breakermaximus/iStock via Getty Images

Thesis highlight

I recommend to stay put on Cadre Holdings (NYSE:CDRE) which is currently trading at $28.25. Management has demonstrated their ability to execute, and I believe this is a good company with several secular tailwinds. However, at the current valuation, investors should expect market-like returns, and the investment would be more appealing to me if the price were lower.

Company overview

CDRE manufactures and distributes safety and survival gear for first responders as their line of work. In dangerous or life-threatening scenarios, their equipment offers essential protection to enable their users to securely carry out their tasks and safeguard others around them. Through direct and indirect channels, they offer a variety of goods such as body armor, disposal of explosive ordnance tools, and duty equipment. Additionally, CDRE acts as a one-stop destination for the first responders by offering both equipment they create themselves as well as items from other companies, such as uniforms, footwear, optics, rifles, and ammo. The vast variety of the produced goods they sell are subjected to strict safety requirements. Their products are in demand because of new technologies and the constant need to update and modernize equipment to keep operations running smoothly, effectively, and in line with regulations.

CDRE S-1

Investments merits

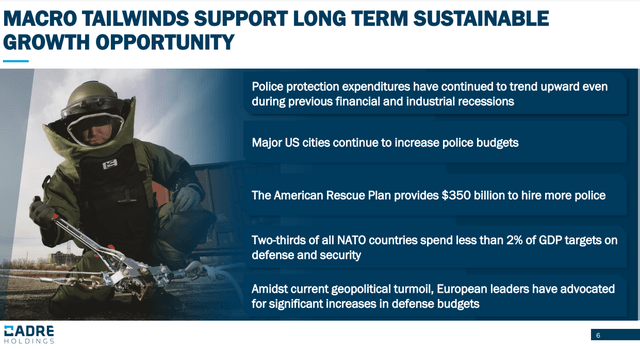

Industry driven by multiple growth drivers

The marketplace for safety and survival gear is aimed at the first responders and concentrates on offering a wide range of goods and solutions that are both secure and mission-enhancing to their target end customers. It is affected by a number of factors, such as customer refresh cycles, an increase in the number of people hired by first responder organizations, changes in gear and modernization trends, a stronger focus on protecting both the public and first responders, and changes in the population.

The development of law enforcement officers is a big factor for CDRE. The key product segments in the market for safety and survival gear are body armor, explosive ordnance disposal gear, and duty equipment. The U.S. Bureau of Labor Statistics forecasts that throughout the ten-year period starting from 2021 to 2031, the country’s law enforcement workforce will grow at a constant pace of 3% CAGR. Rising spending on law enforcement is another thing that is making it more important for first responders to have safety and survival gear.

Each of these product sectors encounters distinct factors independent of the overall macro industry dynamics. Tailwinds for the mandatory body armor market include rising mandates for its usage and replacement, changing technical requirements, and a rise in the number of tactical or SWAT (special weapons and tactics) officers. While new dangers to the world continue to develop, the market for hazardous ordnance disposal gear is primarily driven by equipment usage, replacement cycles, and firearms attachments such as lights and red-dot sights.

CDRE 2Q22 earnings

The yearly addressable demand for soft body armor, which includes tactical soft armor, is estimated by CDRE to be a whopping $870 million (quoted from S-1). Additionally, they project that the addressable demand for explosive ordnance disposal equipment will be in the range of $245 million throughout the course of the established bases in a seven to ten-year life span. Lastly, it is estimated that the public, the army, and law enforcement agencies around the world could buy $380 million worth of holsters every year.

The global armor industry is also expected to expand as other countries look to update outdated technology and deal with more complicated safety issues. Additionally, when nations are confronted with new threats, CDRE anticipates a growth in the market for safety and survivability equipment from global markets due to a greater understanding of the significance and efficiency of such items. CDRE estimates that there are about 9,658,000 law enforcement officers outside of the United States who could be reached. This is a large market opportunity.

CDRE also considers the market for safety and survival gear for first responders to be a long-term opportunity with steady and expanding demand. I think they will be able to take advantage of the good market conditions because they have a strong market position, good relationships with end users, a wide range of distribution channels, a long history of development, and pretty high standards for quality.

Strong market position

CDRE’s reputation as a premier supplier of top-notch safety and survival gear stretches back to 1964. Even now, they are the go-to premium brand for first responders because of their distinct value proposition. This, however, is the result of an uncompromising commitment to vital safety requirements and high quality. Their wide range of products lets them meet the security and survival gear needs of their customers all in one place.

CDRE is quite optimistic that they have a dominant market ranking across a number of product categories because of the better quality and reliability that sets them apart from the competition, as per the statistics provided by CDRE and referenced in its S-1 filings. If compared to its nearest competitors, they supply the majority of the leading 50 police agencies in the United States with concealable tactical, hard armor, or duty retaining holsters by size. In addition, they are a part of multi-year agreements with the biggest bomb suit squads in the world, which also include the US military as a whole. Their products always go above and beyond the strict safety standards in the industry and are praised for their performance and improvements made possible by new ideas and better technology.

Mission-critical products lead to recurring demand

With little to no room for error, their products offer essential safety to both the end users and those nearby. In order to guarantee effective and efficient functioning in all situations, strict safety rules and conventional warranty clauses produce refresh cycles on more than 80% of the gear they make. An extremely predictable source of recurrent income is driven by the demand that is connected to these refresh periods. Meanwhile, associated consumable products drive recurring sales based on replenishment needs.

Strategies to improve growth and profits set in place

To continue generating sales growth, the management group is committed to launching new products, boosting consumer wallet share, executing on significant new contract possibilities, and enhancing their ecommerce and direct interaction with customers. Some recent product innovations include the creation of a 3D body-sizing solution for soft armor, the upcoming release of their holsters, and working with major suppliers to use cutting-edge materials for future armor items.

By improving their blast sensor gear for military safety, CDRE also hopes to strengthen their position as a pioneer in fast-moving technology. Depending on the overall scale of the Department of Defense branches taking part in the initiative, they think this possibility might offer a total potential market opportunity of up to $500 million. The Blast Pressure Exposure Study Improvement Act, which was passed as part of the National Defense Authorization Act for Fiscal Year 2020, supports the need for explosion sensors and the possible market for them in all branches of the U.S. military.

Management also places a premium on broadening the company’s reach in international markets. I think CDRE is well-positioned to capitalize on the growing international demand for safety and survivability equipment for first responders as a result of its dominant domestic market position and the high-quality standards and performance of its products. The plan for the company’s growth is to leverage existing relationships, form market-specific teams, and enter neighboring international markets.

The increase in profit margin over the years is proof that the management group has a proven track record of delivering cost structure improvements to achieve operating leverage. In order to continuously enhance operating and marketing processes, their operating approach begins with complexity reduction. The company’s production footprint has been rationalized. Non-core activities have been divested. Their supply chain has been improved. Relationships with customers and important contracts have been optimized. Together, these initiatives have made the company’s production and sales processes better, which has led to higher profits and growth.

Valuation

Price target

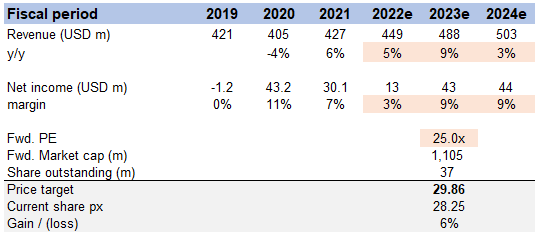

My model suggests a price target of ~$29.86 or ~6% upside in FY23 from today’s share price of $28.25, making it roughly fairly valued. This is based on the idea that sales will grow at a mid-single-digit CAGR until 2024e, that net margins will get a little better, and that the forward PE multiple will be 25x in FY23e.

Image created by author using data from CDRE’s filings and own estimates

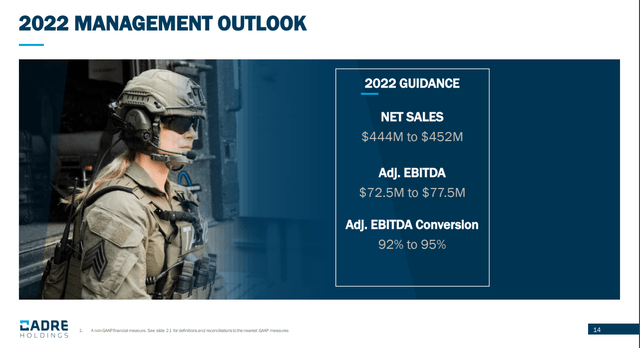

For FY22e, I used the mid-point of management guidance during 2Q22 and consensus net income estimates. Moving forward from FY22e to FY24e, I assumed revenue and net income to grow in line with what consensus estimated. As for valuation, CDRE is currently trading at 28x forward earnings, which is 3x higher than its historical average. I think CDRE will go back to its historical average of 25x.

CDRE 2Q22 earnings

Risks

Inherent product risk

The activities and circumstances in which the products are being used frequently involve a substantial risk of human damage. Significant physical harm or death could come from using their products improperly, failing to use or maintain them properly, or from malfunctioning. In certain rare instances, even using their products correctly could cause serious physical harm or death. Given this potential for harm, maintaining the products properly is essential.

Business impacted by fluctuating budgets

First responders from all over the world and in the United States are among their customers. Budgetary allotments for these clients may change depending on government tax collections and fluctuating budgetary limitations. Budget shortfalls have previously occurred in a number of domestic and international government agencies. This has resulted in less money being spent on defence, enforcement agencies, and other army and security-related areas. In addition, resources for first responders have come under more scrutiny as a result of debates over police reform. Depending on how much the government spends on the army, law enforcement, and other things, the company’s operational performance may change a lot from one period to the next.

Competitive market

The sectors in which they compete are quite competitive and have a wide range of competitors, from tiny firms to international organisations. Rivals who are bigger, wealthier, and more well-known than them could be able to fight more successfully than they probably can. They must adapt to shifting customer tastes and technological trends in order to remain competitive in the market. Their revenues could fall if they fail to set themselves apart from their rivals in the market. In order to improve their capacity to meet client needs, the company’s rivals have also developed links with one another or with other parties. As a result, it’s possible that brand-new rivals or rival alliances will form and compete more successfully than they can. Any such change might negatively impact their activities, liquidity, economic position, and business.

Conclusion

To conclude, I believe CDRE is fairly valued at the current valuation and will be more attractive if the valuation gets re-rated downwards. That said, if management is able to drive growth faster than what consensus expects due to value-accretive M&A, then it may be an attractive entry point today. My other concern is that valuation (28x forward earnings) is rather rich when we compare it against the S&P500—this means there is more room for CDRE to fall in terms of valuation.

Be the first to comment