of the “Ecosystem” model. In addition, the more products a user transacts with the more “sticky” the platform will become.

Cash App Growth (Investor Day Presentation 2022)

P2P (Peer to Peer Payments) can be instantly sent to other Cash App users via a “Cashtag” which is a unique identifier. This has been used by popular Social Media stars such as Kim Kardashian and Miley Cyrus in order to send Cash to fans. The Cash App even has an option for teens to get started with authorization from a Parent or Guardian. This opens up the Total Addressable Market (“TAM”) even more, as Banks are continuously trying to find ways to reach the younger demographic. Squares Cash App can then grow with the customer and offer more financial services to them in the future.

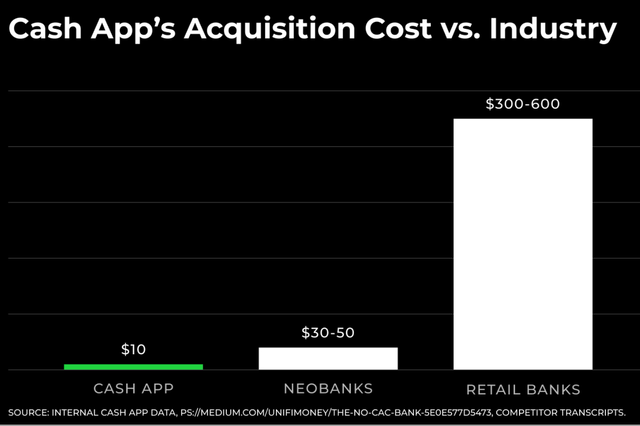

According to Blocks 2022 investor presentation, they have a Customer Acquisition Cost (CAC) of $10, which is lower than Neobanks, which have an average between $30 to $50. In addition, this is much lower than Retail banks, which have an eye-watering $300 to $600 acquisition cost. The low cost of customer acquisition indicates efficiency of the marketing spend and the viral effect of the platform.

Cash App Customer Acquisition cost (Investor Day Presentation 2022)

Scaling Internationally

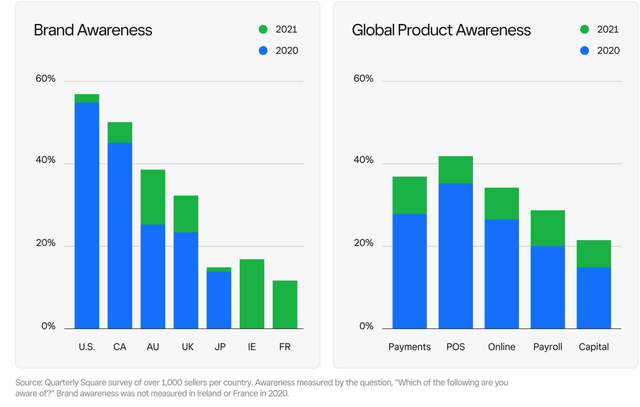

A high level strategy for growing a large business’ revenue generally only has a couple of options, new products or new markets. In this case Block is doing both. We covered the new products and features prior, now let’s dive into the internationally expansion plans. The company has increased its international investment into marketing substantially, which has increased Global Brand and Product Awareness vastly since 2020.

Brand Awareness (Investor Day Presentation 2022)

Emerging Initiatives

Block has many “Emerging Initiatives” which include Bitcoin Mining and Spiral. Spiral is a Bitcoin Developer focused company which according to sources, acts independently from Block. The sole goal of Spiral is to “enable Bitcoin to touch everything” and be a “useful everyday currency.” This business segment is in the early stages but does offer a low risk way of playing the crypto market.

Growing Financials

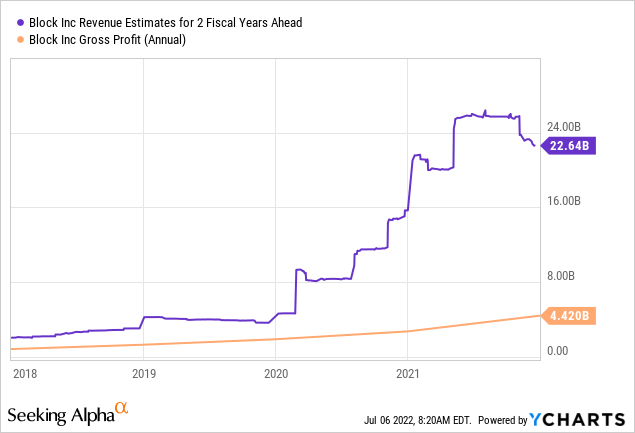

For the first quarter of 2022, Block generated net revenue of $3.96 billion which was down 22% compared to the prior year. As mentioned during the intro this was due to a decline in Bitcoin revenue, which I highlighted as a risk in a prior post. Excluding Bitcoin revenue, total net revenue actually jumped by a rapid 44% compared to the same period last year. The good news is as Bitcoin is a low margin part of Block’s business, the decline didn’t impact profitability substantially. Gross profit was $1.29 billion Q1, up a rapid 34% year over year and up 55% over the past two years.

The company’s results were driven by its “growing upmarket” strategy of targeting Mid-Market sellers with its “Square Savings” product. This segment saw a rapid 47% increase in gross profit. The Cash App Ecosystem generated $2.46 billion of revenue and $642 million of gross profit. Revenue decreased by an eye watering 36% (due to the aforementioned Bitcoin) but Gross profit was actually up by 26%. Afterpay contributed $65 million of revenue and $46 million of gross profit to Cash App Q122.

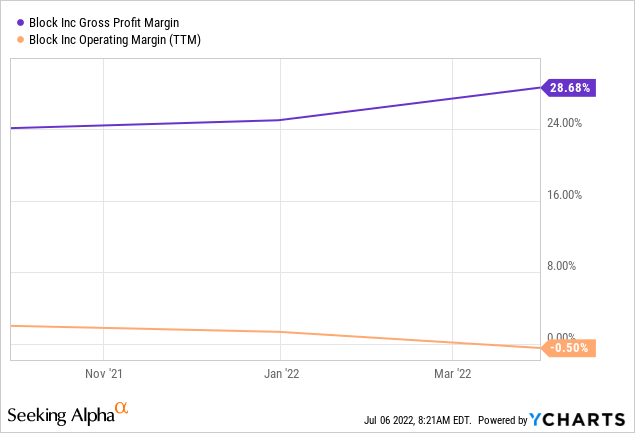

Block has a Gross margin of ~29%, which has steadily increased over the past year. However, the operating profit has slid back into negative territory with -$160.8 million produced in Q122. As a comparison, this loss was greater than the negative $54 million produced in Q421 and a major decline relative to the $87 million profit in Q121. The decline in operating profit was mainly driven by $1.52 billion in operating expenses, which represented a 70% surge year over year. This includes $42 million related to Afterpay and $66 million in stock based compensation. The good news is the Afterpay costs are a one off expense and thus this is not a major red flag, and I would expect to see margins improve in the upcoming quarters.

Block’s Balance sheet is in a stable position with $4.8 billion in cash, cash equivalents and short term investments. In addition, they have $4.5 billion in long term debt, this is fairly high for a growth company but not unmanageable.

Advanced Valuation

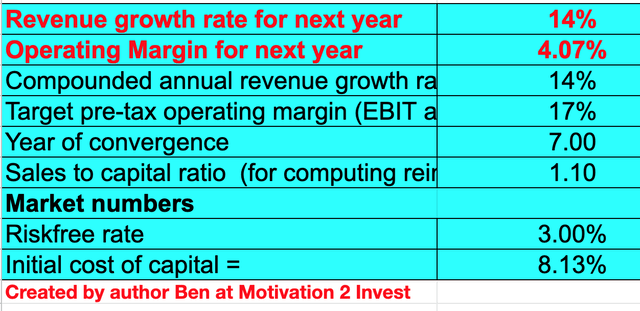

In order to value Block I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation.

Block Stock Valuation (created by author Ben at Motivation 2 Invest)

I have forecasted 14% revenue growth for next year and 14% for the next 2 to 5 years, which is inline with analyst estimates. In addition, I have forecasted margins to increase to 17% in the next 7 years as the company focuses on software sales and multi product offerings at a greater scale.

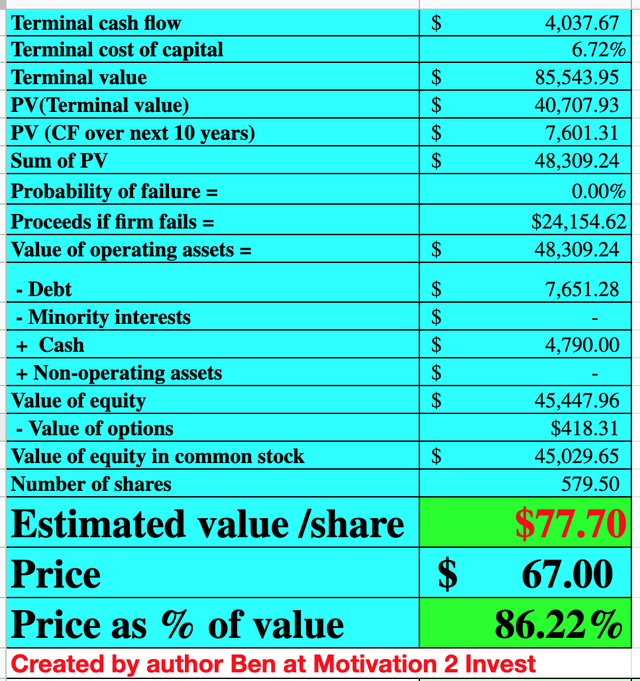

Block Valuation Model (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $77.7 per share, the stock is currently trading at ~$67/share and thus is ~14% undervalued.

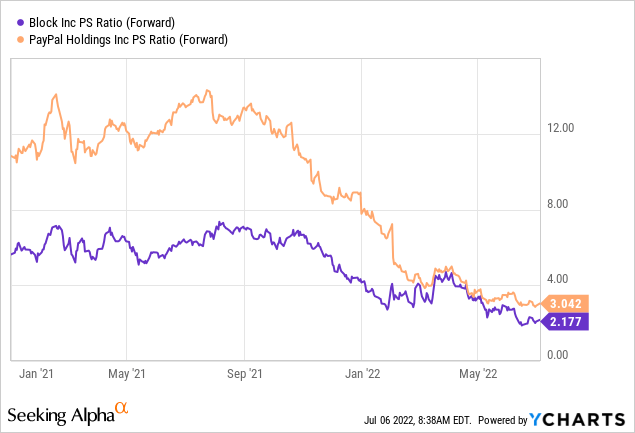

Block is also trading at a Price to Sales (Forward) ratio = 2.2 , which is lower than historic levels and PayPal, which trades at a Price to Sales Ratio = 3.

Risks

Tidal acquisition was unrelated

Block acquired “Tidal,” the Artist-friendly music streaming service from rapper and entrepreneur Jay-Z, for $302 million in March 2021. Although I see the potential of this company and its ability to “empower musicians,” I think it was a poor acquisition by Block. The music streaming business is unrelated to Blocks core Financial ecosystem and doesn’t connect. Hopefully this was just a blip on radar and not a sign of many unrelated acquisitions by management moving forward. The only silver lining is they paid for the acquisition in both cash and stock, when the share price was extremely high, so not a major loss.

Consumer Spending Slowdown/Recession

High Inflation squeezes the consumer with higher food and utility bill costs. The Ukraine-Russian War has only exasperated rising energy costs and higher interest rates will make mortgage payments more expense for households and reduce surplus income for consumers. Many Fintech companies make their revenue based on transaction volume, less volume equals less revenue. Although I believe this is only a temporary issue (until inflation subdues), it is a still a risk. The “Bitcoin Winter” also plays apart in this, as the asset’s recent crash and continued volatility has decimated Blocks revenue.

Final Thoughts

Block is a tremendous company which has two major Ecosystems for growth. These twin engines offer huge potential which can be enhanced via international expansion and moving upmarket. I highlighted the company’s heavy reliance on Bitcoin for revenue as a major risk prior. The fact the asset is not a major direct profit driver for the company is a positive. After the decline in share price, the stock is now undervalued intrinsically and relative to historic multiples.

I believe the market is pricing in a “recession” and slowdown in consumer spending, thus I expect more pain and volatility in the short term. However, in the long term I forecast strong continued growth and fintech expansion.

Be the first to comment